This version of the form is not currently in use and is provided for reference only. Download this version of

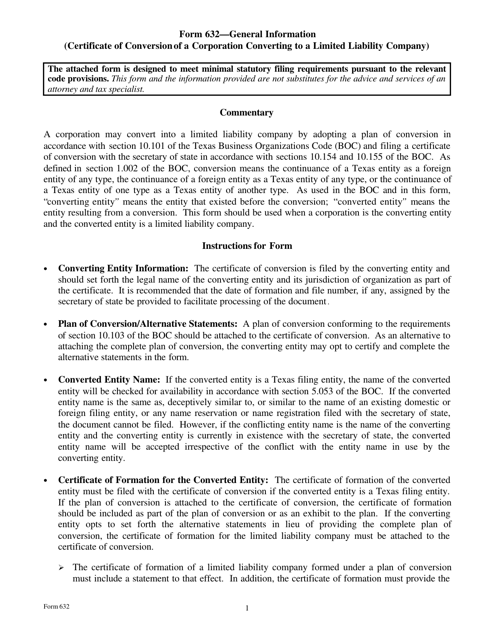

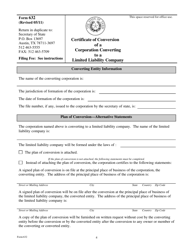

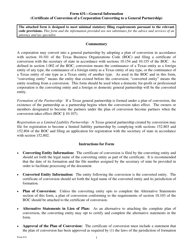

Form 632

for the current year.

