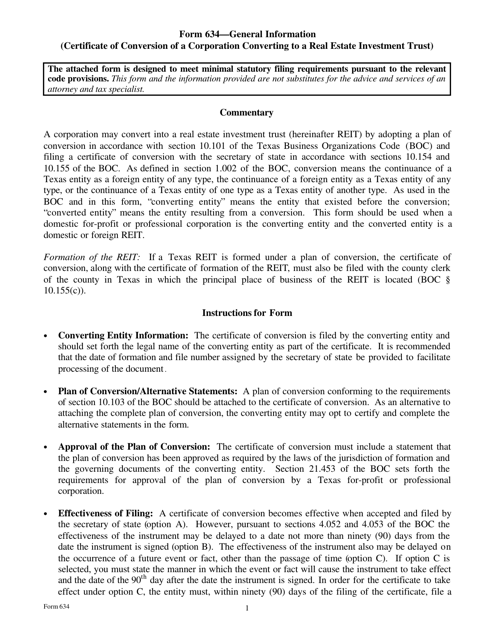

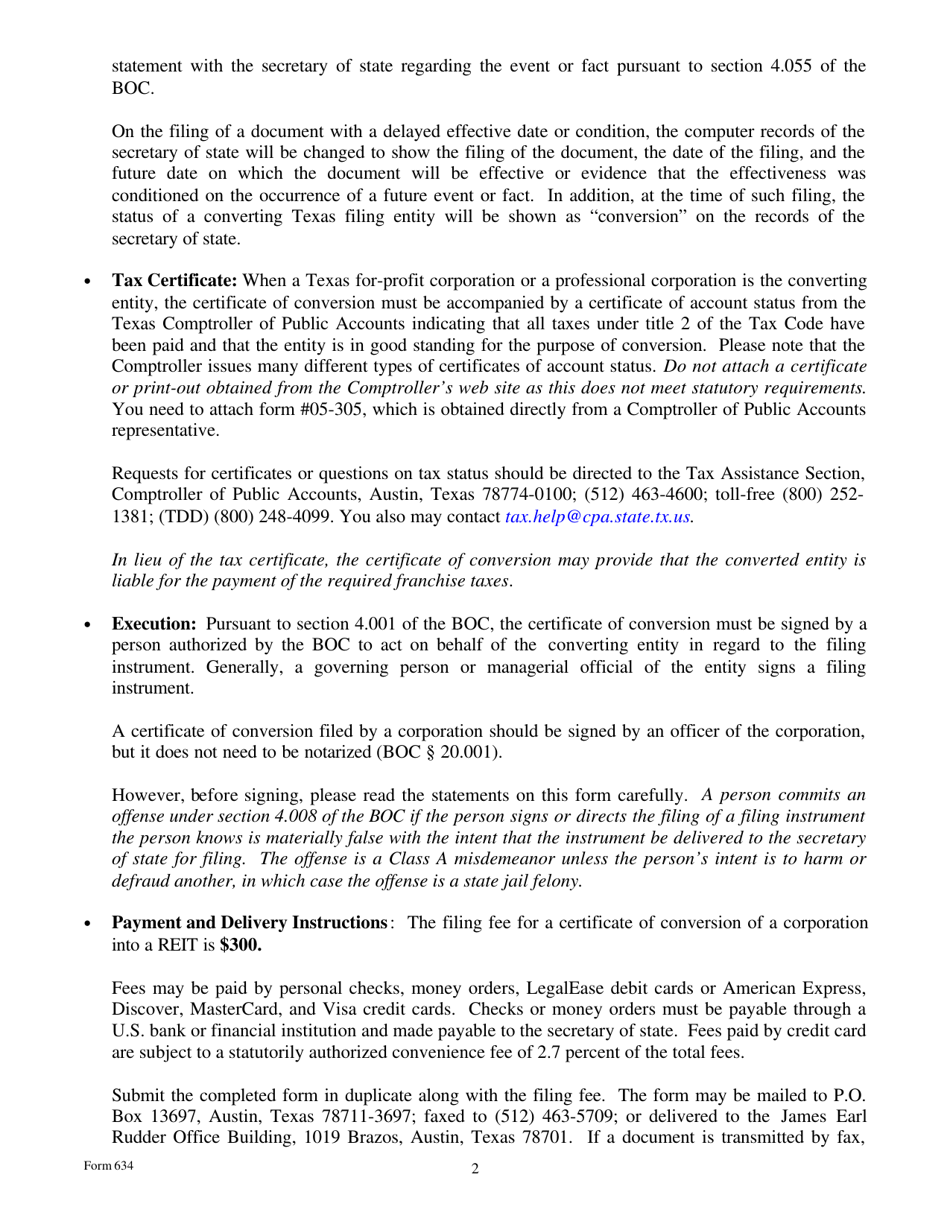

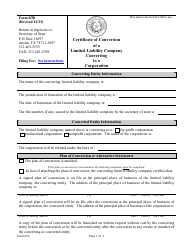

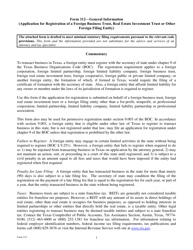

Form 634 Certificate of Conversion of a Corporation Converting to a Real Estate Investment Trust - Texas

