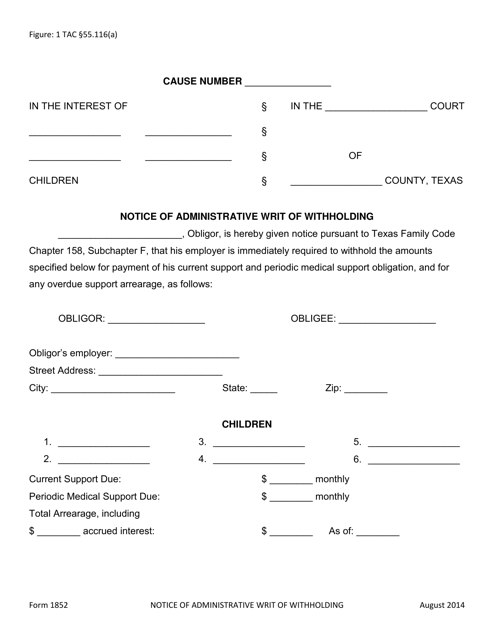

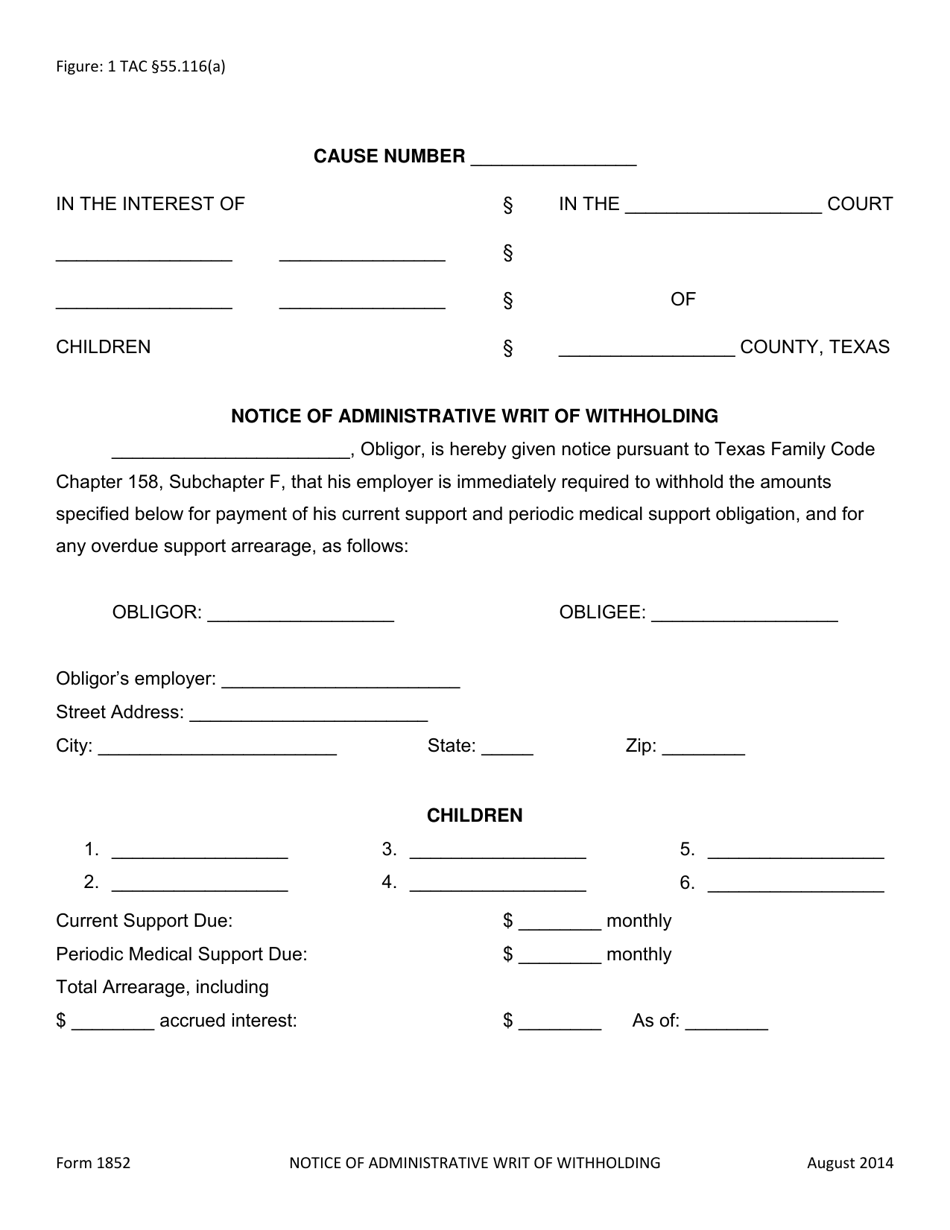

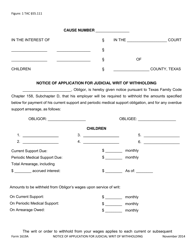

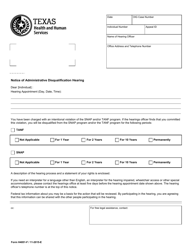

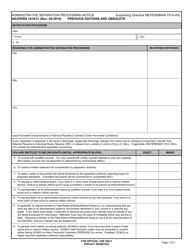

Form 1852 Notice of Administrative Writ of Withholding - Texas

What Is Form 1852?