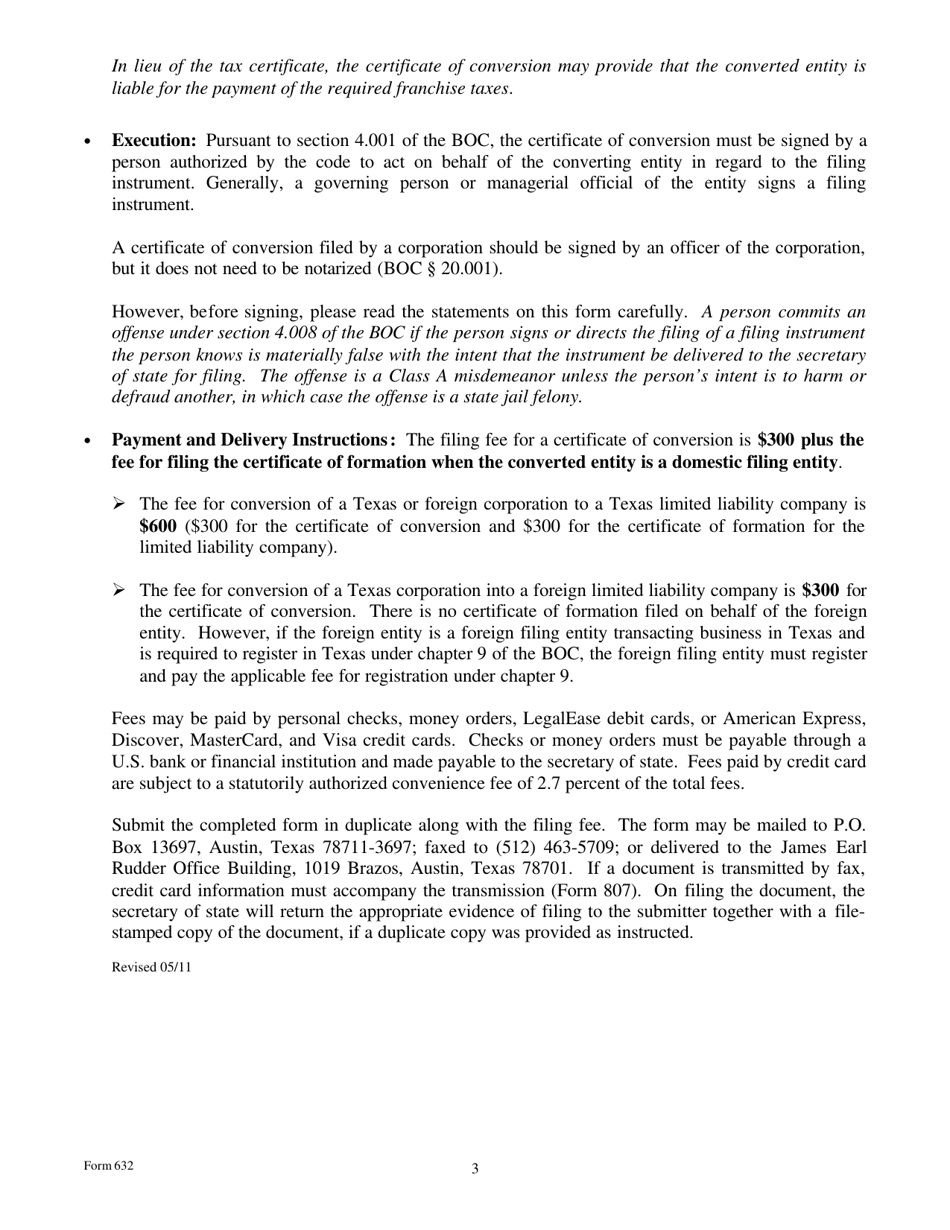

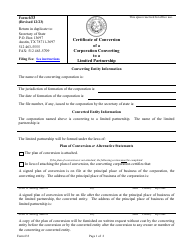

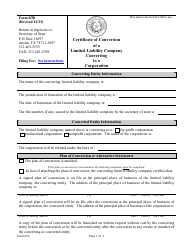

Form 632 Certificate of Conversion of a Corporation Converting to a Limited Liability Company - Texas

What Is Form 632?

