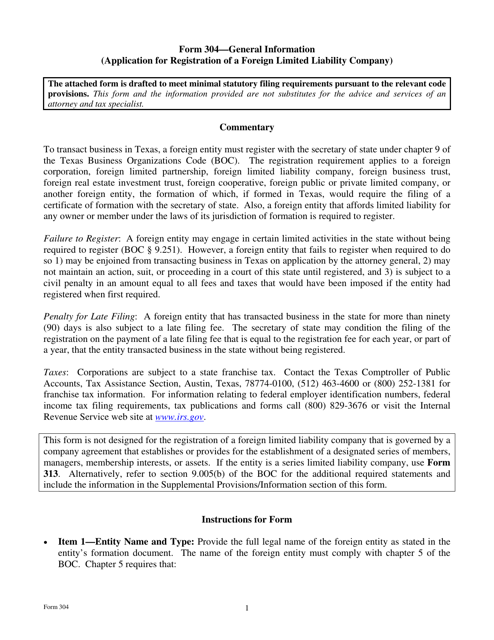

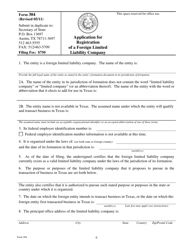

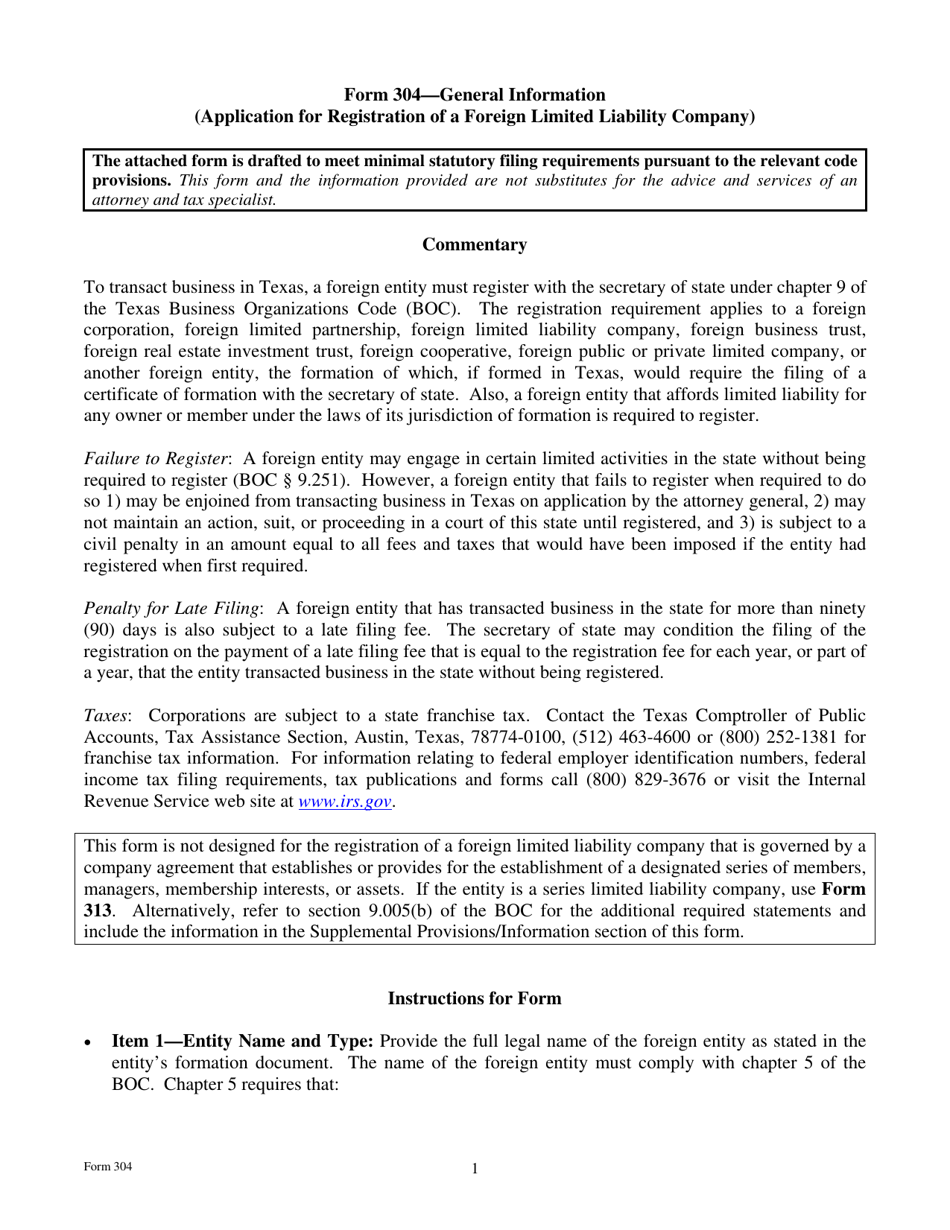

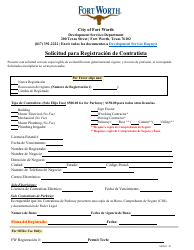