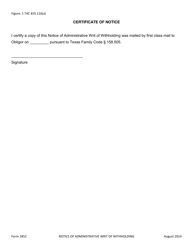

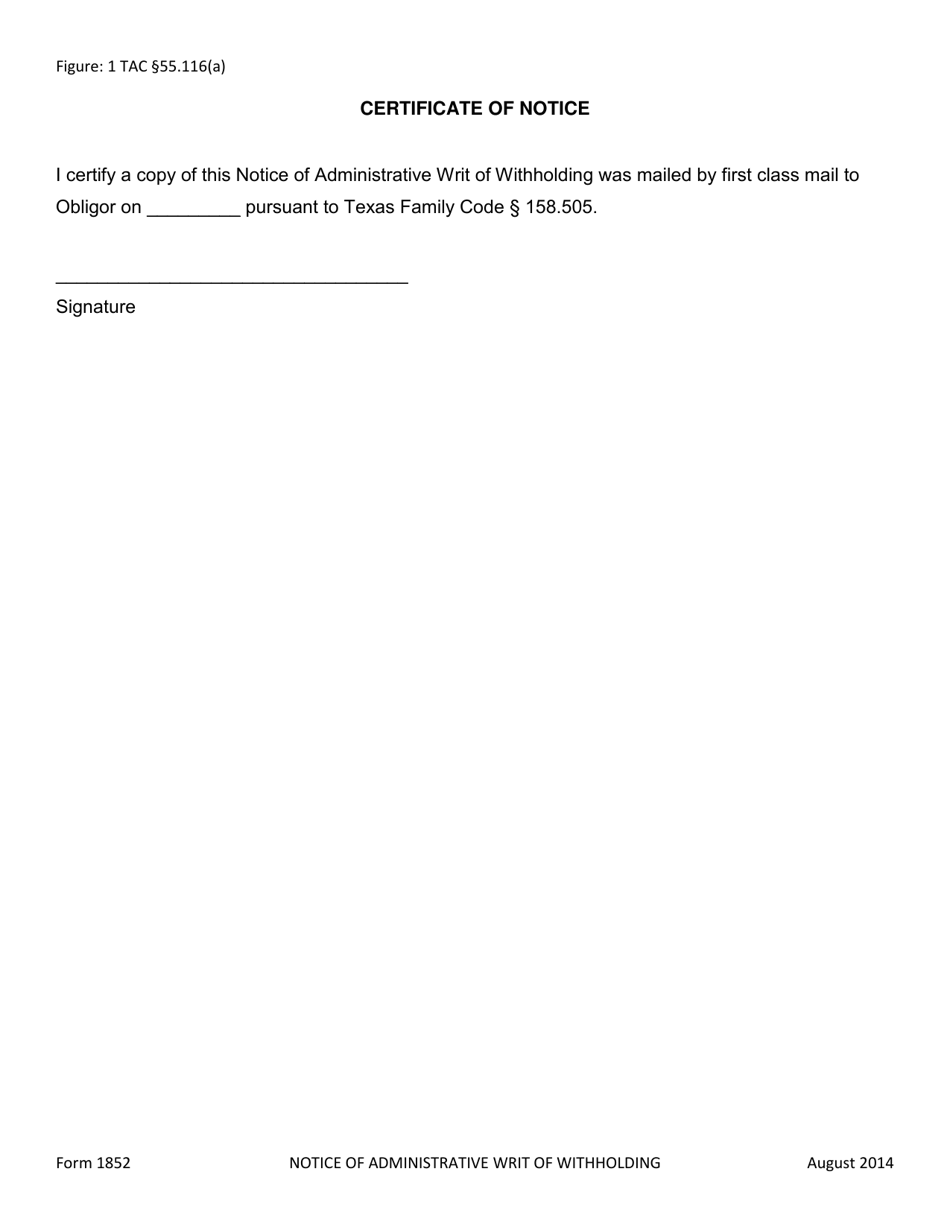

This is a legal form that was released by the Texas Office of the Attorney General - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1852?

A: Form 1852 is the Notice of Administrative Writ of Withholding used in Texas.

