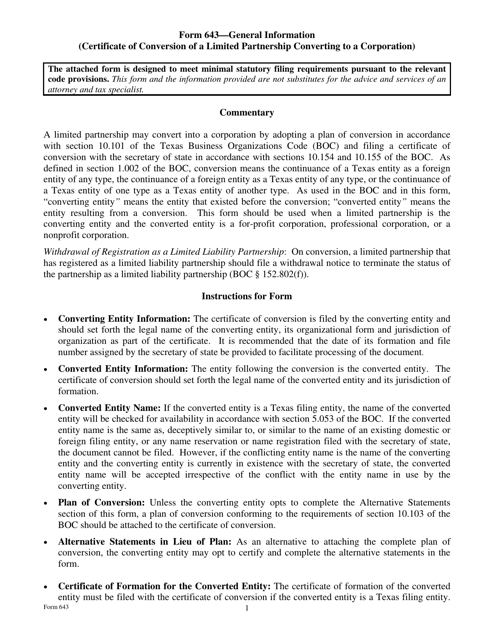

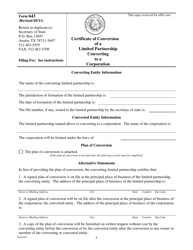

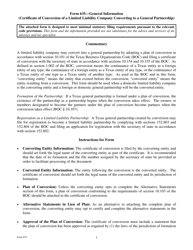

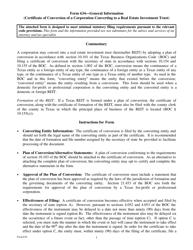

Form 643 Certificate of Conversion of a Limited Partnership Converting to a Corporation - Texas

What Is Form 643?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 643?

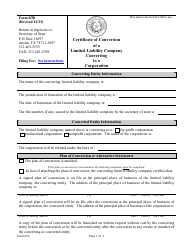

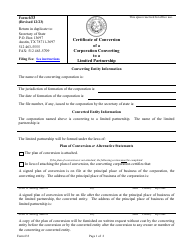

A: Form 643 is a Certificate of Conversion for a Limited Partnership converting to a Corporation in Texas.

Q: What is the purpose of Form 643?

A: The purpose of Form 643 is to officially convert a Limited Partnership into a Corporation in the state of Texas.

Q: Who needs to file Form 643?

A: Any Limited Partnership in Texas that wishes to convert to a Corporation needs to file Form 643.

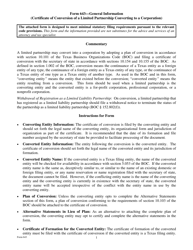

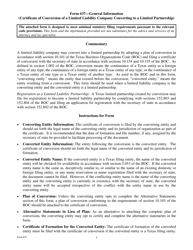

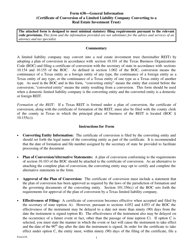

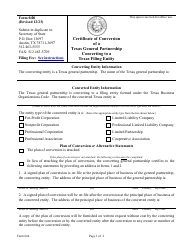

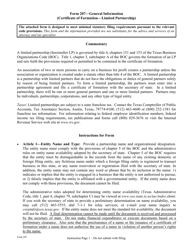

Q: What information is required on Form 643?

A: Form 643 requires information about the Limited Partnership, including its name, previous entity type, and planned Corporation name.

