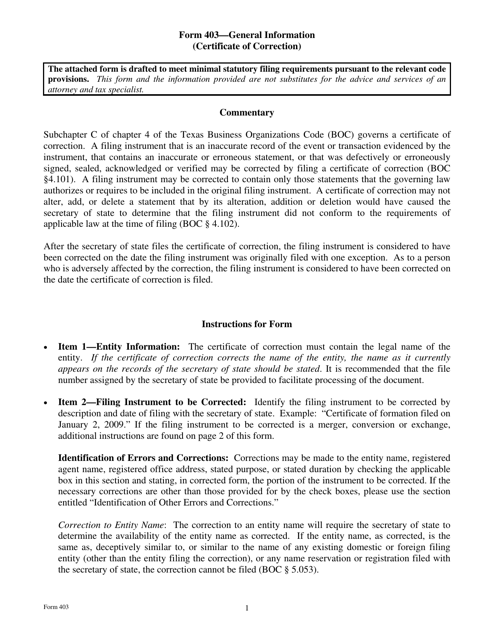

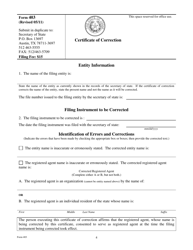

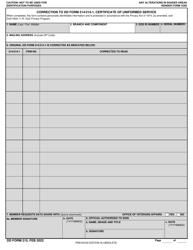

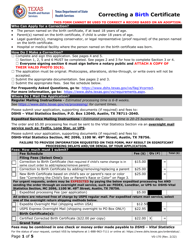

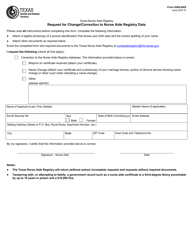

Form 403 Certificate of Correction - Texas

What Is Form 403?

