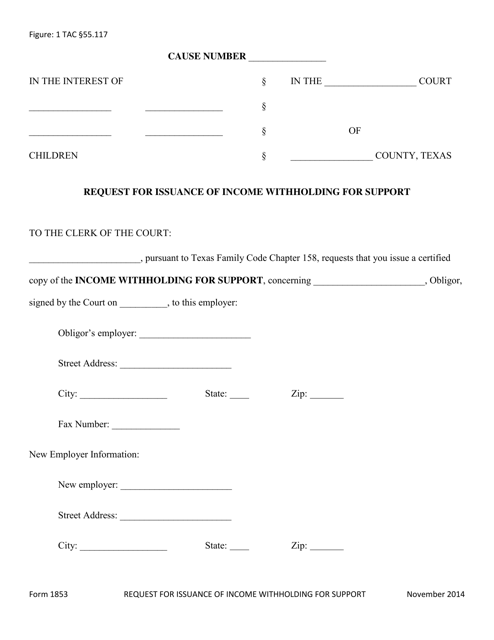

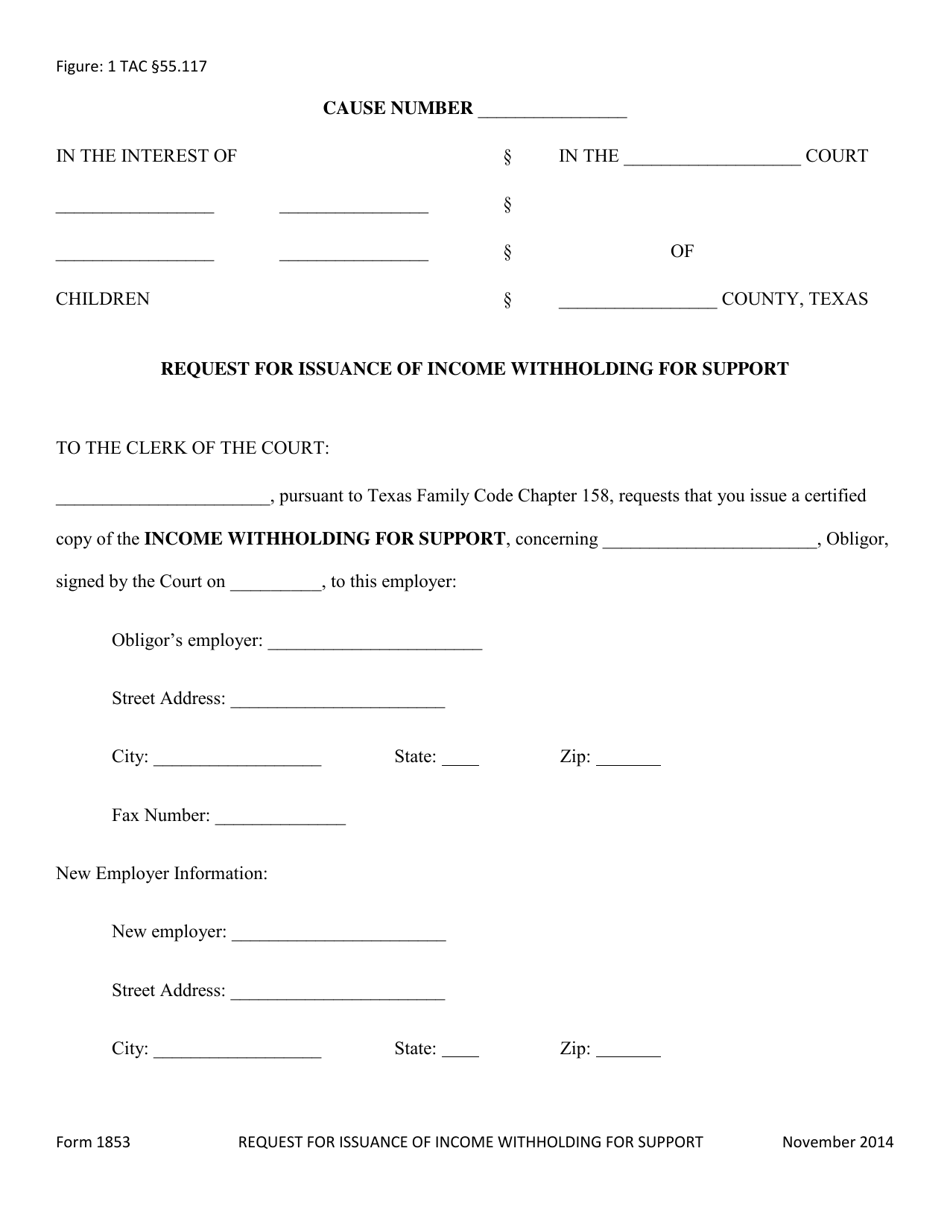

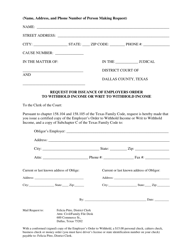

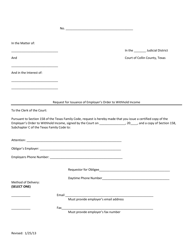

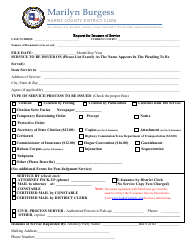

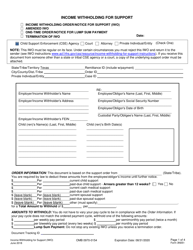

Form 1853 Request for Issuance of Income Withholding for Support - Texas

What Is Form 1853?

This is a legal form that was released by the Texas Office of the Attorney General - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1853?

A: Form 1853 is a request for the issuance of income withholding for support in Texas.

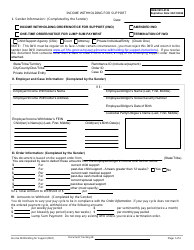

Q: What is income withholding for support?

A: Income withholding for support is a legal process where a portion of a person's income is withheld to pay child support or spousal support.

Q: Who can use Form 1853?

A: Form 1853 can be used by individuals in Texas who are seeking to enforce child or spousal support payments.

Q: How do I fill out Form 1853?

A: You need to provide information about the child or spousal support order, the employer of the person who owes support, and your own contact information.

Q: Is there a fee for submitting Form 1853?

A: There is no fee for submitting Form 1853.

