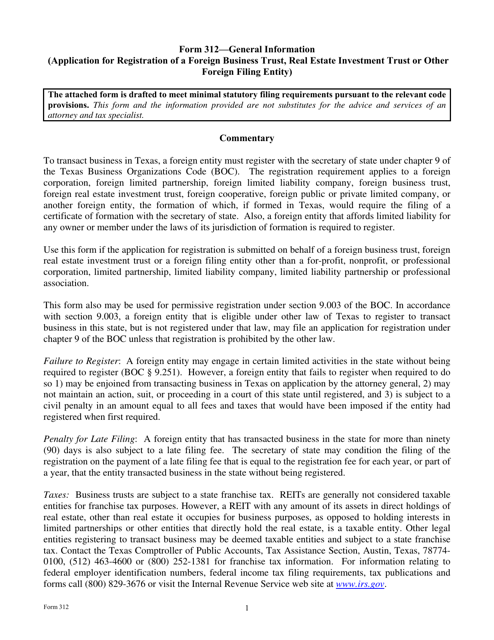

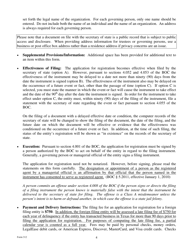

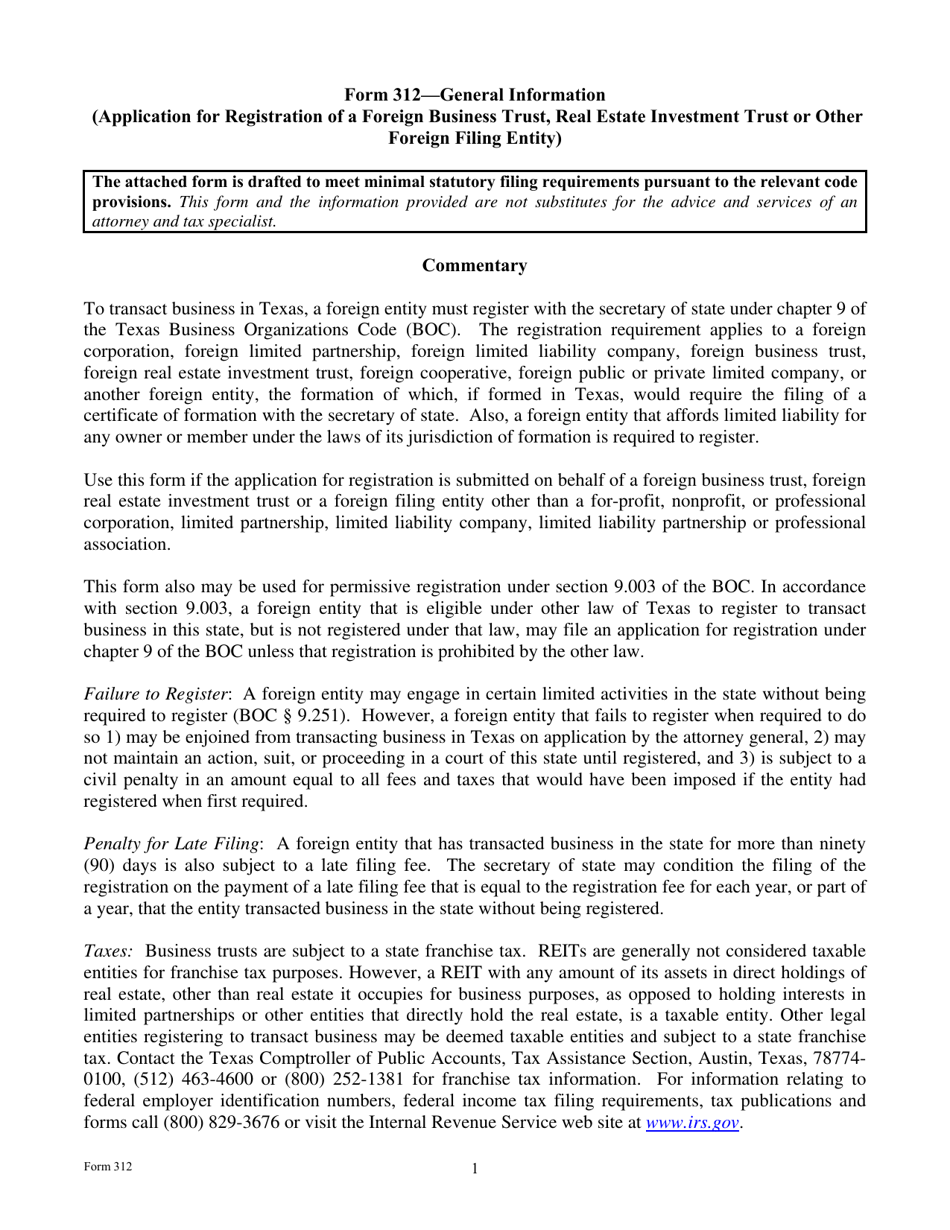

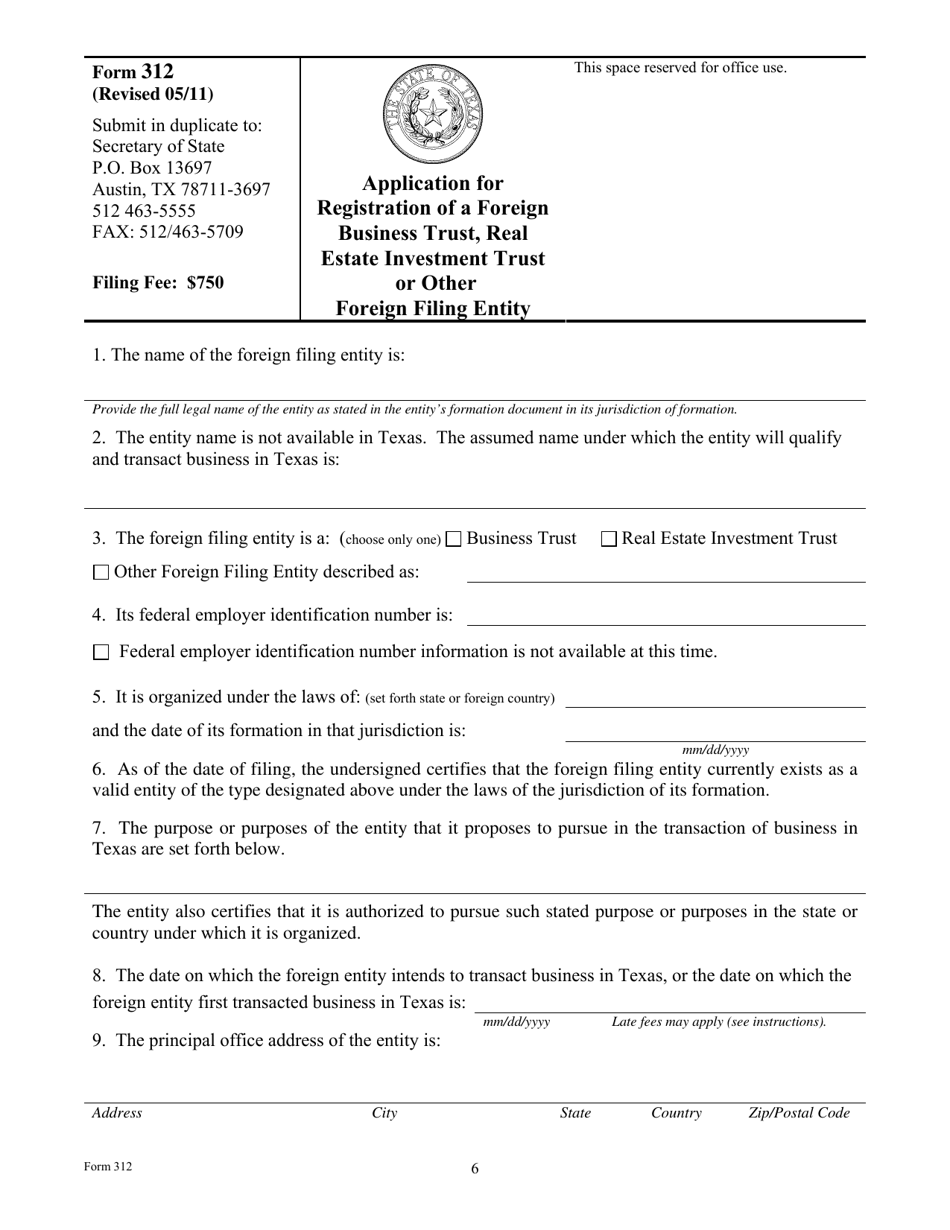

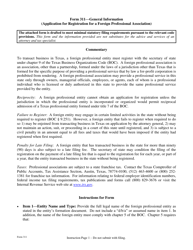

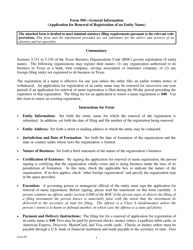

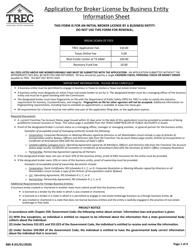

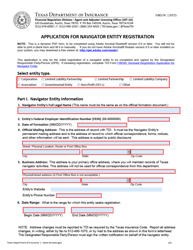

Form 312 Application for Registration of a Foreign Business Trust, Real Estate Investment Trust or Other Foreign Filing Entity - Texas

