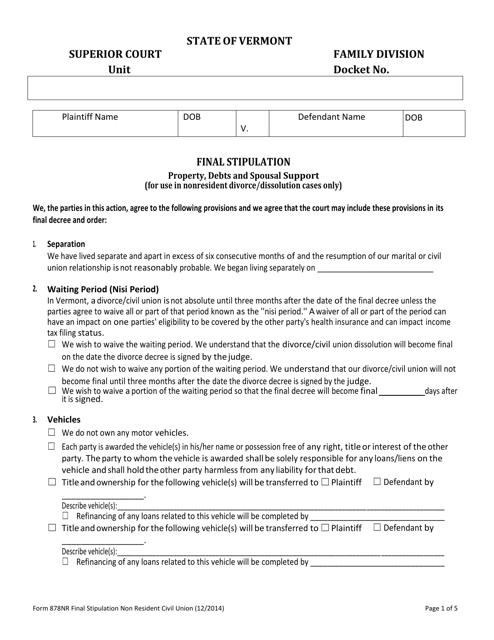

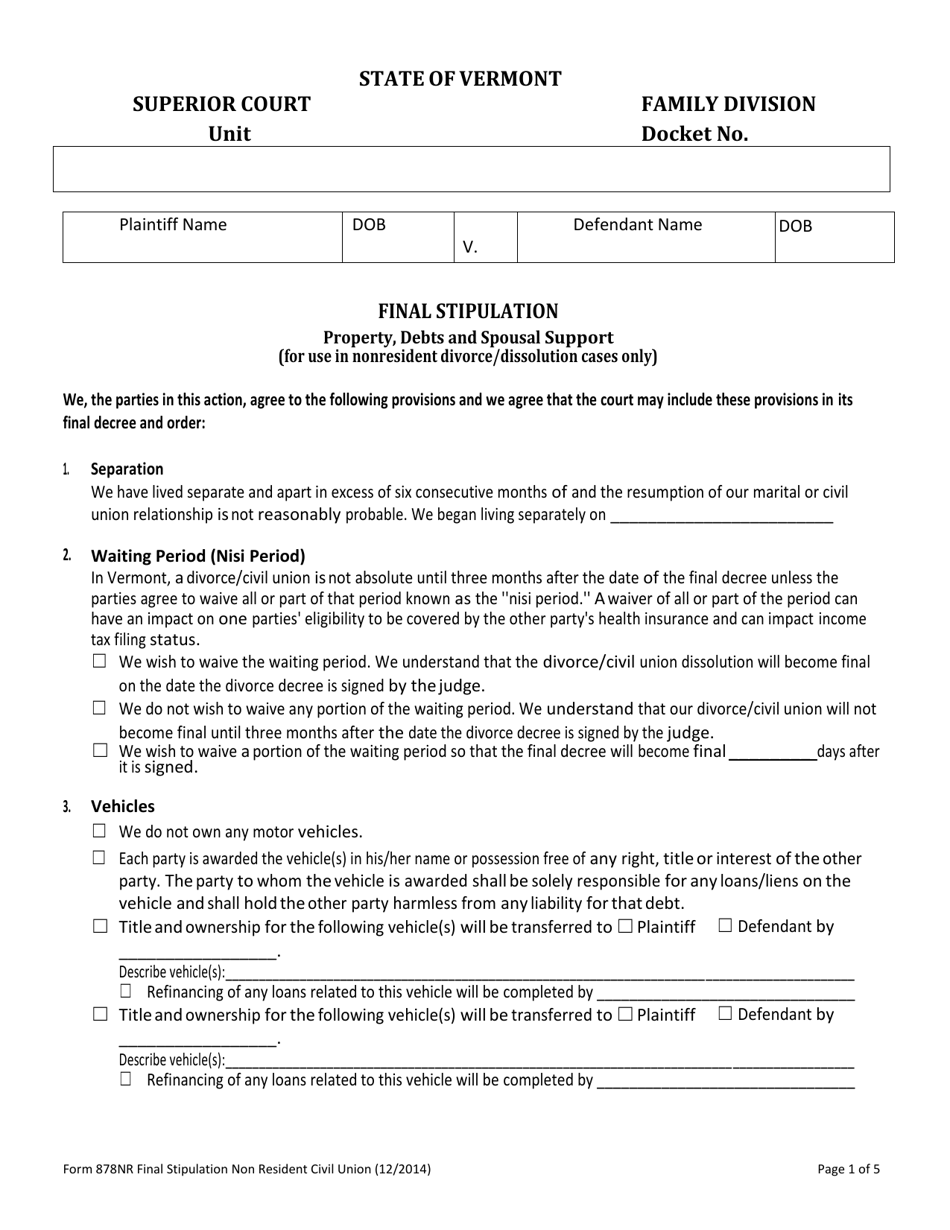

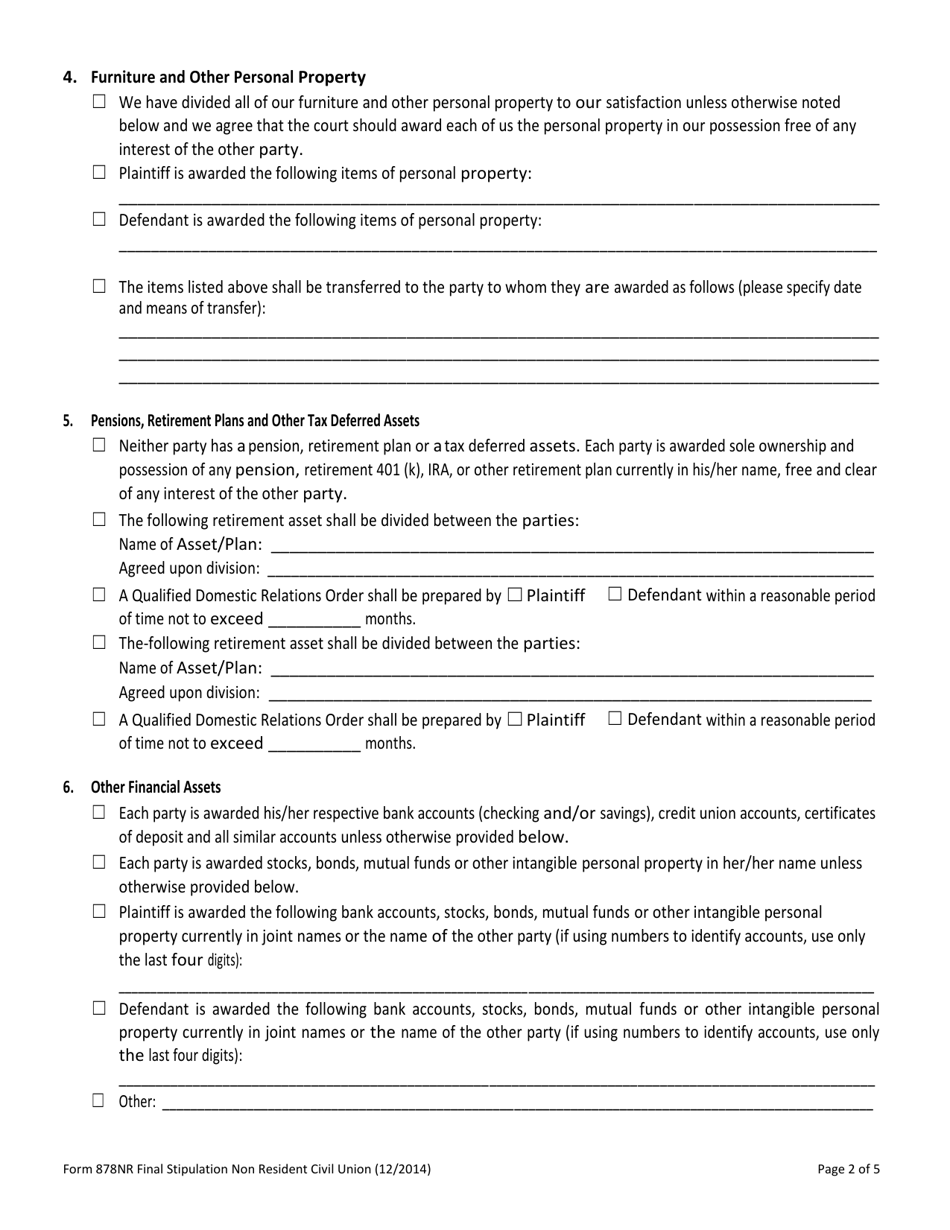

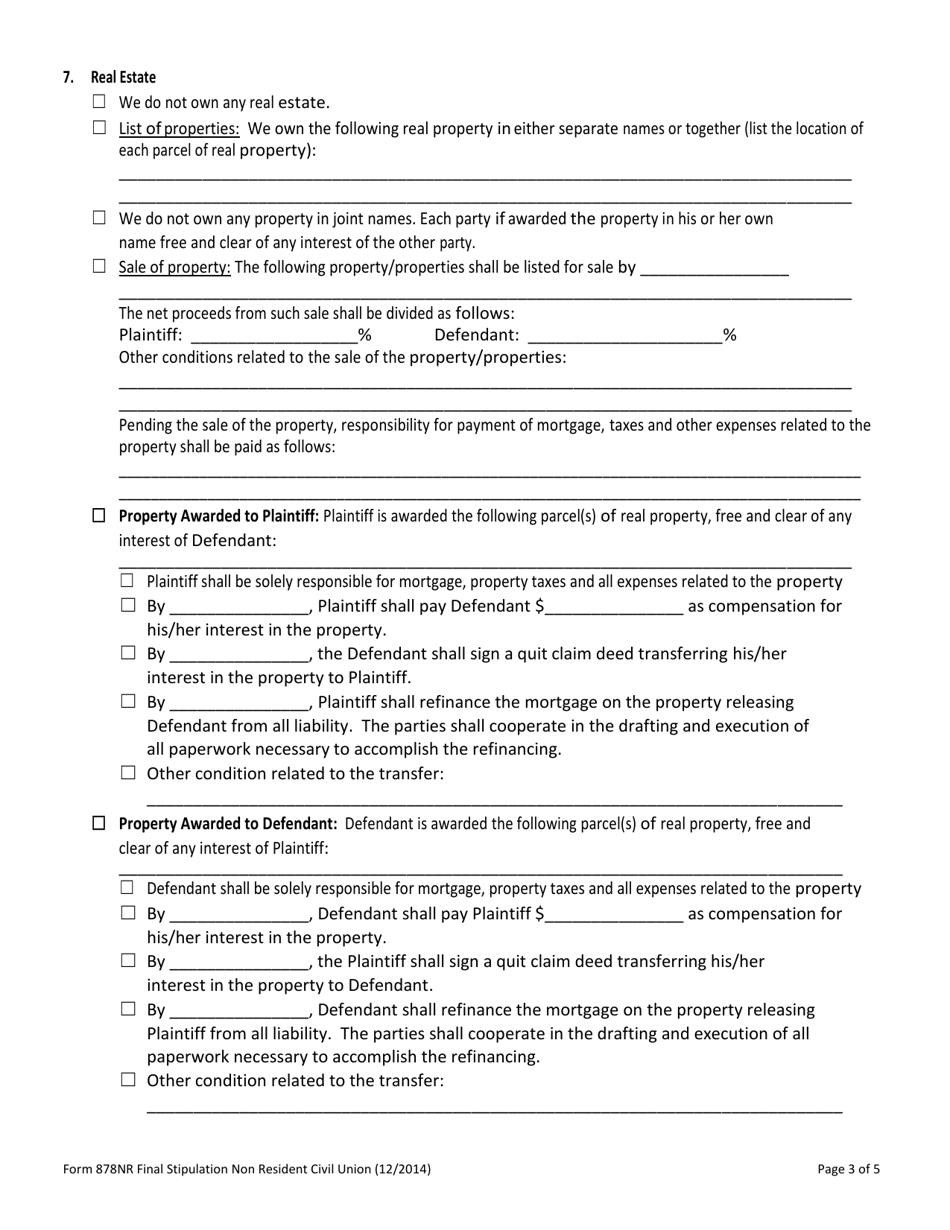

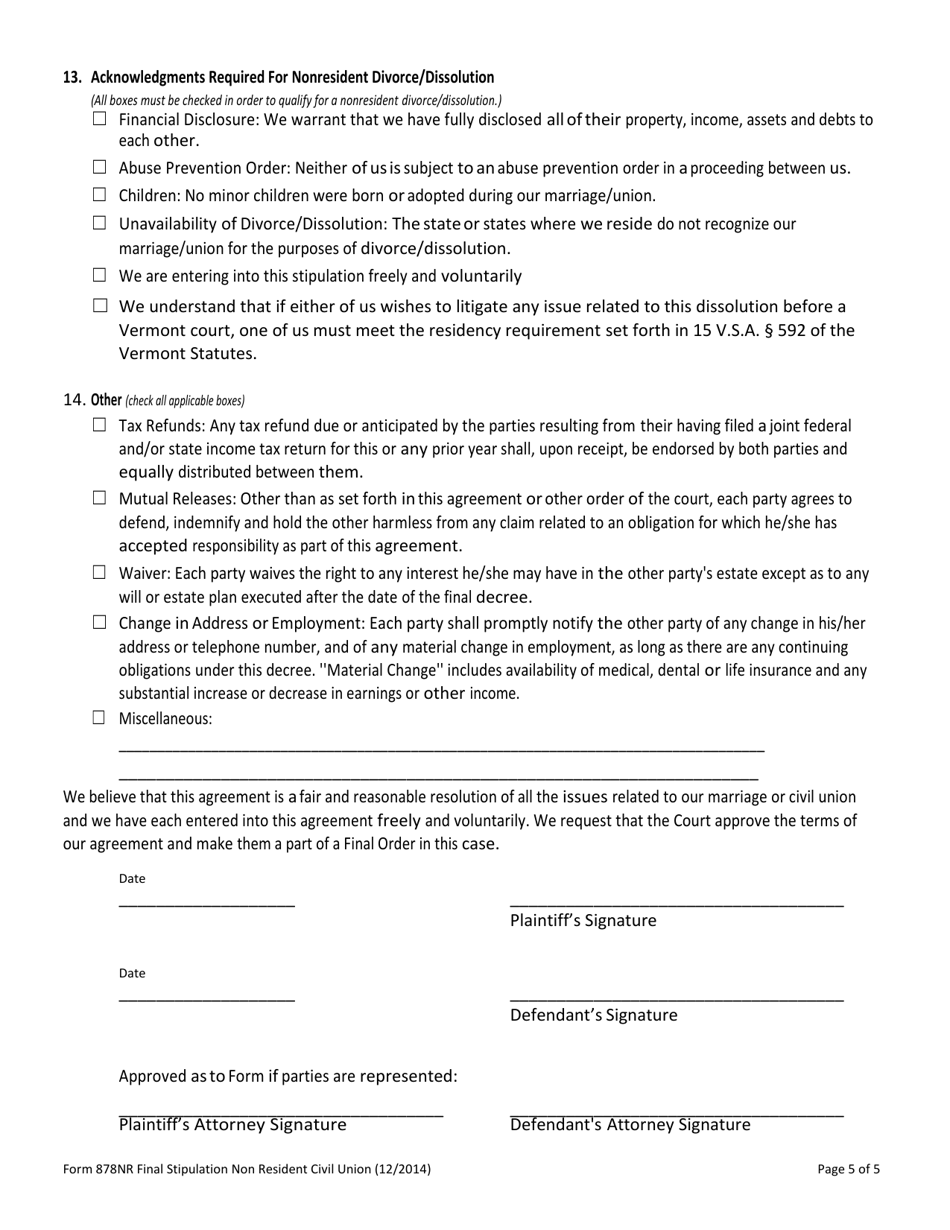

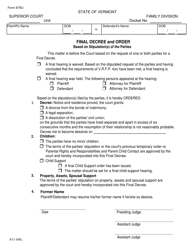

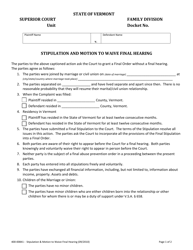

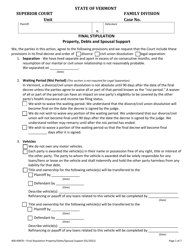

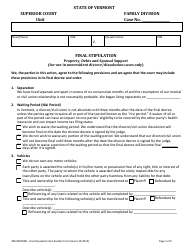

Form 878NR Final Stipulation - Vermont

What Is Form 878NR?

This is a legal form that was released by the Vermont Superior Court - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 878NR?

