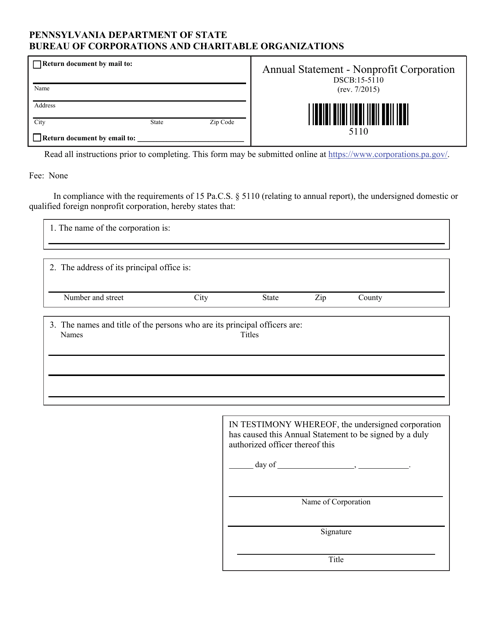

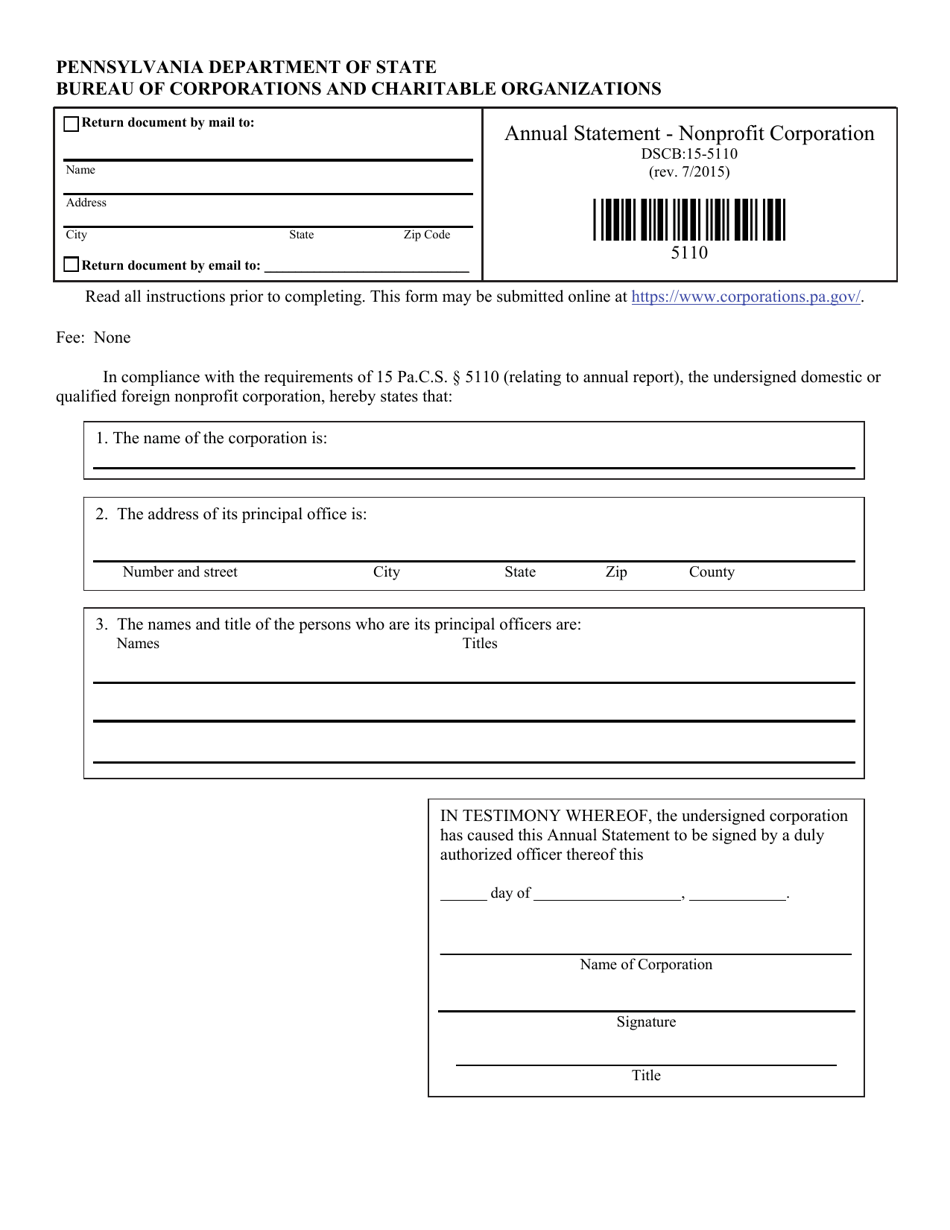

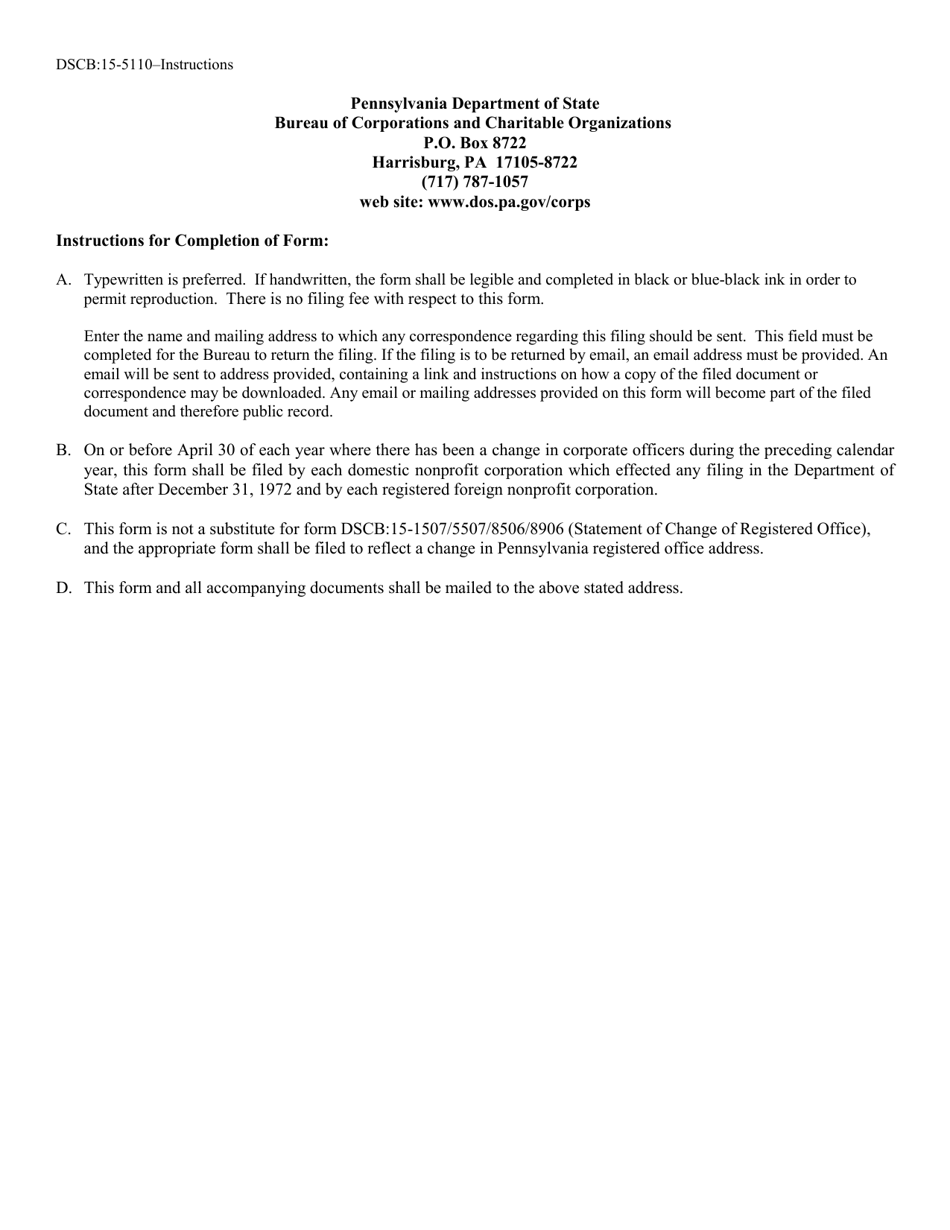

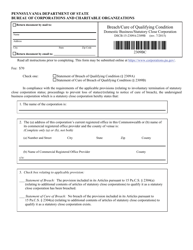

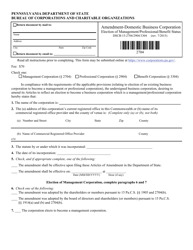

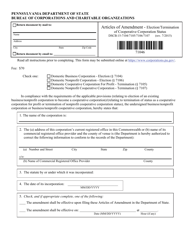

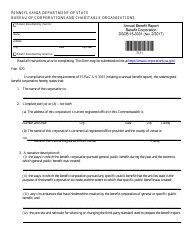

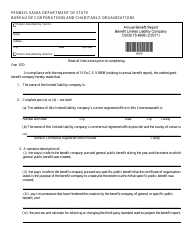

Form DSCB:15-5110 Annual Statement - Nonprofit Corporation - Pennsylvania

What Is Form DSCB:15-5110?

This is a legal form that was released by the Pennsylvania Department of State - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DSCB:15-5110?

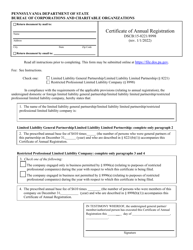

A: Form DSCB:15-5110 is the Annual Statement for a Nonprofit Corporation in Pennsylvania.

Q: Who needs to file Form DSCB:15-5110?

A: Nonprofit Corporations in Pennsylvania need to file Form DSCB:15-5110.

