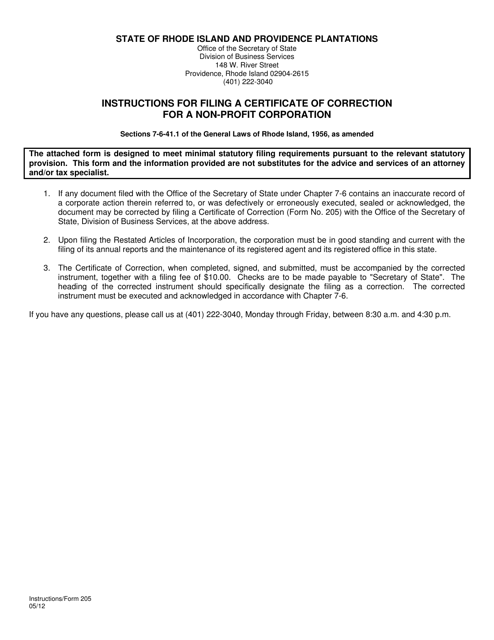

This version of the form is not currently in use and is provided for reference only. Download this version of

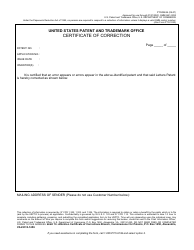

Form 205

for the current year.

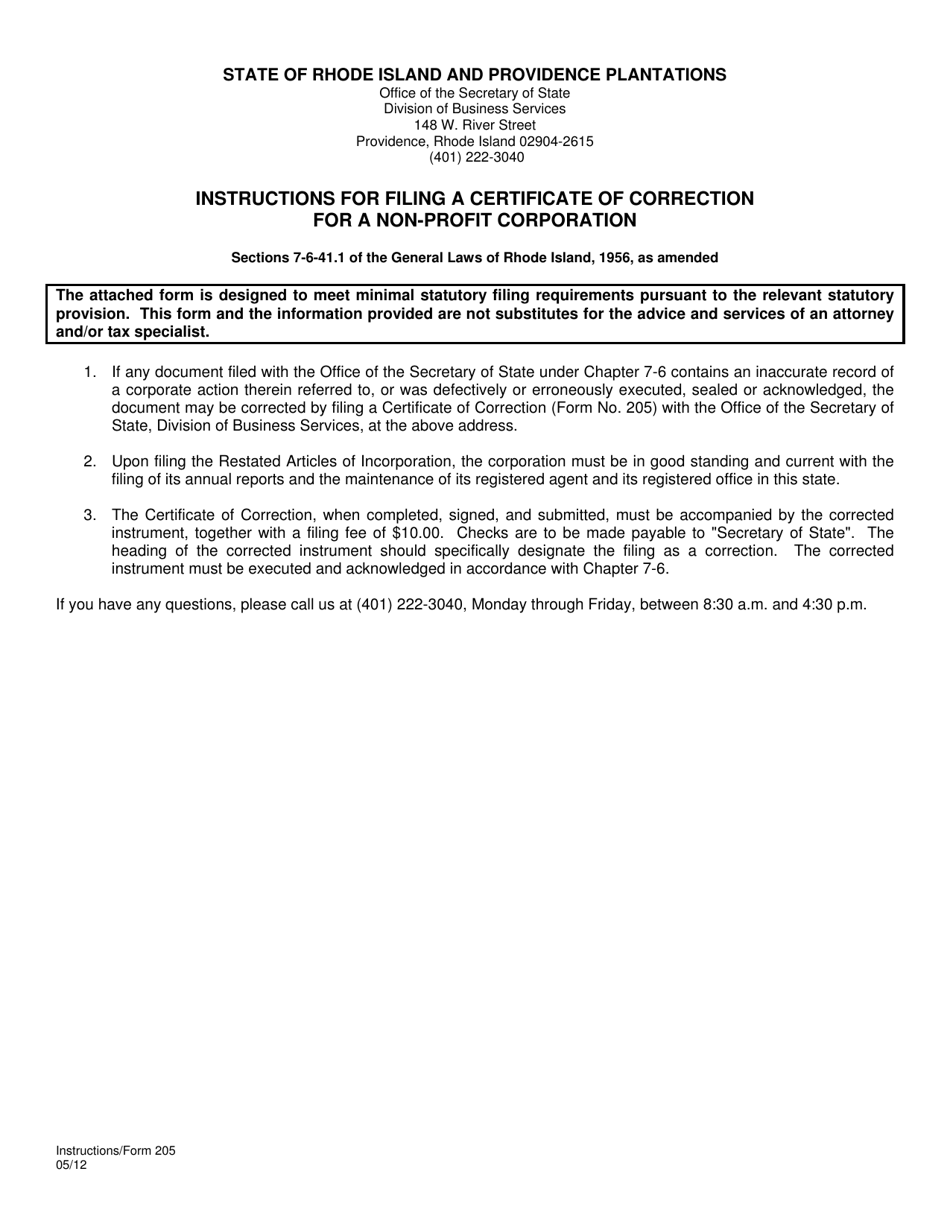

Form 205 Certificate of Correction for a Non-profit Corporation - Rhode Island

What Is Form 205?