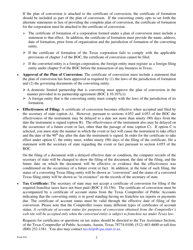

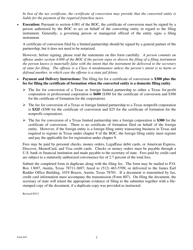

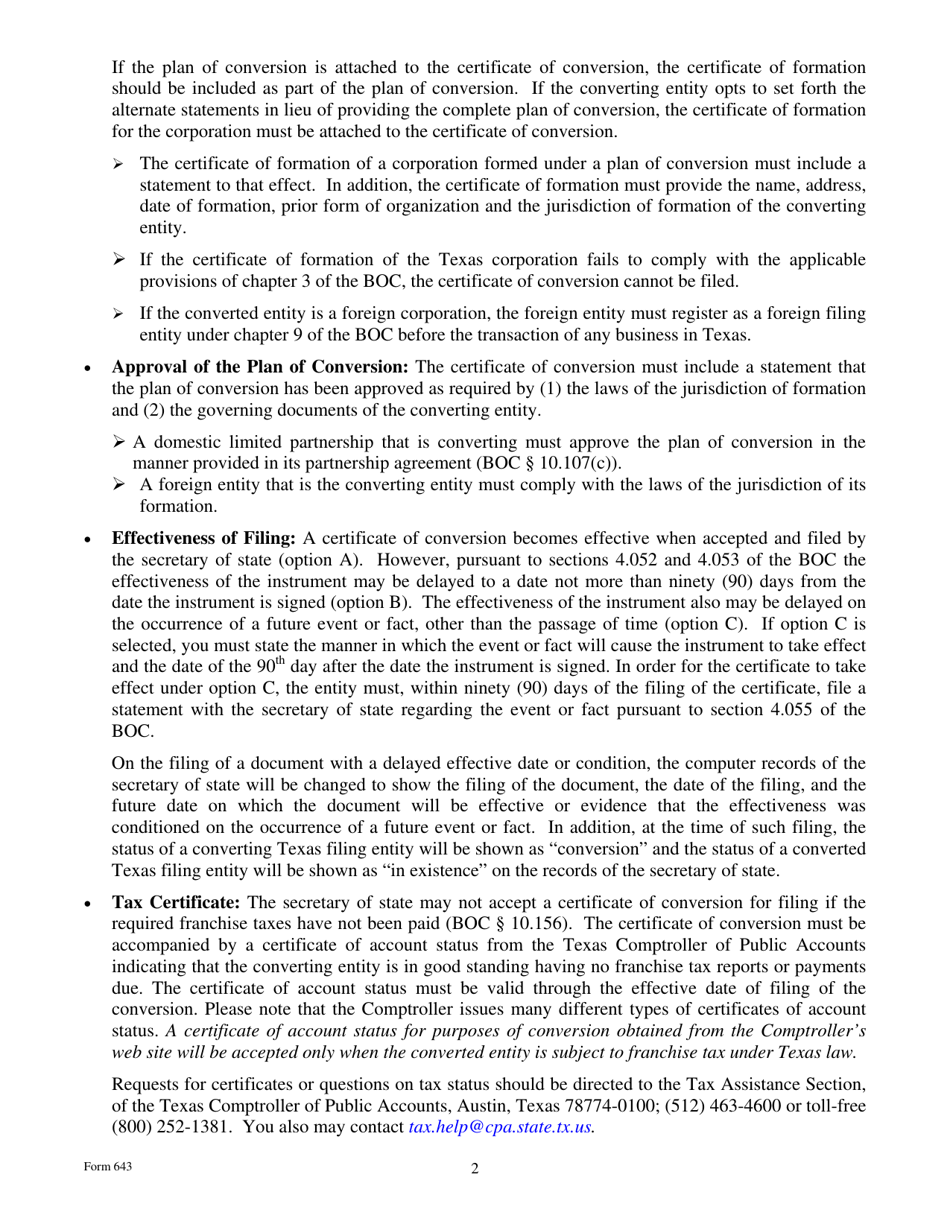

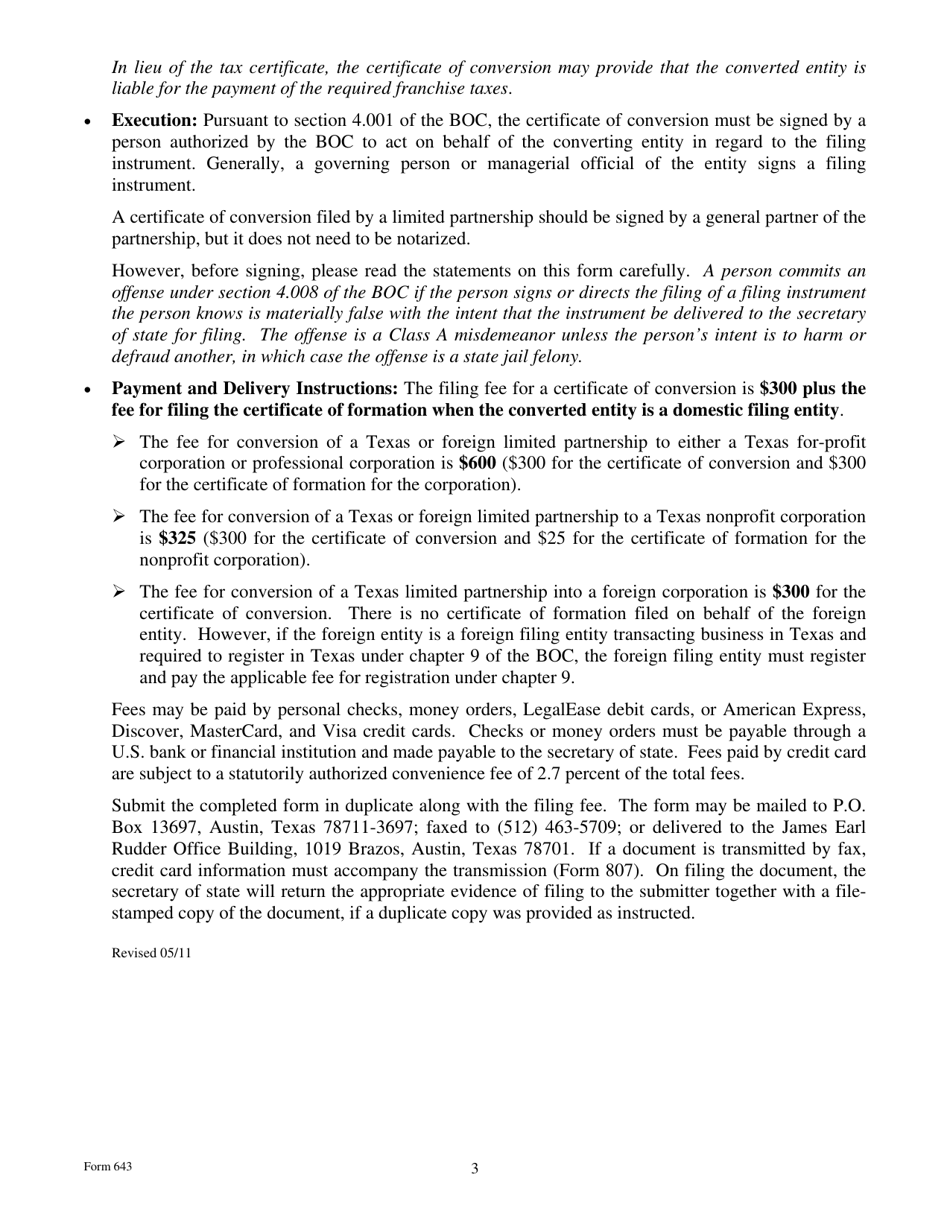

Q: Are there any fees for filing Form 643?

A: Yes, there is a fee associated with filing Form 643. The amount may vary, so it's best to check with the Texas Secretary of State for the current fee.

Q: Is it necessary to consult legal advice before filing Form 643?

A: While not required, it is advisable to consult legal advice or a professional when filing Form 643 to ensure compliance with the applicable laws and regulations.

Q: What is the processing time for Form 643?

A: The processing time for Form 643 may vary. It is recommended to check with the Texas Secretary of State for the current processing time.

Q: What happens after Form 643 is approved?

A: After Form 643 is approved, the Limited Partnership will be officially converted into a Corporation in Texas.

Q: Can I convert a Limited Partnership to a Corporation in a different state using Form 643?

A: No, Form 643 is specific to the state of Texas. If you need to convert a Limited Partnership to a Corporation in a different state, you will need to comply with the requirements of that state.

Q: Can I use Form 643 to convert a different type of business entity?

A: No, Form 643 is only for the conversion of a Limited Partnership to a Corporation in Texas. For other types of entity conversions, different forms and procedures may apply.

Q: Is there a deadline for filing Form 643?

A: There is no specific deadline mentioned for filing Form 643. However, it is recommended to file it as soon as you decide to convert the Limited Partnership to a Corporation.

Q: Does Form 643 require notarization?

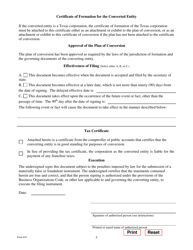

A: Yes, Form 643 requires notarization. A notary public must attest to the authenticity of the signatures on the form.

Q: What are the consequences of not filing Form 643?

A: Failure to file Form 643 may result in the Limited Partnership not being recognized as a Corporation in Texas, potentially leading to legal and operational issues.

Q: Can I obtain a copy of the approved Form 643?

A: Yes, once the Form 643 is approved, you can obtain a copy from the Texas Secretary of State or through authorized filing services.

Q: Can I amend Form 643 after submission?

A: No, once Form 643 is submitted, you cannot amend it. It is important to review the form carefully before submission.

Q: Can I dissolve the Corporation after conversion?

