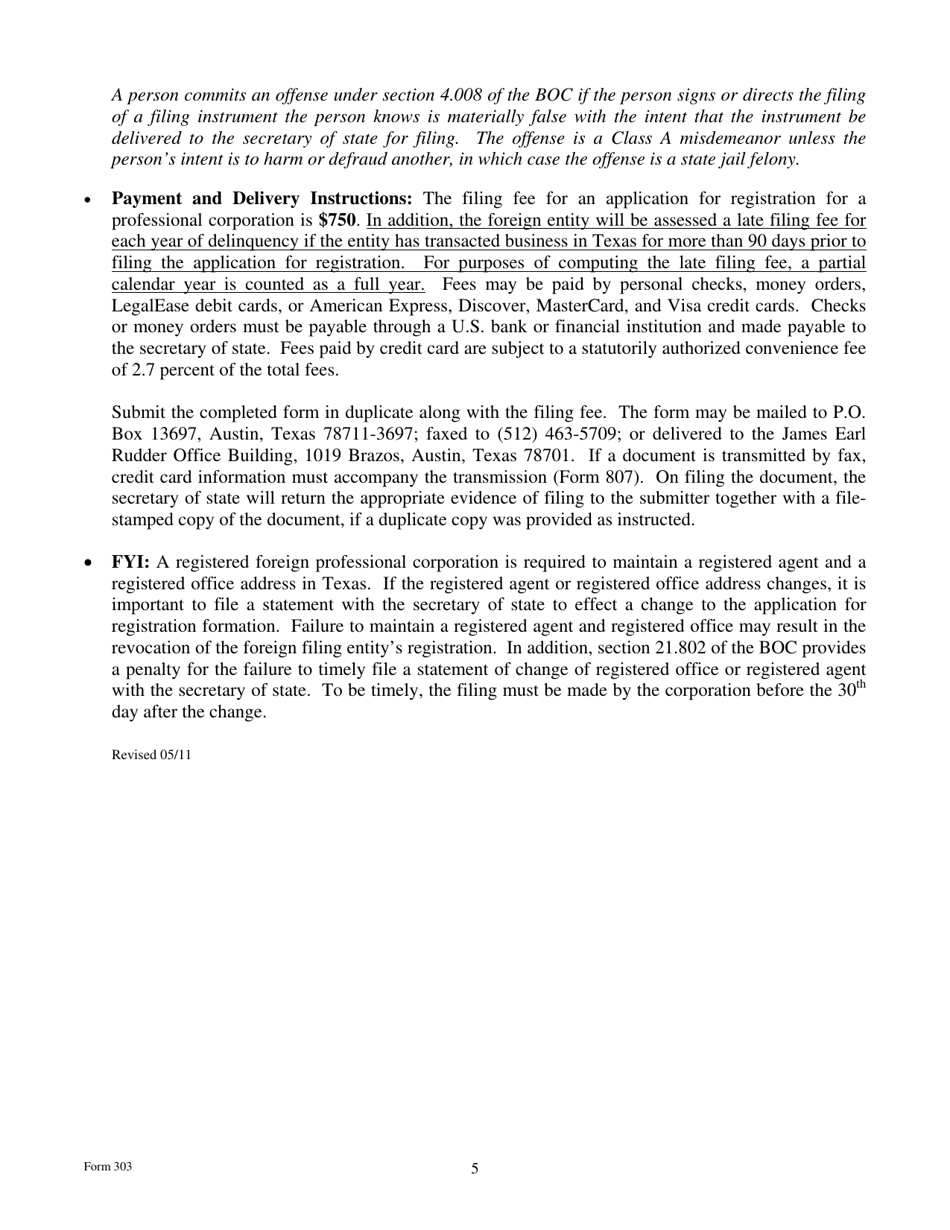

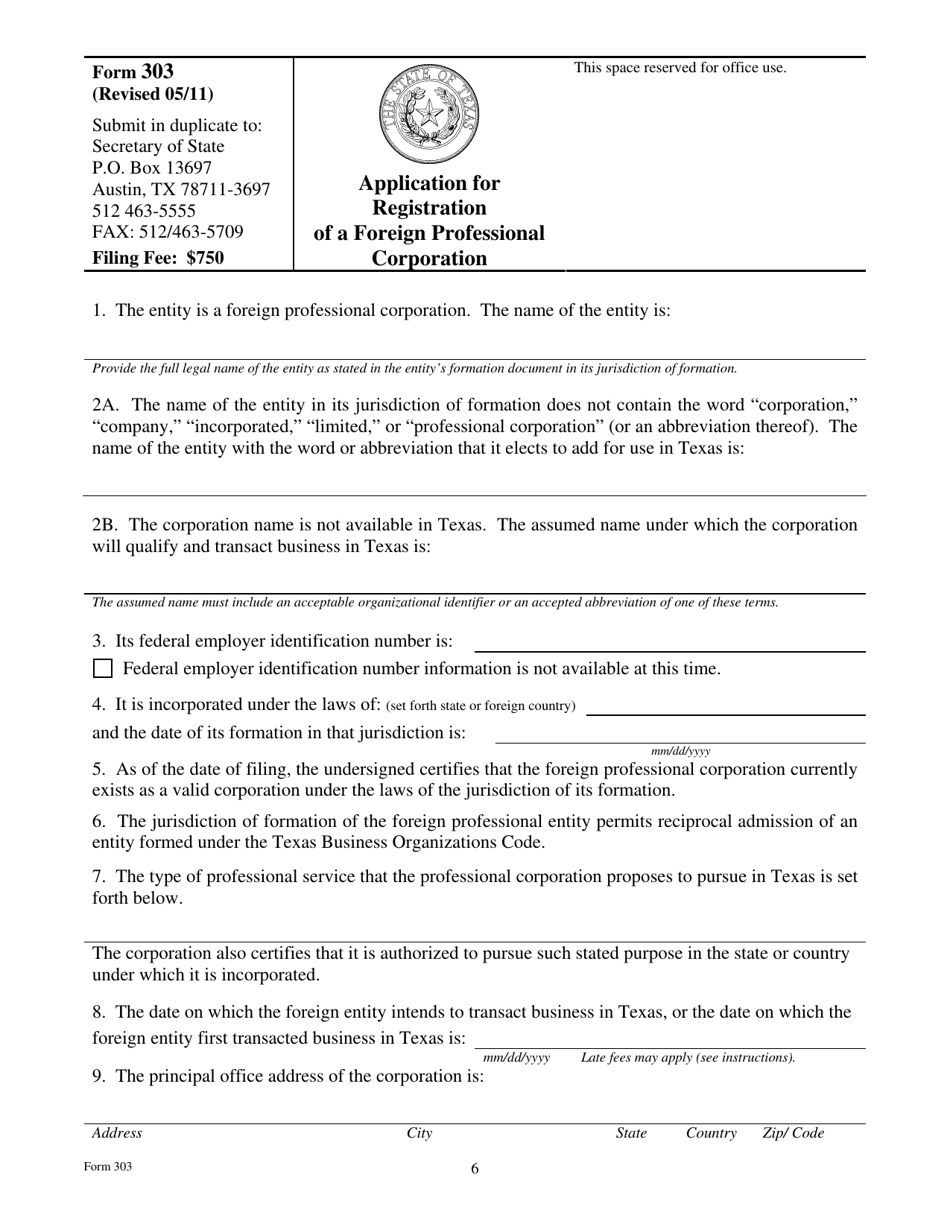

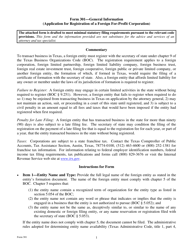

Form 303 Application for Registration for a Foreign Professional Corporation - Texas

What Is Form 303?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 303?

A: Form 303 is an application for registration for a foreign professional corporation in Texas.

Q: Who needs to fill out Form 303?

A: Foreign professional corporations that want to operate in Texas need to fill out Form 303.

Q: What is a foreign professional corporation?

A: A foreign professional corporation is a corporation that was formed in another state or country and wants to do business in Texas.

