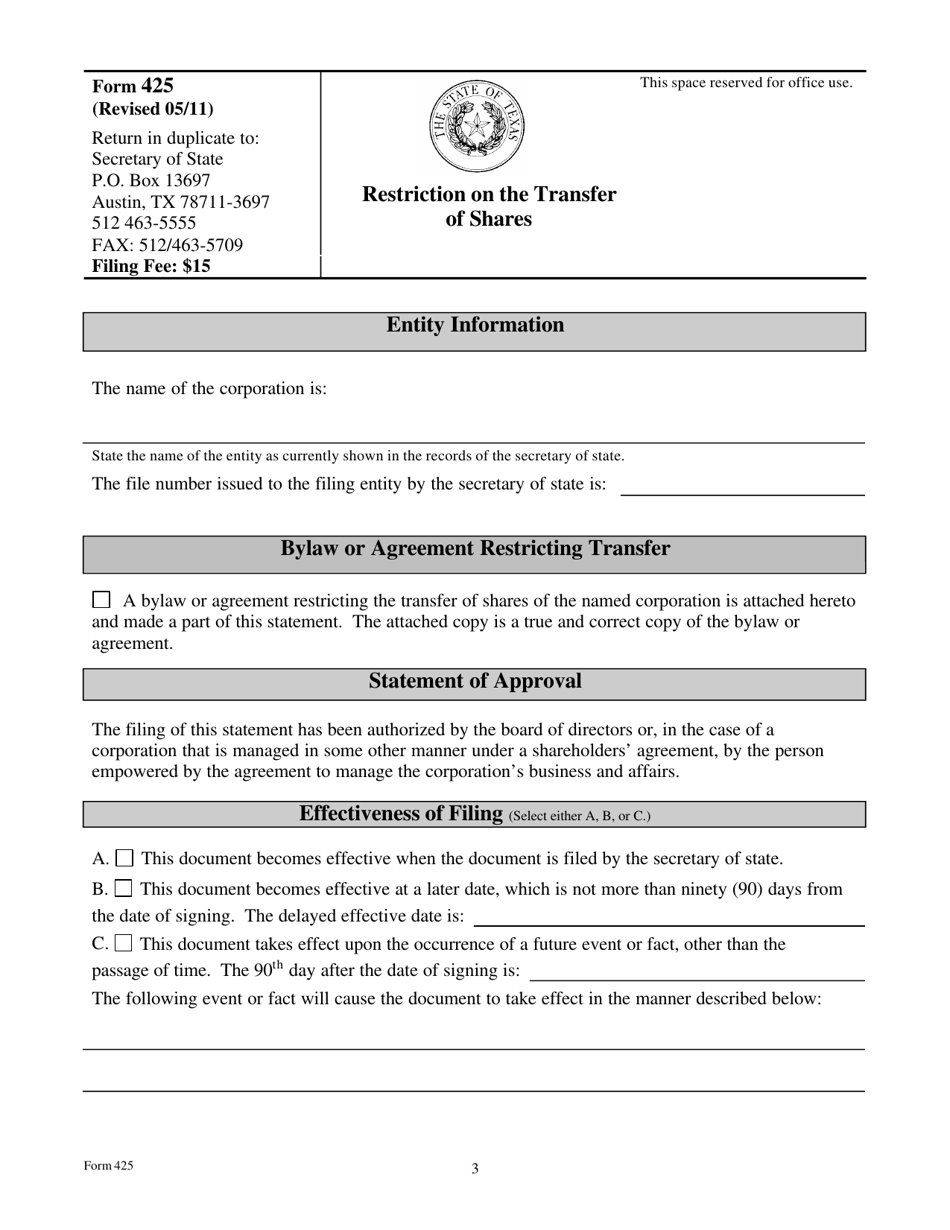

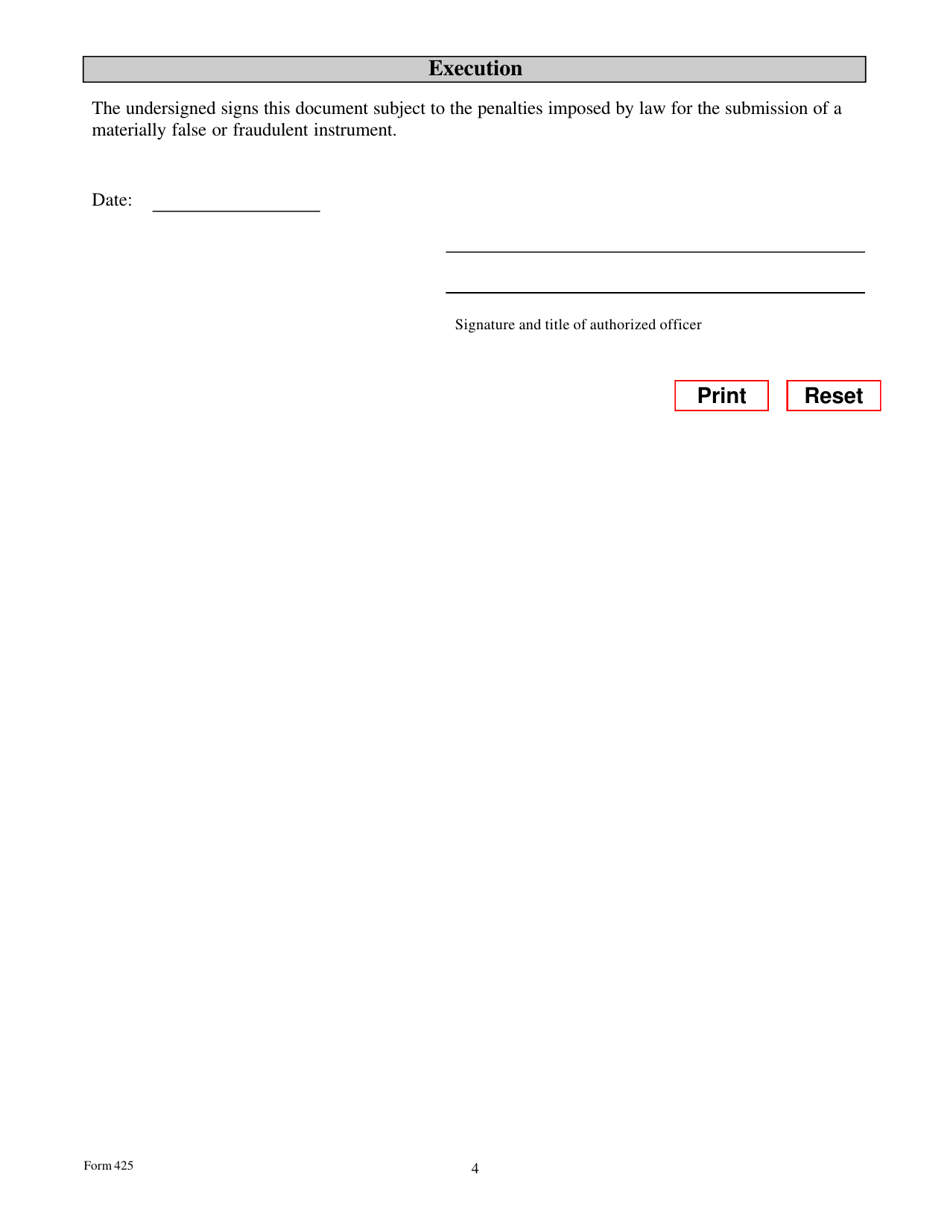

Form 425 Restriction on the Transfer of Shares - Texas

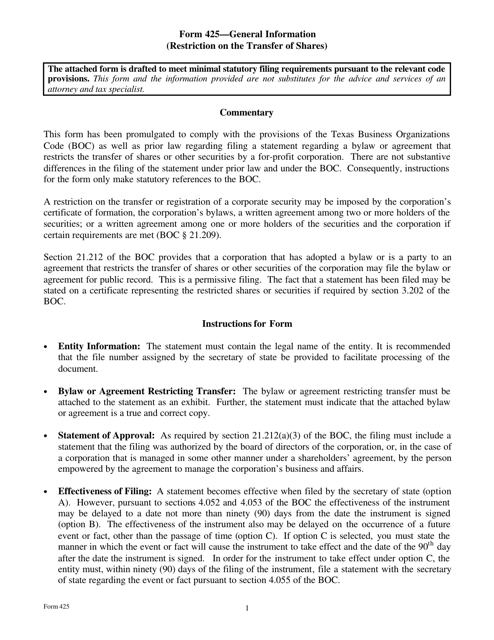

