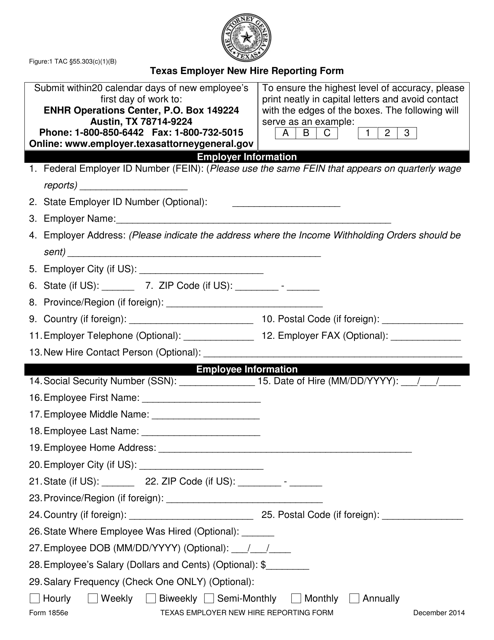

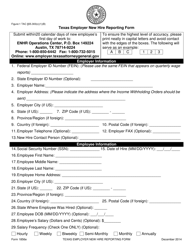

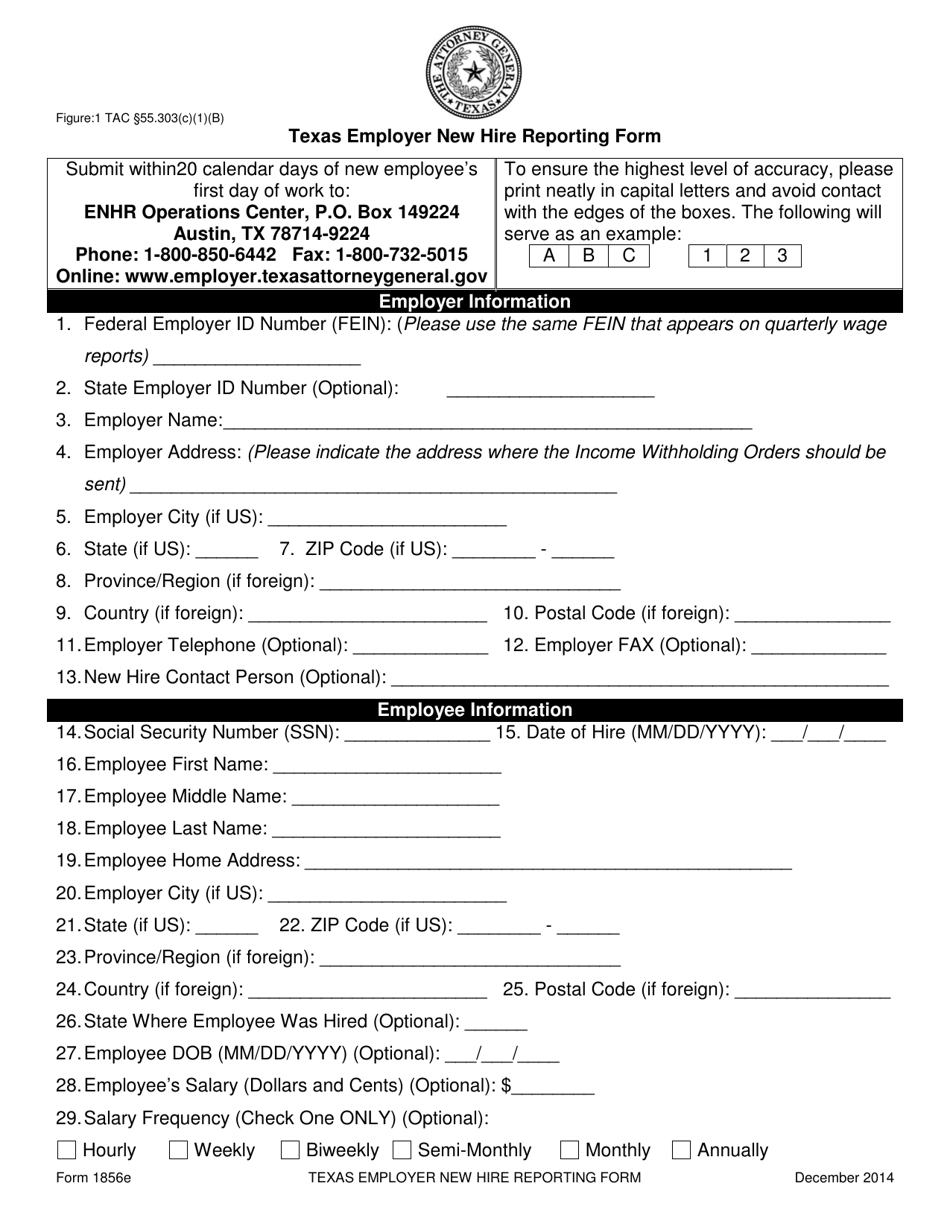

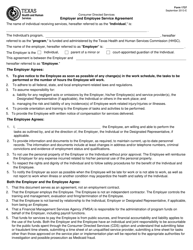

Form 1856E Texas Employer New Hire Reporting Form - Texas

What Is Form 1856E?

