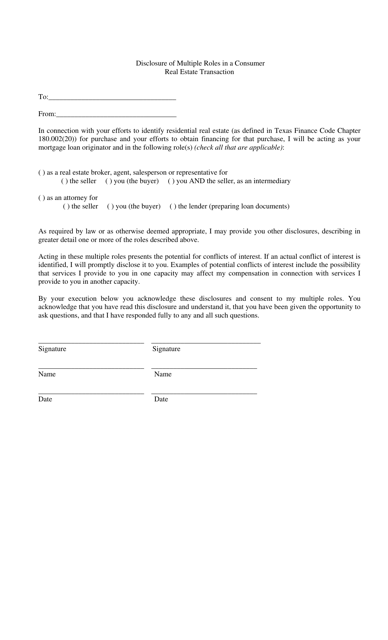

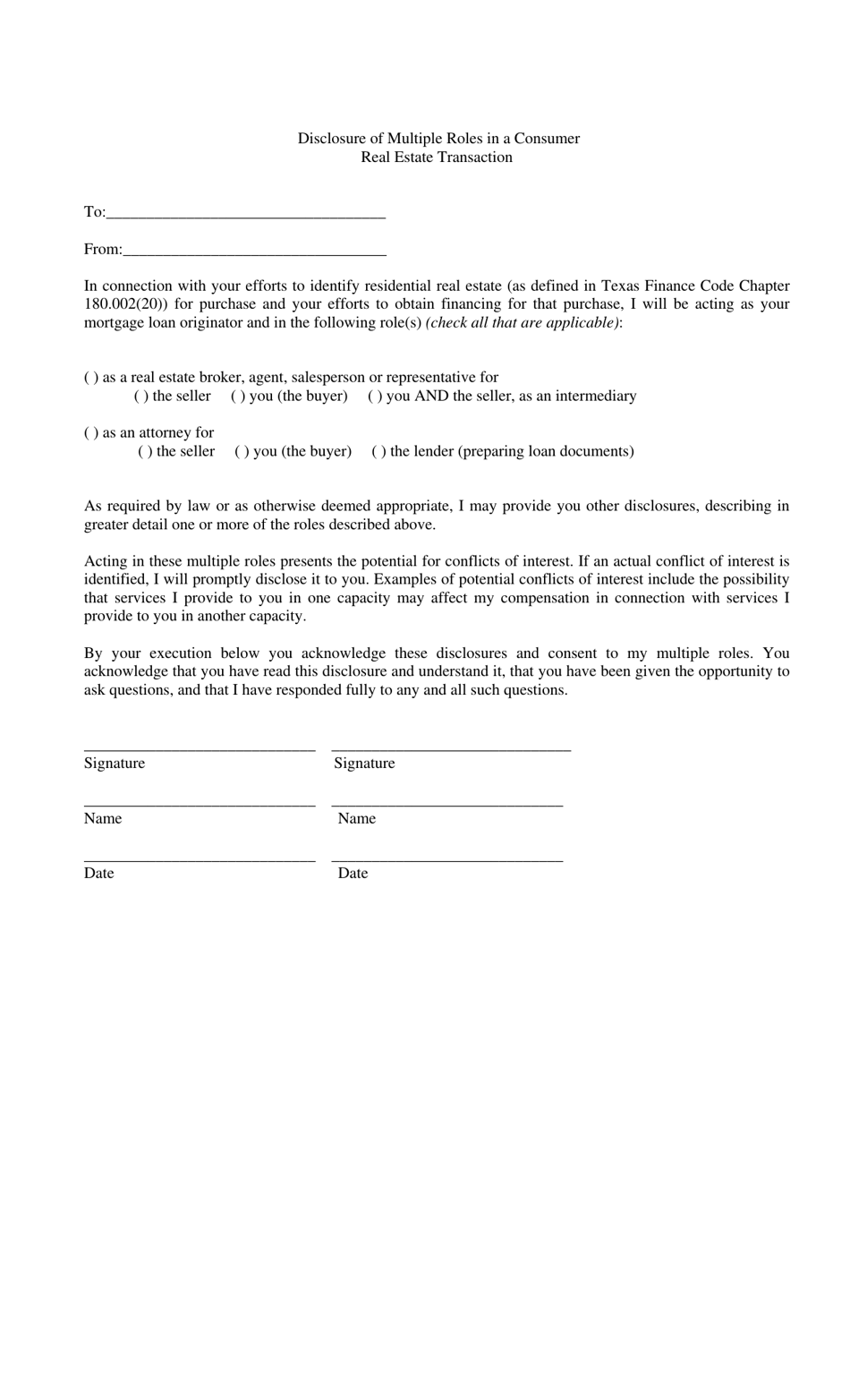

Disclosure of Multiple Roles in a Consumer Real Estate Transaction - Texas

Disclosure of Multiple Roles in a Consumer Real Estate Transaction is a legal document that was released by the Texas Department of Savings and Mortgage Lending - a government authority operating within Texas.

FAQ

Q: What is a consumer real estate transaction?

A: A consumer real estate transaction refers to the buying or selling of a property by an individual.

Q: Why is disclosure of multiple roles important in a consumer real estate transaction?

A: Disclosure of multiple roles is important to ensure transparency and avoid conflicts of interest in the transaction.

Q: What are multiple roles in a consumer real estate transaction?

A: Multiple roles refer to situations where a person involved in the transaction has more than one role, such as being both the buyer's and seller's agent.

Q: Who is required to disclose multiple roles in Texas?

A: Real estate license holders in Texas are required to disclose any multiple roles they have in a consumer real estate transaction.

Q: What information should be disclosed regarding multiple roles?

A: The disclosure should include the role(s) the licensee is assuming, the names of the parties involved, and that the person is licensed as a real estate broker or sales agent.

Q: Is disclosure of multiple roles a legal requirement in Texas?

A: Yes, disclosure of multiple roles is a legal requirement in Texas for real estate license holders.

Q: What happens if a licensee fails to disclose multiple roles?

A: Failure to disclose multiple roles can result in disciplinary action, including fines and license suspension or revocation.

Form Details:

- The latest edition currently provided by the Texas Department of Savings and Mortgage Lending;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Texas Department of Savings and Mortgage Lending.