Q: What is the purpose of Form DSCB:15-5110?

A: The purpose of Form DSCB:15-5110 is for nonprofit corporations to provide updated information about their organization to the Pennsylvania Department of State.

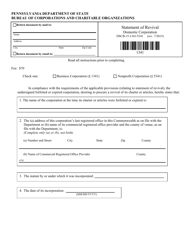

Q: When is Form DSCB:15-5110 due?

A: Form DSCB:15-5110 is due by the end of the calendar year, or within 15 days after the nonprofit corporation's fiscal year end.

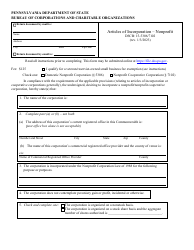

Q: What information is required on Form DSCB:15-5110?

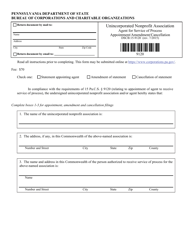

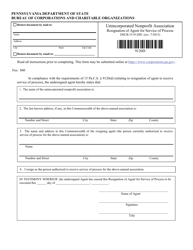

A: Form DSCB:15-5110 requires information such as the corporation's name, address, officers, registered agent, and purpose.

Q: Are there any fees associated with filing Form DSCB:15-5110?

A: Yes, there is a filing fee associated with Form DSCB:15-5110. The fee amount may vary.

Q: What happens if Form DSCB:15-5110 is not filed?

A: If Form DSCB:15-5110 is not filed, the nonprofit corporation may be subject to penalties, including the possibility of losing its active status and being dissolved by the Pennsylvania Department of State.

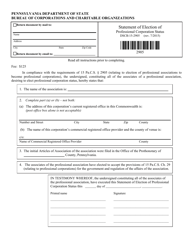

Q: Can Form DSCB:15-5110 be amended?

A: Yes, Form DSCB:15-5110 can be amended if there are changes to the corporation's information. An amended version of the form must be filed with the Pennsylvania Department of State.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Pennsylvania Department of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DSCB:15-5110 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of State.