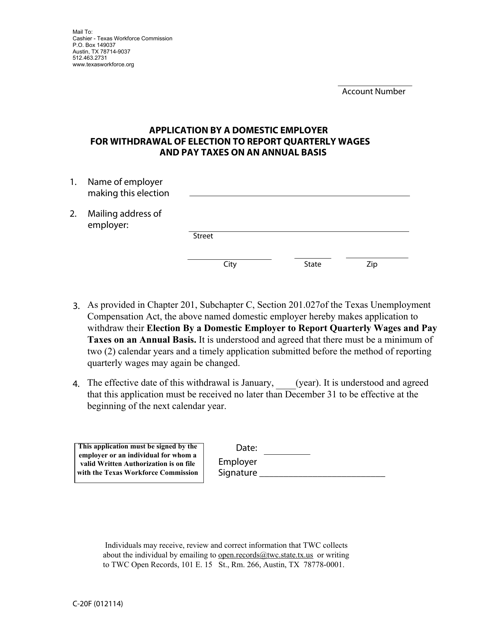

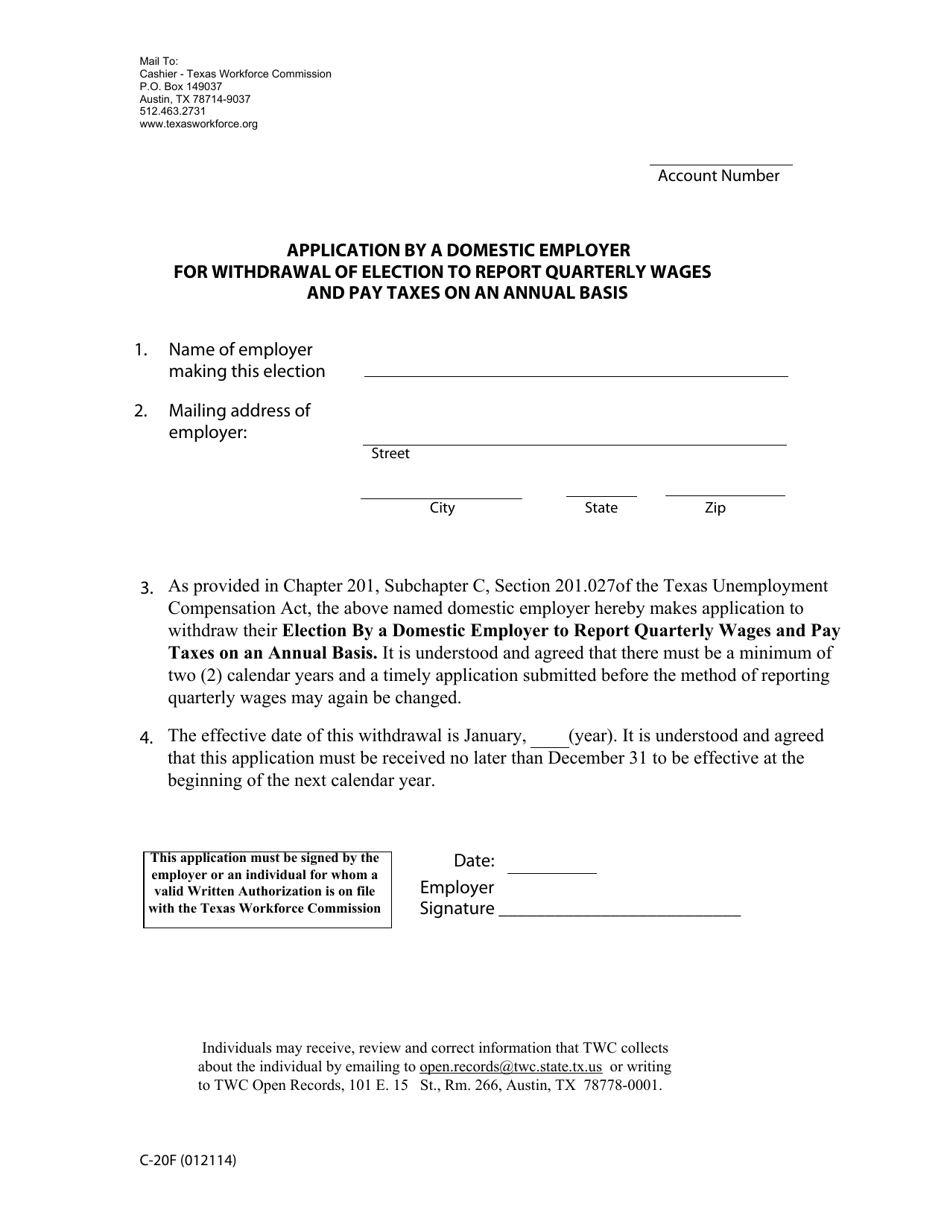

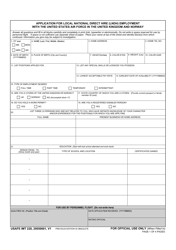

Form C-20F Application by a Domestic Employer for Withdrawal of Election to Report Quarterly Wages and Pay Taxes on an Annual Basis - Texas

What Is Form C-20F?

This is a legal form that was released by the Texas Workforce Commission - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C-20F?

A: Form C-20F is the Application by a Domestic Employer for Withdrawal of Election to Report Quarterly Wages and Pay Taxes on an Annual Basis in Texas.

Q: Who needs to file Form C-20F?

A: Domestic employers in Texas who want to withdraw their election to report quarterly wages and pay taxes on an annual basis need to file Form C-20F.

Q: What is the purpose of filing Form C-20F?

A: The purpose of filing Form C-20F is to withdraw the election to report quarterly wages and pay taxes on an annual basis in Texas.

Q: Is there a deadline for filing Form C-20F?

A: Yes, there is a deadline for filing Form C-20F. It must be filed before the beginning of the calendar year for which the withdrawal is requested.

Q: Are there any fees associated with filing Form C-20F?

A: No, there are no fees associated with filing Form C-20F.

Q: What happens after I file Form C-20F?

A: After you file Form C-20F, the Texas Workforce Commission will process your application and notify you of the acceptance or denial of your withdrawal request.

Q: Do I need to provide any supporting documentation with Form C-20F?

A: No, you do not need to provide any supporting documentation with Form C-20F. The form itself is sufficient for the withdrawal request.

Q: Can I re-elect to report quarterly wages and pay taxes on an annual basis after filing Form C-20F?

A: Yes, you can re-elect to report quarterly wages and pay taxes on an annual basis after filing Form C-20F. However, there are restrictions on when you can do so.

Q: What should I do if I have any questions about Form C-20F?

A: If you have any questions about Form C-20F, you can contact the Texas Workforce Commission for assistance.

Form Details:

- Released on January 21, 2014;

- The latest edition provided by the Texas Workforce Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C-20F by clicking the link below or browse more documents and templates provided by the Texas Workforce Commission.