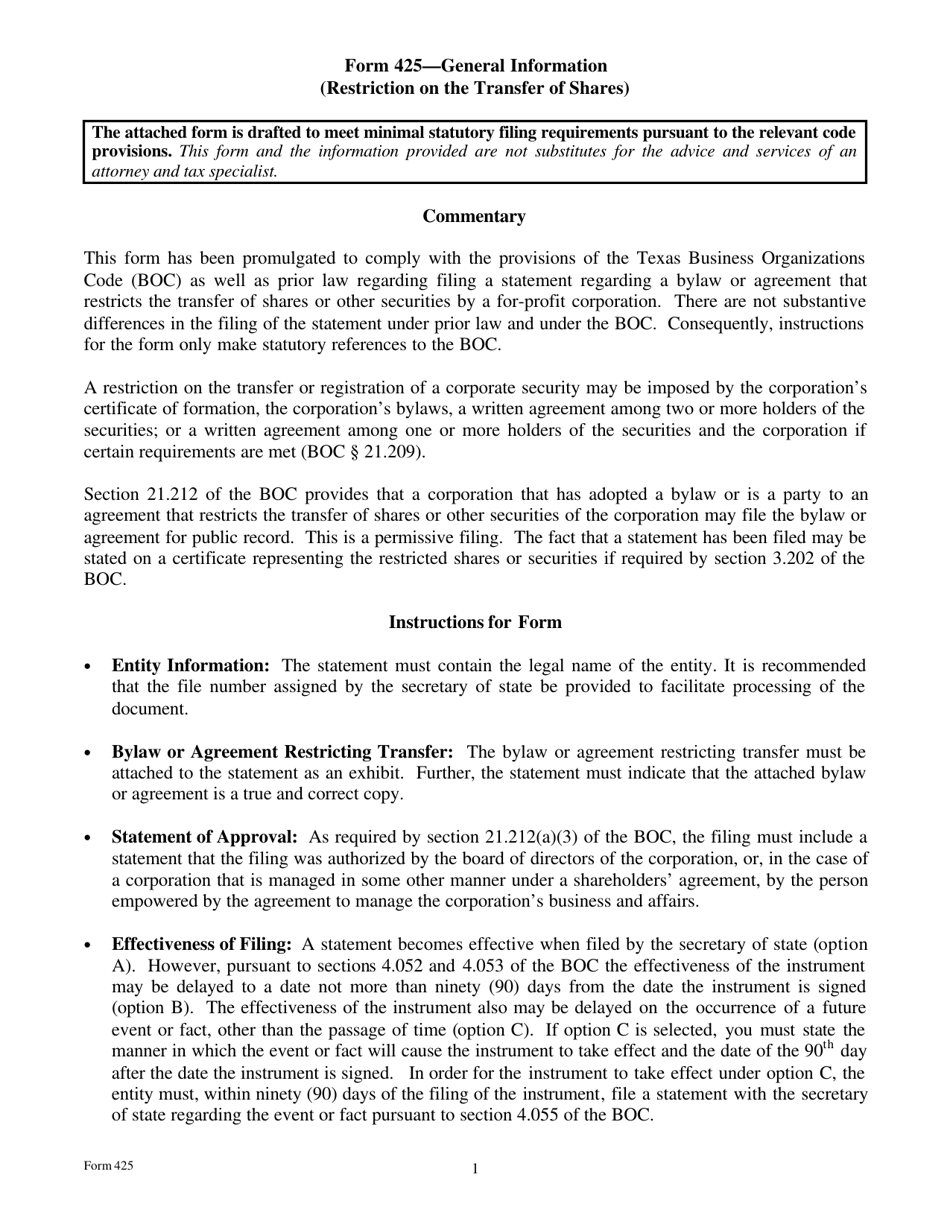

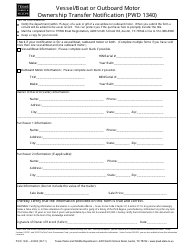

What Is Form 425?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 425?

A: Form 425 is a document used to restrict the transfer of shares in Texas.

Q: What does Form 425 do?

A: Form 425 imposes restrictions on the transfer of shares.