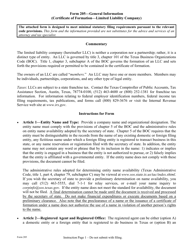

Form 304 Application for Registration of a Foreign Limited Liability Company - Texas

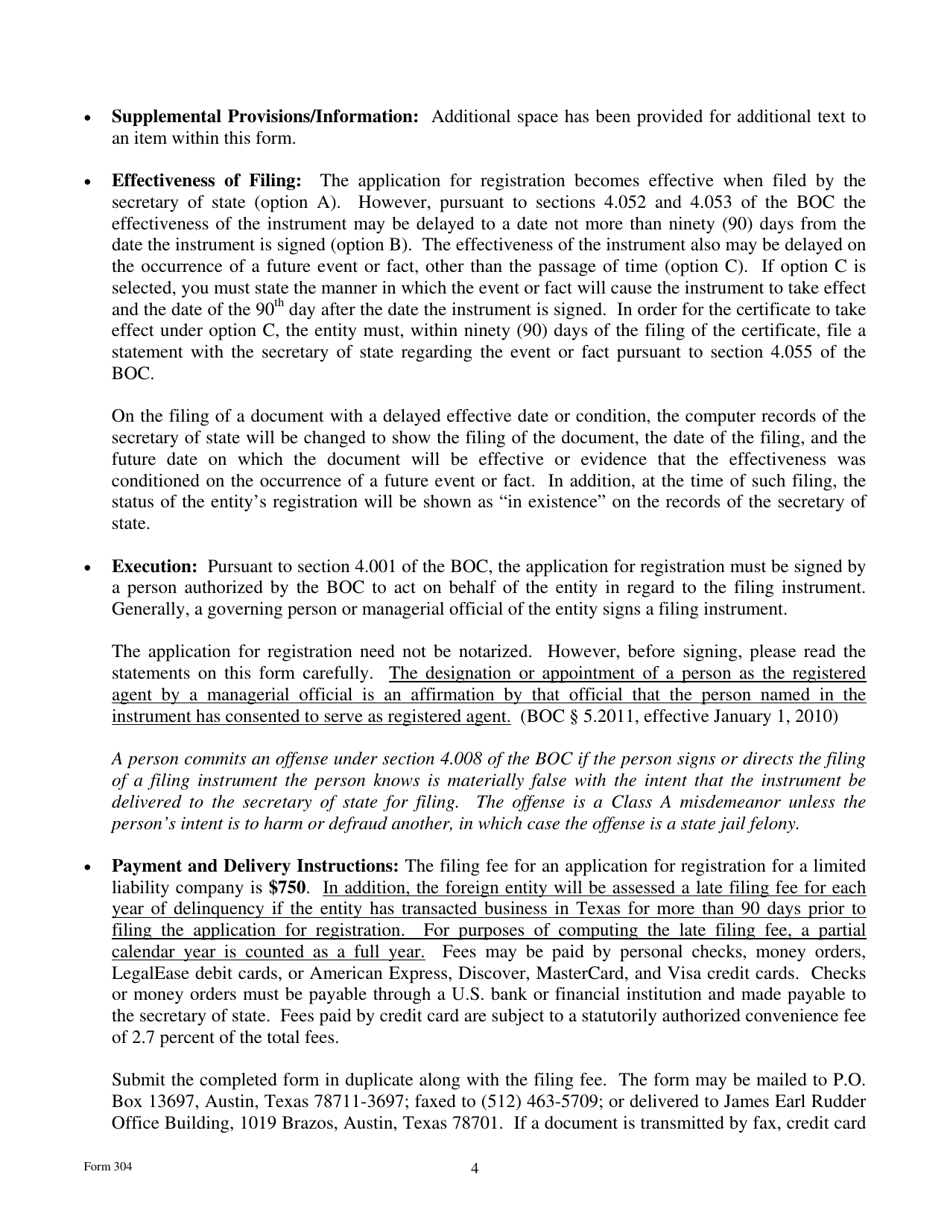

What Is Form 304?