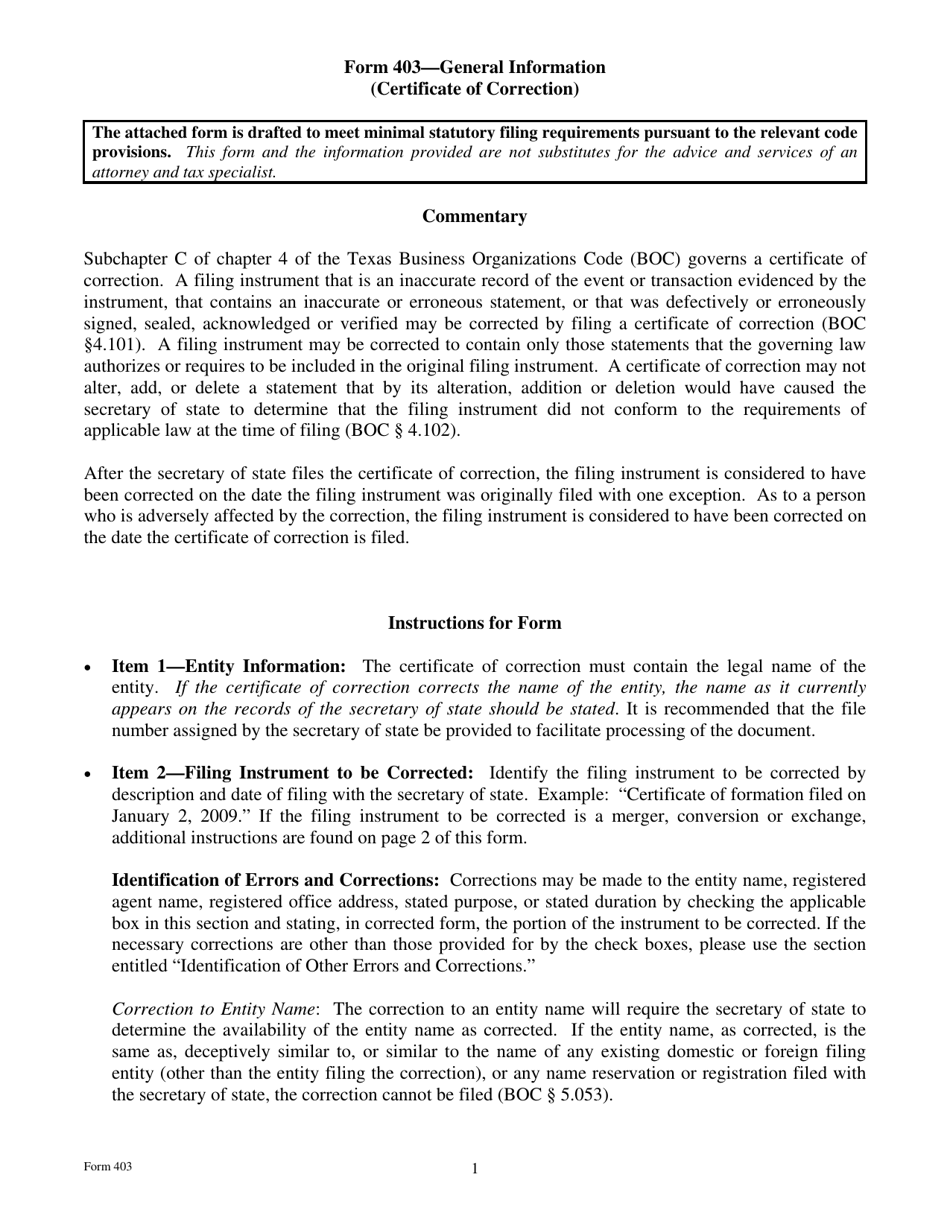

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

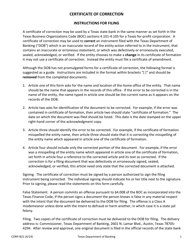

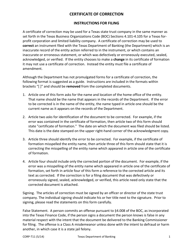

Q: What is Form 403 Certificate of Correction?

A: Form 403 Certificate of Correction is a document used in the state of Texas to correct errors or changes in previously filed business documents.

