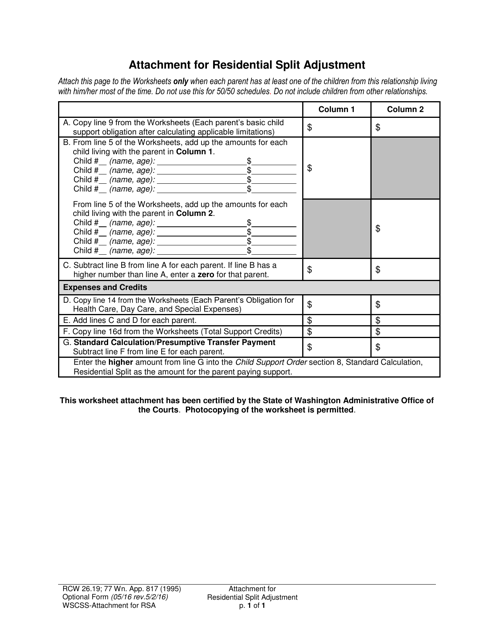

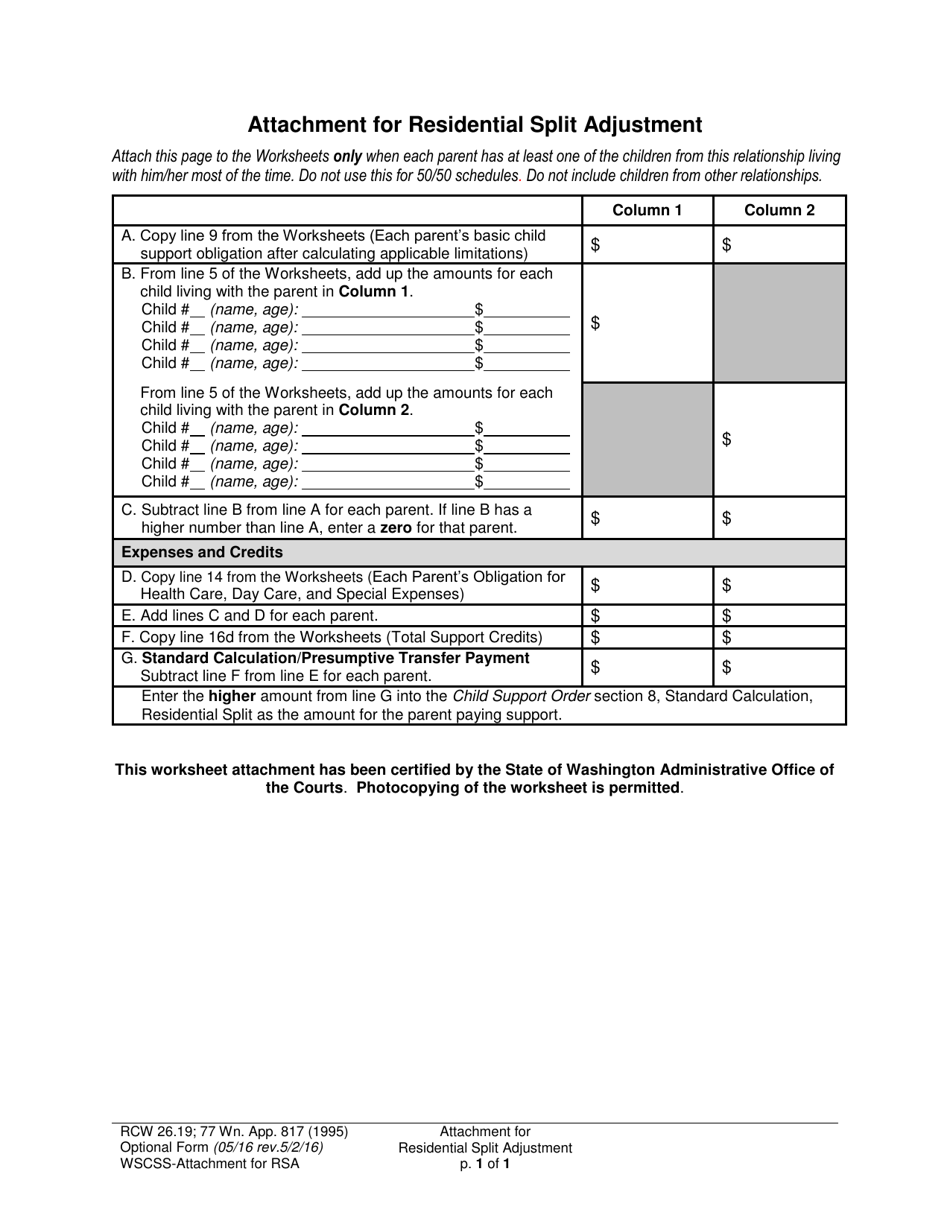

Form WSCSS Attachment for Residential Split Adjustment - Washington

What Is Form WSCSS?

This is a legal form that was released by the Washington State Courts - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WSCSS Attachment?

A: Form WSCSS Attachment is a form used in the state of Washington to report residential split adjustment information.

Q: What is a residential split adjustment?

A: A residential split adjustment is an adjustment made to the assessed value of a residential property in order to determine property taxes.

Q: When is Form WSCSS Attachment used?

A: Form WSCSS Attachment is used when reporting residential split adjustment information for property tax purposes in Washington.

Q: Who should use Form WSCSS Attachment?

A: Property owners in Washington who have received a residential split adjustment should use Form WSCSS Attachment to report the adjustment.

Q: Are there any deadlines for submitting Form WSCSS Attachment?

A: Yes, the deadline for submitting Form WSCSS Attachment varies by county. You should check with your local county assessor's office for the specific deadline in your area.

Q: Is Form WSCSS Attachment required for all residential properties in Washington?

A: No, Form WSCSS Attachment is only required for residential properties that have undergone a split adjustment.

Q: What information is required on Form WSCSS Attachment?

A: Form WSCSS Attachment requires you to provide details about the residential split adjustment, including the property address, parcel number, and the reason for the adjustment.

Q: Can I e-file Form WSCSS Attachment?

A: Yes, in most cases, you can e-file Form WSCSS Attachment. However, some counties may still require paper filing. Check with your local county assessor's office for the e-filing options available in your area.

Form Details:

- Released on May 2, 2016;

- The latest edition provided by the Washington State Courts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WSCSS by clicking the link below or browse more documents and templates provided by the Washington State Courts.