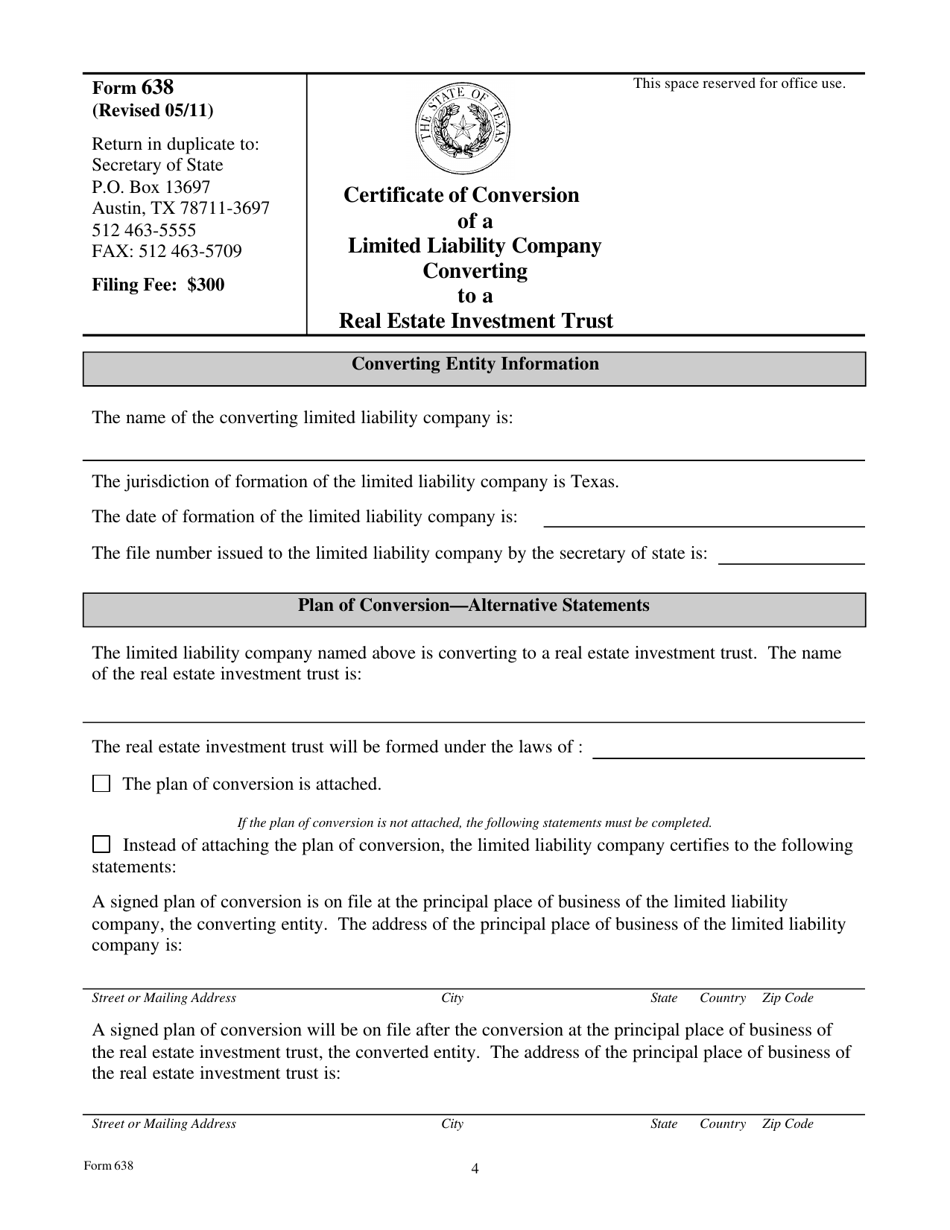

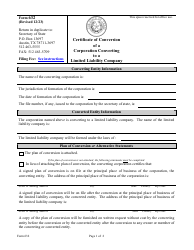

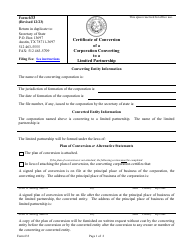

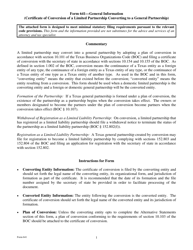

Form 638 Certificate of Conversion of a Limited Liability Company Converting to a Real Estate Investment Trust - Texas

