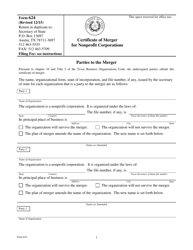

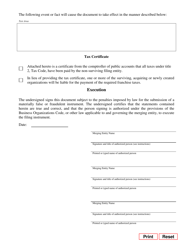

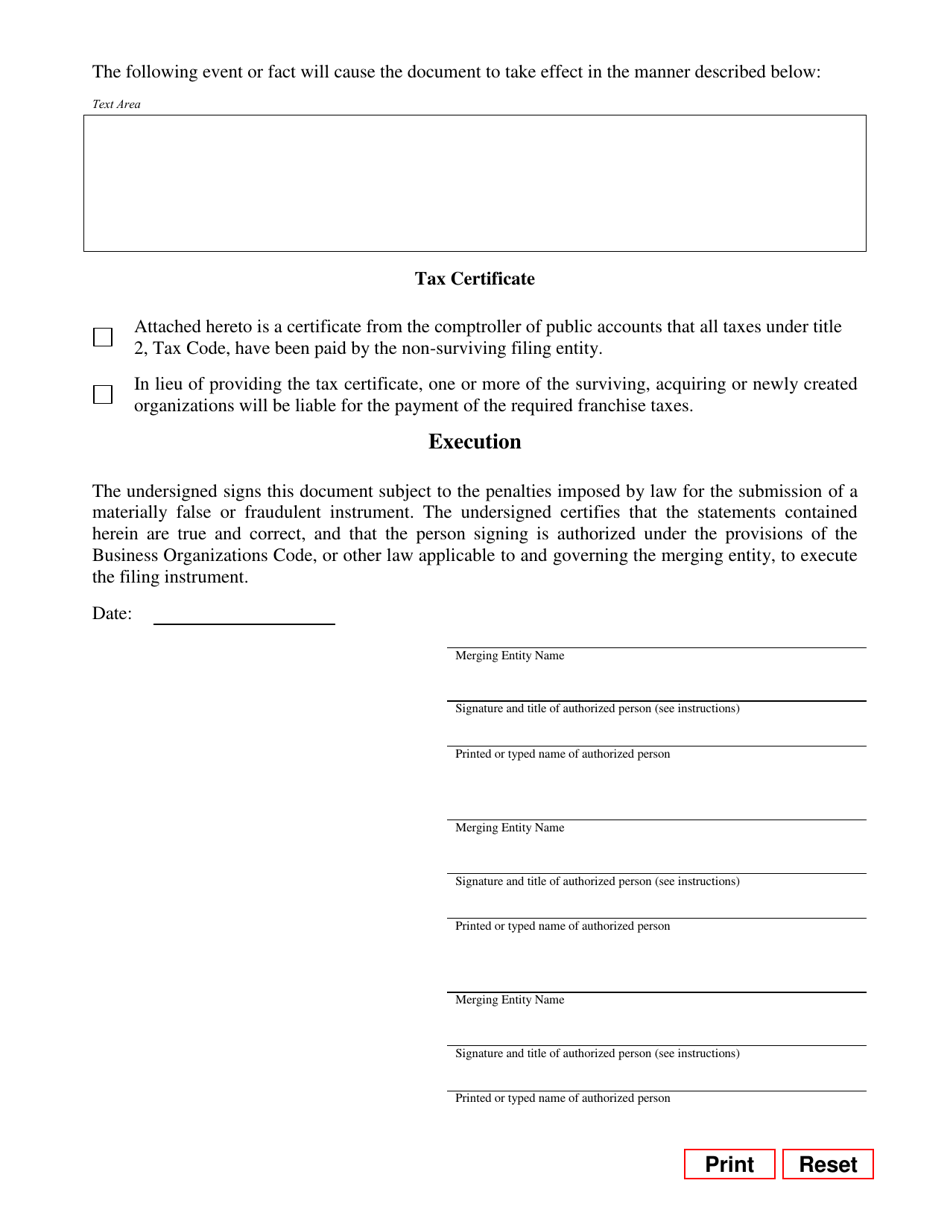

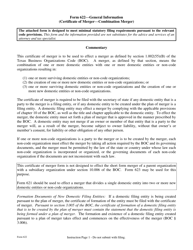

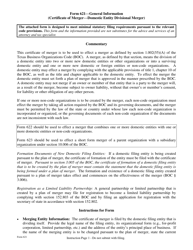

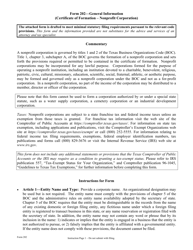

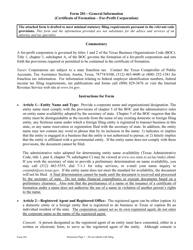

