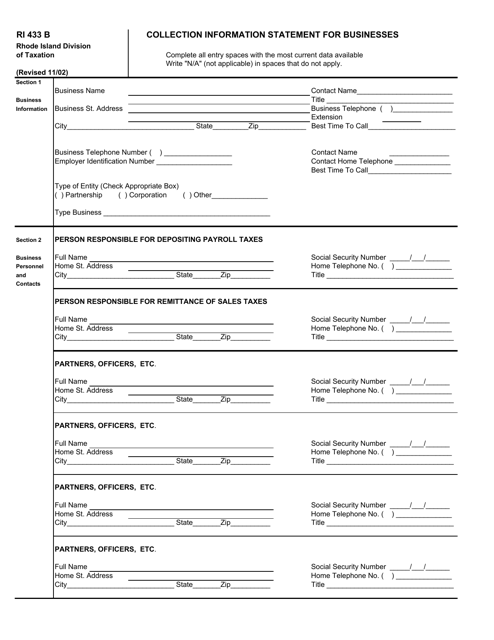

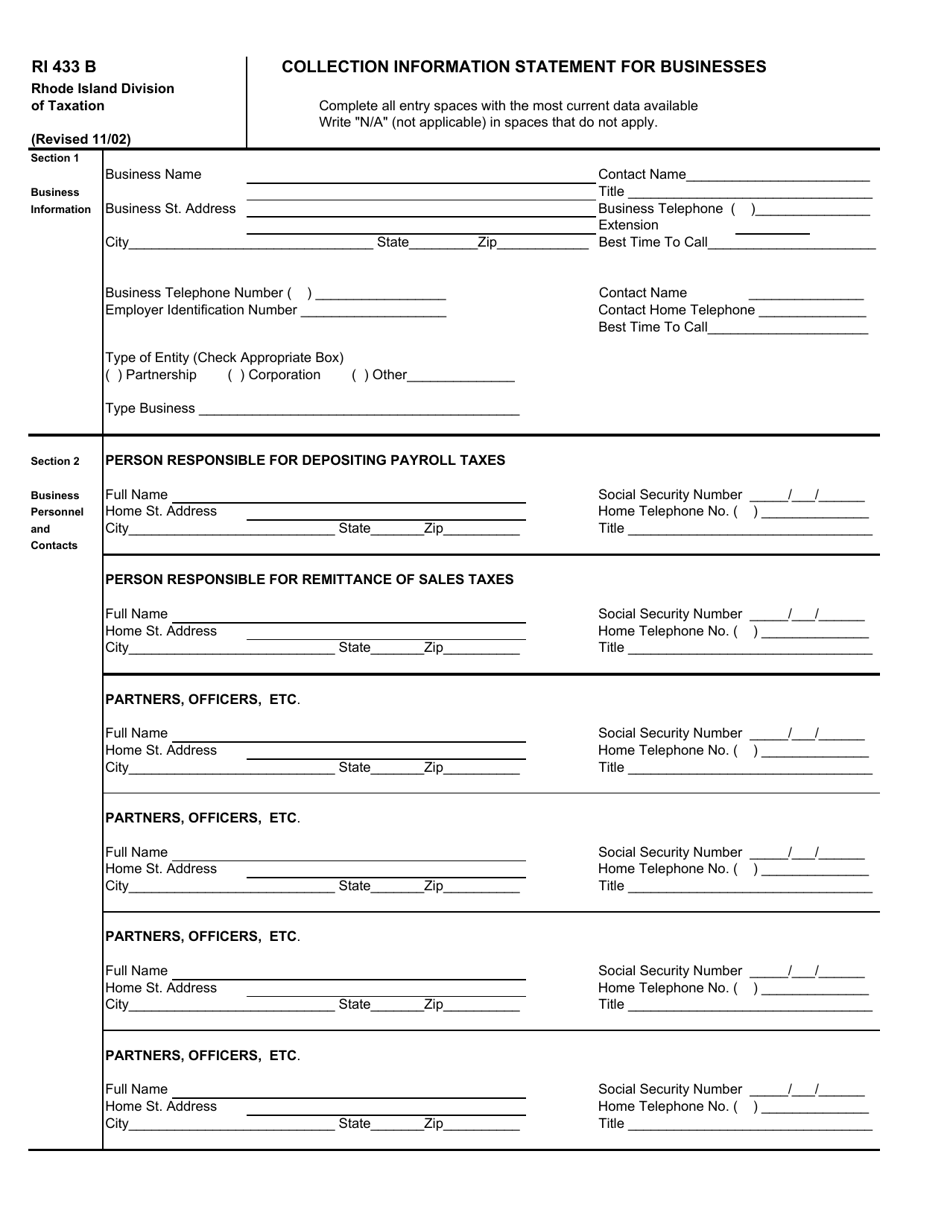

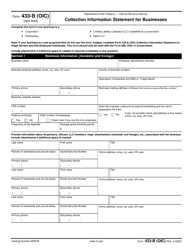

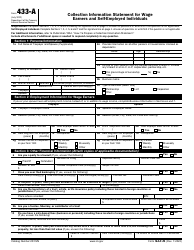

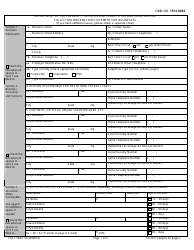

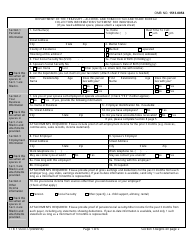

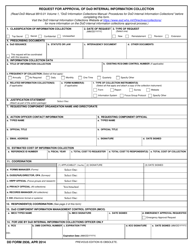

Form RI433 B Collection Information Statement for Businesses - Rhode Island

What Is Form RI433 B?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RI433 B?

A: Form RI433 B is the Collection Information Statement for Businesses in Rhode Island.

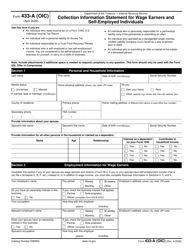

Q: Who should fill out form RI433 B?

A: Businesses in Rhode Island that owe taxes and are unable to pay in full should fill out form RI433 B.