A: Form 878NR is a tax form used by non-resident aliens to report income earned in the United States.

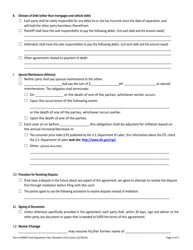

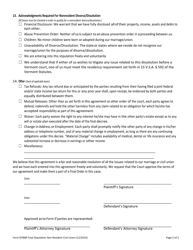

Q: What is a Final Stipulation?

A: A Final Stipulation is a legal document that outlines the final agreement reached between parties in a lawsuit or legal dispute.

Q: Why would someone use Form 878NR Final Stipulation?

A: Form 878NR Final Stipulation is not a specific form. It seems there may be some confusion in your question.

Q: Is Form 878NR used in Vermont?

A: Yes, Form 878NR can be used in Vermont or any other state in the United States.

Q: What information is required on Form 878NR?

A: Form 878NR requires information about the non-resident alien's income, deductions, and tax liability.

Q: Are there any specific instructions for completing Form 878NR in Vermont?

A: No, the instructions for completing Form 878NR are the same regardless of the state.

Q: Are there any deadlines for submitting Form 878NR?

A: Yes, the deadline for filing Form 878NR is generally the same as the deadline for filing individual income tax returns, which is typically April 15th.

Q: Can someone help me fill out Form 878NR?

A: Yes, you can seek assistance from a tax professional or use tax software to help you fill out Form 878NR.

Q: What happens after I submit Form 878NR?

A: After you submit Form 878NR, the IRS will process your return and determine if you owe any taxes or are due a refund.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the Vermont Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 878NR by clicking the link below or browse more documents and templates provided by the Vermont Superior Court.