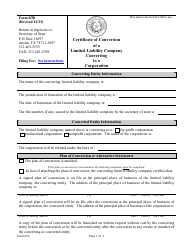

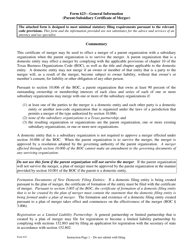

Form 624 Certificate of Merger for Nonprofit Corporations - Texas

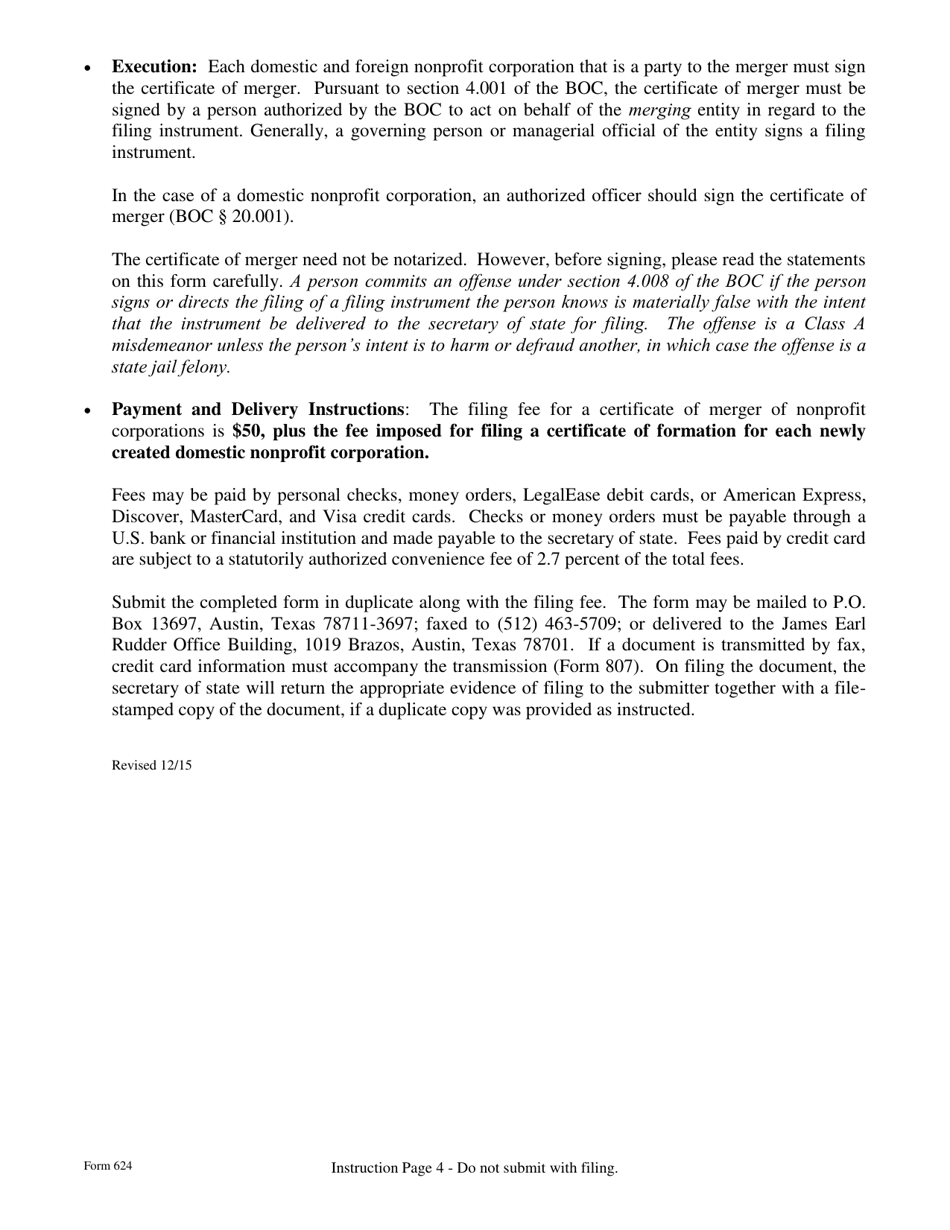

What Is Form 624?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

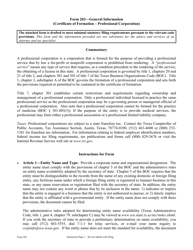

Q: What is Form 624?