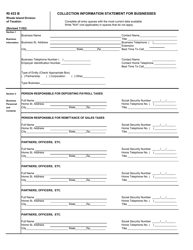

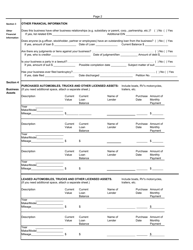

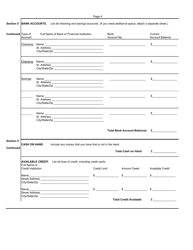

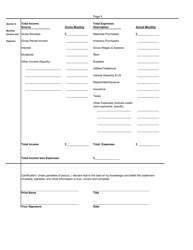

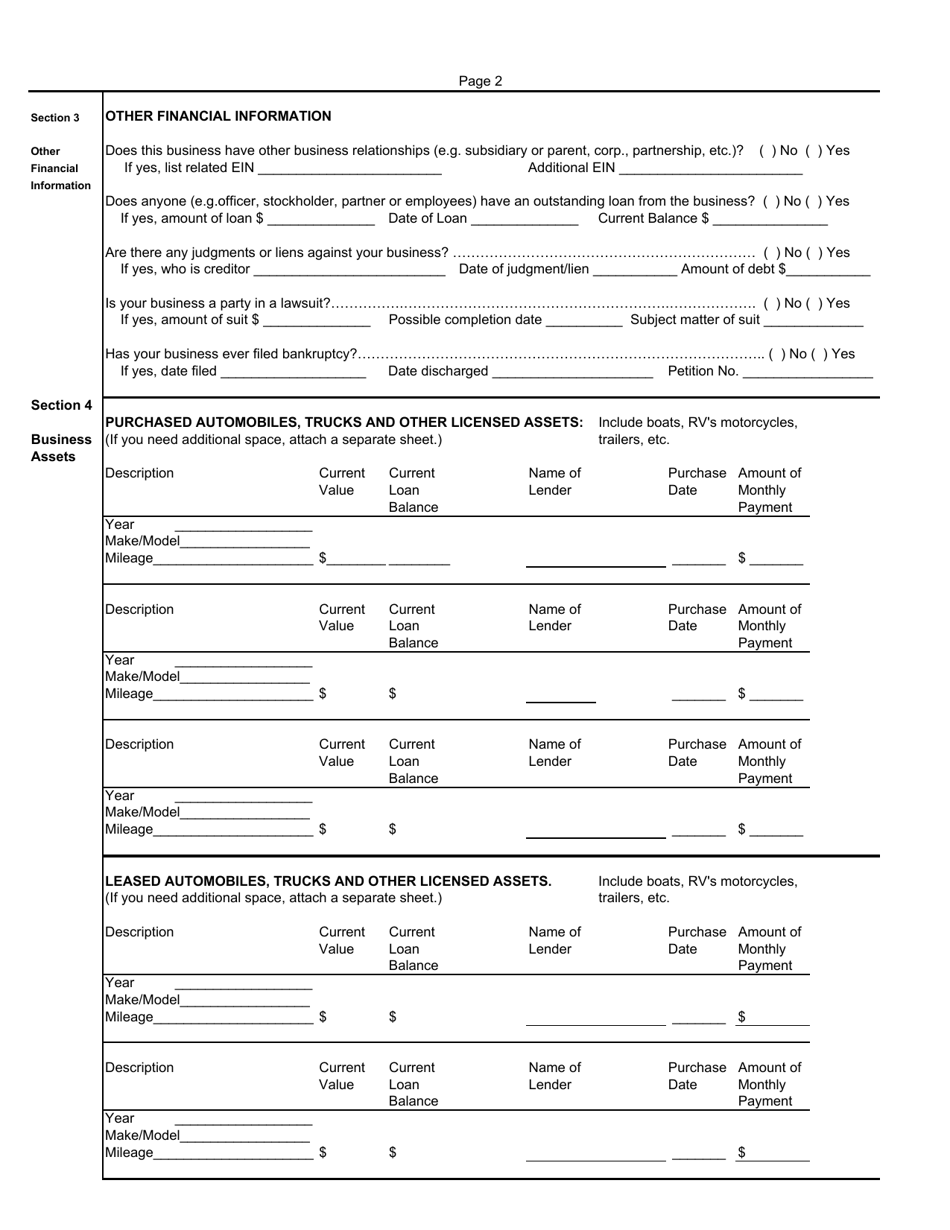

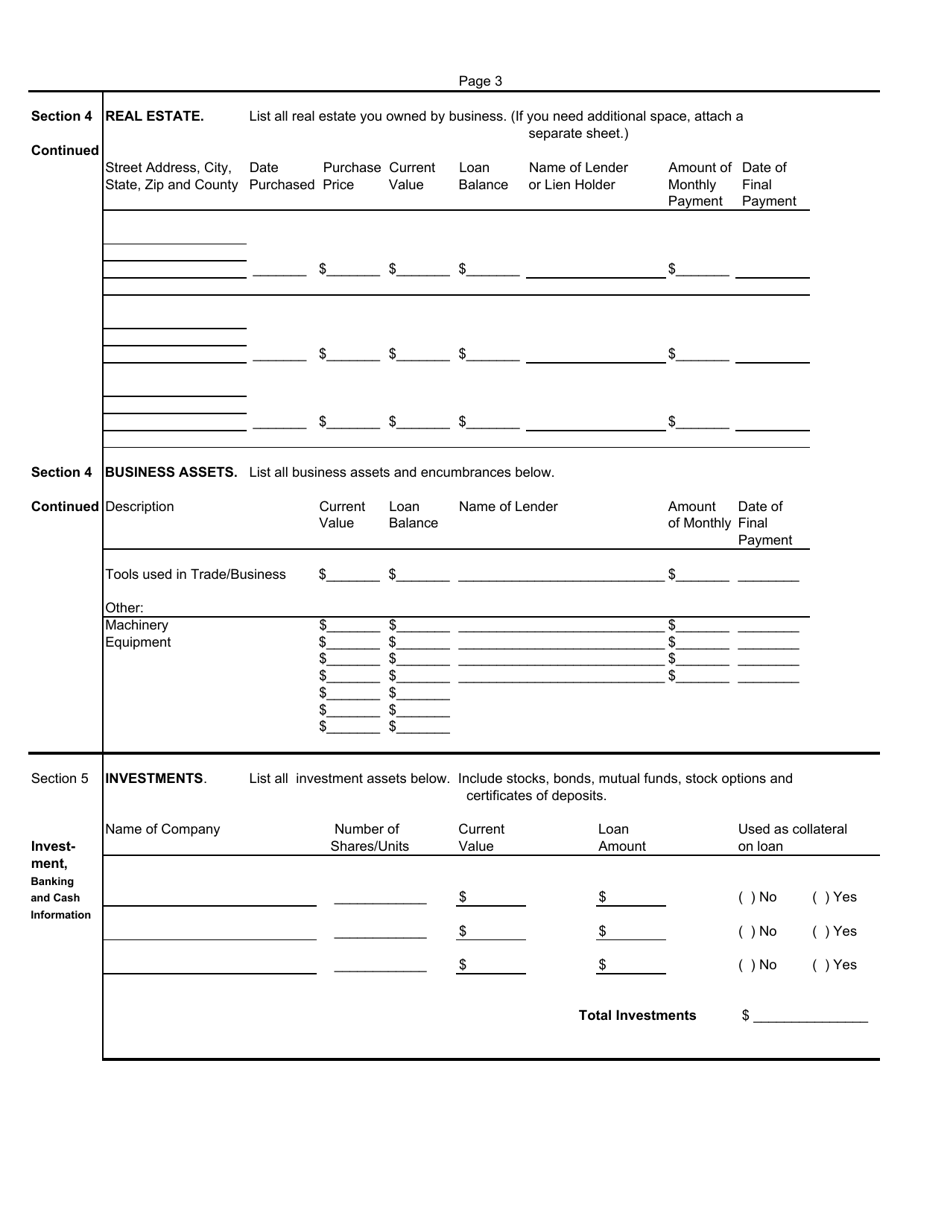

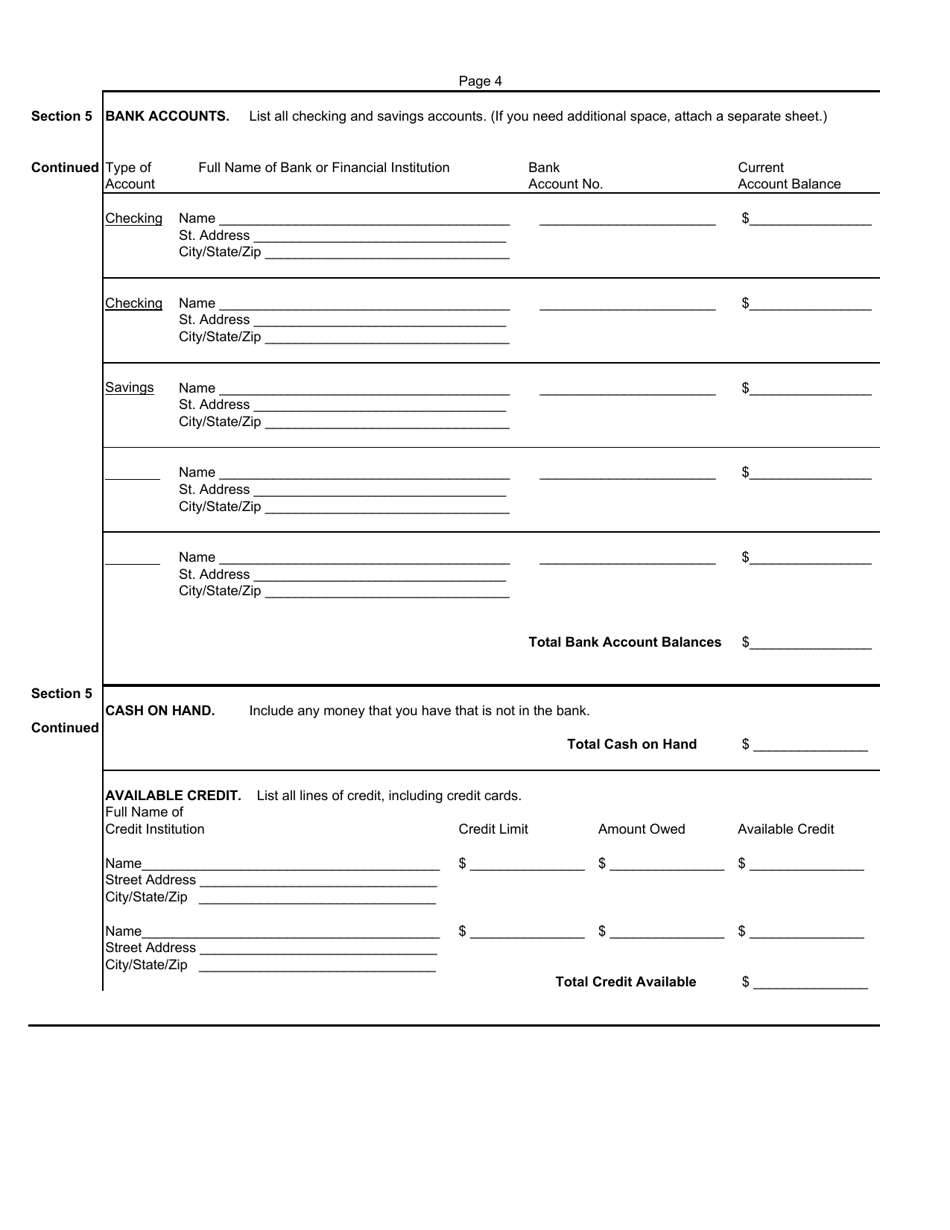

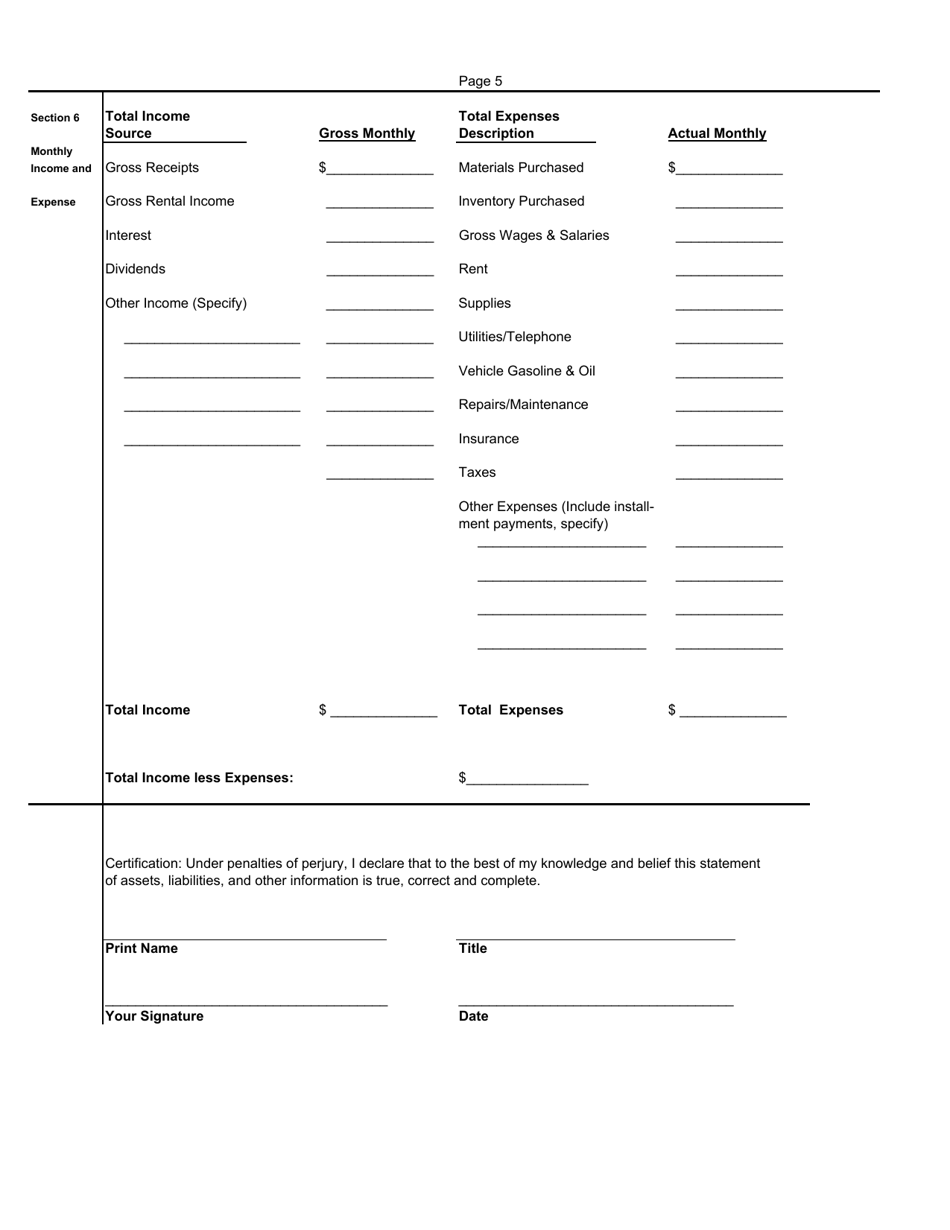

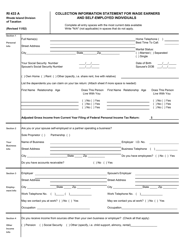

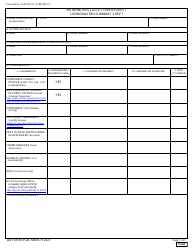

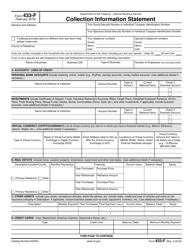

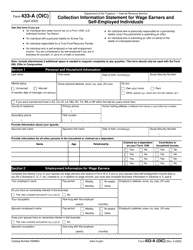