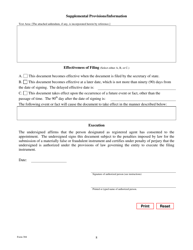

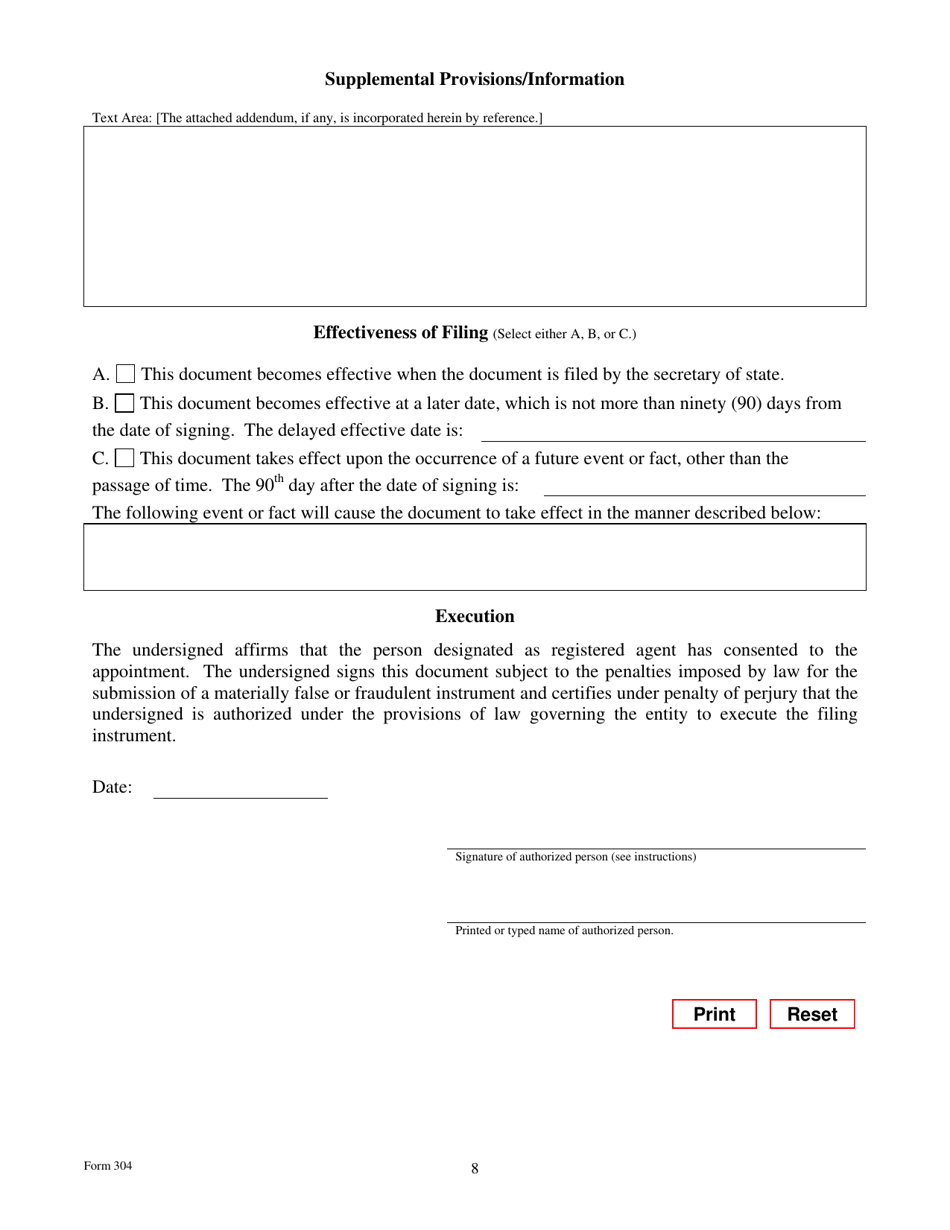

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 304?

A: Form 304 is the Application for Registration of a Foreign Limited Liability Company in Texas.

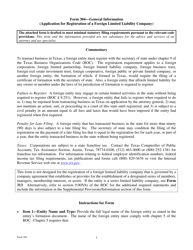

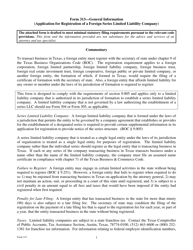

Q: Who should file Form 304?

A: Form 304 should be filed by a foreign limited liability company that wishes to register to do business in Texas.

Q: What is a foreign limited liability company?

A: A foreign limited liability company is a company that was formed in a state or country other than Texas.

