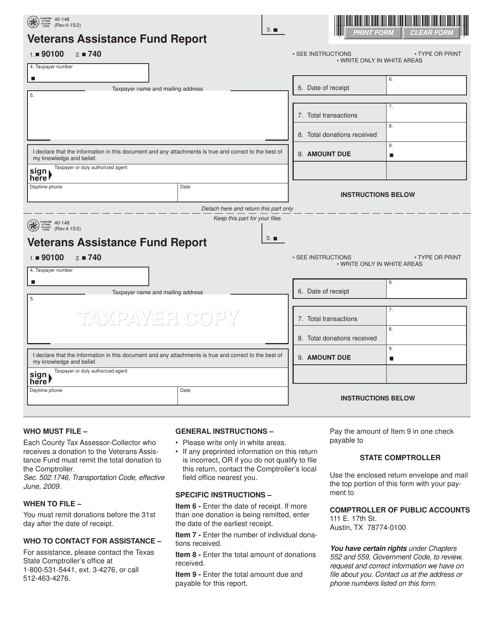

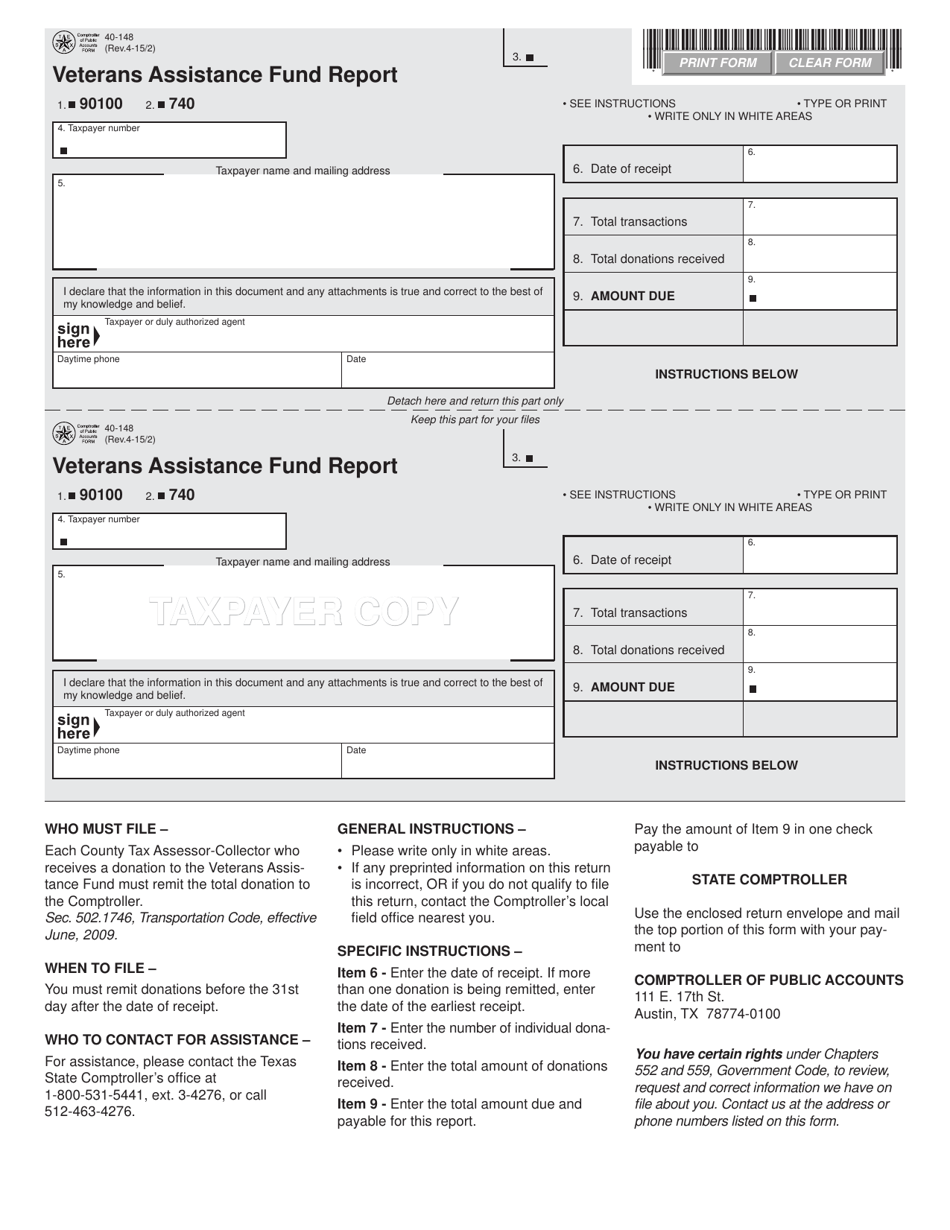

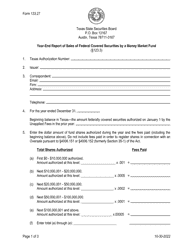

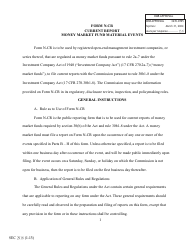

Form 40-148 Veterans Assistance Fund Report - Texas

What Is Form 40-148?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 40-148?

A: Form 40-148 is the Veterans AssistanceFund Report in Texas.

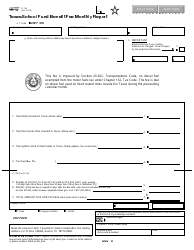

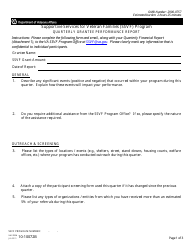

Q: Who needs to file Form 40-148?

A: Veterans organizations in Texas that receive funds from the Veterans Assistance Fund need to file Form 40-148.

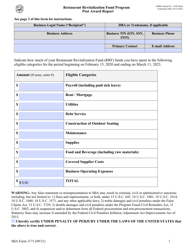

Q: What is the purpose of Form 40-148?

A: Form 40-148 is used by veterans organizations in Texas to report their receipts and expenditures from the Veterans Assistance Fund.

Q: Is Form 40-148 applicable to veterans outside of Texas?

A: No, Form 40-148 is specific to veterans organizations in Texas that receive funds from the Veterans Assistance Fund.

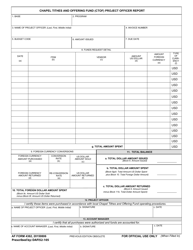

Q: What information is required on Form 40-148?

A: Form 40-148 requires veterans organizations to provide information such as their name, address, and financial details of receipts and expenditures.

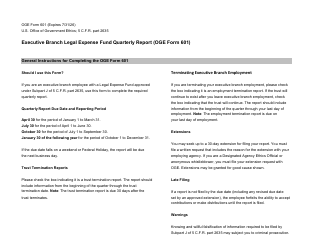

Q: When is the deadline to file Form 40-148?

A: The deadline to file Form 40-148 is specified by the Texas Veterans Commission and may vary each year. It is important to check the specific deadline for the current year.

Q: What happens if a veterans organization fails to file Form 40-148?

A: Failure to file Form 40-148 may result in penalties or loss of eligibility for funding from the Veterans Assistance Fund.

Q: Are there any fees associated with filing Form 40-148?

A: No, there are no fees associated with filing Form 40-148.

Form Details:

- Released on April 2, 2015;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40-148 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.