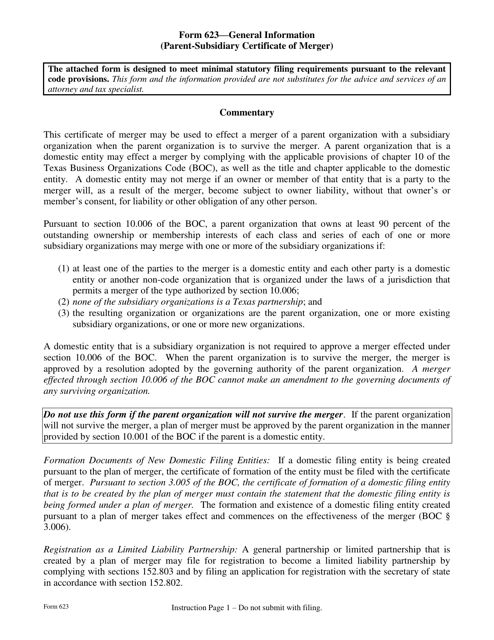

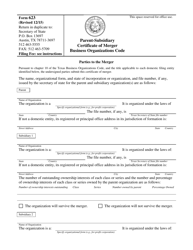

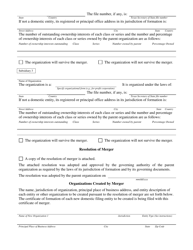

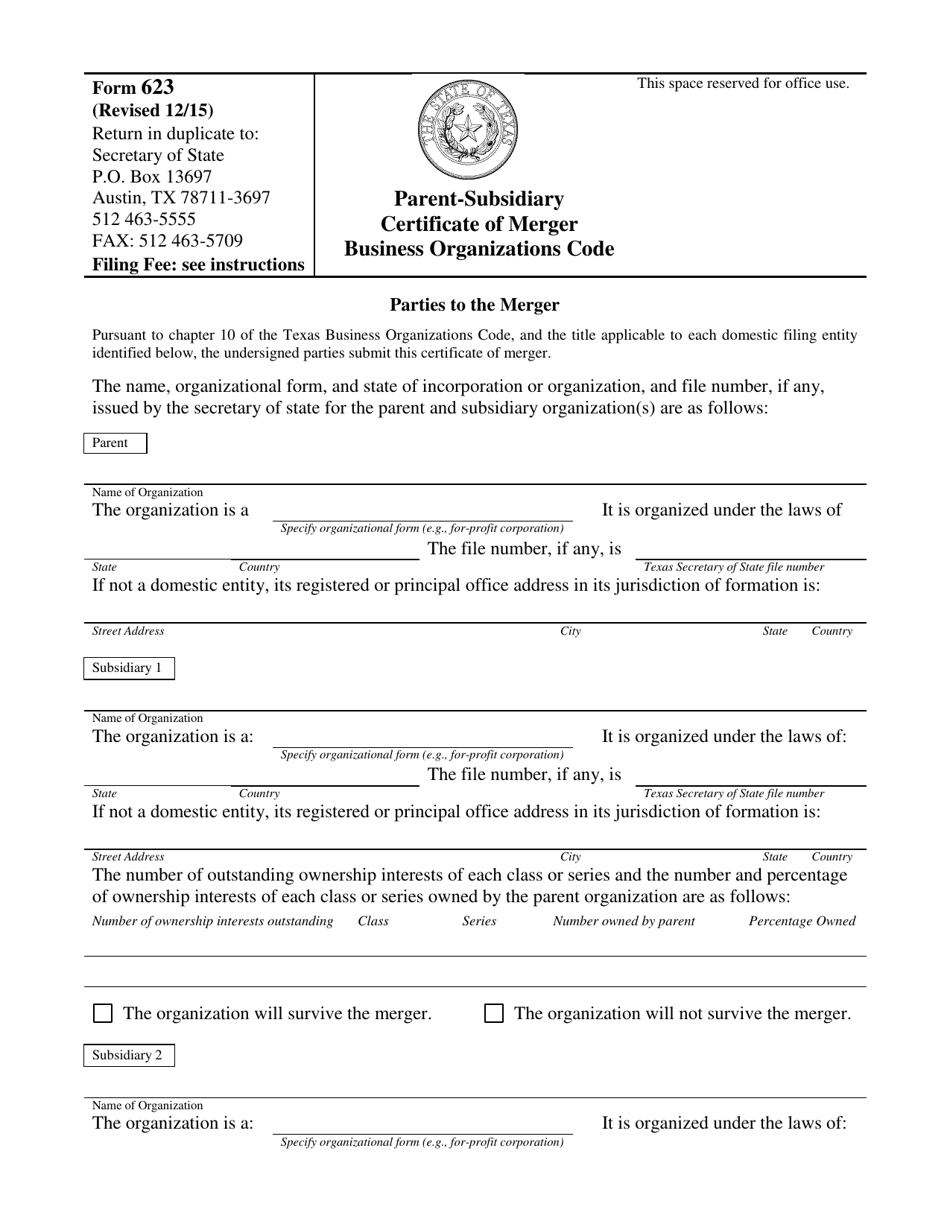

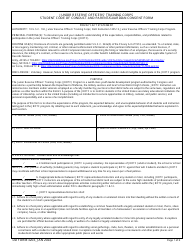

Form 623 Parent-Subsidiary Certificate of Merger Business Organizations Code - Texas