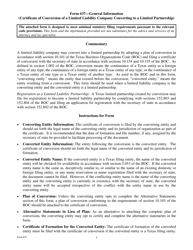

What Is Form 638?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

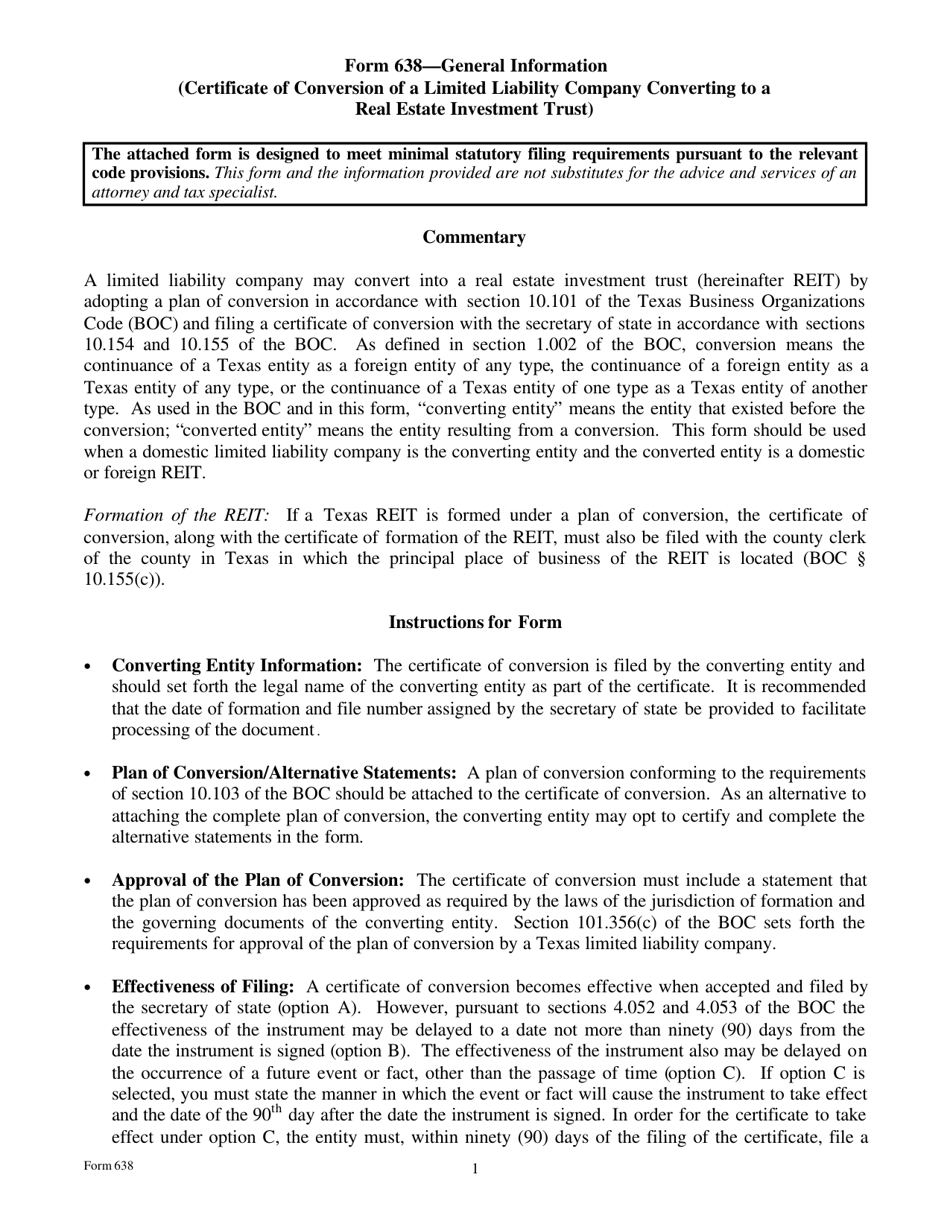

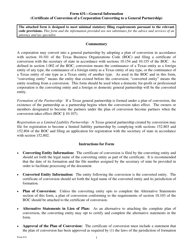

Q: What is a Form 638 Certificate of Conversion?

A: Form 638 Certificate of Conversion is a legal document used when a limited liability company (LLC) in Texas is converting to a real estate investment trust (REIT).

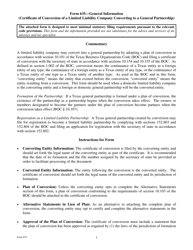

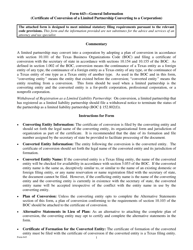

Q: Why would an LLC want to convert to a REIT?

A: LLCs may choose to convert to a REIT to take advantage of certain tax benefits and investment opportunities available to REITs.

Q: What is a Real Estate Investment Trust (REIT)?

A: A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate. REITs are required to distribute a significant portion of their income to shareholders.