What Is Form 634?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 634?

A: Form 634 is the Certificate of Conversion of a Corporation Converting to a Real Estate Investment Trust in Texas.

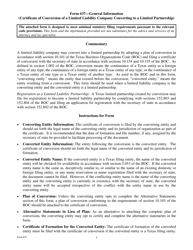

Q: What does Form 634 do?

A: Form 634 is used to convert a corporation into a Real Estate Investment Trust (REIT) in Texas.

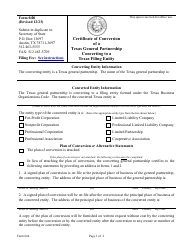

Q: Who needs to file Form 634?

A: Any corporation that wants to convert to a Real Estate Investment Trust in Texas needs to file Form 634.

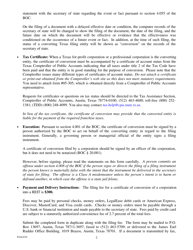

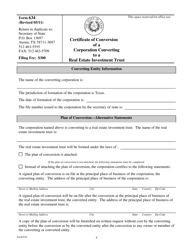

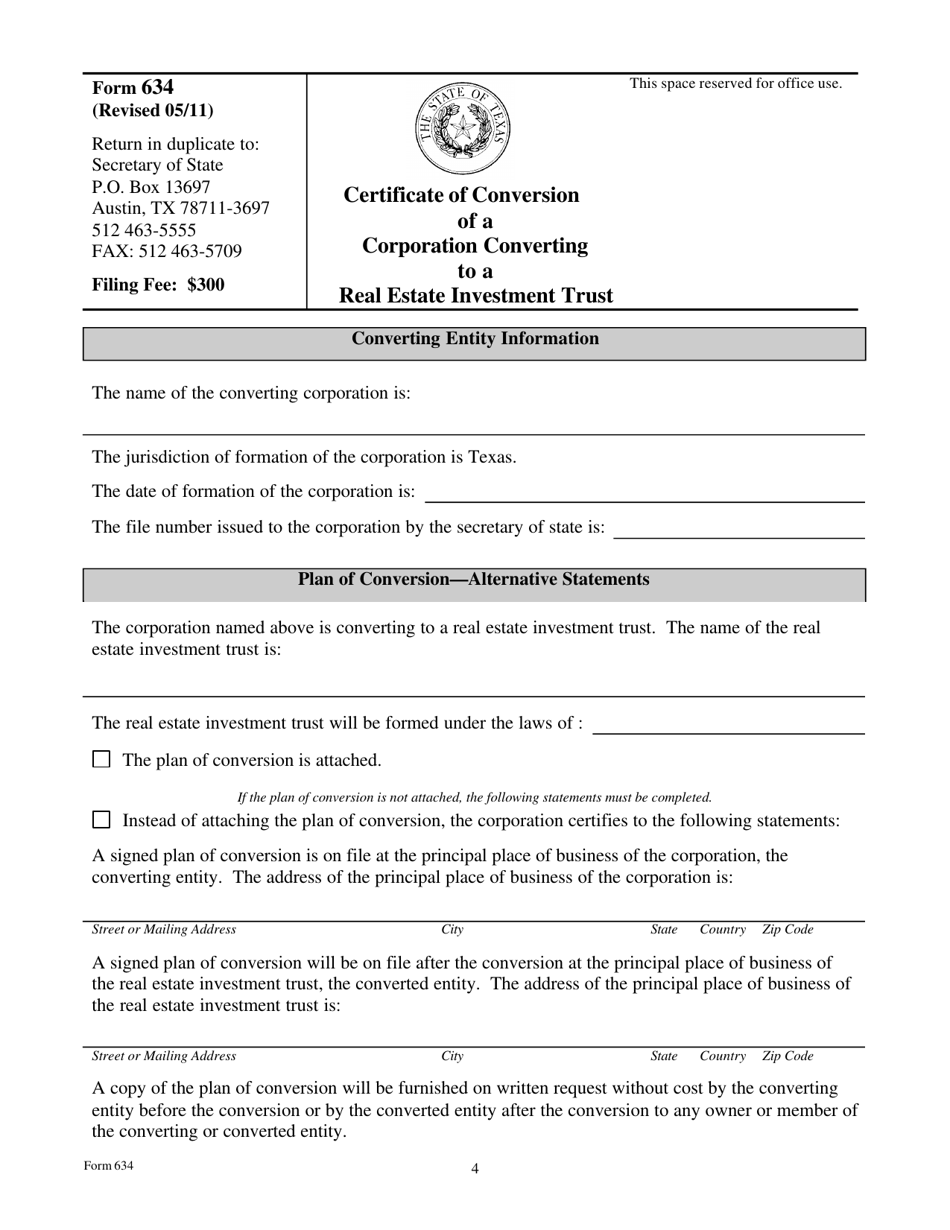

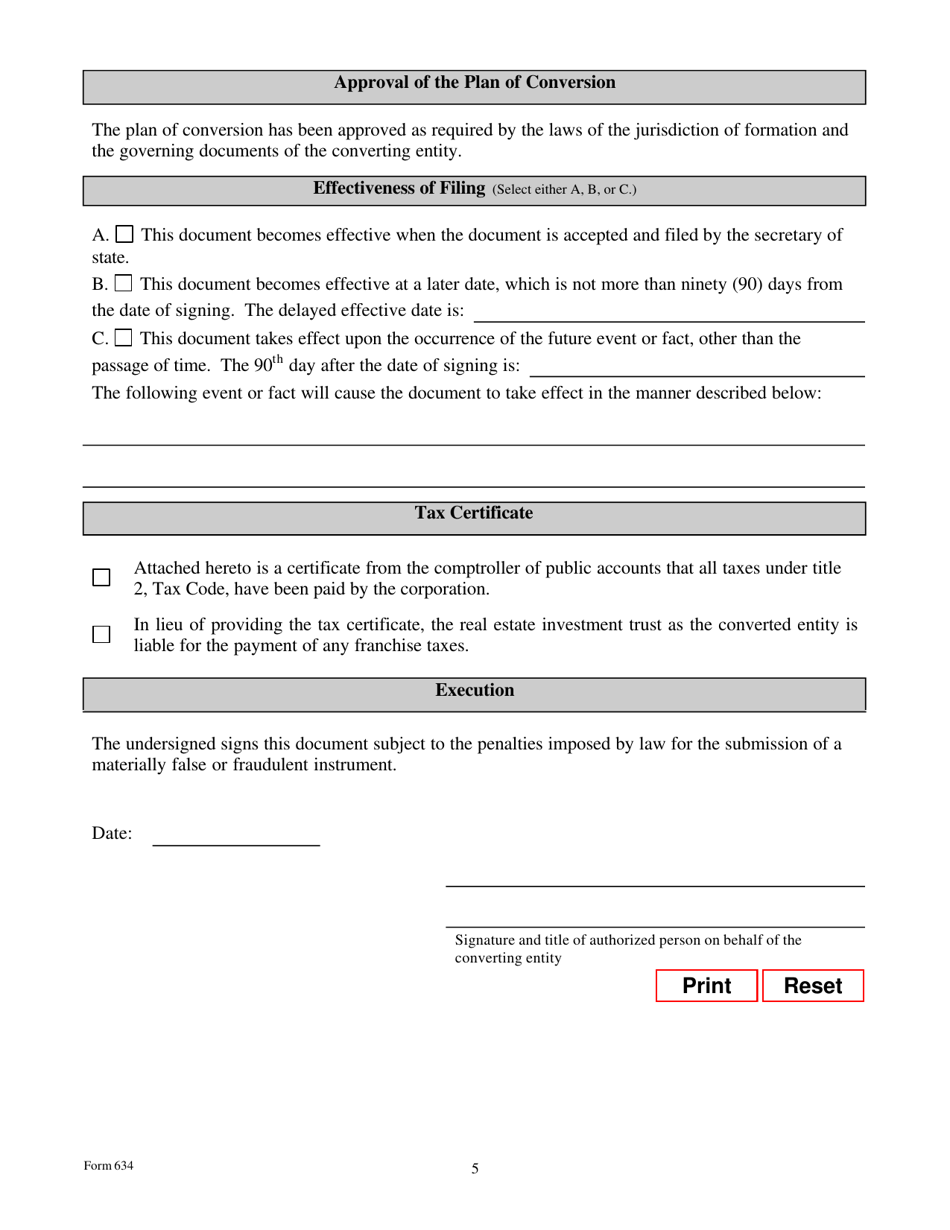

Q: What information is required on Form 634?

