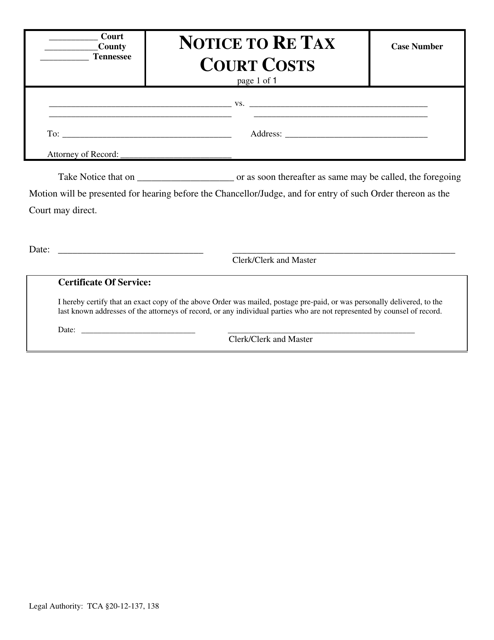

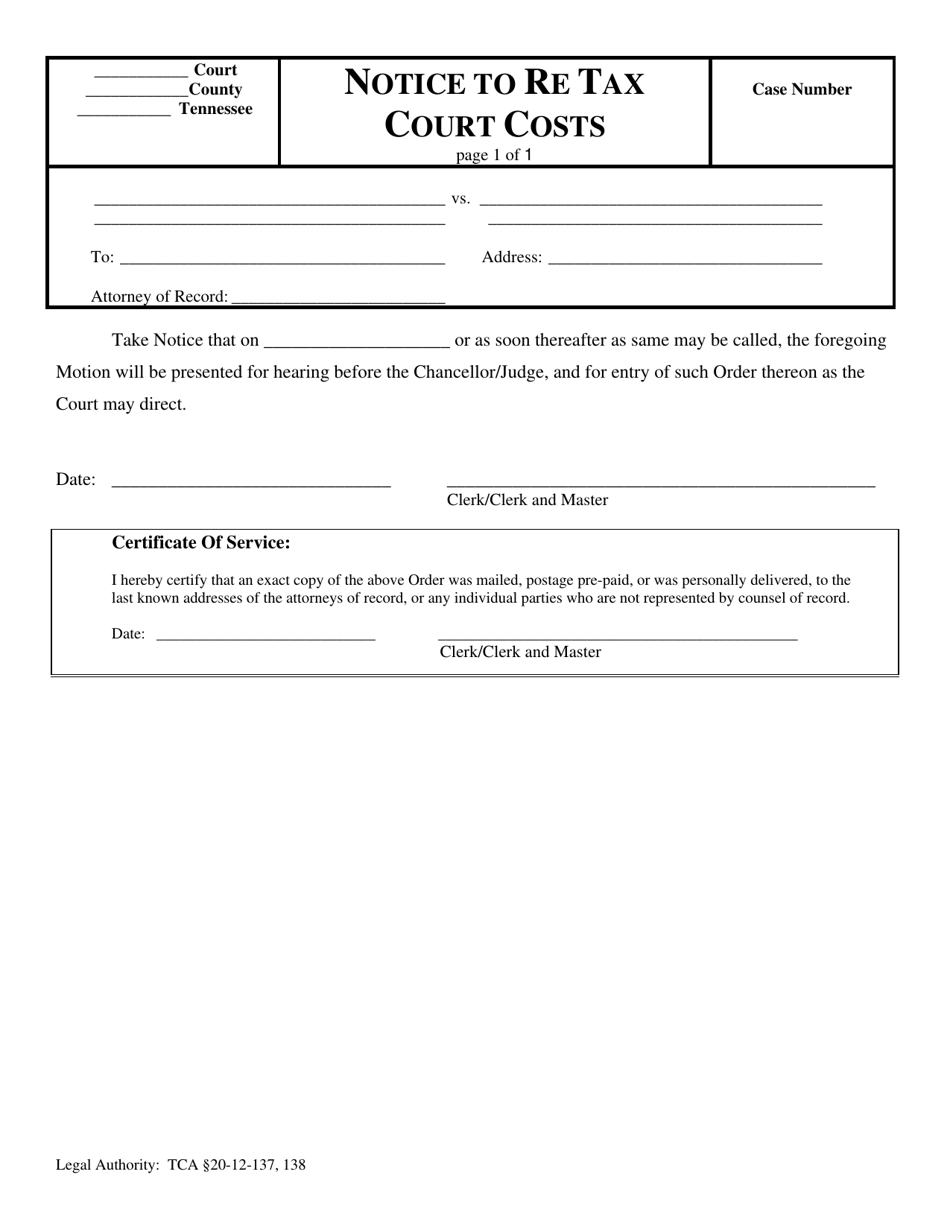

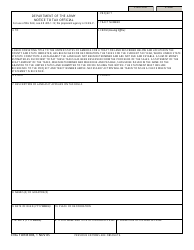

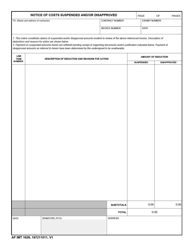

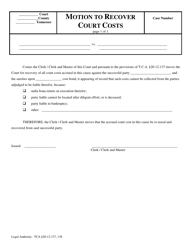

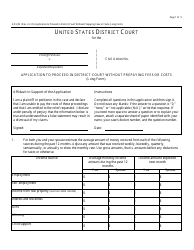

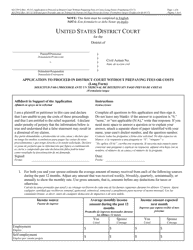

Notice to Re-tax Court Cost - Tennessee

Notice to Re-tax Court Cost is a legal document that was released by the Tennessee State Courts - a government authority operating within Tennessee.

FAQ

Q: What is a re-tax court cost?

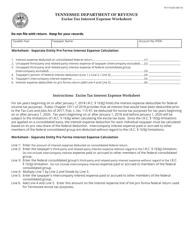

A: A re-tax court cost is an additional fee imposed by the court in Tennessee.

Q: Why am I being charged a re-tax court cost?

A: You are being charged a re-tax court cost to cover administrative expenses related to the court proceedings.

Q: How much is the re-tax court cost in Tennessee?

A: The amount of the re-tax court cost varies and is determined by the court.

Q: Is the re-tax court cost refundable?

A: No, the re-tax court cost is not refundable.

Q: When do I have to pay the re-tax court cost?

A: The re-tax court cost is typically due at the time of the court proceedings or within a specified period of time set by the court.

Q: Can I challenge the re-tax court cost?

A: In some cases, you may be able to challenge the re-tax court cost by filing an appeal with the court.

Q: What happens if I don't pay the re-tax court cost?

A: If you don't pay the re-tax court cost, the court may take additional legal action to collect the outstanding amount.

Form Details:

- The latest edition currently provided by the Tennessee State Courts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee State Courts.