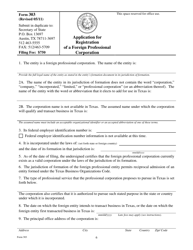

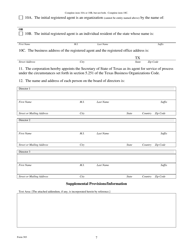

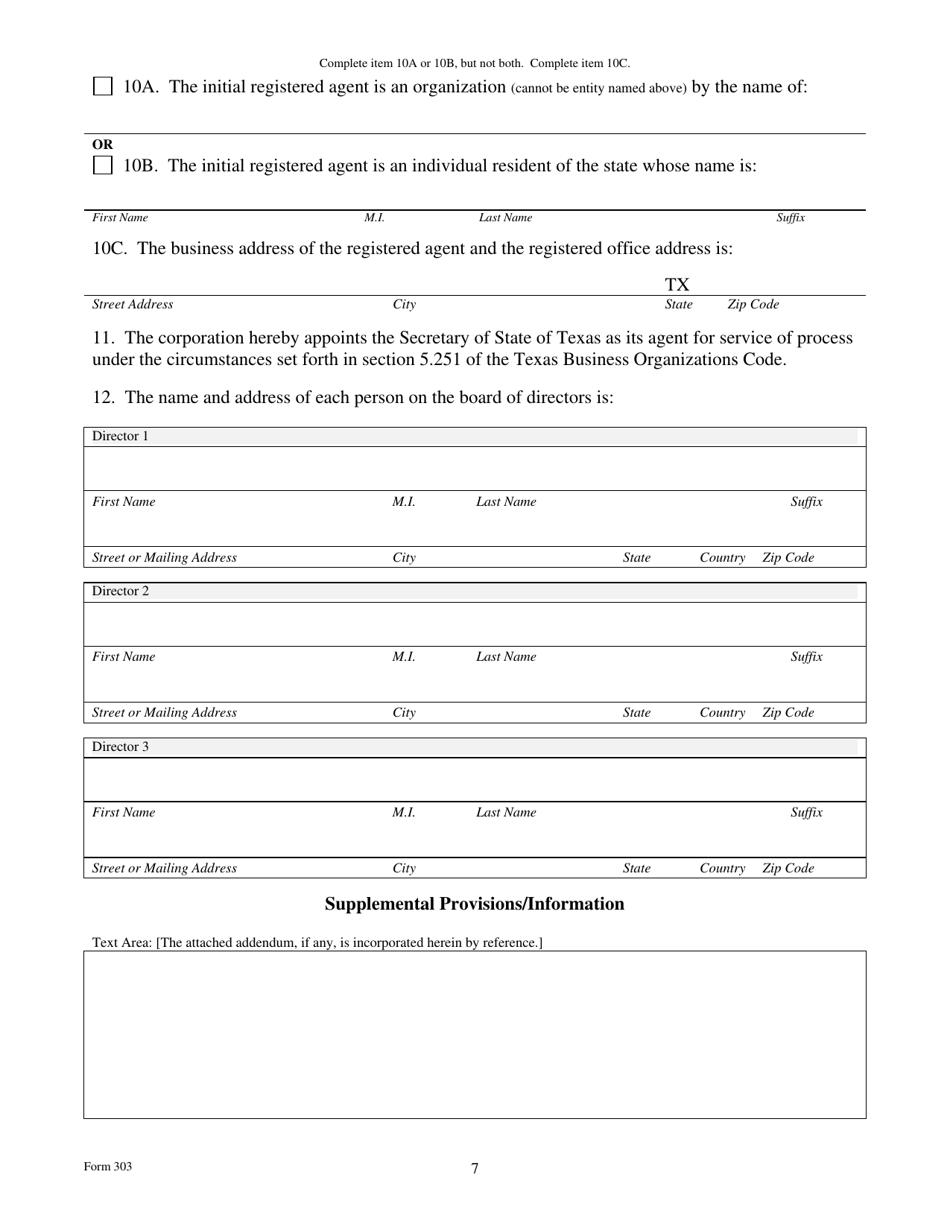

Q: What information is required on Form 303?

A: Form 303 requires information such as the corporation's name, state or country of formation, and the type of professional services it offers.

Q: How do I submit Form 303?

A: Form 303 can be submitted by mail or in person to the Texas Secretary of State's office.

Q: Are there any additional requirements for foreign professional corporations?

A: Yes, foreign professional corporations may need to fulfill additional requirements, such as appointing a registered agent in Texas.

Q: What is the purpose of registering a foreign professional corporation in Texas?

