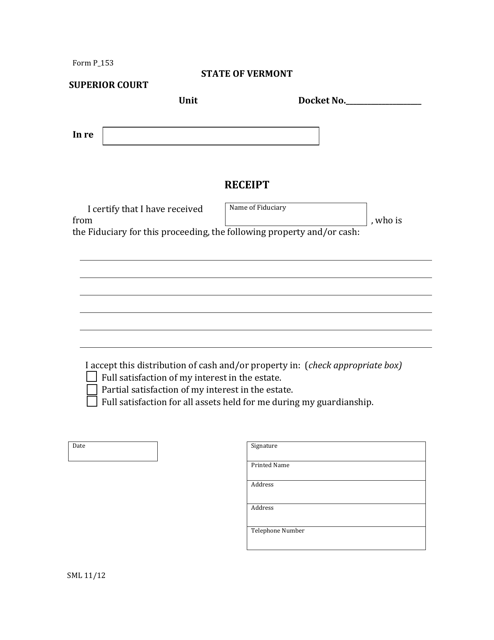

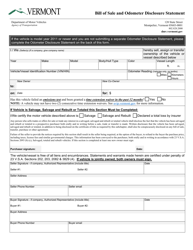

Form P153 Receipt - Vermont

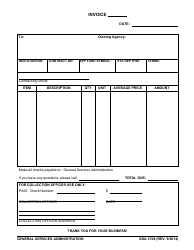

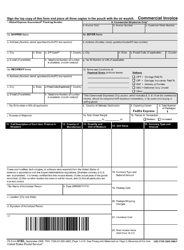

What Is Form P153?

This is a legal form that was released by the Vermont Superior Court - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

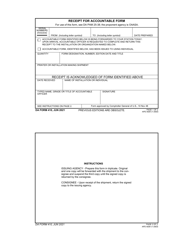

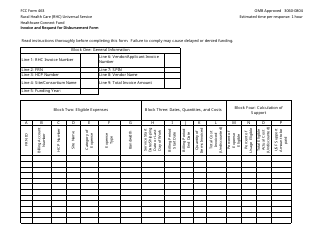

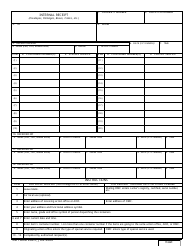

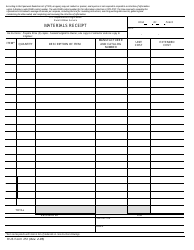

Q: What is Form P153 Receipt?

A: Form P153 Receipt is a document used in the state of Vermont to provide proof of payment for various fees and taxes.

Q: What is the purpose of Form P153 Receipt?

A: The purpose of Form P153 Receipt is to document the payment of fees and taxes in Vermont.

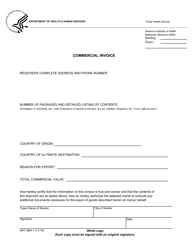

Q: What information is required on Form P153 Receipt?

A: Form P153 Receipt requires information such as the taxpayer's name, address, payment details, and the purpose of the payment.

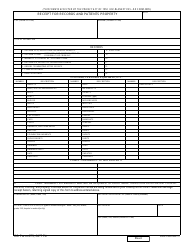

Q: When should I submit Form P153 Receipt?

A: Form P153 Receipt should be submitted at the time of payment or as instructed by the Vermont Department of Taxes.

Q: Is Form P153 Receipt the same as a receipt from a business?

A: No, Form P153 Receipt is a specific form provided by the Vermont Department of Taxes for tax and fee payments.

Q: Can I use Form P153 Receipt for federal taxes?

A: No, Form P153 Receipt is only for state tax and fee payments in Vermont.

Q: Do I need to keep a copy of Form P153 Receipt?

A: Yes, it is recommended to keep a copy of Form P153 Receipt for your records in case of any future inquiries or audits.

Form Details:

- Released on November 1, 2012;

- The latest edition provided by the Vermont Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form P153 by clicking the link below or browse more documents and templates provided by the Vermont Superior Court.