A: Yes, after the Limited Partnership is converted to a Corporation, you can choose to dissolve the Corporation following the legal procedures for dissolution.

Q: What other documents may be required along with Form 643?

A: Additional documents may be required depending on the specific circumstances. It is advisable to consult legal advice or the Texas Secretary of State for a complete list of required documents.

Q: I have misplaced my filed Form 643, how can I obtain a copy?

A: If you have misplaced your filed Form 643, you can request a copy of the filed document from the Texas Secretary of State or through authorized filing services.

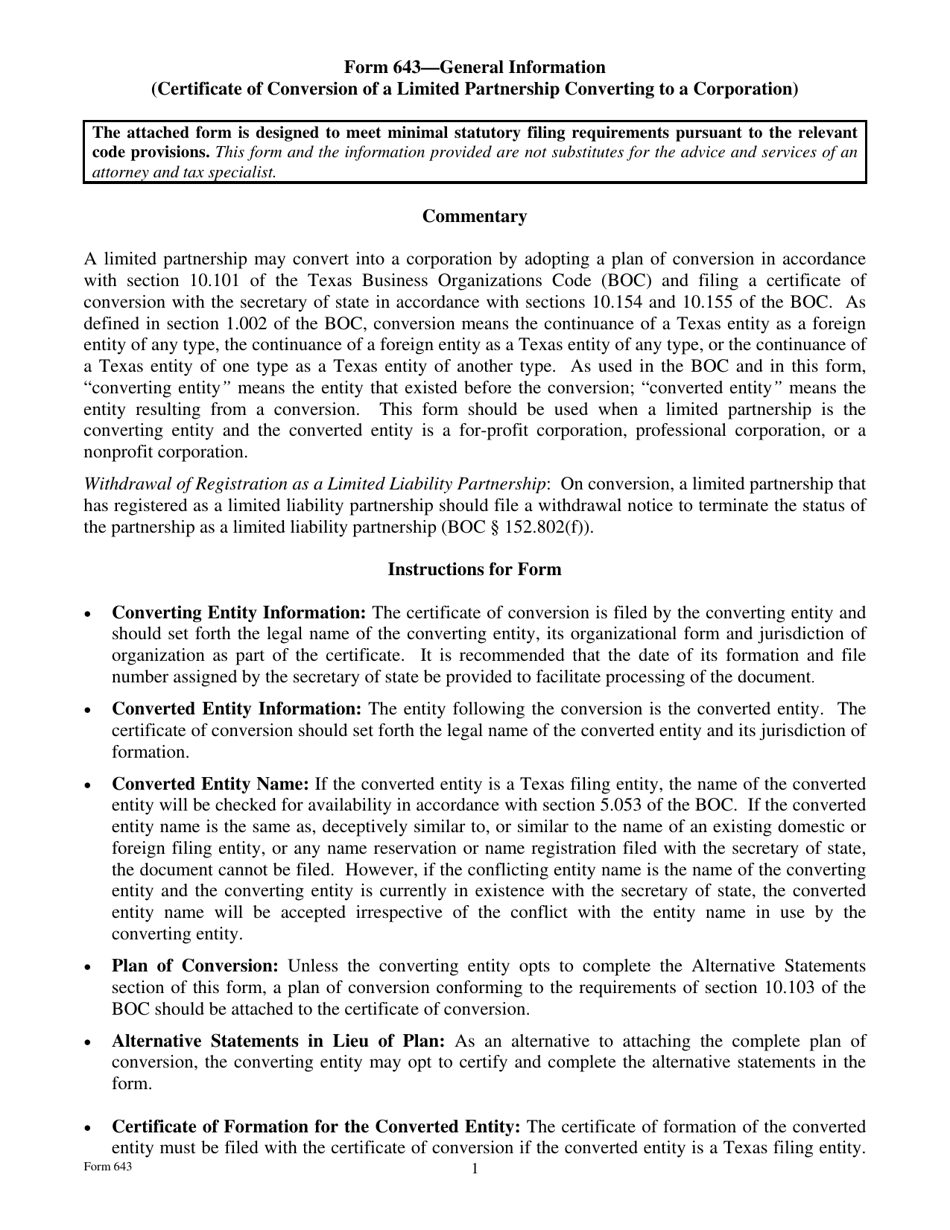

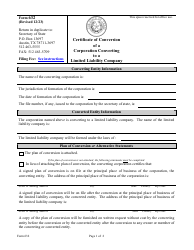

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 643 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.