A: Form 634 requires information such as the name of the corporation, the effective date of the conversion, and the name and address of the registered agent.

Q: Is there a deadline for filing Form 634?

A: There is no specific deadline for filing Form 634, but it is recommended to file it as soon as the decision to convert to a Real Estate Investment Trust is made.

Q: Are there any additional requirements for converting to a Real Estate Investment Trust in Texas?

A: Yes, there may be additional requirements such as obtaining consent from shareholders and complying with applicable tax laws. It is advisable to consult with a legal professional.

Q: What is a Real Estate Investment Trust?

A: A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate. It allows individual investors to invest in large-scale, income-producing real estate properties.

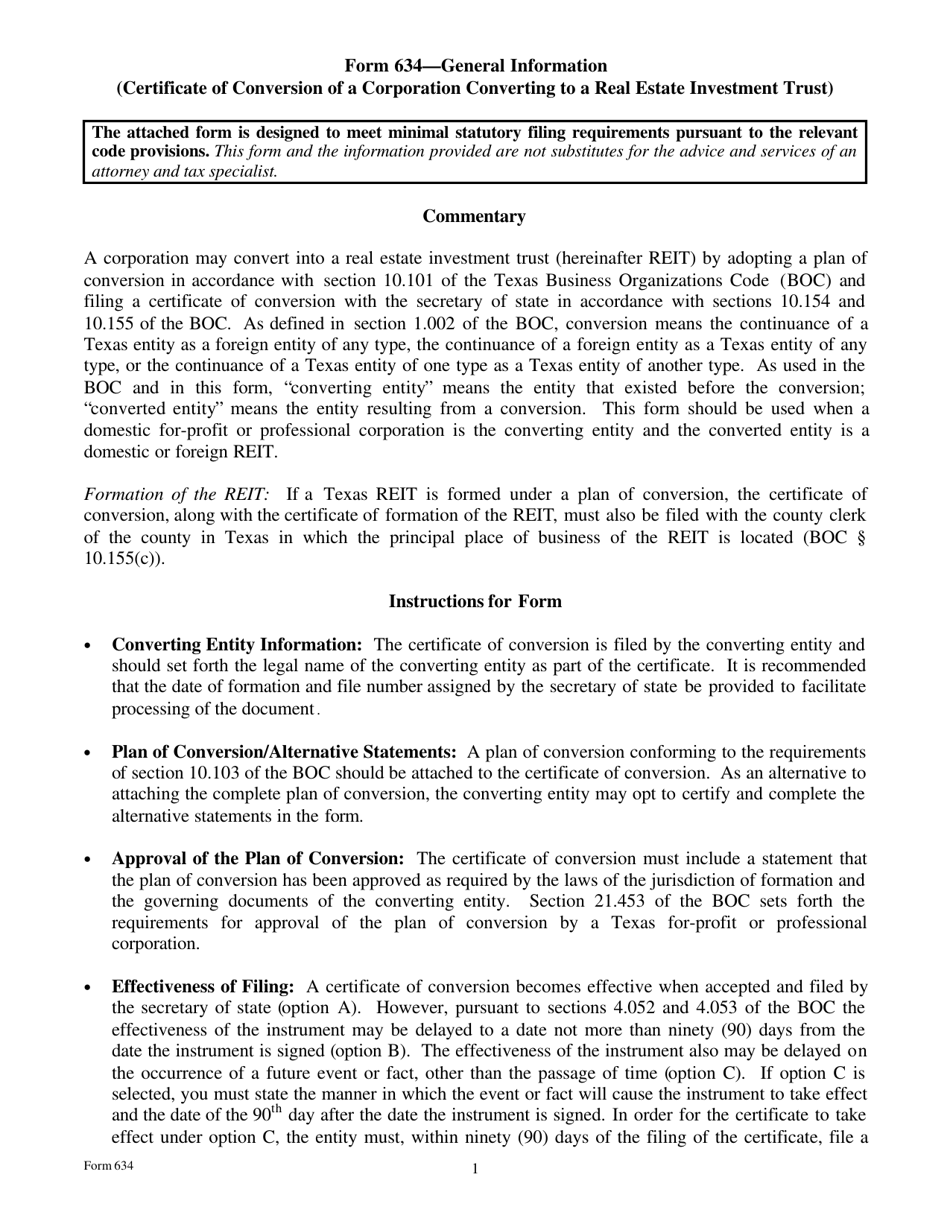

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 634 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.