A: Registering a foreign professional corporation in Texas allows the corporation to legally operate and provide professional services in the state.

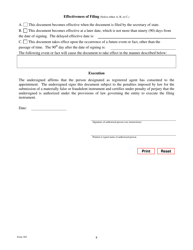

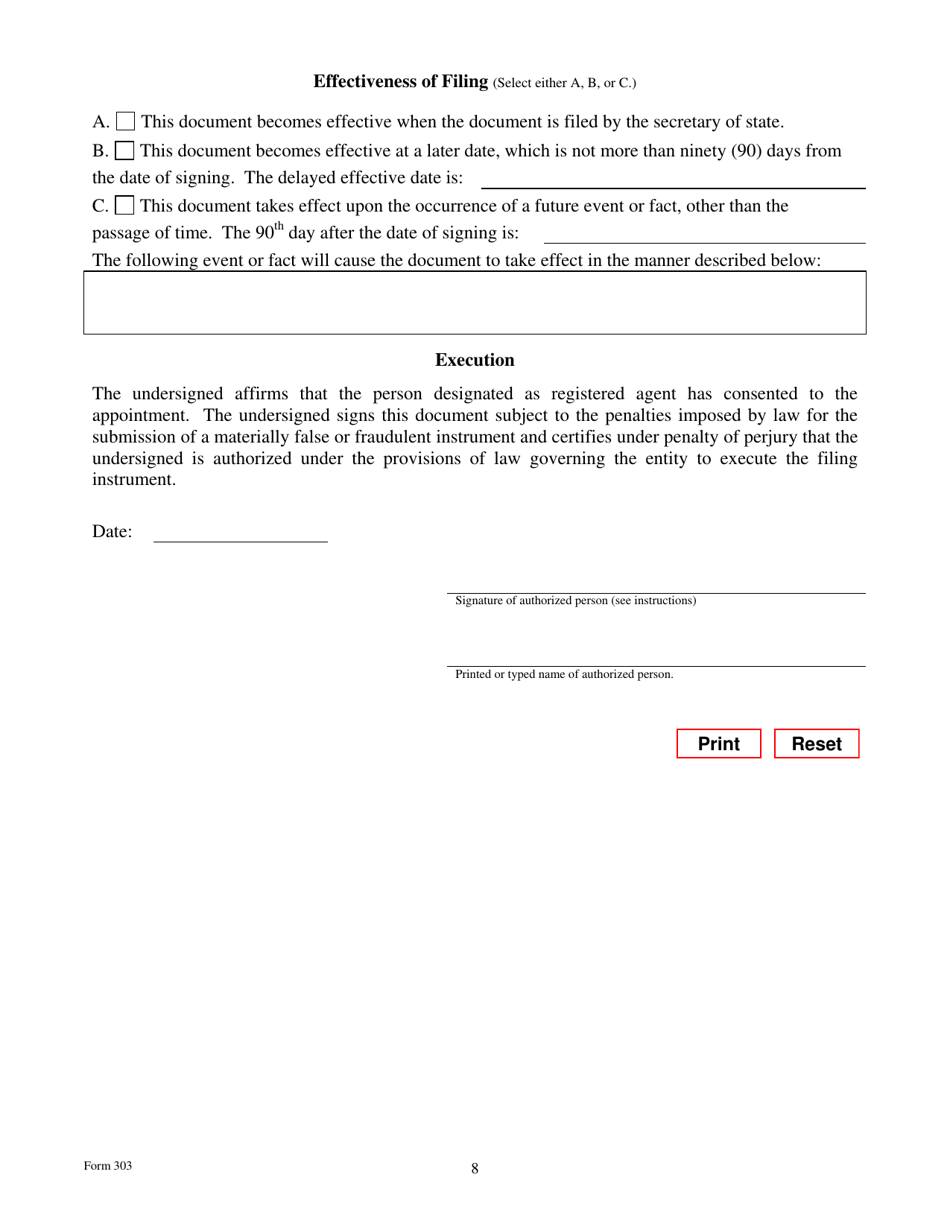

Q: What happens after I submit Form 303?

A: After submitting Form 303, the Texas Secretary of State will review the application and, if approved, issue a certificate of authority to the foreign professional corporation.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 303 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.