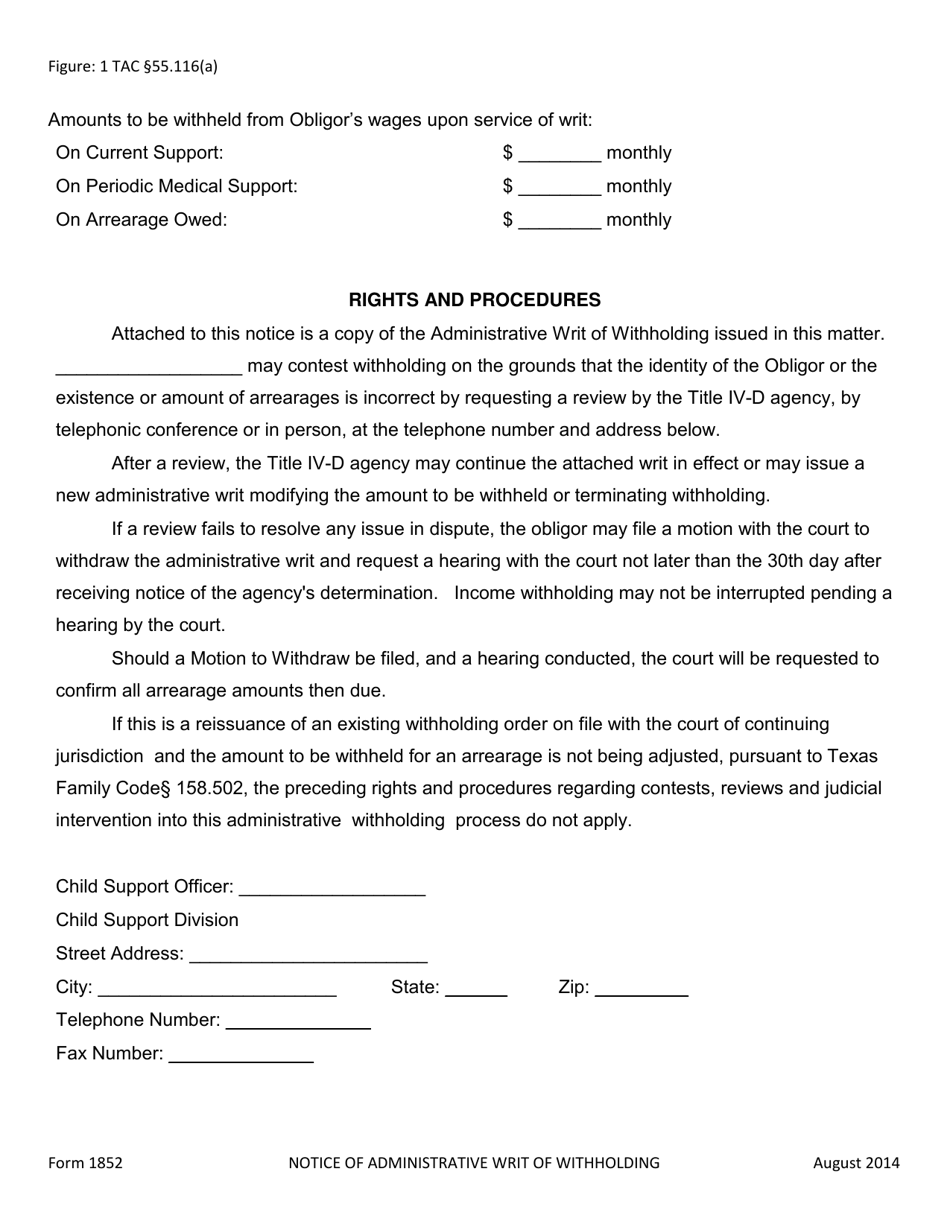

Q: What is the purpose of Form 1852?

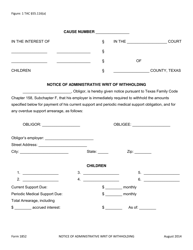

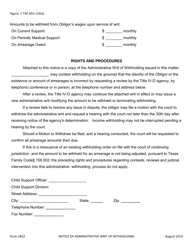

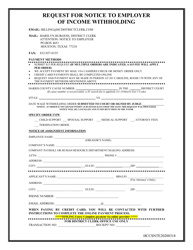

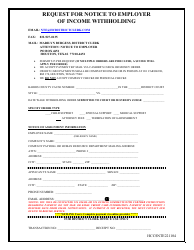

A: The purpose of Form 1852 is to notify an employer to withhold wages in order to satisfy a debt owed to a government agency in Texas.

Q: Who uses Form 1852?

A: Government agencies in Texas use Form 1852 to request wage withholding from an employer.

Q: What is an administrative writ of withholding?

A: An administrative writ of withholding is a legal document that authorizes an employer to withhold a portion of an employee's wages to satisfy a debt owed to a government agency.

Q: Do I need to respond to Form 1852?

A: Yes, if you are an employer who receives Form 1852, you are required to comply with the wage withholding request.

Q: Is Form 1852 specific to Texas?

A: Yes, Form 1852 is specific to Texas and is used within the state's administrative procedures.

Q: Can an employer refuse to comply with Form 1852?

A: No, an employer is legally obligated to comply with the wage withholding request outlined in Form 1852.

Form Details:

- Released on August 1, 2014;

- The latest edition provided by the Texas Office of the Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1852 by clicking the link below or browse more documents and templates provided by the Texas Office of the Attorney General.