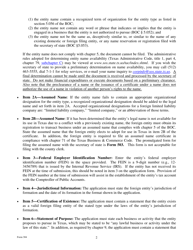

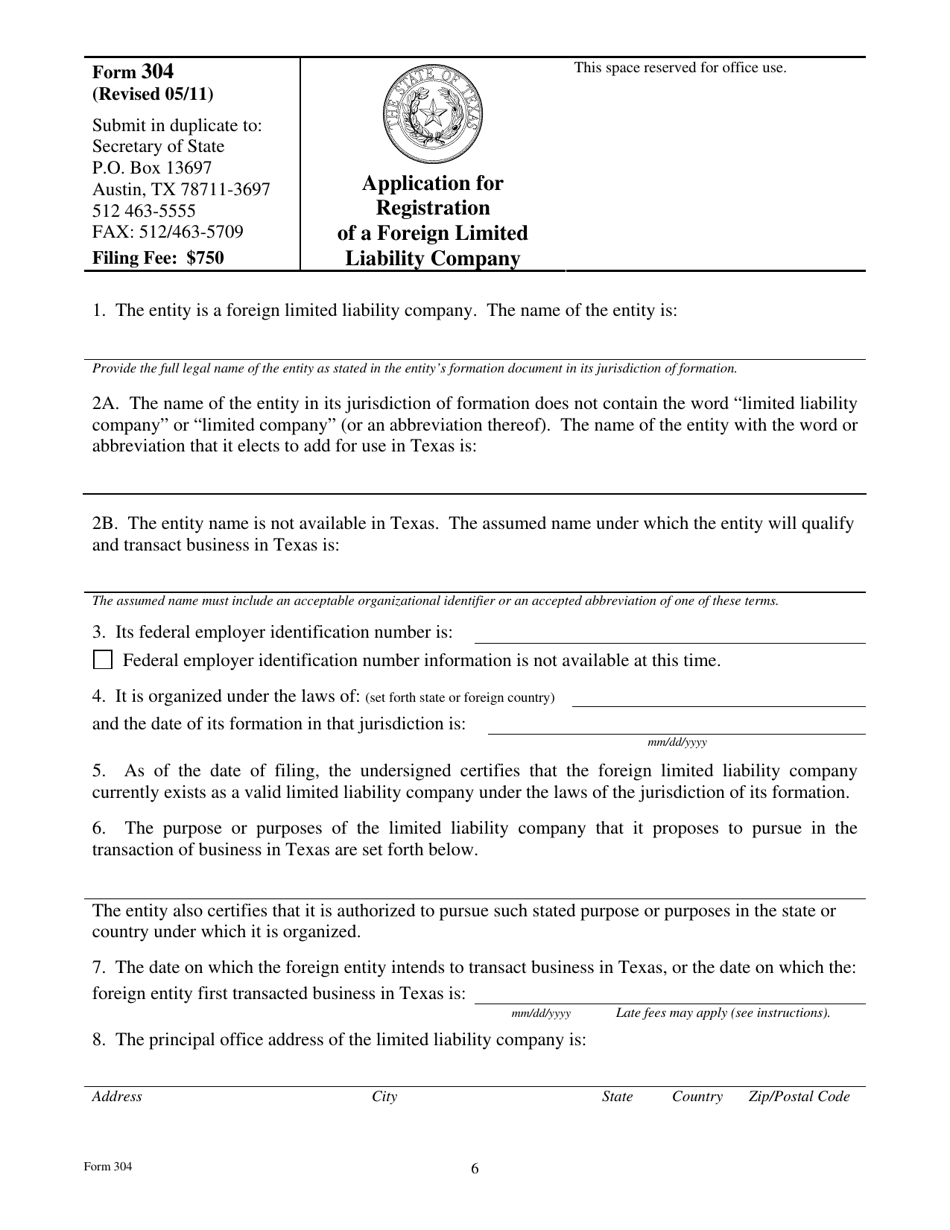

Q: What information is needed to complete Form 304?

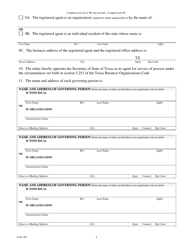

A: To complete Form 304, you will need to provide information about the foreign limited liability company, including its name, jurisdiction of formation, and principal office address.

Q: Is there a fee to file Form 304?

A: Yes, there is a fee associated with filing Form 304. The current fee is $750.

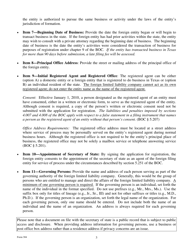

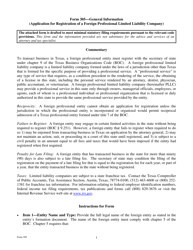

Q: What is the deadline for filing Form 304?