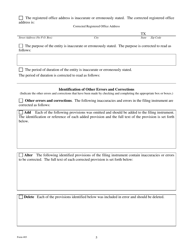

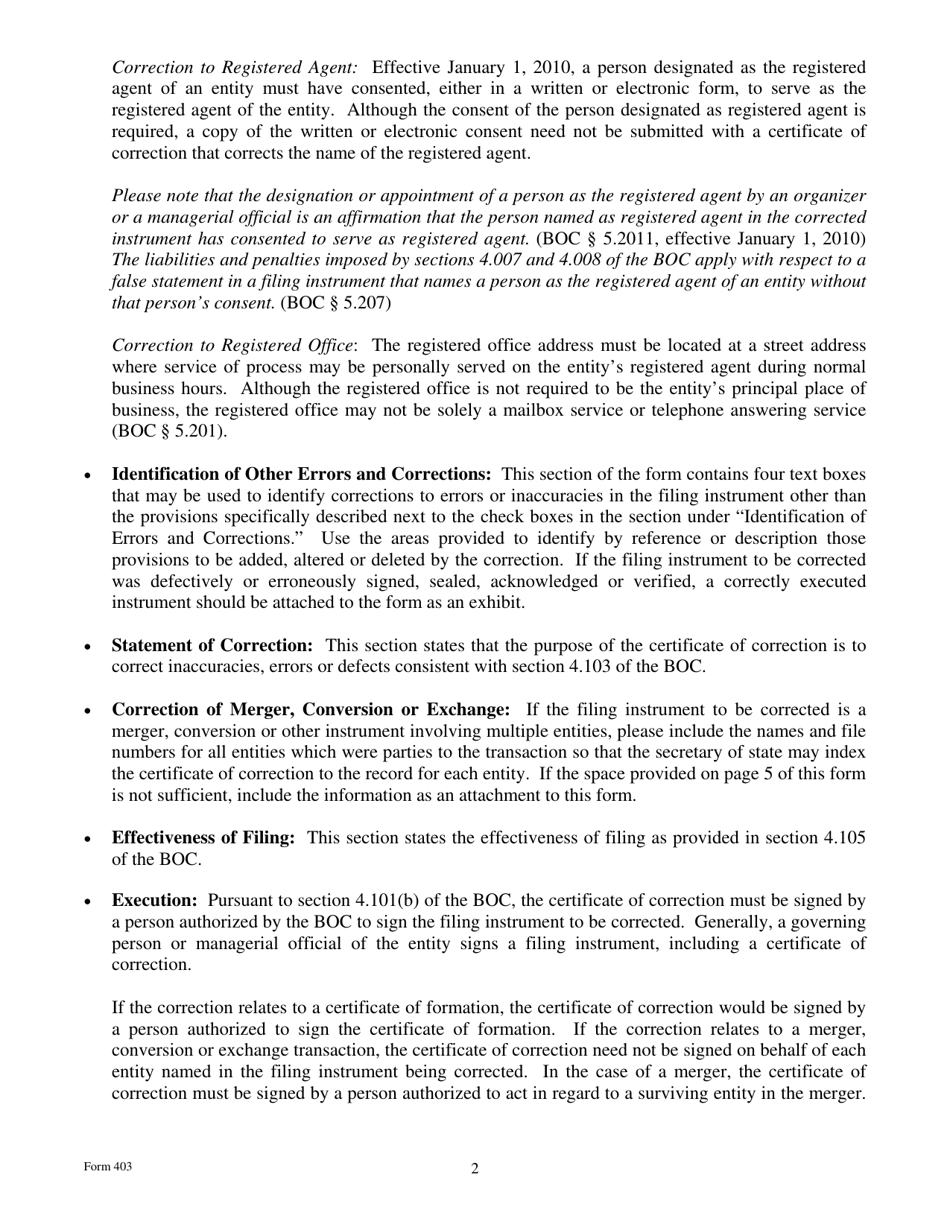

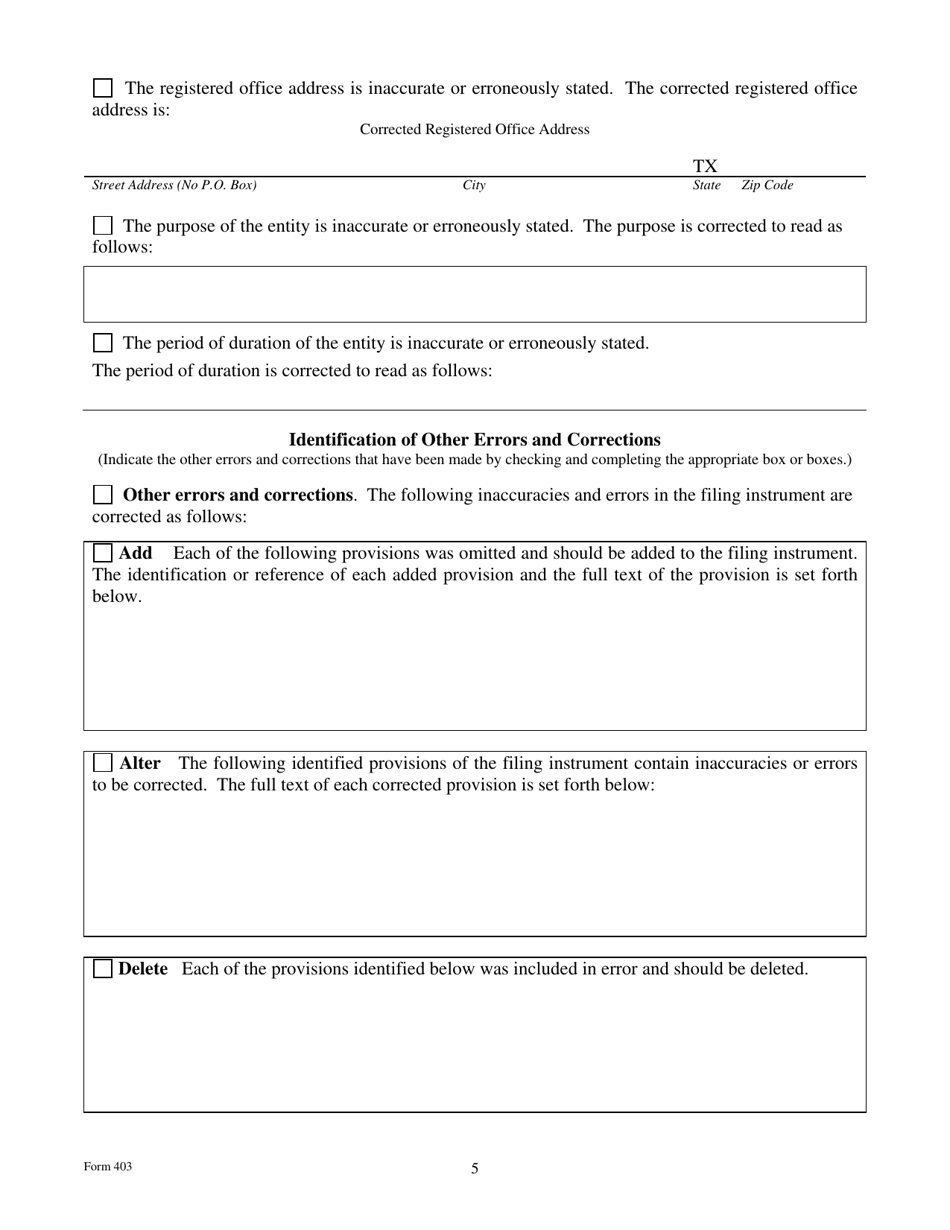

Q: What type of errors can be corrected using Form 403?

