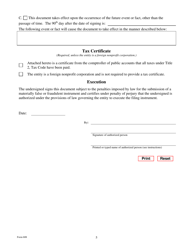

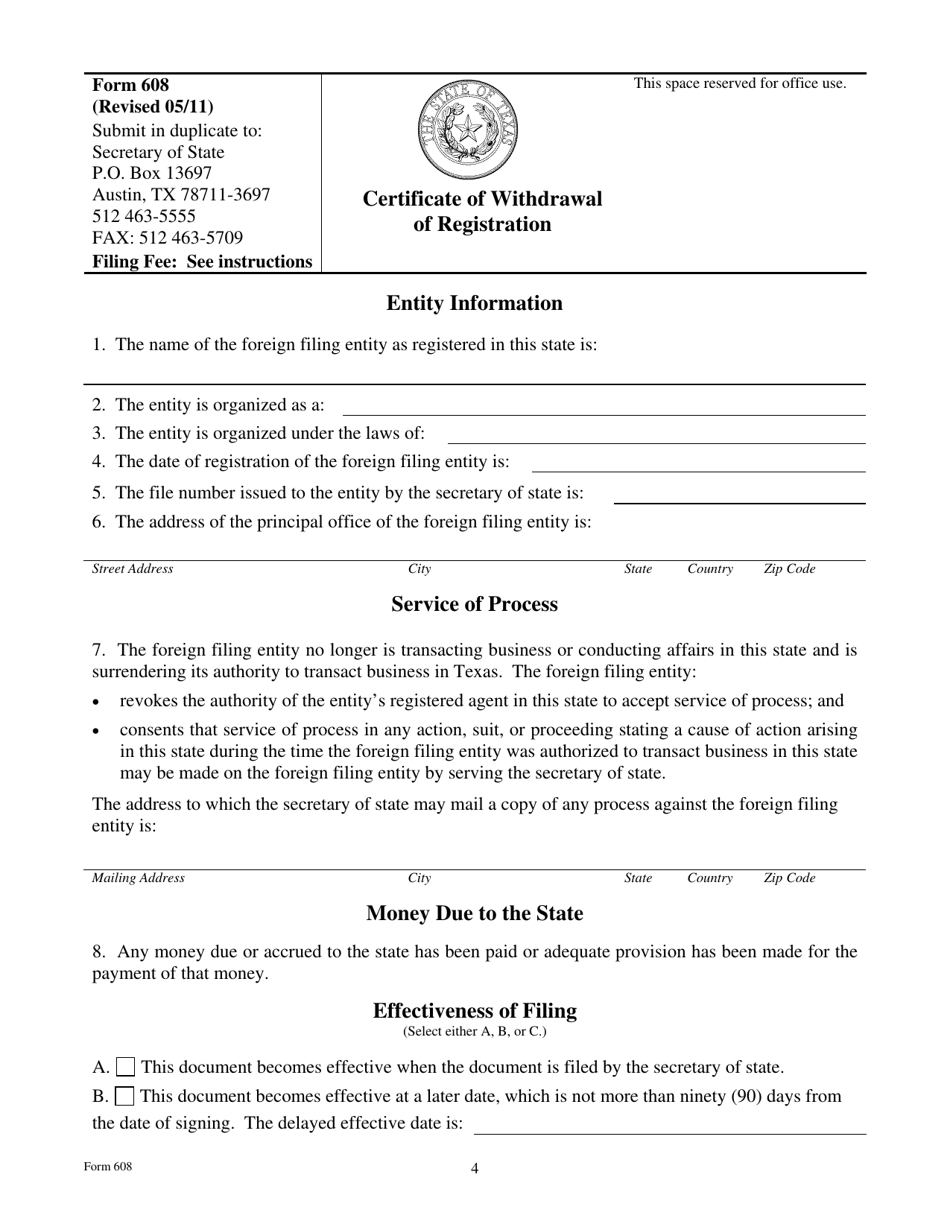

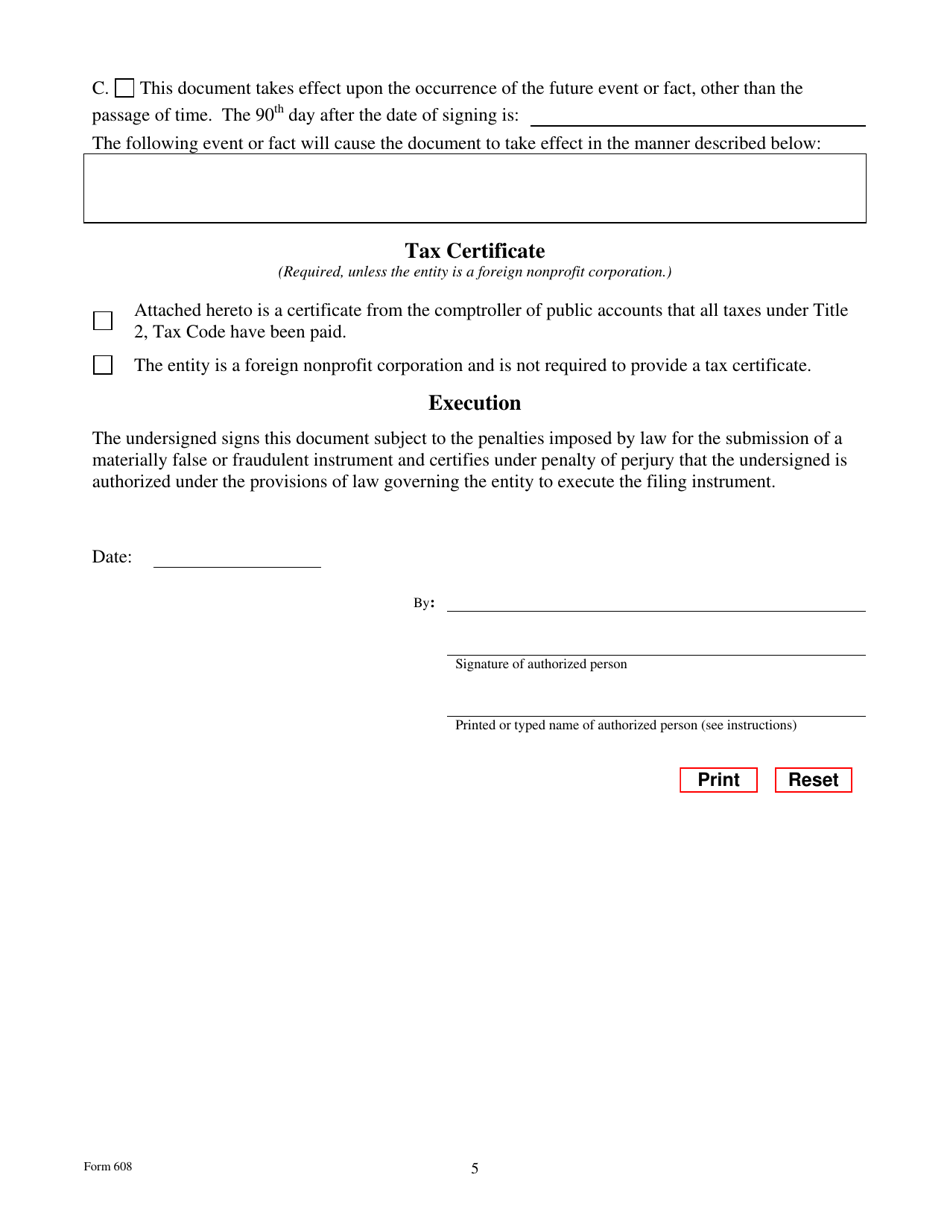

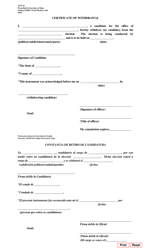

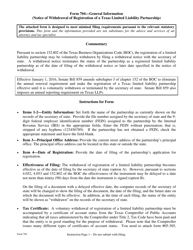

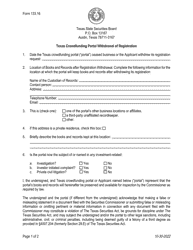

Form 608 Certificate of Withdrawal of Registration - Texas

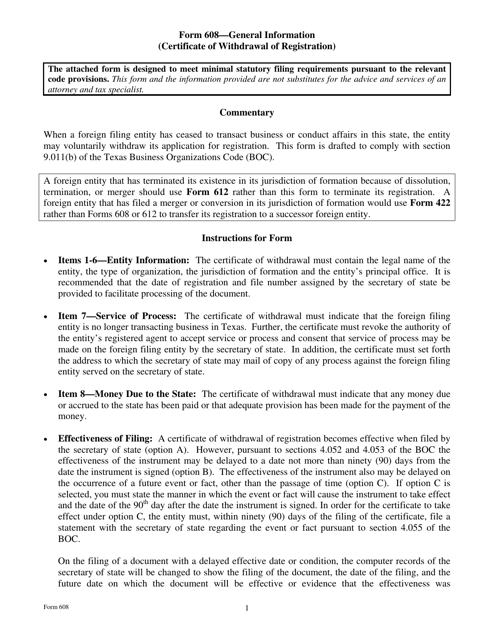

What Is Form 608?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 608?

A: Form 608 is the Certificate of Withdrawal of Registration in Texas.

Q: What is the purpose of Form 608?

A: The purpose of Form 608 is to officially withdraw the registration of a business entity in Texas.

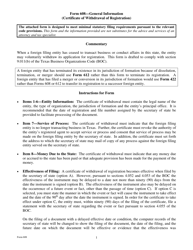

Q: Who can file Form 608?

A: Any authorized person or representative of a business entity can file Form 608.

Q: Is there a fee for filing Form 608?

A: Yes, there is a non-refundable filing fee for Form 608.

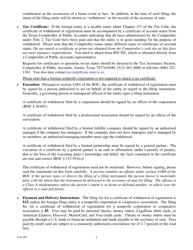

Q: How long does it take to process Form 608?

A: Processing time for Form 608 varies, but it generally takes a few weeks.

Q: Are there any specific requirements for filing Form 608?

A: Yes, there are specific requirements for filing Form 608, including providing a valid reason for the withdrawal.

Q: Can I withdraw the registration of a foreign entity using Form 608?

A: No, Form 608 is only for the withdrawal of registration of domestic entities.

Q: What happens after filing Form 608?

A: After filing Form 608, the business entity's registration will be officially withdrawn.

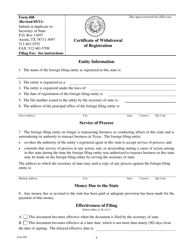

Q: Can I reinstate a withdrawn registration?

A: Yes, you can reinstate a withdrawn registration by filing the appropriate form and paying the required fees.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 608 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.