A: Form 304 must be filed within 90 days of the foreign limited liability company's registration in Texas.

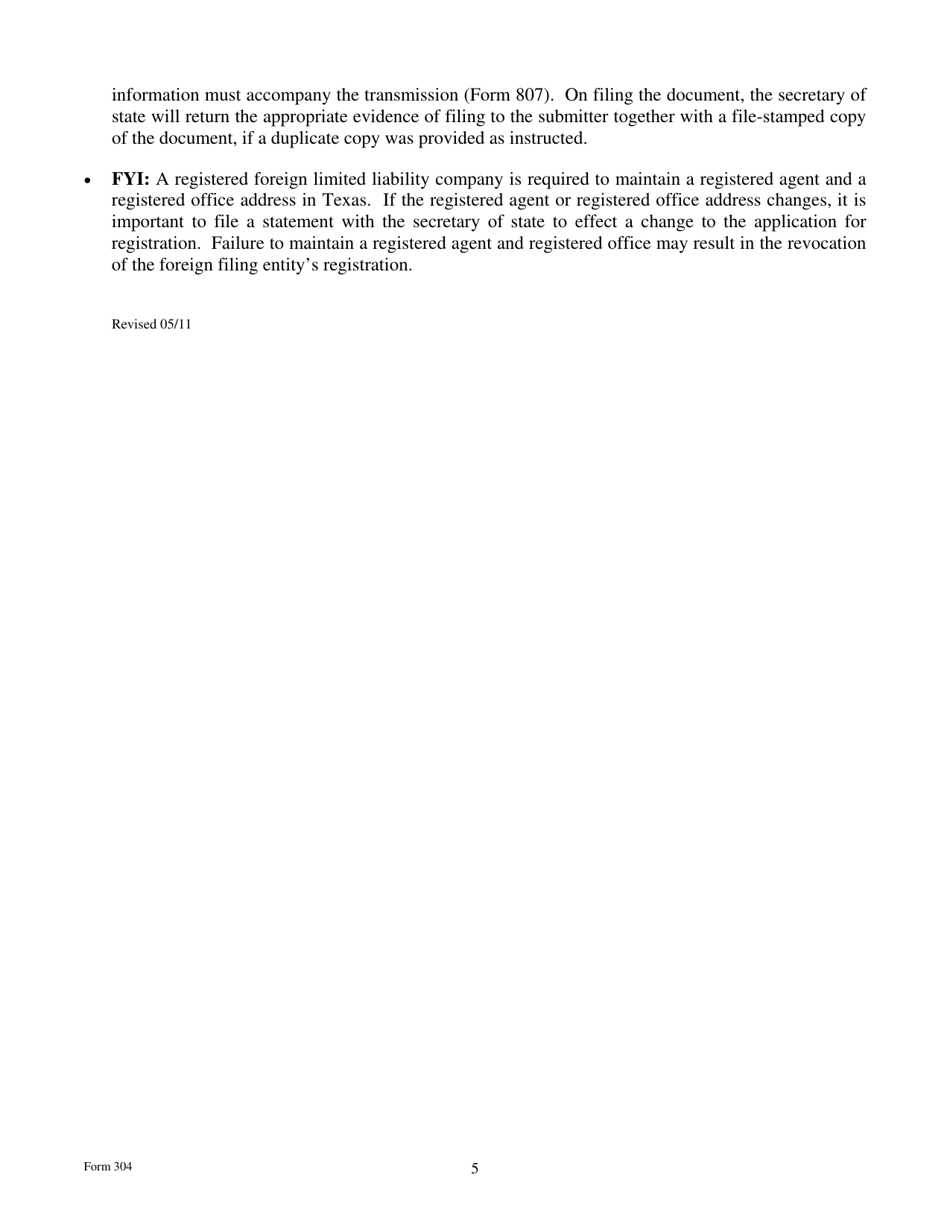

Q: Are there any additional requirements for foreign limited liability companies in Texas?

A: Yes, foreign limited liability companies are required to appoint and maintain a registered agent in Texas and to file an annual report with the Texas Secretary of State.

Q: What happens after Form 304 is filed?

A: After Form 304 is filed and the fee is paid, the foreign limited liability company will be registered to do business in Texas and will receive a Certificate of Authority.

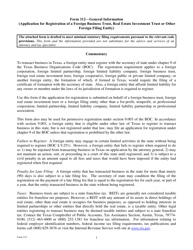

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 304 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.