This is a legal form that was released by the Texas Office of the Attorney General - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1856E?

A: Form 1856E is the Texas Employer New Hire Reporting Form.

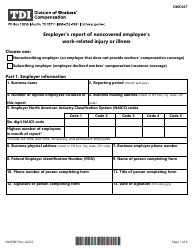

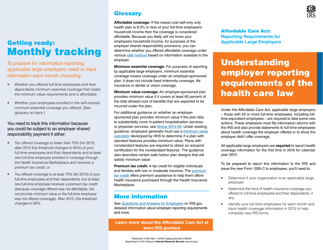

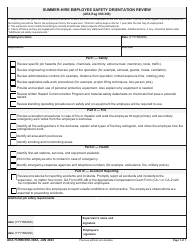

Q: Who needs to fill out Form 1856E?

A: Employers in Texas are required to fill out Form 1856E to report new hires.

Q: What is the purpose of Form 1856E?

A: The purpose of Form 1856E is to report new hires to the Texas Office of the Attorney General for child support enforcement purposes.

Q: When should Form 1856E be filed?

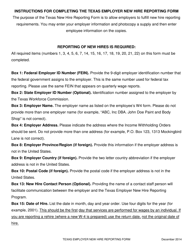

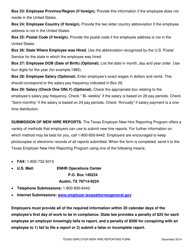

A: Form 1856E should be filed within 20 days of hiring a new employee.

Q: Is Form 1856E only for Texas employers?

A: Yes, Form 1856E is specifically for employers in Texas.

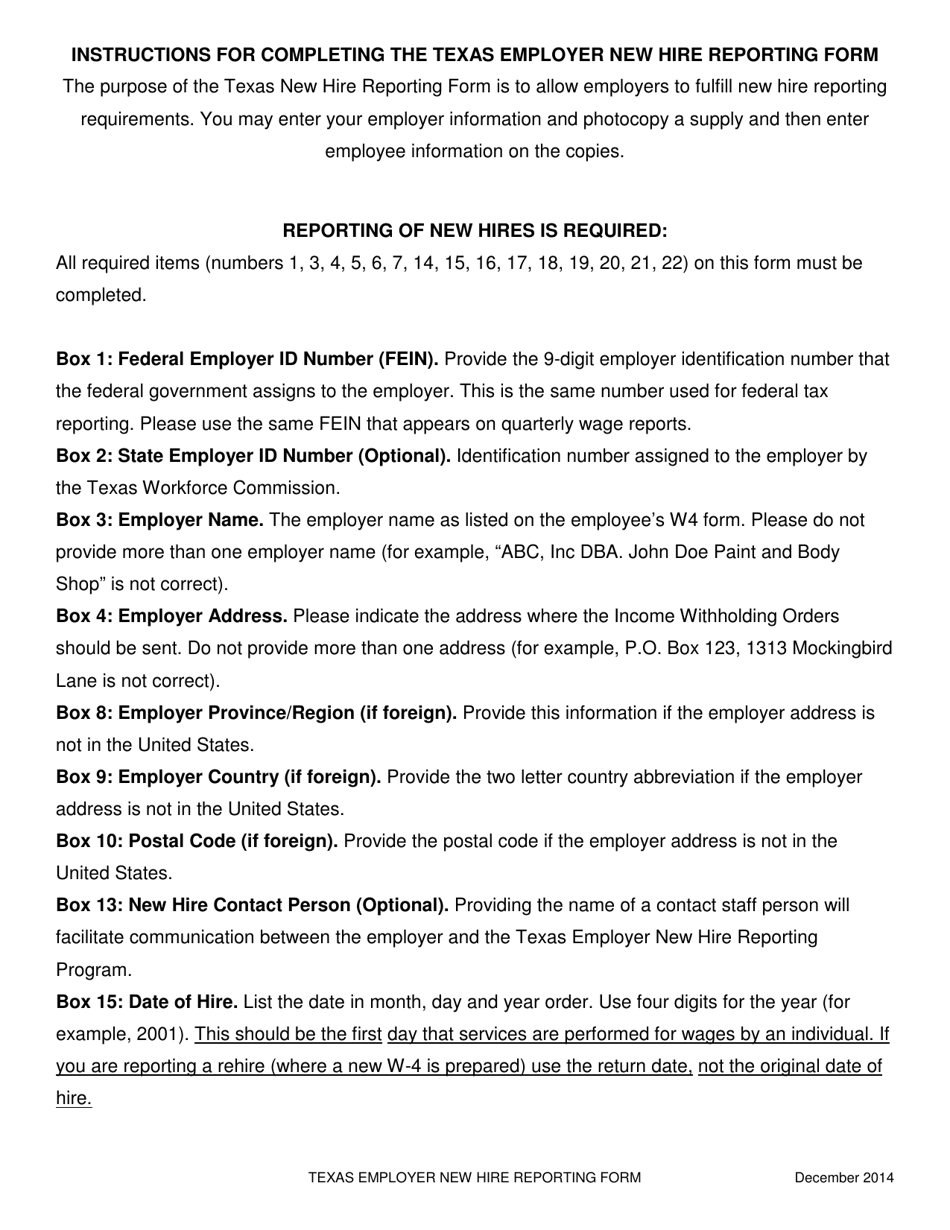

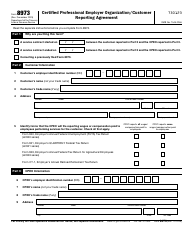

Q: What information is required on Form 1856E?