What Is Form 623?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

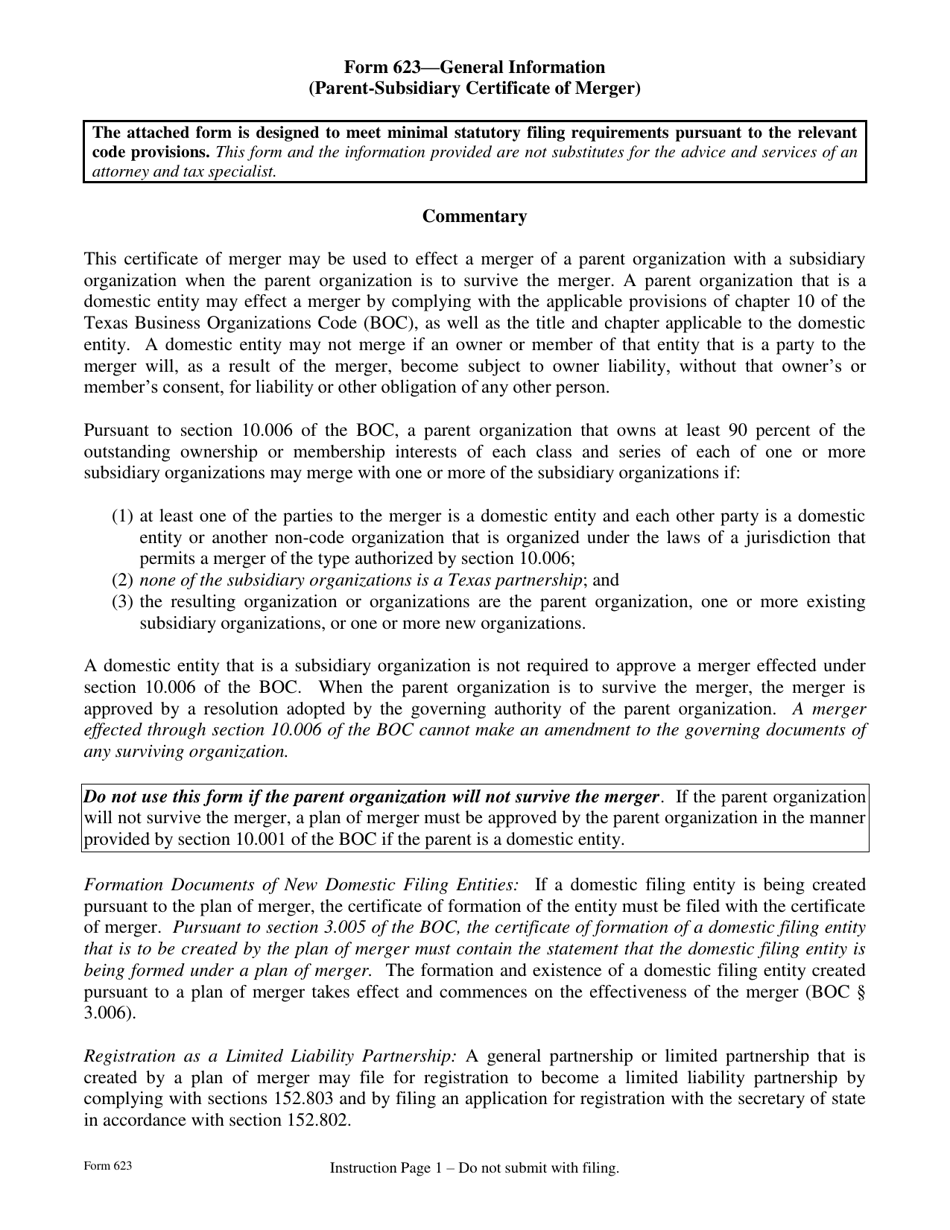

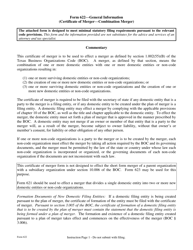

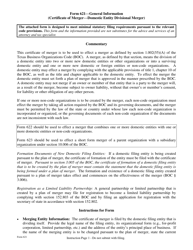

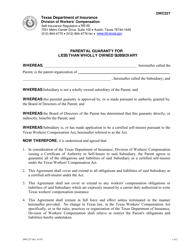

Q: What is Form 623 Parent-Subsidiary Certificate of Merger Business Organizations Code?