A: Form 403 can be used to correct errors or omissions in the formation documents, amendments, or other filings related to a registered business entity in Texas.

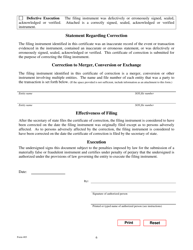

Q: Who can file Form 403?

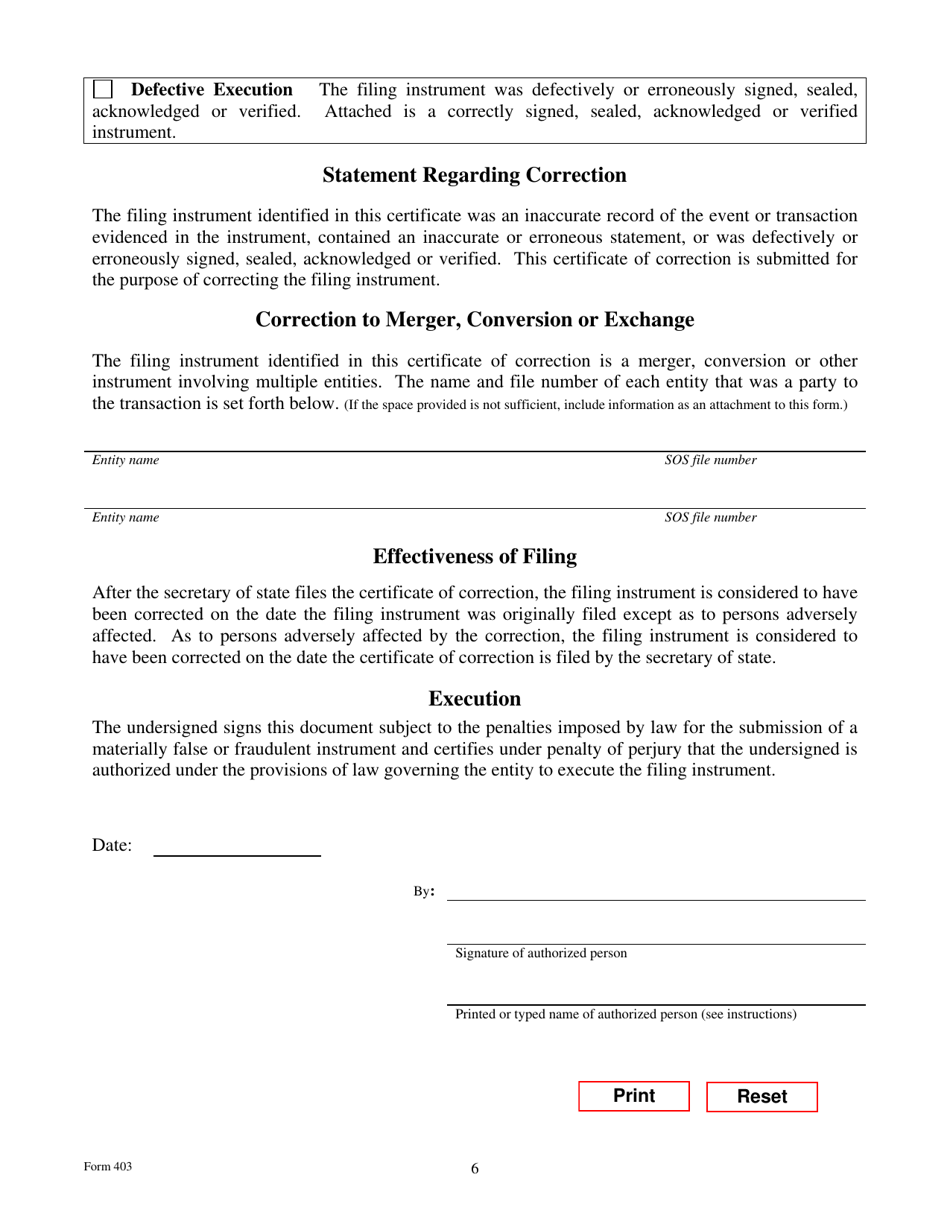

A: Form 403 can be filed by the registered agent or an authorized representative of the business entity.