This is a legal form that was released by the Rhode Island Secretary of State - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

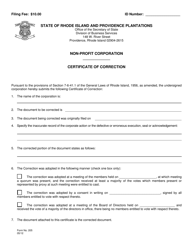

Q: What is a Form 205 Certificate of Correction?

A: Form 205 Certificate of Correction is a document used to correct errors or omissions in previously filed documents of a non-profit corporation in Rhode Island.

Q: When should I use the Form 205 Certificate of Correction?

A: You should use the Form 205 Certificate of Correction when you need to correct mistakes or omissions in previously filed documents of your non-profit corporation in Rhode Island.

Q: What types of errors can be corrected using Form 205?

A: Form 205 can be used to correct errors such as typographical mistakes, incorrect dates, incorrect names, or other inaccuracies in previously filed documents.

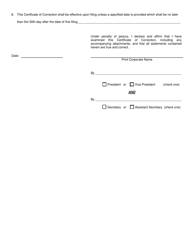

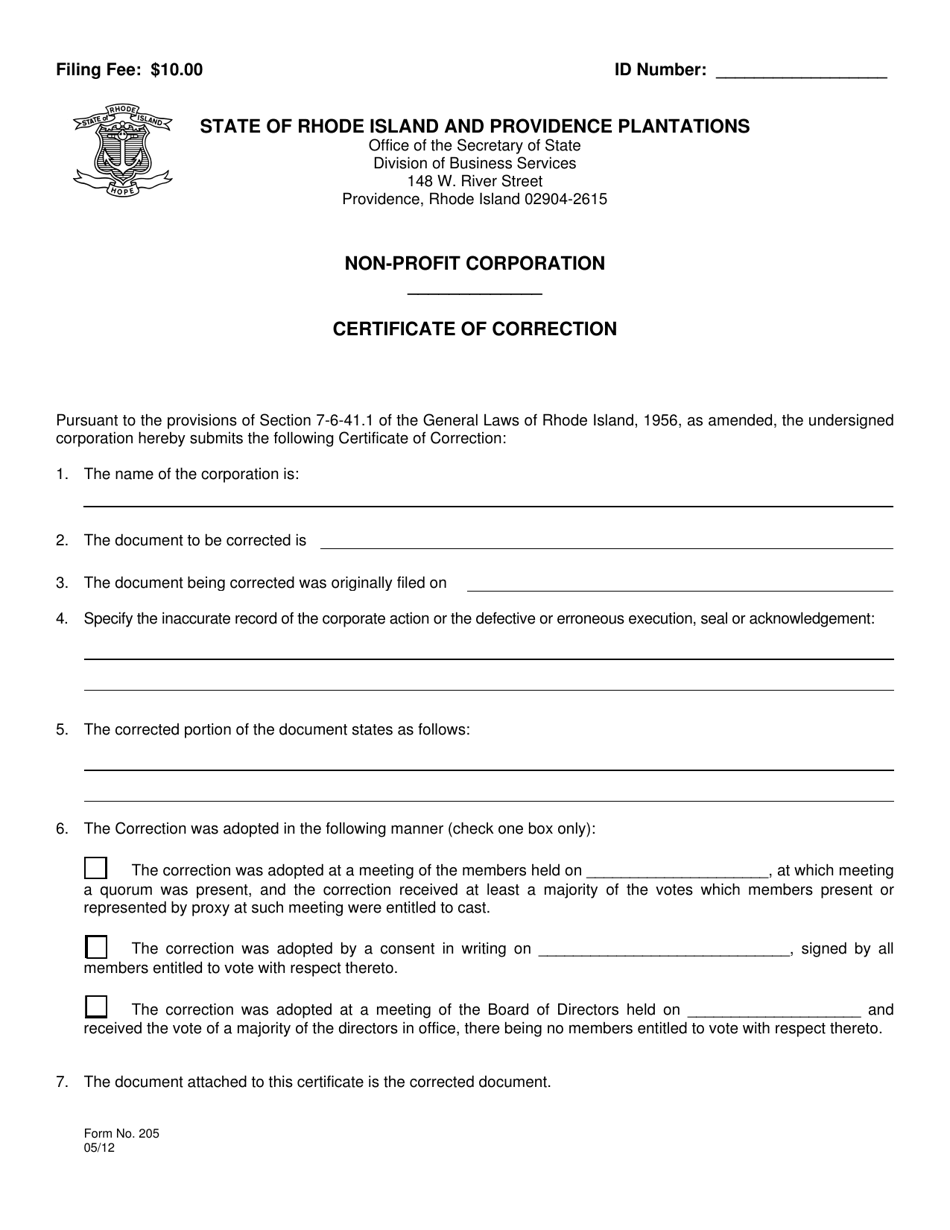

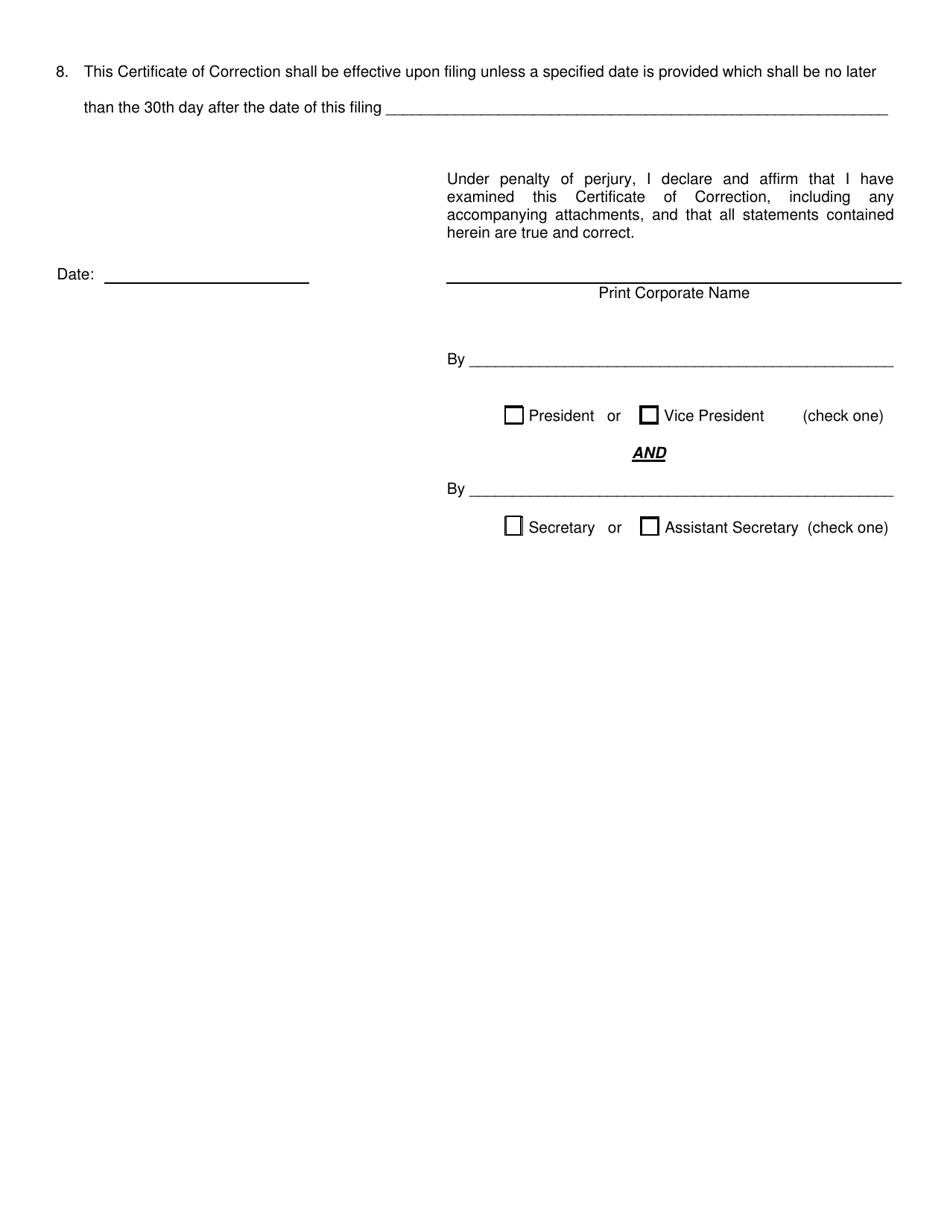

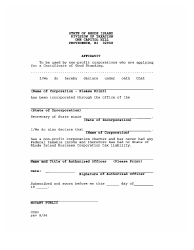

Q: How do I fill out the Form 205 Certificate of Correction?

A: You need to provide the name of your non-profit corporation, the document type being corrected, description of the error, and the correct information in the appropriate sections of the form.

Q: Is there a fee for filing the Form 205 Certificate of Correction?

A: Yes, there is a filing fee associated with submitting the Form 205 Certificate of Correction. The fee may vary, so it's recommended to check with the Secretary of State's office for the current fee.

Form Details:

- Released on May 1, 2012;

- The latest edition provided by the Rhode Island Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 205 by clicking the link below or browse more documents and templates provided by the Rhode Island Secretary of State.