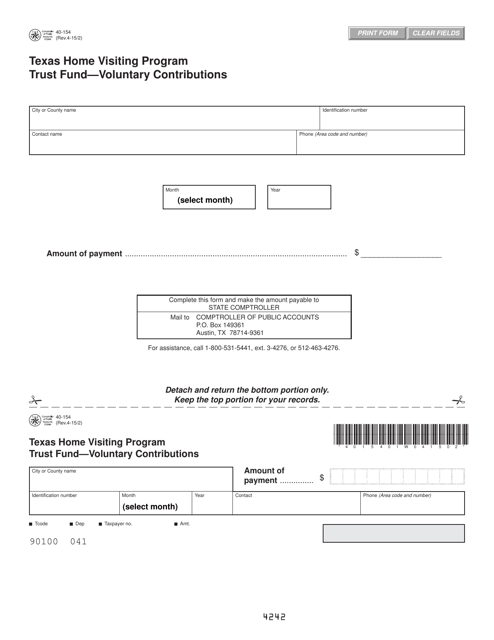

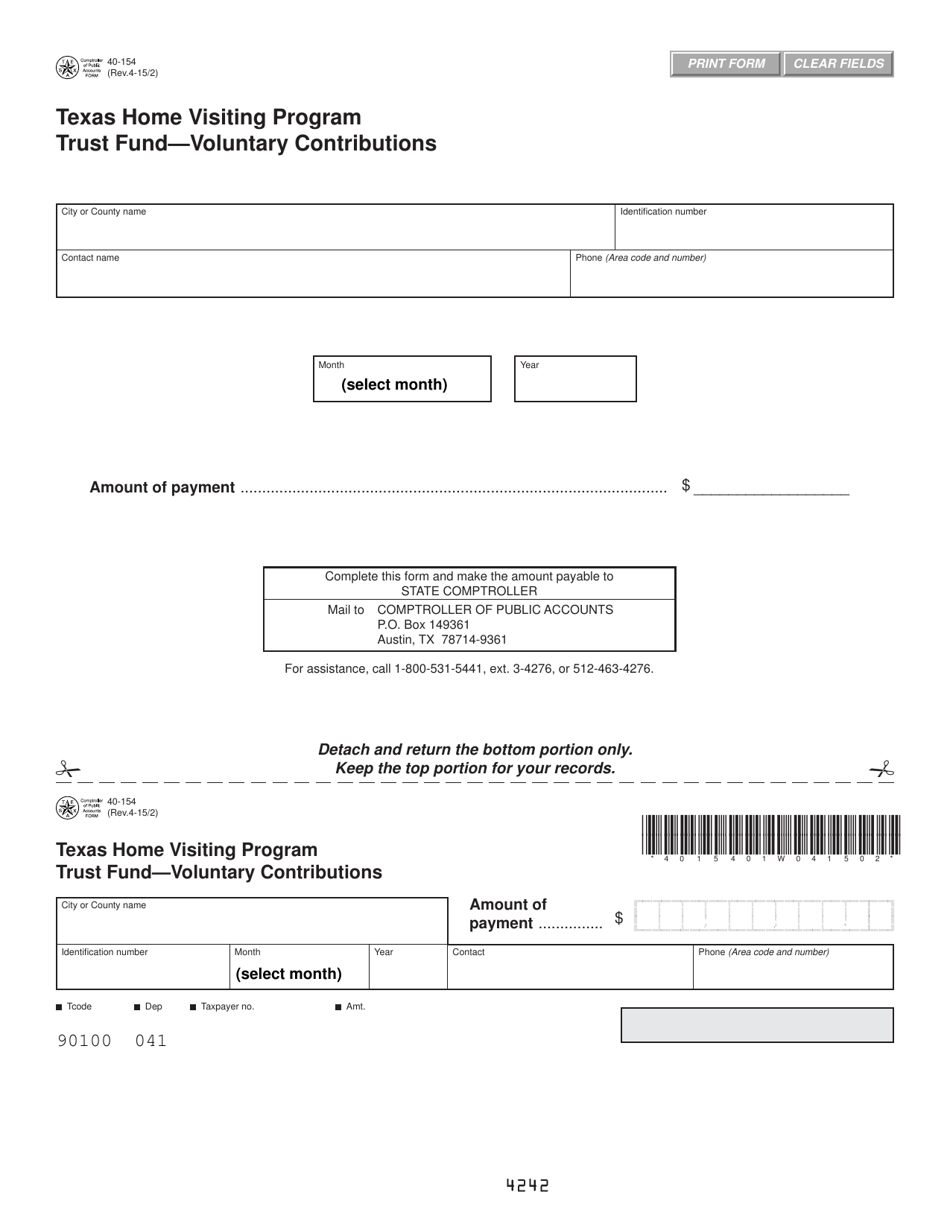

Form 40-154 Texas Home Visiting Program Trust Fund - Voluntary Contributions - Texas

What Is Form 40-154?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 40-154?

A: Form 40-154 is a form used for voluntary contributions to the Texas Home Visiting Program Trust Fund.

Q: What is the Texas Home Visiting Program Trust Fund?

A: The Texas Home Visiting Program Trust Fund is a fund that supports home visiting programs in Texas.

Q: What are voluntary contributions?

A: Voluntary contributions are donations made willingly by individuals or organizations.

Q: Who can contribute to the Texas Home Visiting Program Trust Fund?

A: Any individual or organization can contribute to the Texas Home Visiting Program Trust Fund.

Q: Why would someone contribute to the fund?

A: People might contribute to the fund to support the home visiting programs in Texas and help improve outcomes for children and families.

Q: How can I make a voluntary contribution?

A: You can make a voluntary contribution by filling out Form 40-154 and following the instructions provided.

Q: Is the contribution tax-deductible?

A: The contribution may be tax-deductible. Please consult with a tax professional for specific advice.

Q: Are there any limits on the amount I can contribute?

A: There are no specific limits mentioned for the contribution amount, but it is advisable to check with the Texas Home Visiting Program Trust Fund for any specific guidelines.

Q: What happens to the contributions?

A: The contributions are used to support home visiting programs in Texas and help families and children in need.

Form Details:

- Released on April 2, 2015;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40-154 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.