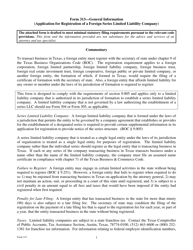

What Is Form 312?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 312?

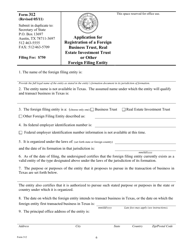

A: Form 312 is an application for registration of a foreign business trust, real estate investment trust or other foreign filing entity in Texas.

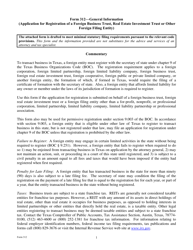

Q: Who needs to file Form 312?

A: Any foreign business trust, real estate investment trust or other foreign filing entity that wants to operate in Texas needs to file Form 312.

Q: What is the purpose of Form 312?

A: The purpose of Form 312 is to register a foreign business trust, real estate investment trust or other foreign filing entity in Texas.

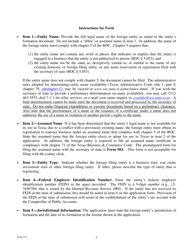

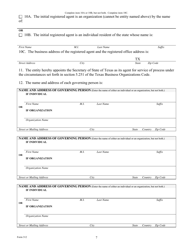

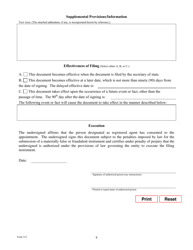

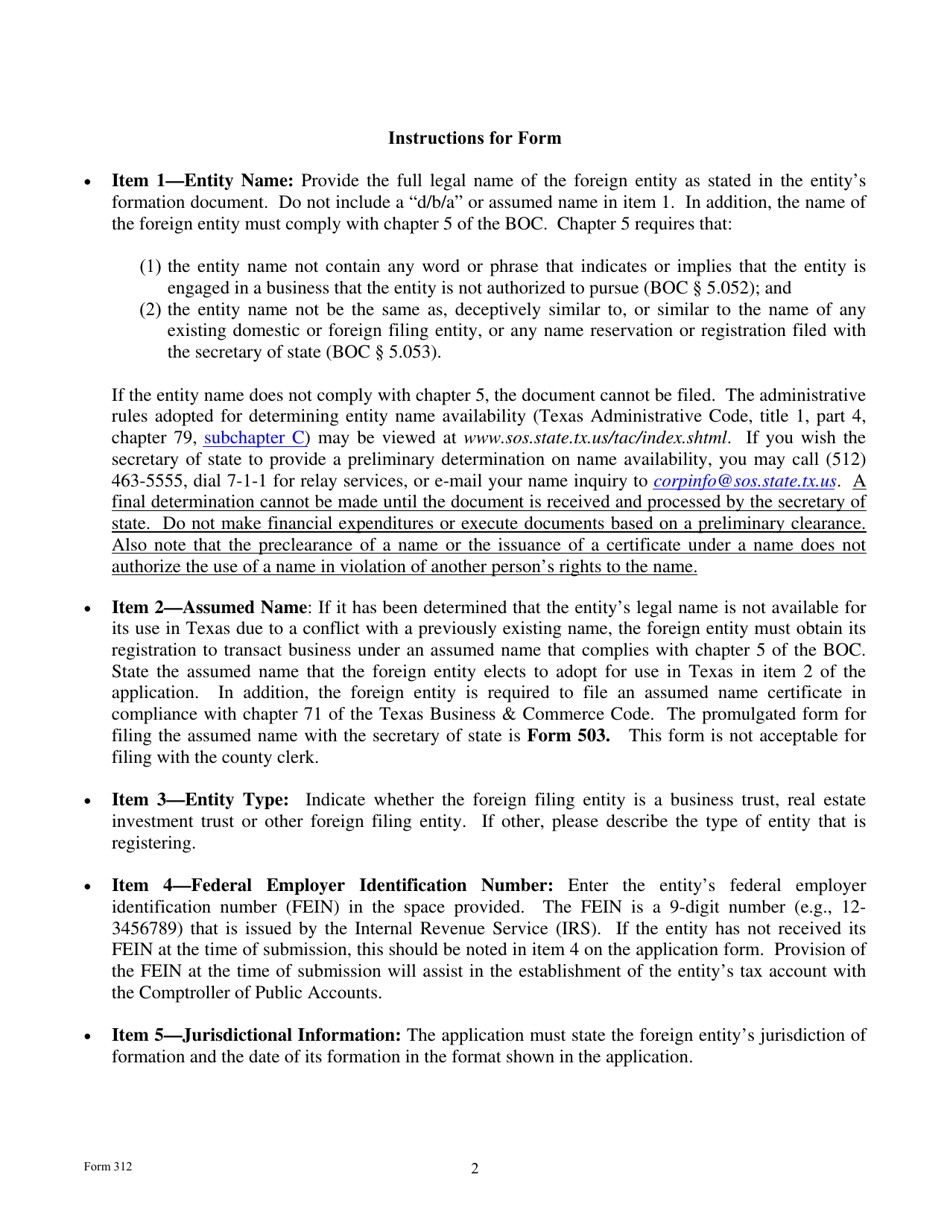

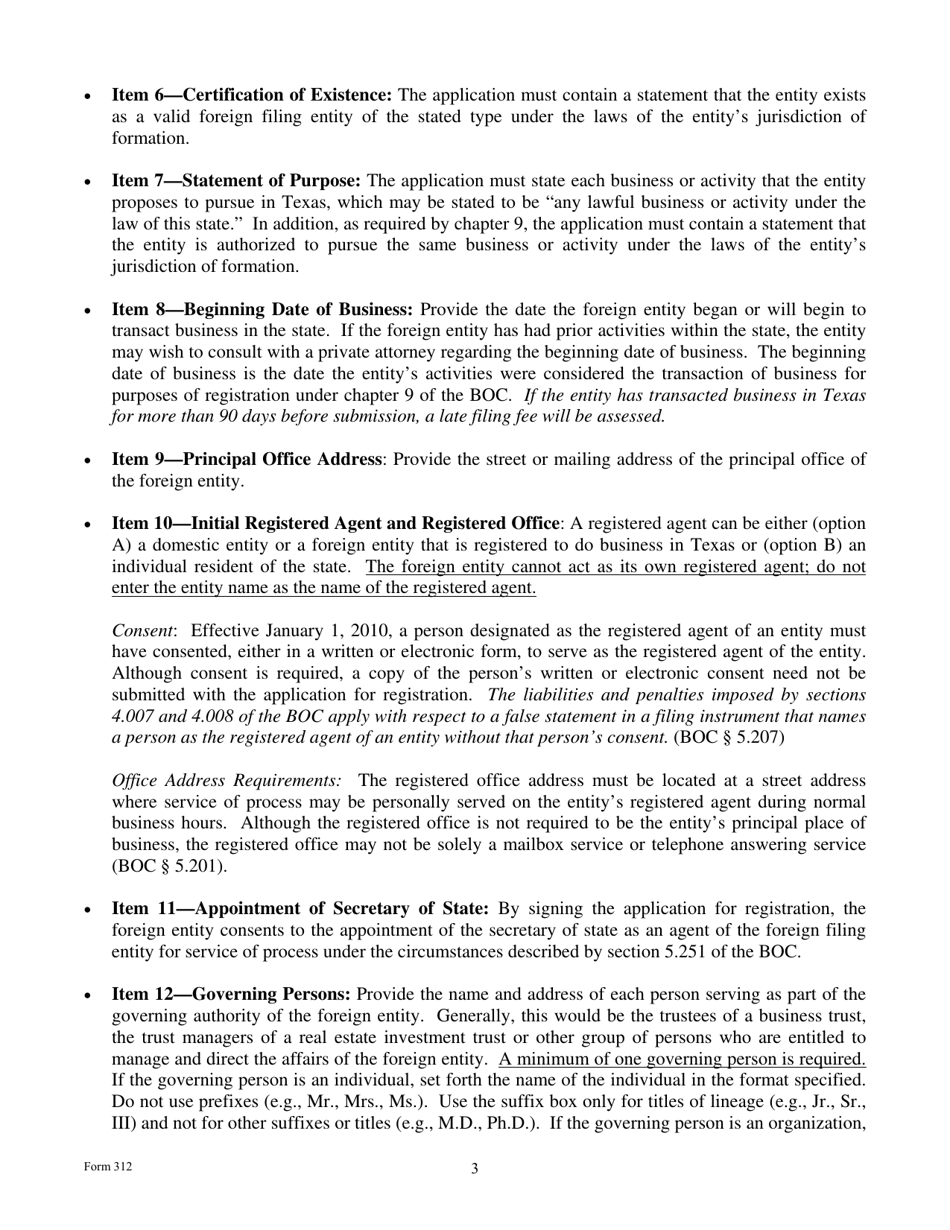

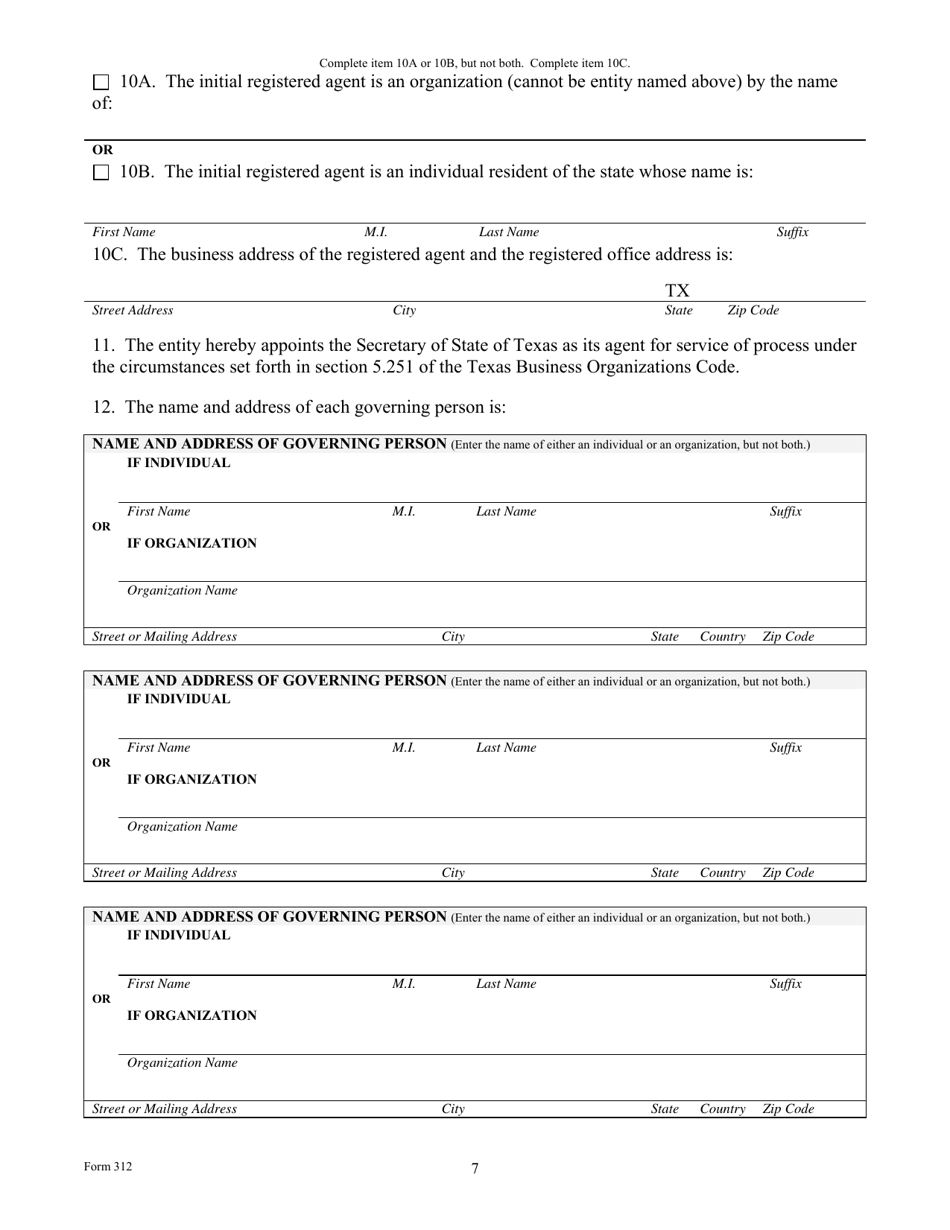