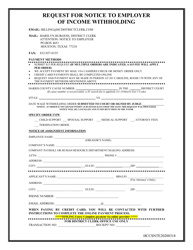

Q: What happens after I submit Form 1853?

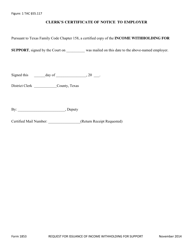

A: The child support agency will review your request and if approved, they will send the income withholding order to the person's employer.

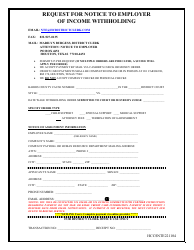

Q: Can the person who owes support challenge the income withholding order?

A: Yes, the person who owes support can request a hearing to challenge the income withholding order.

Q: How long does income withholding for support last?

A: Income withholding for support continues until the child or spousal support obligation is fully paid or until further court order.

Q: What if the person who owes support changes jobs?

A: You should notify the child support agency of any changes in the person's employment so that they can update the income withholding order.

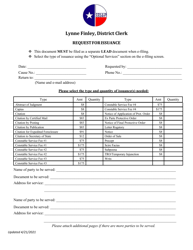

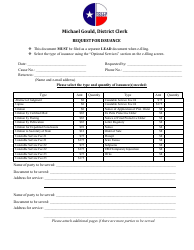

Form Details:

- Released on November 1, 2014;

- The latest edition provided by the Texas Office of the Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1853 by clicking the link below or browse more documents and templates provided by the Texas Office of the Attorney General.