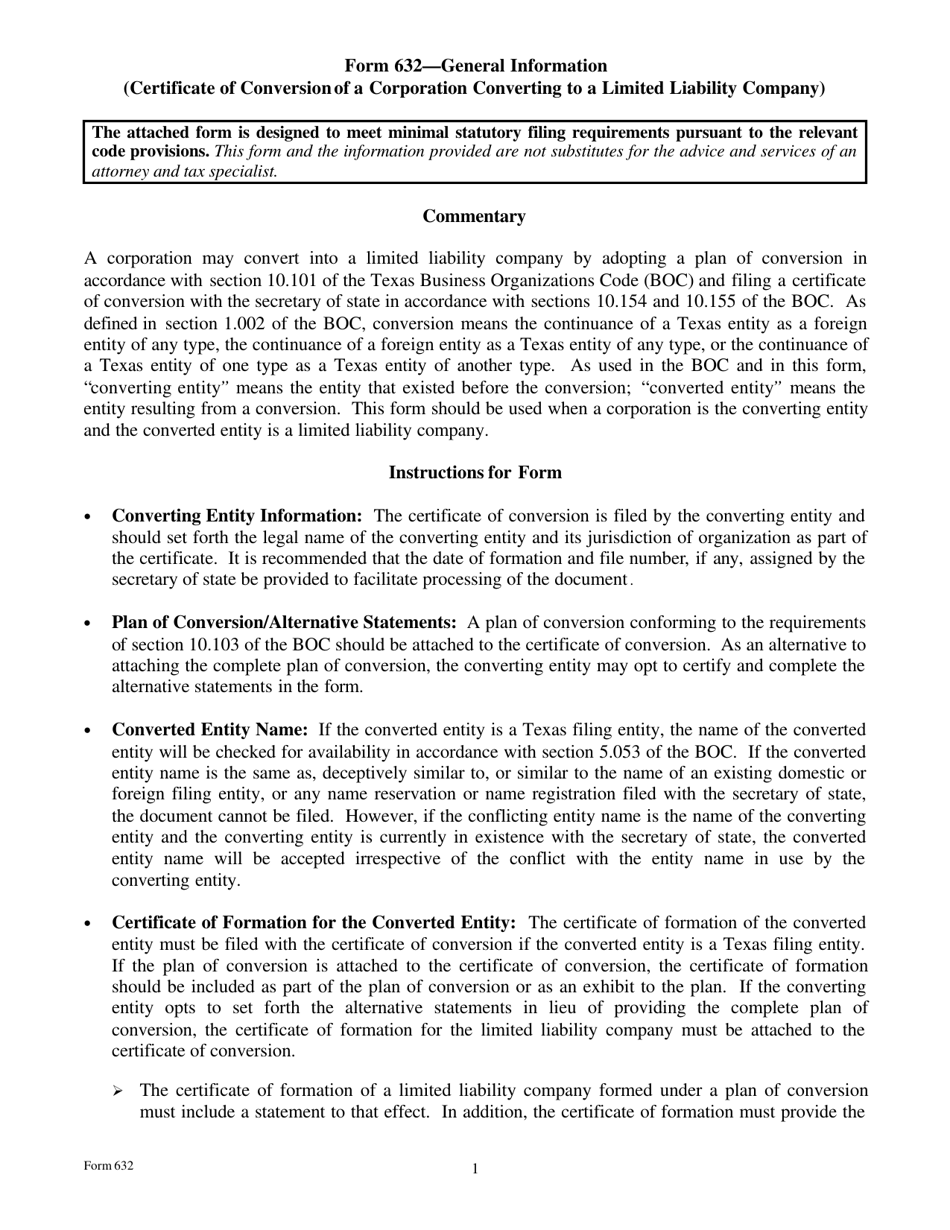

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 632?

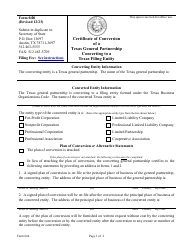

A: Form 632 is the Certificate of Conversion of a Corporation Converting to a Limited Liability Company in Texas.

Q: What is the purpose of Form 632?

A: The purpose of Form 632 is to convert a corporation into a limited liability company (LLC) in the state of Texas.

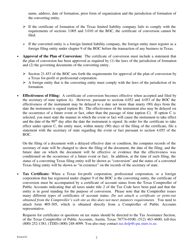

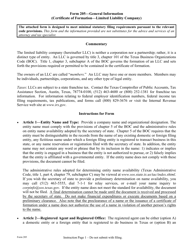

Q: Is Form 632 specific to Texas?

A: Yes, Form 632 is specific to the state of Texas. Other states may have different forms and requirements for converting a corporation to an LLC.

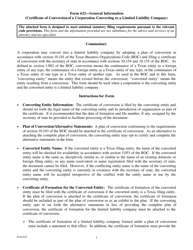

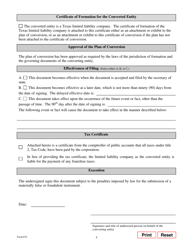

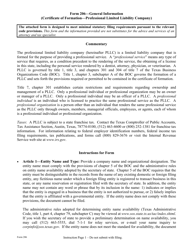

Q: Do I need to fill out any other forms along with Form 632?

A: Depending on the specific circumstances of the conversion, you may need to fill out additional forms and fulfill certain requirements. It is recommended to consult with an attorney or business professional for guidance.

Q: Can I convert a corporation to an LLC without filing Form 632?

A: No, in Texas, filing Form 632 is the legal requirement for converting a corporation to an LLC.

Q: Can I convert a corporation to an LLC in Texas if I am not a resident of the state?

A: Yes, you can convert a corporation to an LLC in Texas even if you are not a resident of the state. However, there may be additional requirements or considerations for out-of-state individuals.

Q: Can I convert a corporation to an LLC myself, or do I need an attorney?

A: While it is possible to convert a corporation to an LLC yourself, it is advisable to consult with an attorney or business professional to ensure compliance with all legal requirements and for guidance throughout the process.