A: Form 623 is a legal document used in Texas to formalize the merger of a parent company and its subsidiary.

Q: What is the purpose of Form 623 Parent-Subsidiary Certificate of Merger?

A: The purpose of Form 623 is to provide a legal framework for the merger of a parent company and its subsidiary.

Q: Who needs to file Form 623 Parent-Subsidiary Certificate of Merger?

A: Any parent company and its subsidiary in Texas that wish to merge are required to file Form 623.

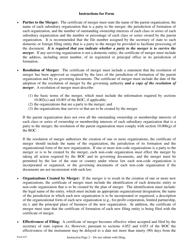

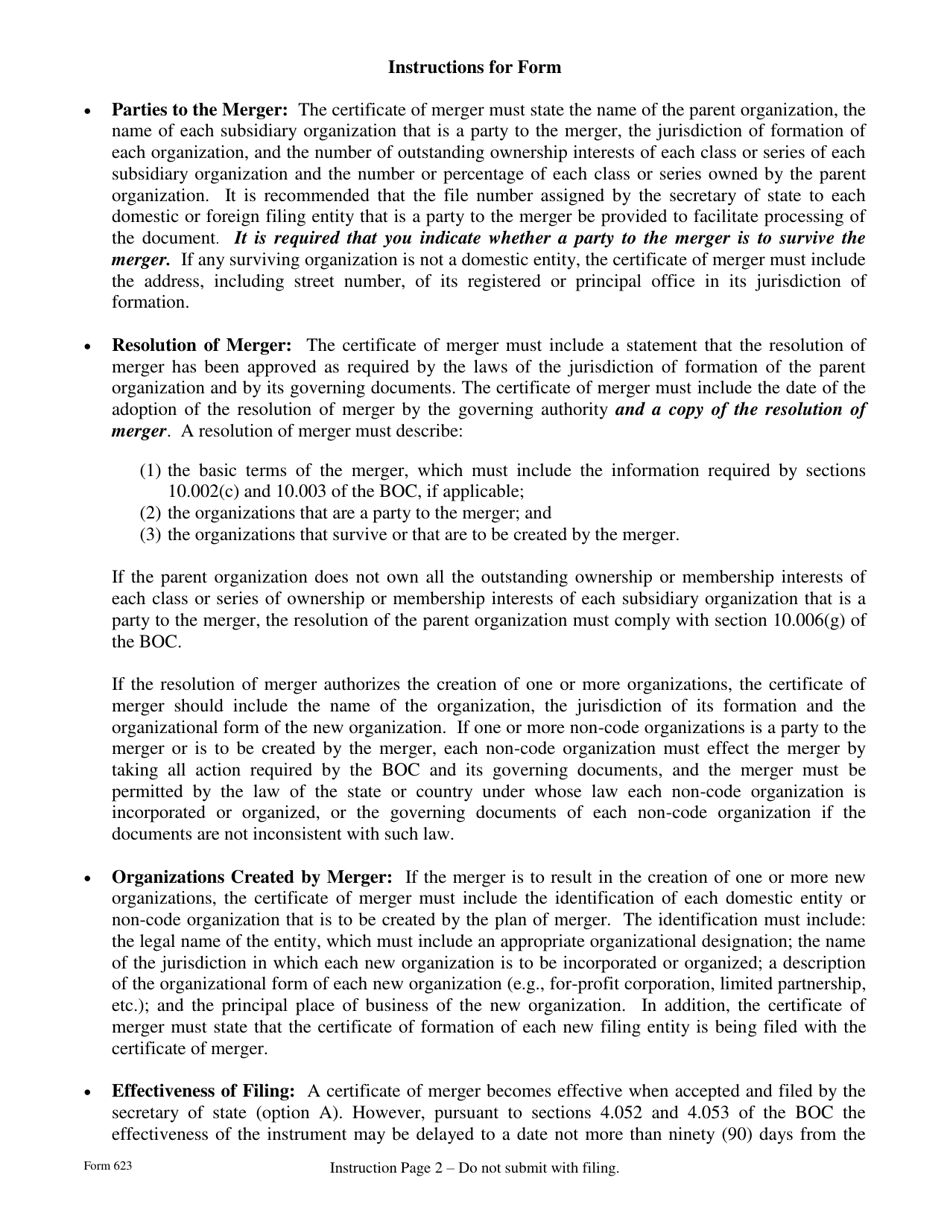

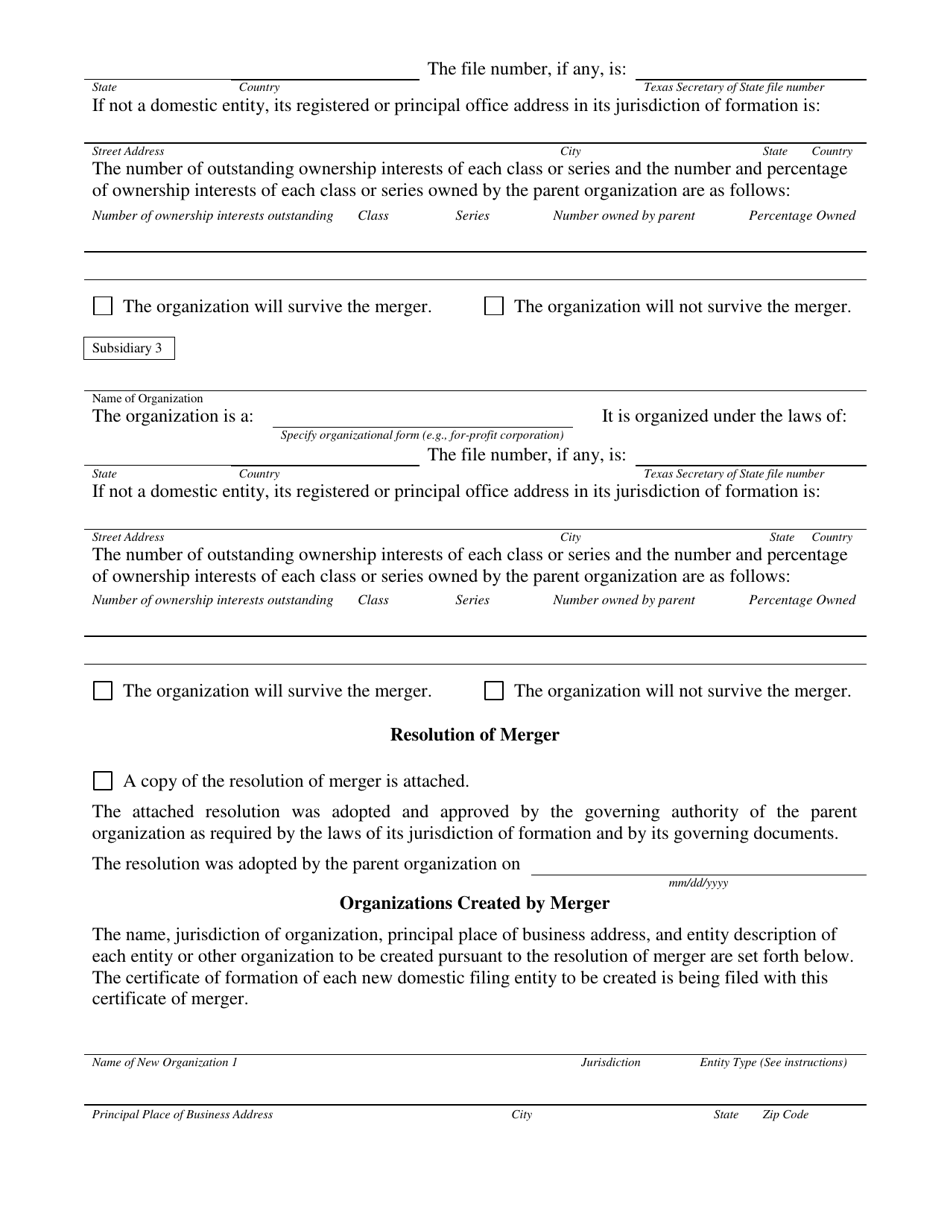

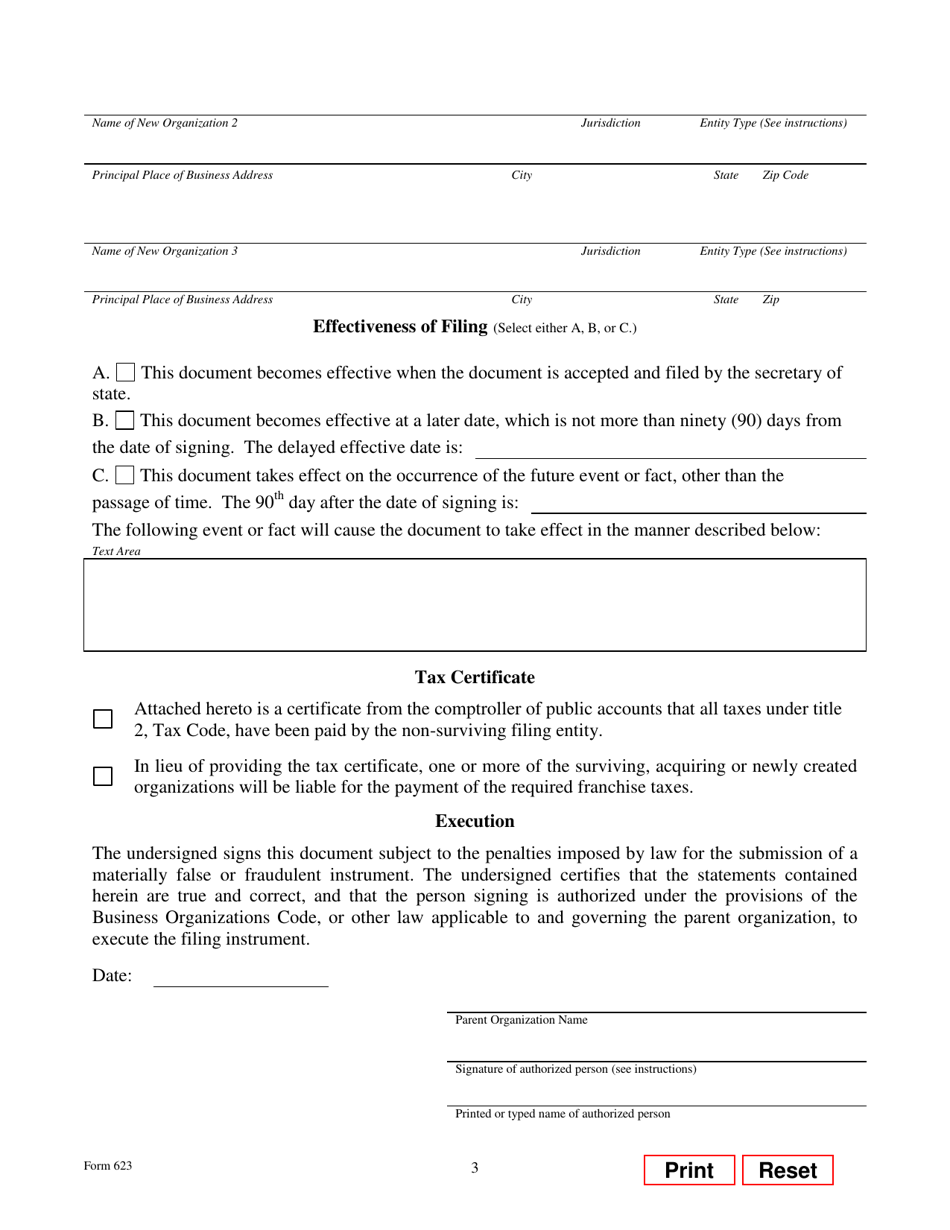

Q: What information is required in Form 623 Parent-Subsidiary Certificate of Merger?

A: Form 623 requires information about the parent company, subsidiary, and the details of the merger, including the effective date.

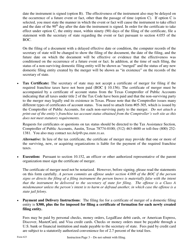

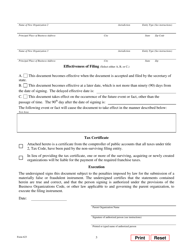

Q: Are there any fees to file Form 623 Parent-Subsidiary Certificate of Merger?

A: Yes, there are fees associated with filing Form 623. The exact amount can be obtained from the Texas Secretary of State's office.

Q: Is legal representation required to file Form 623 Parent-Subsidiary Certificate of Merger?

A: While legal representation is not required, it is recommended to consult with an attorney to ensure the accuracy and legality of the merger.

Q: What is the deadline for filing Form 623 Parent-Subsidiary Certificate of Merger?

A: There is no specific deadline for filing Form 623, but it is recommended to file it as soon as the merger decision is made.

Q: Can I make changes to Form 623 after it is filed?

A: No, once Form 623 is filed, it cannot be amended. It is important to review all information before submission.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 623 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.