A: Form 624 is the Certificate of Merger for Nonprofit Corporations in Texas.

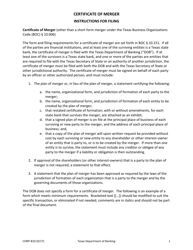

Q: What is the purpose of Form 624?

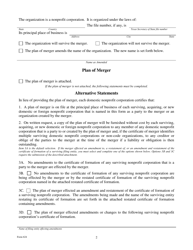

A: The purpose of Form 624 is to document the merger of two nonprofit corporations in Texas.

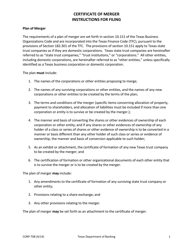

Q: Who needs to file Form 624?

A: Form 624 must be filed by nonprofit corporations in Texas that are seeking to merge with another nonprofit corporation.

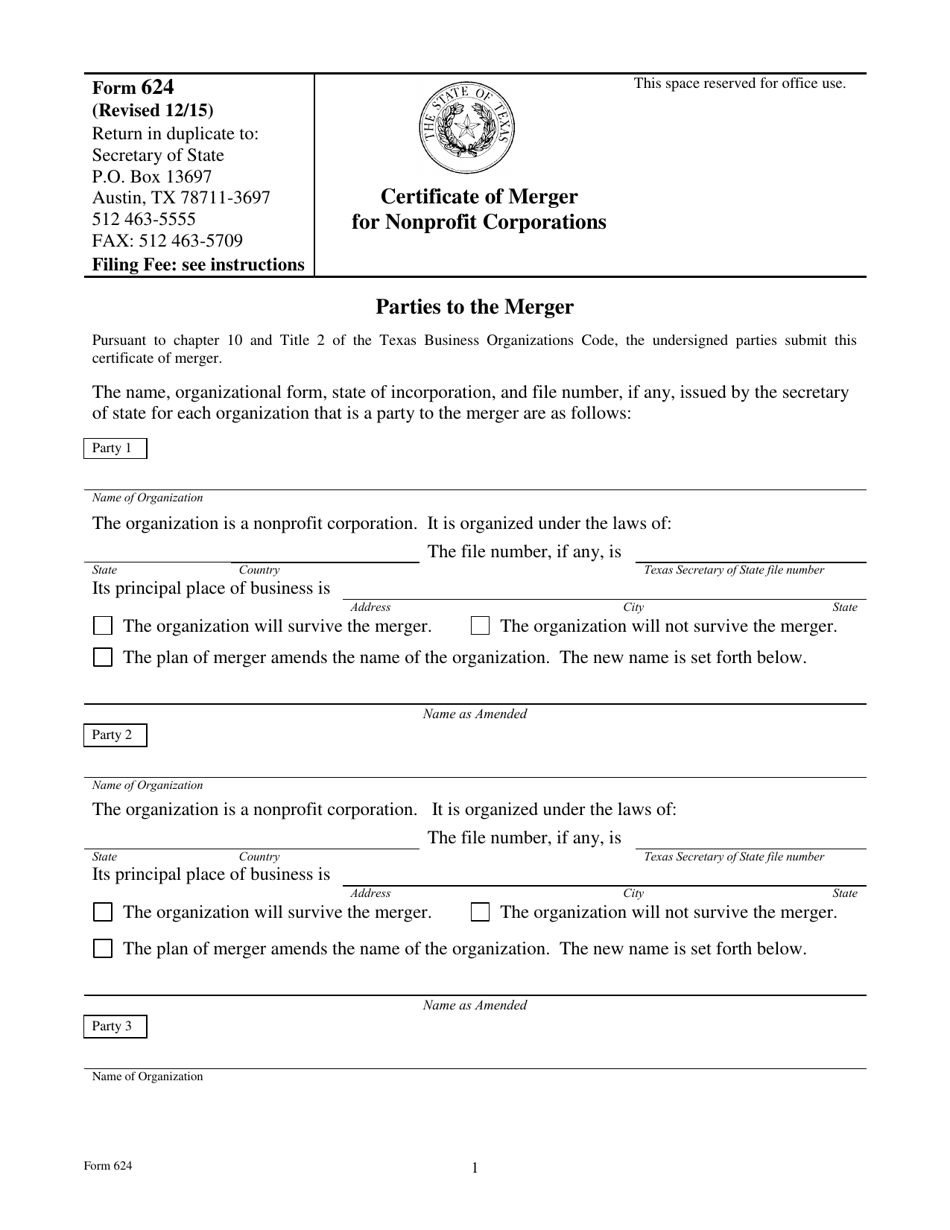

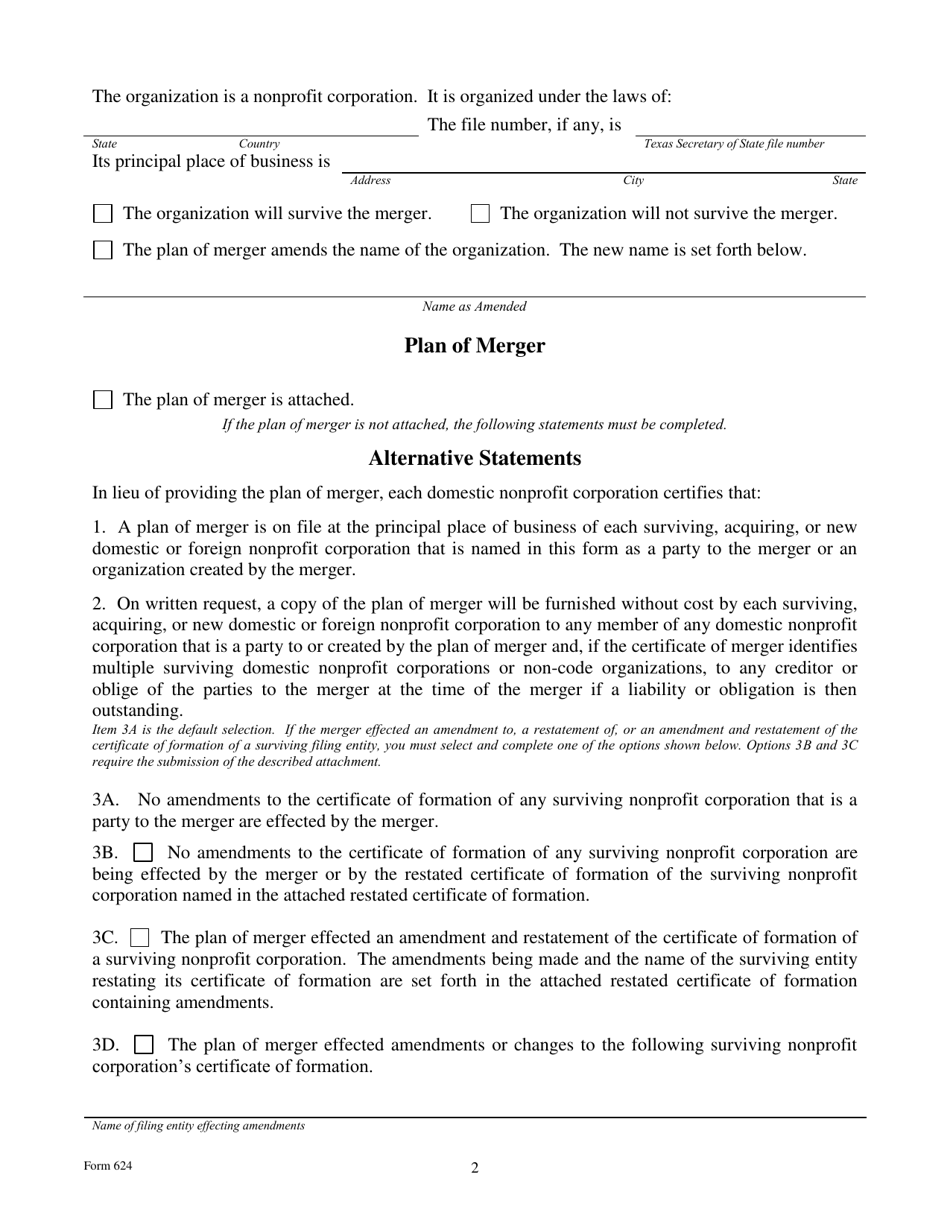