Q: What is the purpose of the Form 638 in Texas?

A: The purpose of the Form 638 in Texas is to document the conversion of an LLC to a REIT and provide the necessary information to the Texas Secretary of State.

Q: Who needs to file the Form 638 Certificate of Conversion?

A: The LLC that is converting to a REIT needs to file the Form 638 Certificate of Conversion with the Texas Secretary of State.

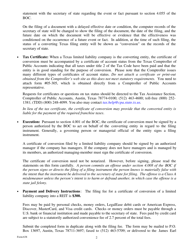

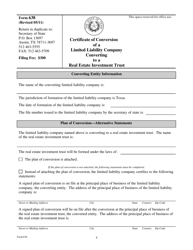

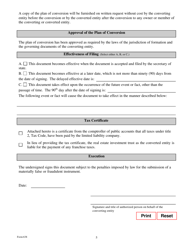

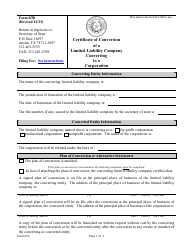

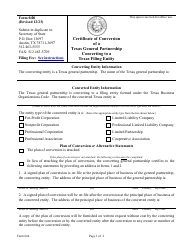

Q: What information is required on the Form 638?

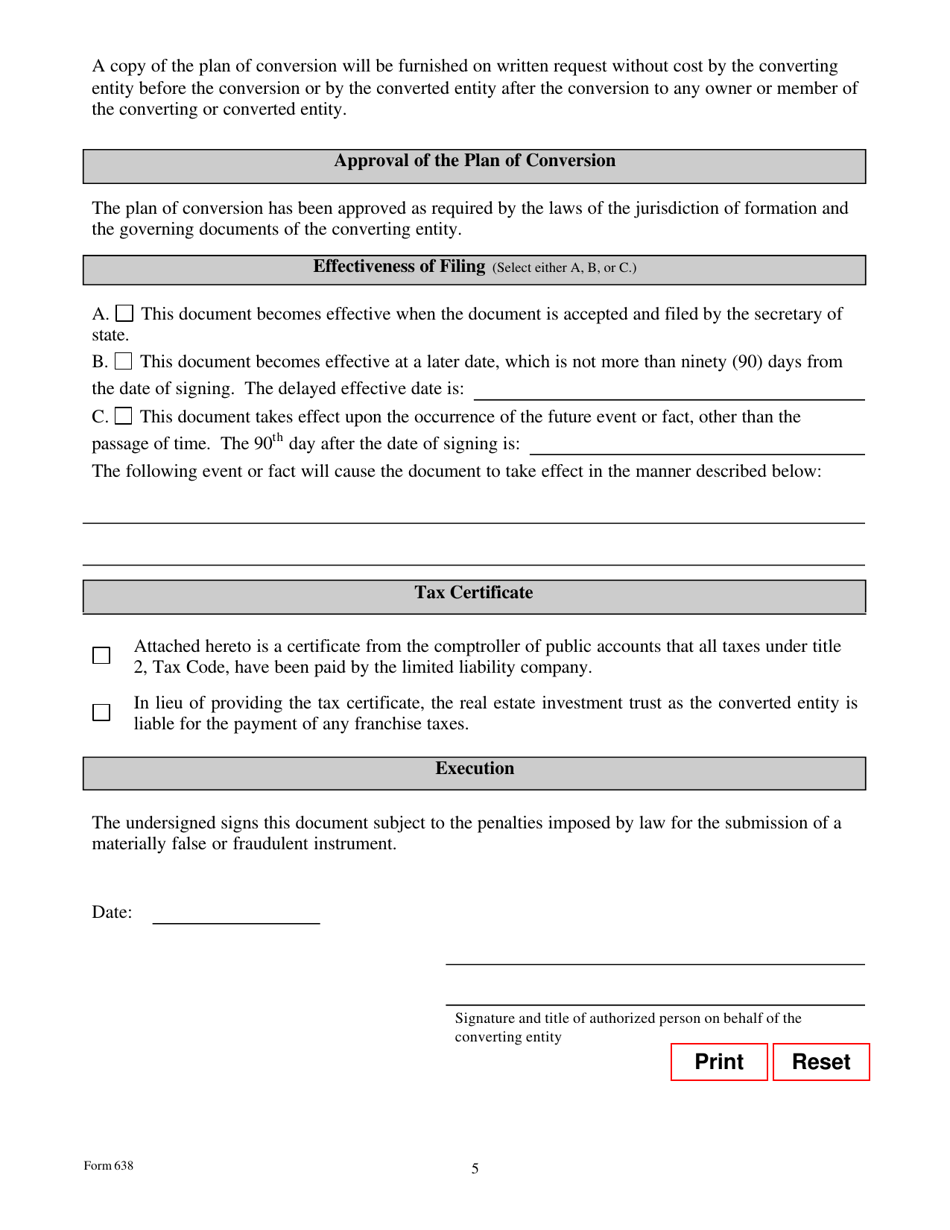

A: The Form 638 requires information such as the name of the LLC, the new name of the REIT, the purpose of the conversion, and the effective date of the conversion.

