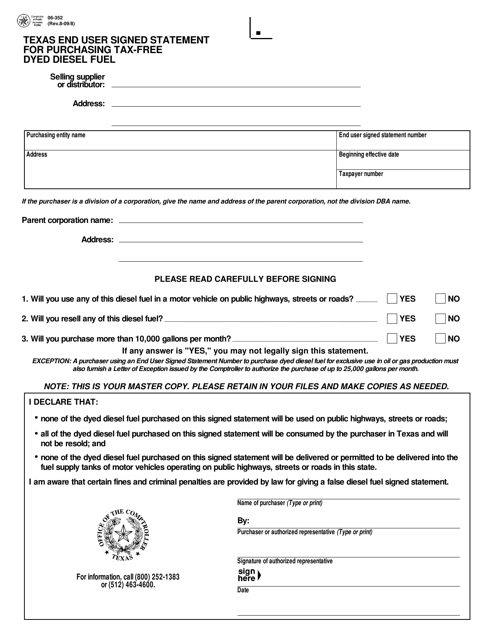

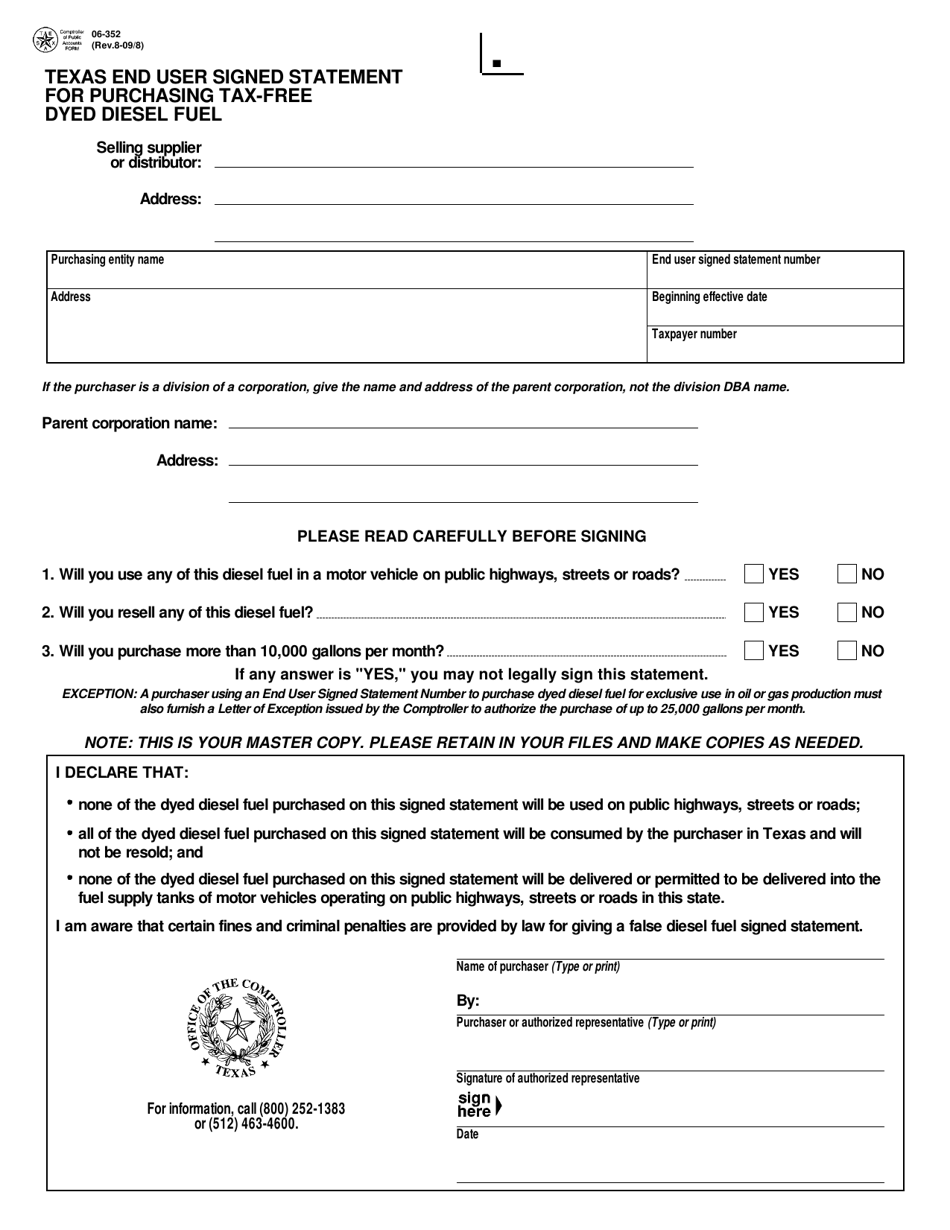

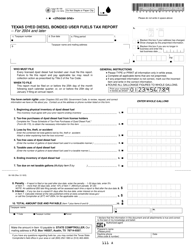

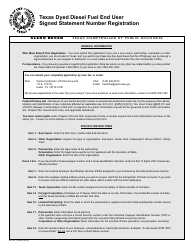

Form 06-352 Texas End User Signed Statement for Purchasing Tax-Free Dyed Diesel Fuel - Texas

What Is Form 06-352?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 06-352?

A: Form 06-352 is a Texas End User Signed Statement for Purchasing Tax-Free Dyed Diesel Fuel.

Q: What is the purpose of form 06-352?

A: The purpose of form 06-352 is to claim exemption from state motor fuel tax when purchasing dyed diesel fuel for non-highway uses.

Q: Who needs to fill out form 06-352?

A: Any end user who wants to purchase tax-free dyed diesel fuel in Texas for non-highway uses needs to fill out form 06-352.

Q: What is dyed diesel fuel?

A: Dyed diesel fuel is a type of fuel that has been marked or colored to indicate that it is not intended for use on public roads.

Q: What is the non-highway use of dyed diesel fuel?

A: Non-highway use of dyed diesel fuel refers to the use of this fuel in off-road vehicles or equipment, such as farming machinery, construction equipment, or generators.

Q: Do I need to keep a copy of form 06-352?

A: Yes, you should keep a copy of form 06-352 for your records in case of an audit.

Q: Can I use dyed diesel fuel in my personal vehicle?

A: No, dyed diesel fuel is only intended for non-highway use and should not be used in personal vehicles driven on public roads.

Q: What are the consequences of using dyed diesel fuel in a vehicle on public roads?

A: Using dyed diesel fuel in a vehicle on public roads can result in penalties, fines, and legal consequences.

Q: Are there any exceptions to using dyed diesel fuel in vehicles on public roads?

A: There are very limited exceptions for using dyed diesel fuel in vehicles on public roads, and these generally require specific permits and circumstances.

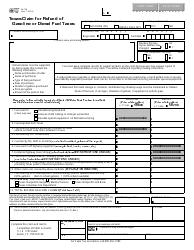

Q: Can I claim a refund for taxes paid on dyed diesel fuel?

A: No, taxes paid on dyed diesel fuel are not refundable.

Form Details:

- Released on August 1, 2009;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 06-352 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.