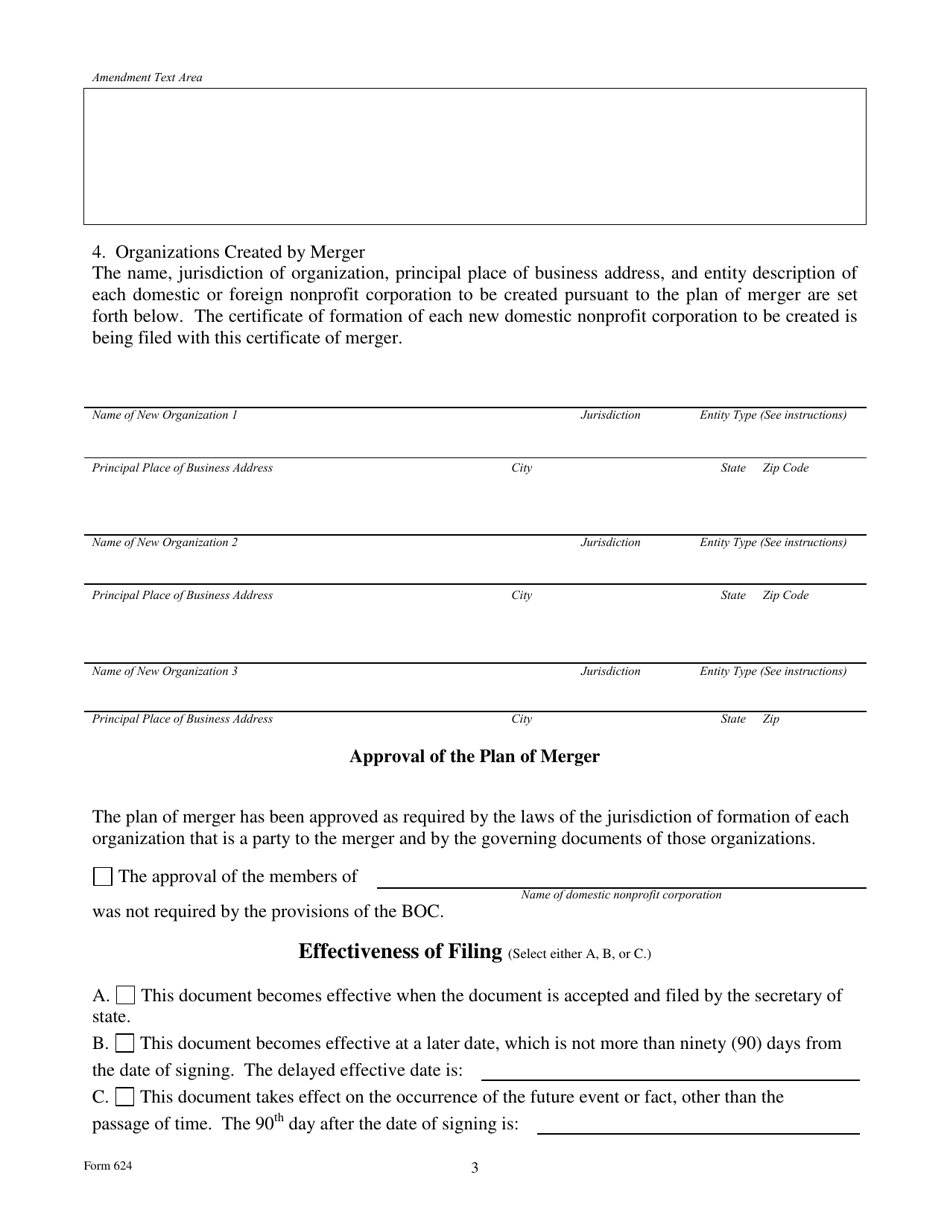

Q: What information do I need to provide on Form 624?

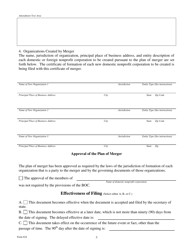

A: You will need to provide information about the merging nonprofit corporations, including their names, addresses, and the effective date of the merger.

Q: Is there a deadline for filing Form 624?

A: There is no specific deadline for filing Form 624, but it must be filed before the effective date of the merger.

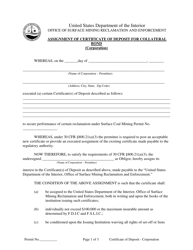

Q: What happens after I file Form 624?

A: After filing Form 624, the Texas Secretary of State will review the application and if everything is in order, they will approve the merger.

Q: Can I get a copy of the filed Form 624?

A: Yes, you can request a copy of the filed Form 624 from the Texas Secretary of State's office.

Q: Is legal advice required to file Form 624?

A: While legal advice is not required, it is recommended to consult with an attorney experienced in nonprofit law to ensure compliance with all applicable regulations.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 624 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.