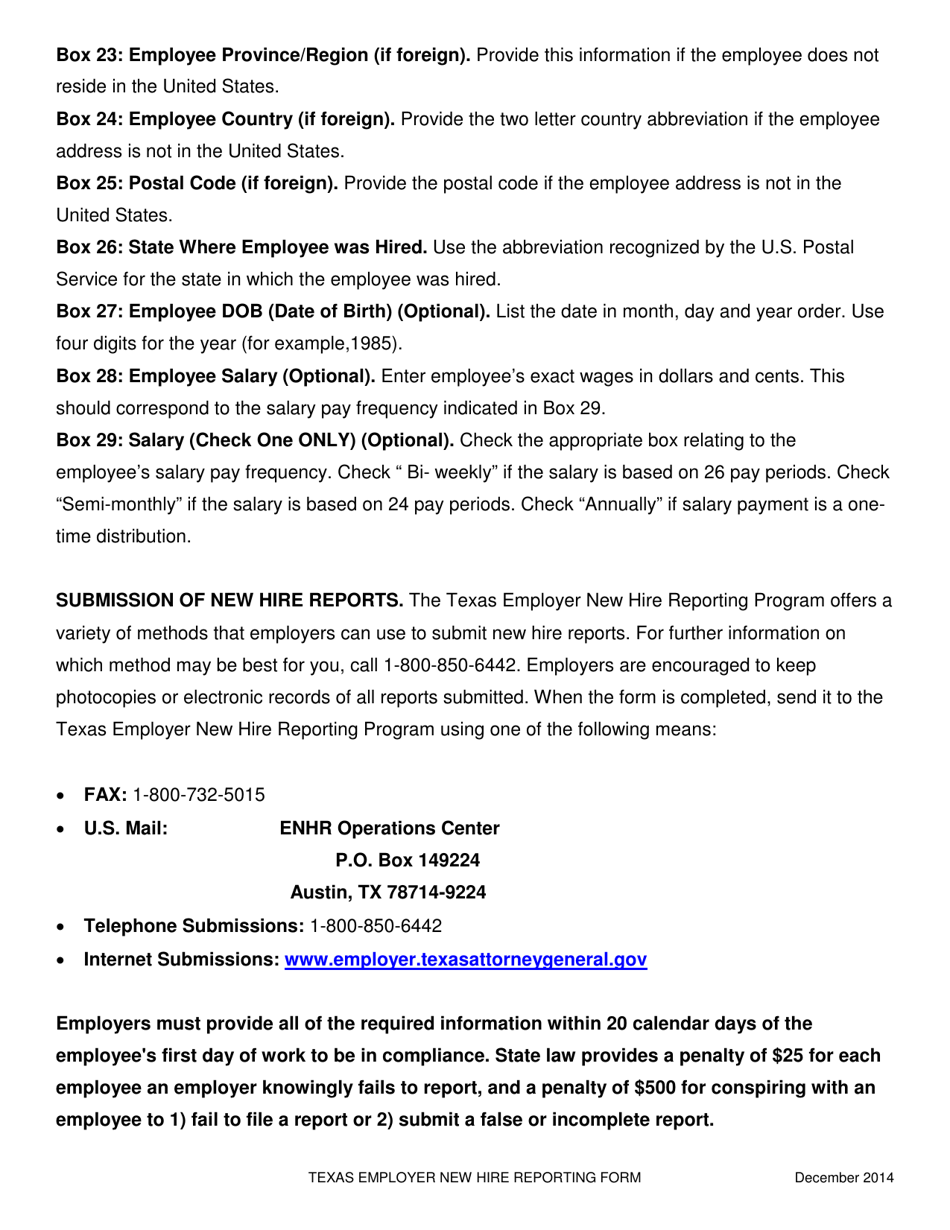

A: Form 1856E requires information such as the employer's name, address, federal employer identification number (FEIN), and the new employee's name, address, and Social Security number.

Q: Are there any penalties for not filing Form 1856E?

A: Yes, there may be penalties for failing to timely file Form 1856E, such as fines.

Q: Can Form 1856E be filed electronically?

A: Yes, employers have the option to file Form 1856E electronically through the Texas New Hire Reporting System.

Q: What should I do with Form 1856E after filing?

A: After filing Form 1856E, you should keep a copy for your records.

Q: Is there a fee to file Form 1856E?

A: No, there is no fee to file Form 1856E.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the Texas Office of the Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1856E by clicking the link below or browse more documents and templates provided by the Texas Office of the Attorney General.