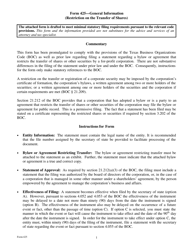

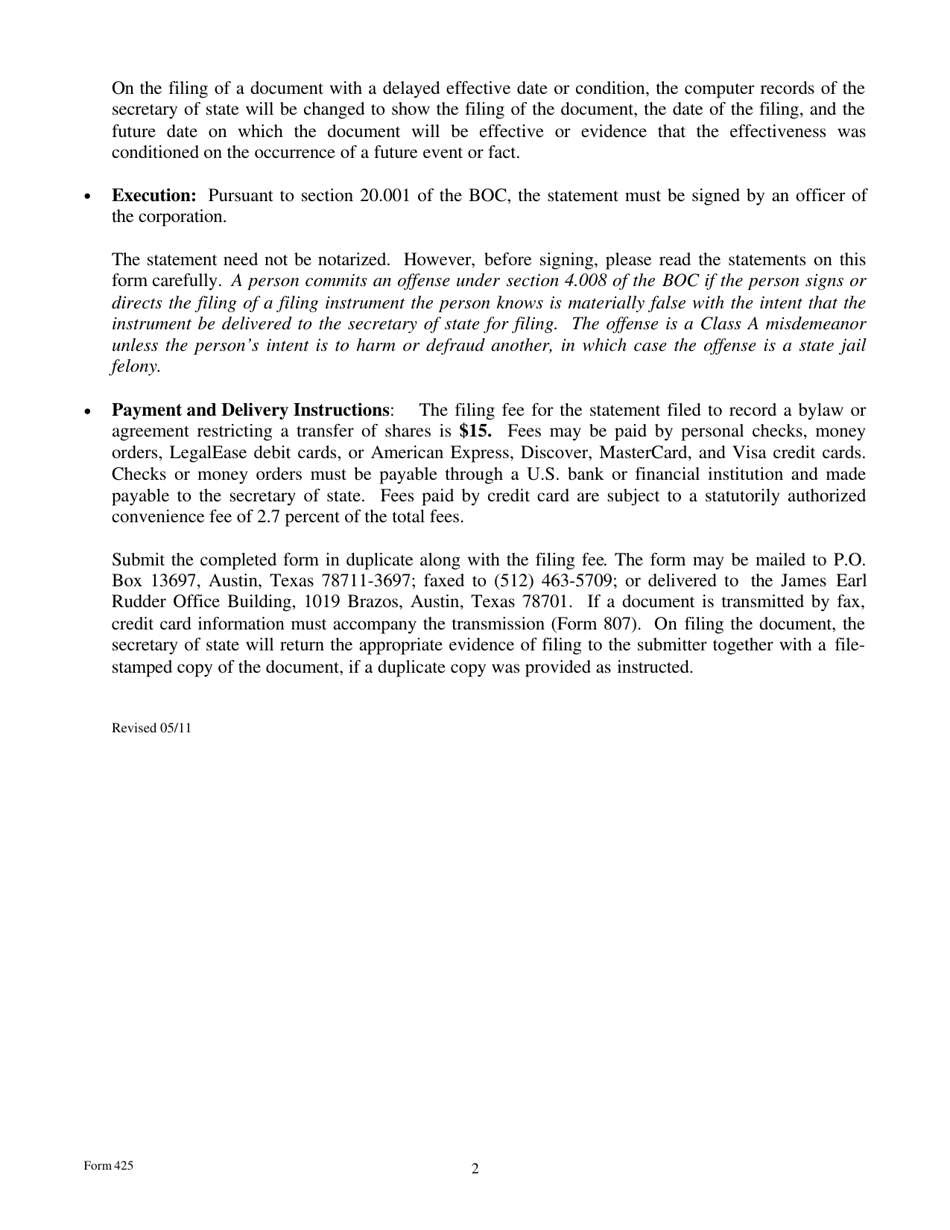

Q: Who is required to file Form 425?

A: The shareholders or the company may be required to file Form 425.

Q: What is the purpose of restricting the transfer of shares?

A: Restricting the transfer of shares allows the company to control who becomes a shareholder and maintain ownership control.

Q: Are there any exemptions to the restrictions in Form 425?

A: There may be exemptions based on the company's bylaws or other agreements.

Q: What happens if the transfer of shares is made in violation of Form 425?

A: The transfer may be deemed invalid or the parties involved may face legal consequences.

Q: Is Form 425 specific to Texas?

A: Yes, Form 425 is specific to Texas and its laws governing the transfer of shares.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 425 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.