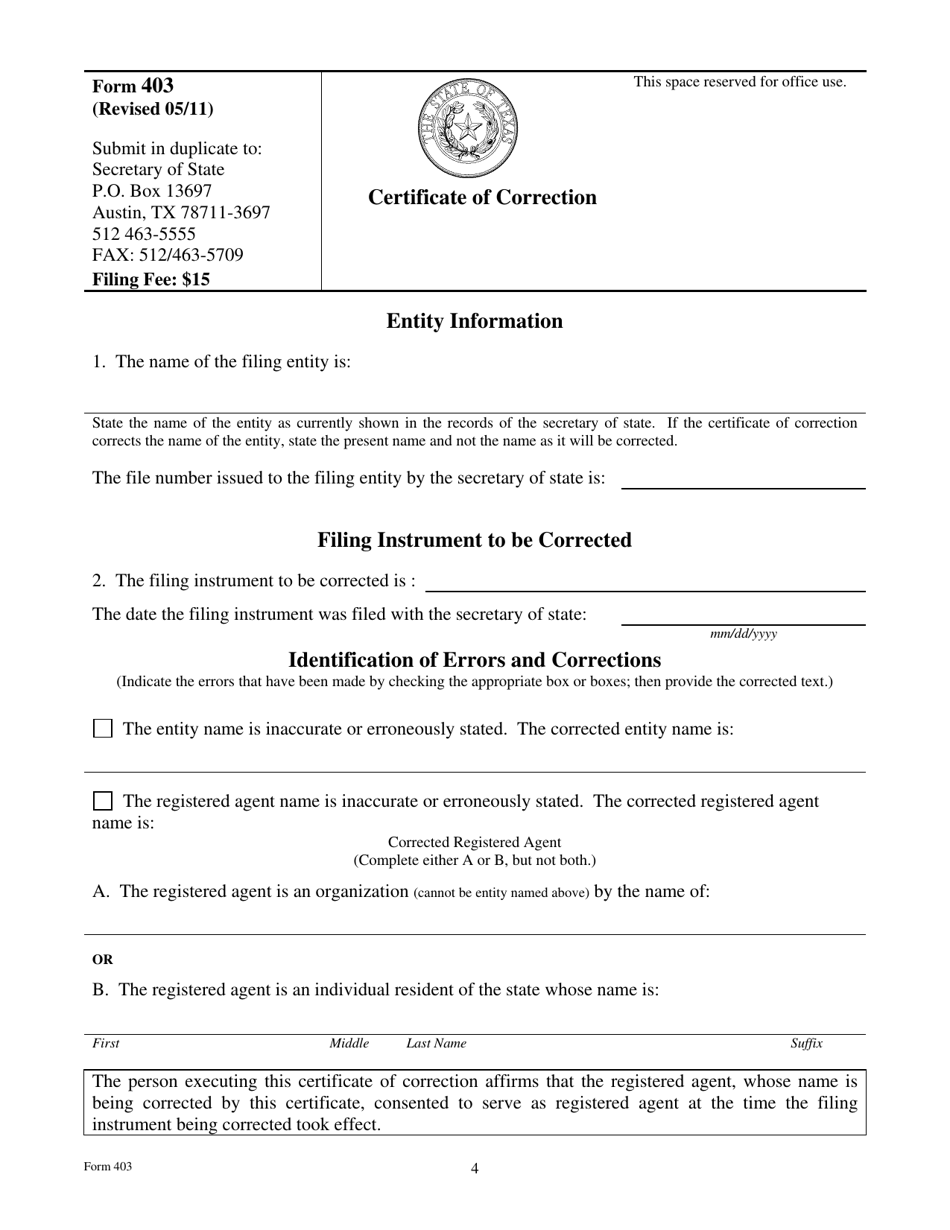

Q: What information is needed to file Form 403?

A: To file Form 403, you will need to provide the entity name, file number, date of the document being corrected, and a description of the error or change being made.

Q: What happens after Form 403 is filed?

A: Once Form 403 is filed and the fee is paid, the corrected information will be updated in the state's records for the business entity.

Q: Is Form 403 the same as an amendment?

A: No, Form 403 is specifically used for correcting errors or changes in previously filed documents, whereas an amendment is used to make changes or updates to the original document.

Q: Can Form 403 be used for out-of-state entities?

A: No, Form 403 is only applicable for business entities registered in the state of Texas.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 403 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.