Q: What information is required on form RI433 B?

A: Form RI433 B requires information about the business's financial situation, assets, liabilities, income, expenses, and payment history.

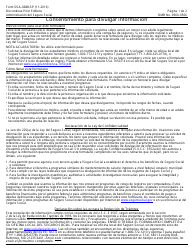

Q: Do I need to submit any supporting documentation with form RI433 B?

A: Yes, businesses are required to submit supporting documentation, such as bank statements and financial statements, along with form RI433 B.

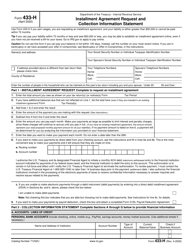

Q: What is the purpose of form RI433 B?

A: The purpose of form RI433 B is to provide the Rhode Island Division of Taxation with a detailed picture of a business's financial situation to determine an appropriate payment plan for outstanding tax debt.

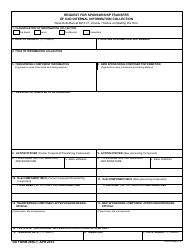

Q: What happens after I submit form RI433 B?

A: After submitting form RI433 B, the Rhode Island Division of Taxation will review the information provided and contact the business to discuss a potential payment plan.

Q: What if I don't fill out form RI433 B?

A: If a business does not fill out and submit form RI433 B, the Rhode Island Division of Taxation may take enforcement actions, such as bank levies or legal action, to collect the outstanding tax debt.

Q: Can I request an extension to submit form RI433 B?

A: Yes, businesses can request an extension to submit form RI433 B by contacting the Rhode Island Division of Taxation.

Form Details:

- Released on November 1, 2002;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI433 B by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.