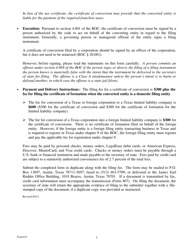

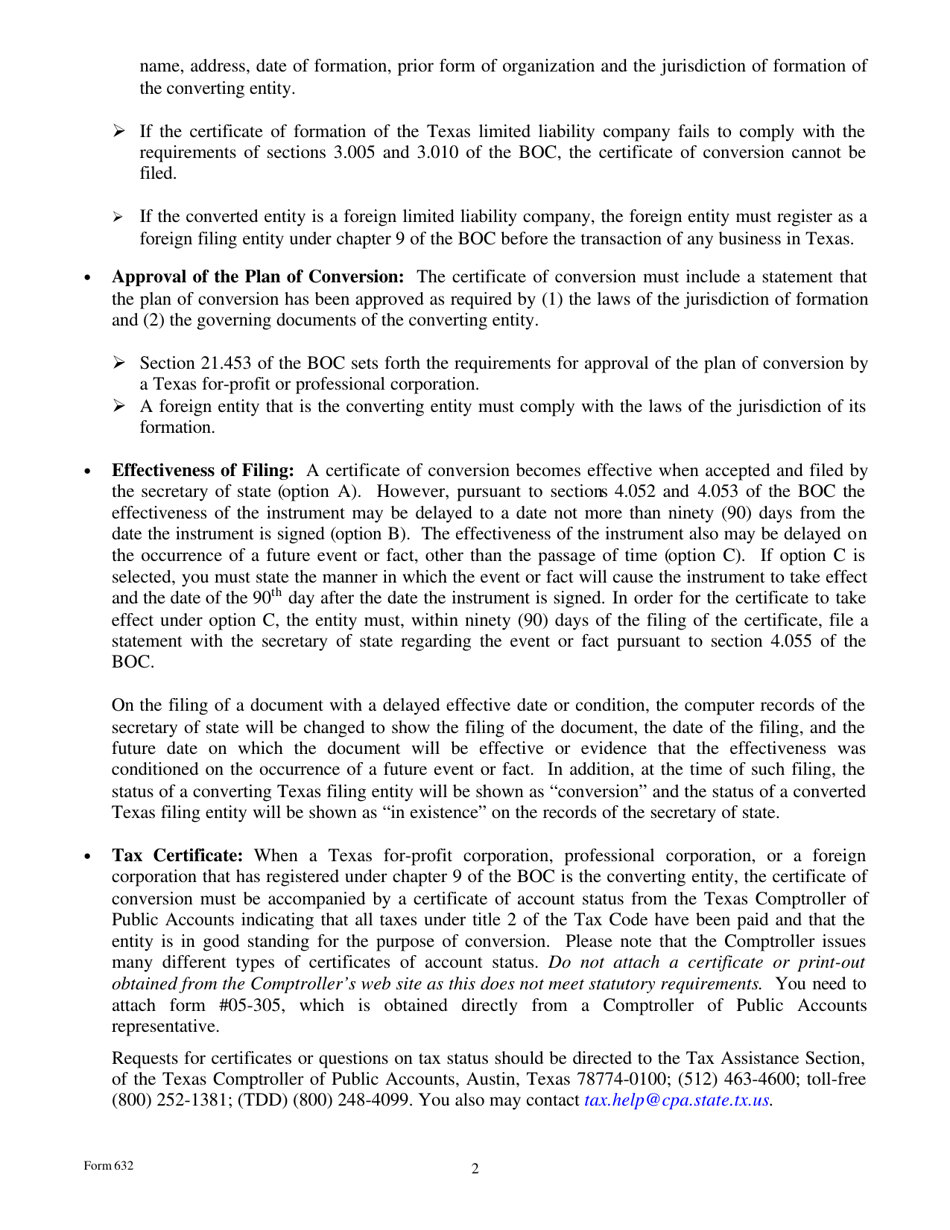

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 632 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.