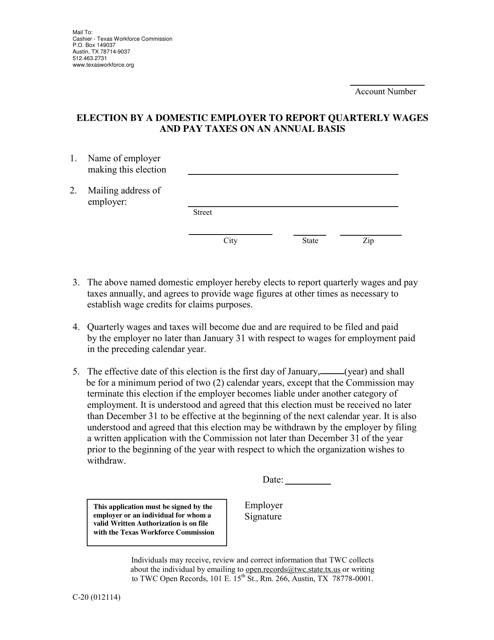

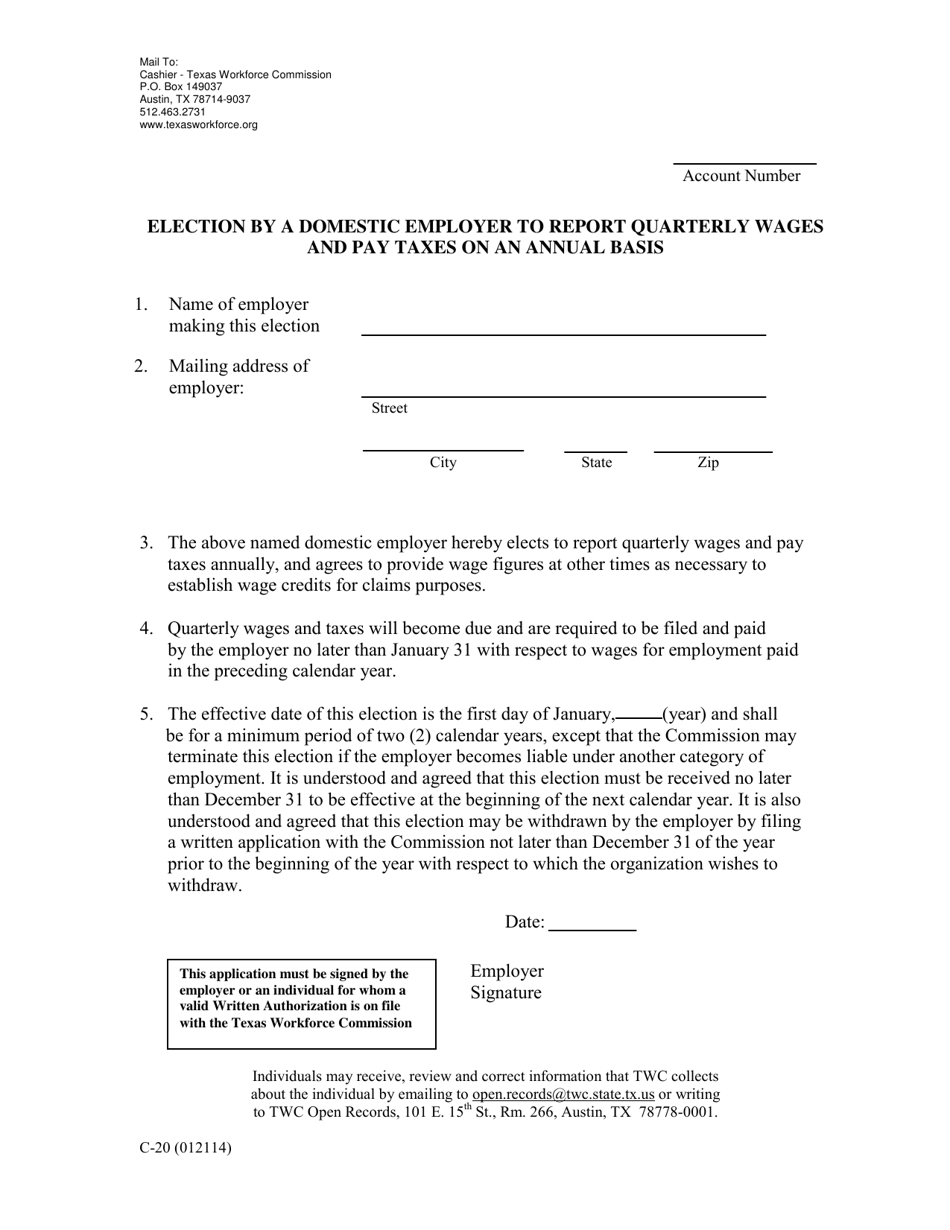

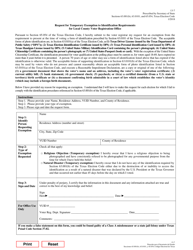

Form C-20 Election by a Domestic Employer to Report Quarterly Wages and Pay Taxes on an Annual Basis - Texas

What Is Form C-20?

This is a legal form that was released by the Texas Workforce Commission - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C-20?

A: Form C-20 is a document used by domestic employers in Texas to elect to report quarterly wages and pay taxes on an annual basis.

Q: Who uses Form C-20?

A: Domestic employers in Texas use Form C-20.

Q: What is the purpose of Form C-20?

A: The purpose of Form C-20 is to allow domestic employers in Texas to report quarterly wages and pay taxes on an annual basis.

Q: Is Form C-20 mandatory?

A: No, Form C-20 is not mandatory. It is an option for domestic employers in Texas.

Q: When should Form C-20 be filed?

A: Form C-20 should be filed within 30 days after the end of the calendar quarter.

Form Details:

- Released on January 21, 2014;

- The latest edition provided by the Texas Workforce Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C-20 by clicking the link below or browse more documents and templates provided by the Texas Workforce Commission.