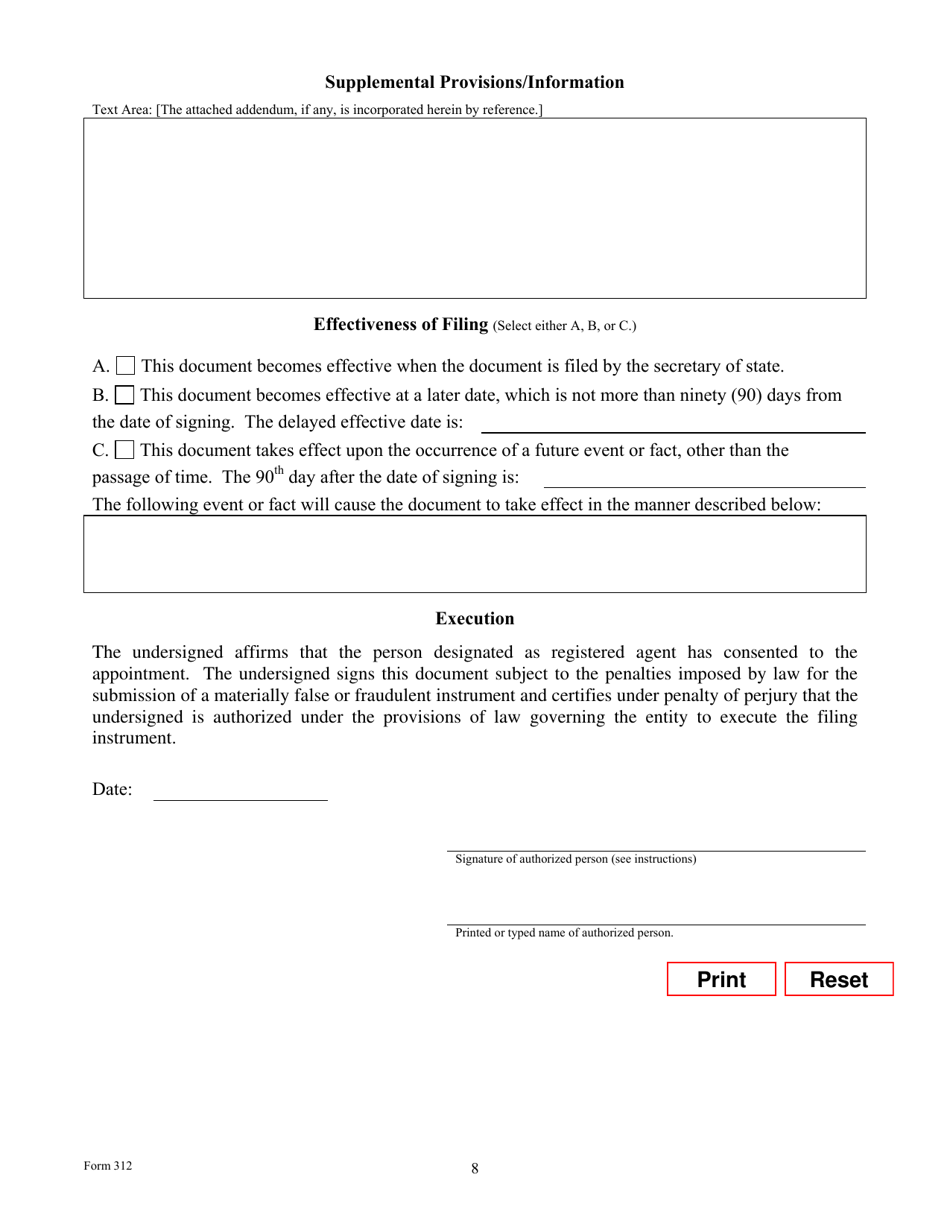

Q: What information is required on Form 312?

A: Form 312 requires information about the entity's name, type of entity, principal place of business, registered agent, and other details.

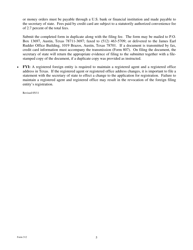

Q: How do I file Form 312?

A: You can file Form 312 by mail or in person at the Texas Secretary of State's office. Make sure to include the filing fee and any required supporting documents.

Q: What happens after I file Form 312?

A: After filing Form 312, the Secretary of State will review the application and, if everything is in order, will issue a certificate of registration.

Q: Do I need to renew the registration?

A: Yes, the registration needs to be renewed periodically. The exact renewal requirements will be specified in the certificate of registration.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 312 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.