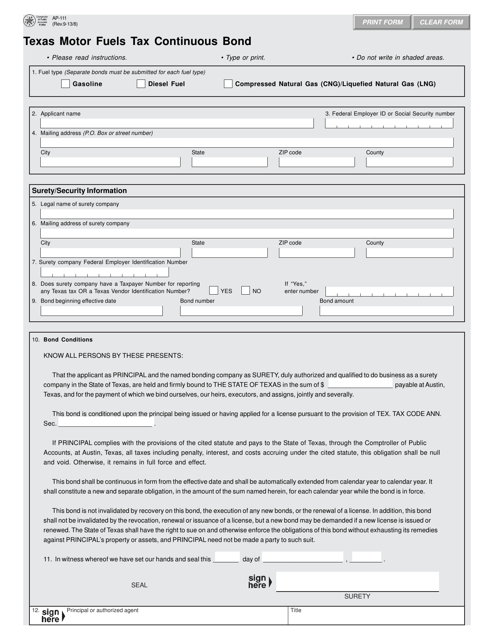

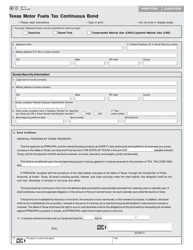

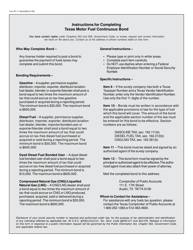

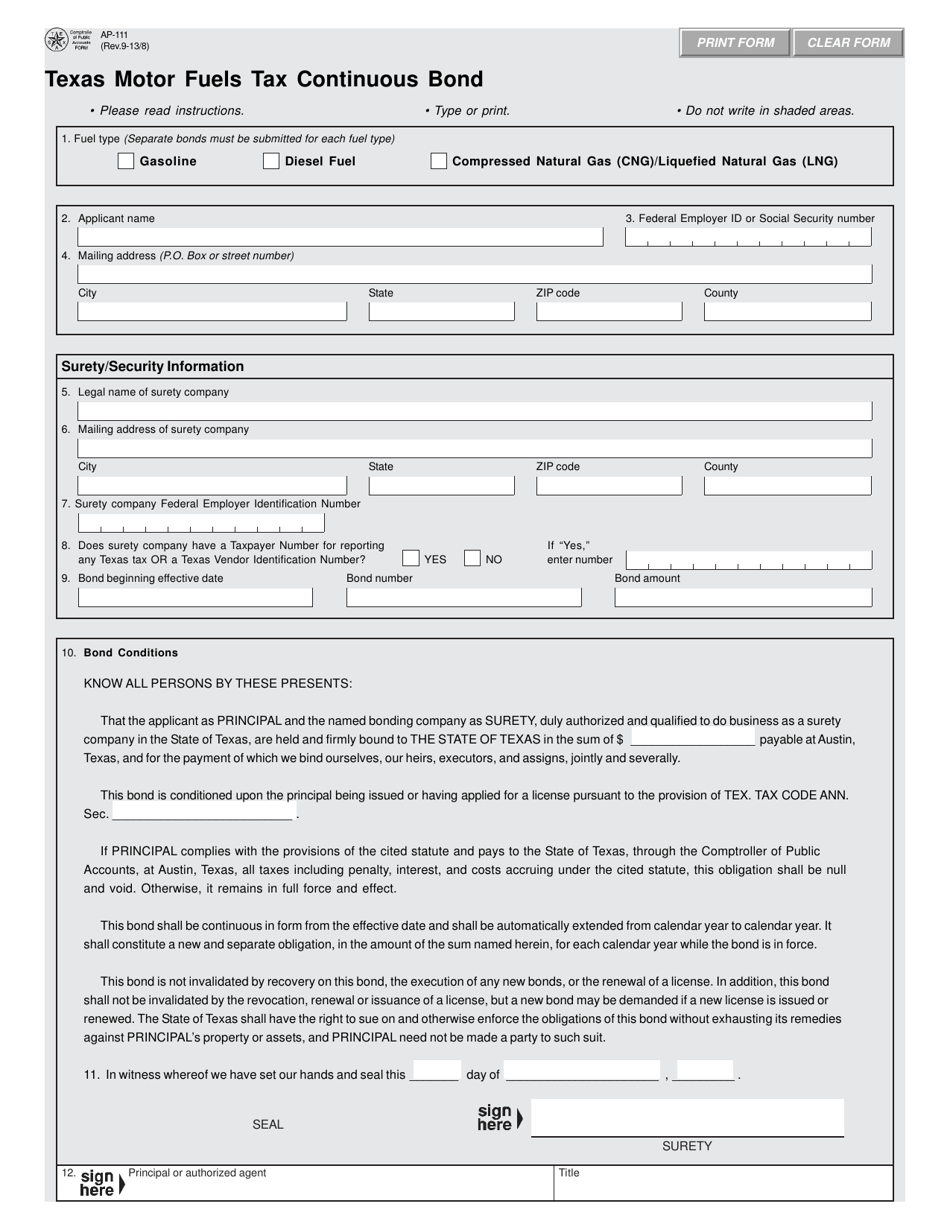

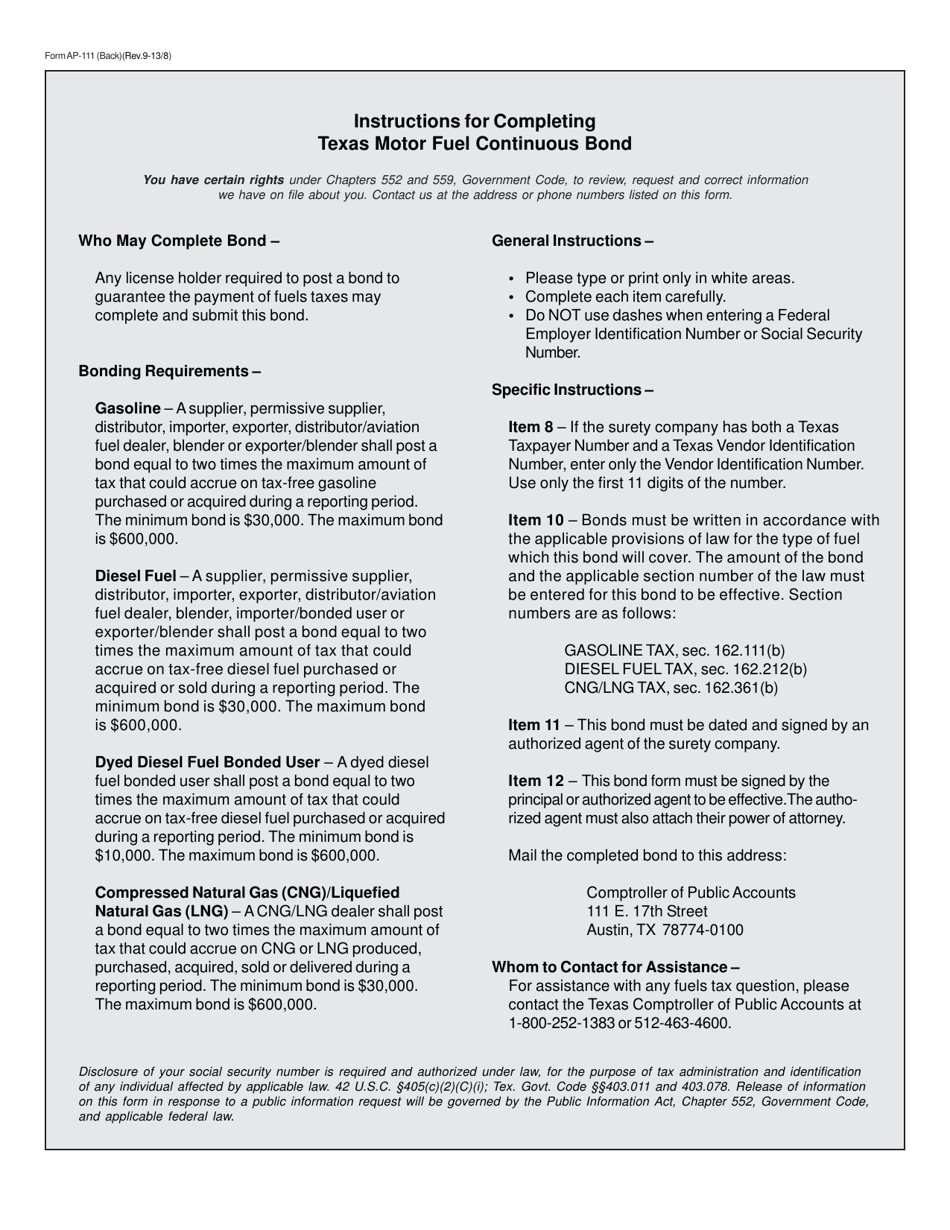

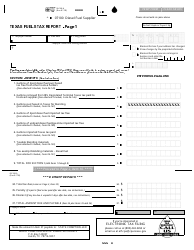

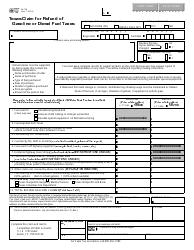

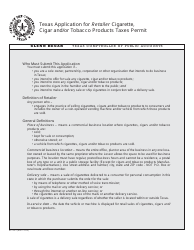

Form AP-111 Texas Motor Fuels Tax Continuous Bond - Texas

What Is Form AP-111?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AP-111?

A: Form AP-111 is the Texas Motor Fuels TaxContinuous Bond.

Q: What is the purpose of Form AP-111?

A: The purpose of Form AP-111 is to serve as a bond for motor fueltax purposes in Texas.

Q: Do I need to fill out Form AP-111?

A: If you are a motor fuel distributor in Texas, you may need to fill out Form AP-111.

Q: What information is required on Form AP-111?

A: Form AP-111 requires information such as the business name, address, bond amount, and surety company information.

Q: Are there any fees associated with Form AP-111?

A: Yes, there may be fees associated with Form AP-111. It is best to check with the Texas Comptroller of Public Accounts for the current fee schedule.

Q: What happens if I don't submit Form AP-111?

A: Failure to submit Form AP-111 may result in penalties and fines.

Q: Can I make changes to Form AP-111 once it is filed?

A: Once Form AP-111 is filed, you may need to contact the Texas Comptroller of Public Accounts to make any necessary changes or amendments.

Form Details:

- Released on September 1, 2013;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-111 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.