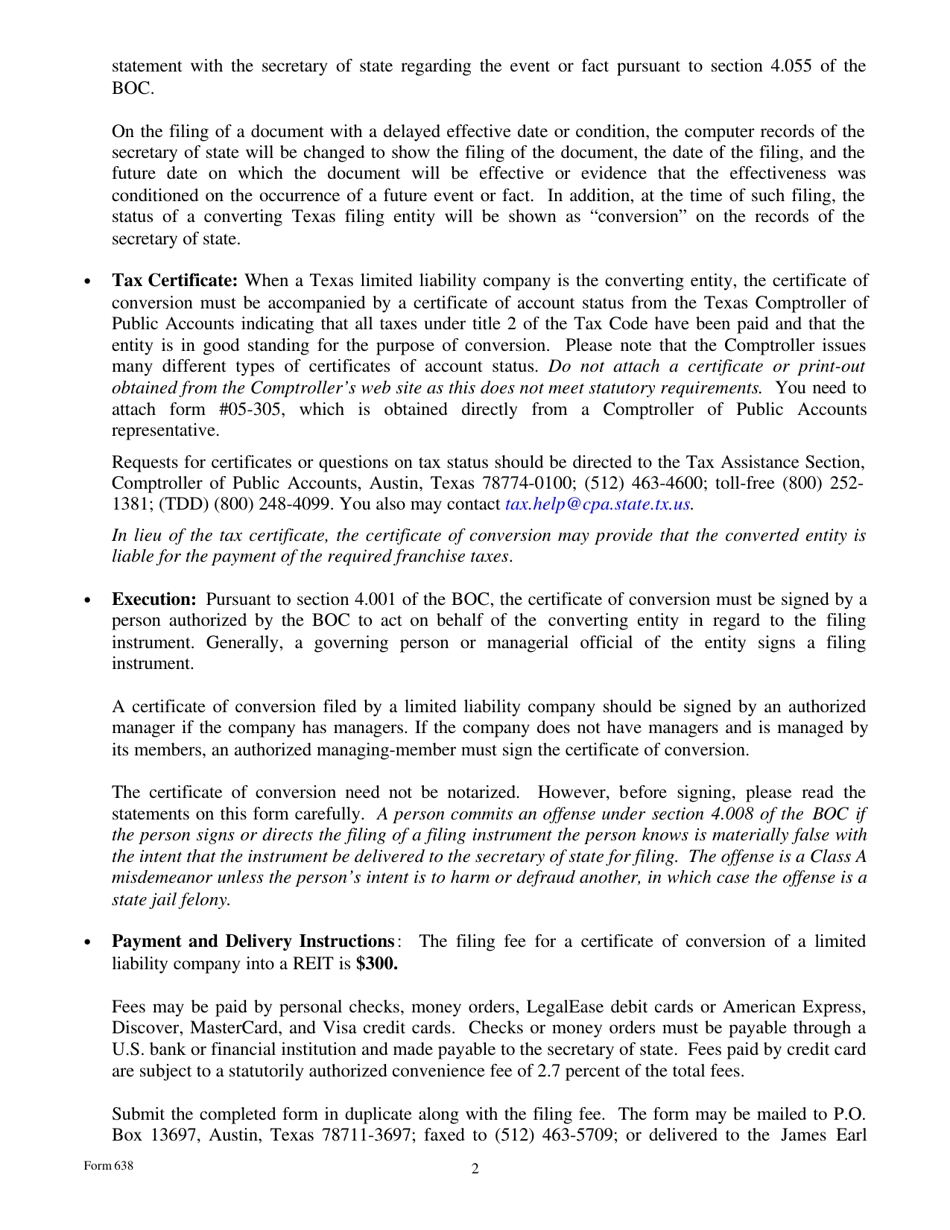

Q: Are there any fees associated with filing the Form 638?

A: Yes, there are filing fees associated with submitting the Form 638. The fees can vary, so it's best to check with the Texas Secretary of State for the current fee schedule.

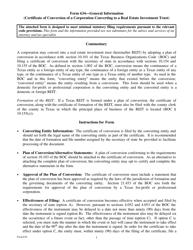

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 638 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.