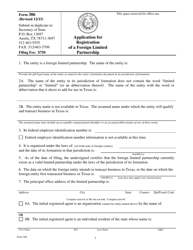

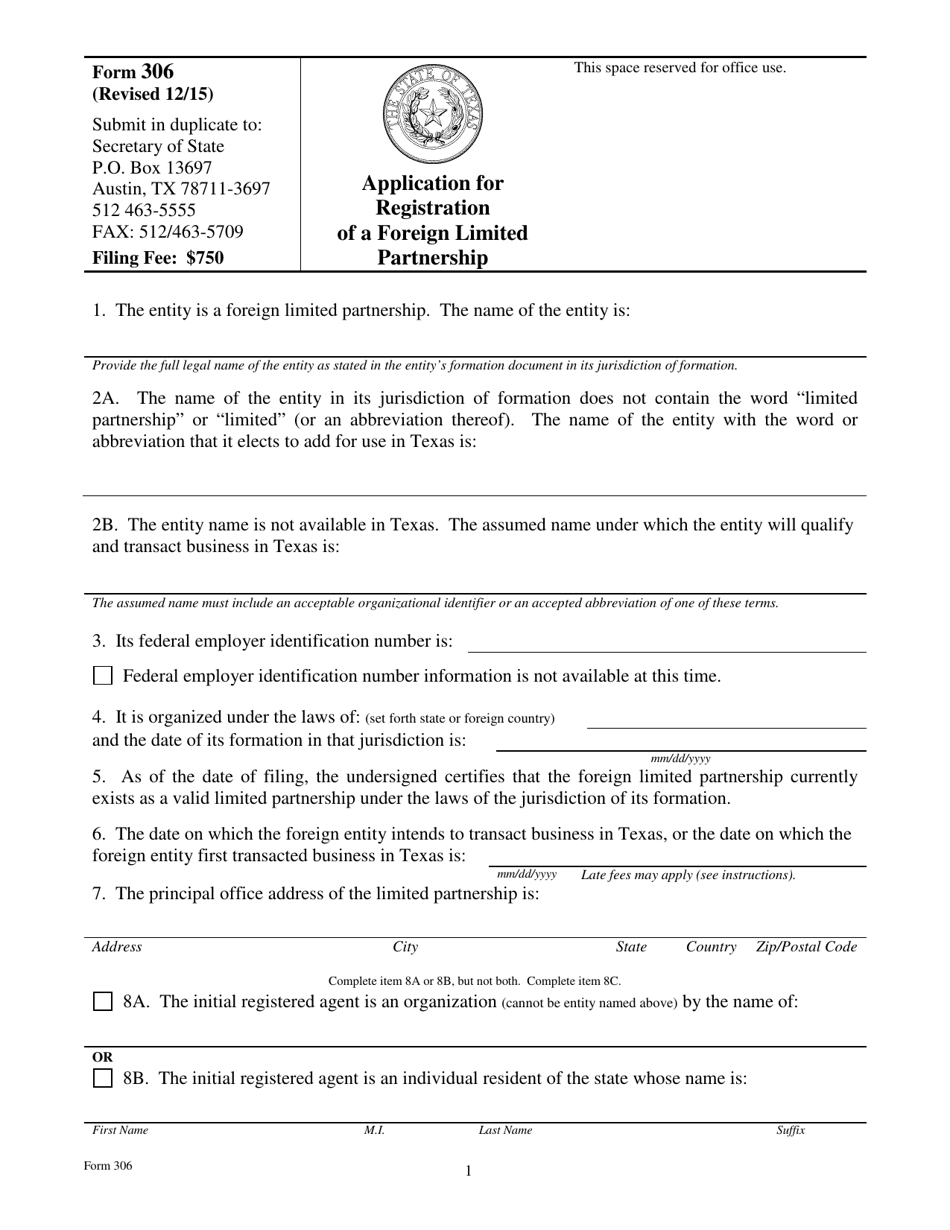

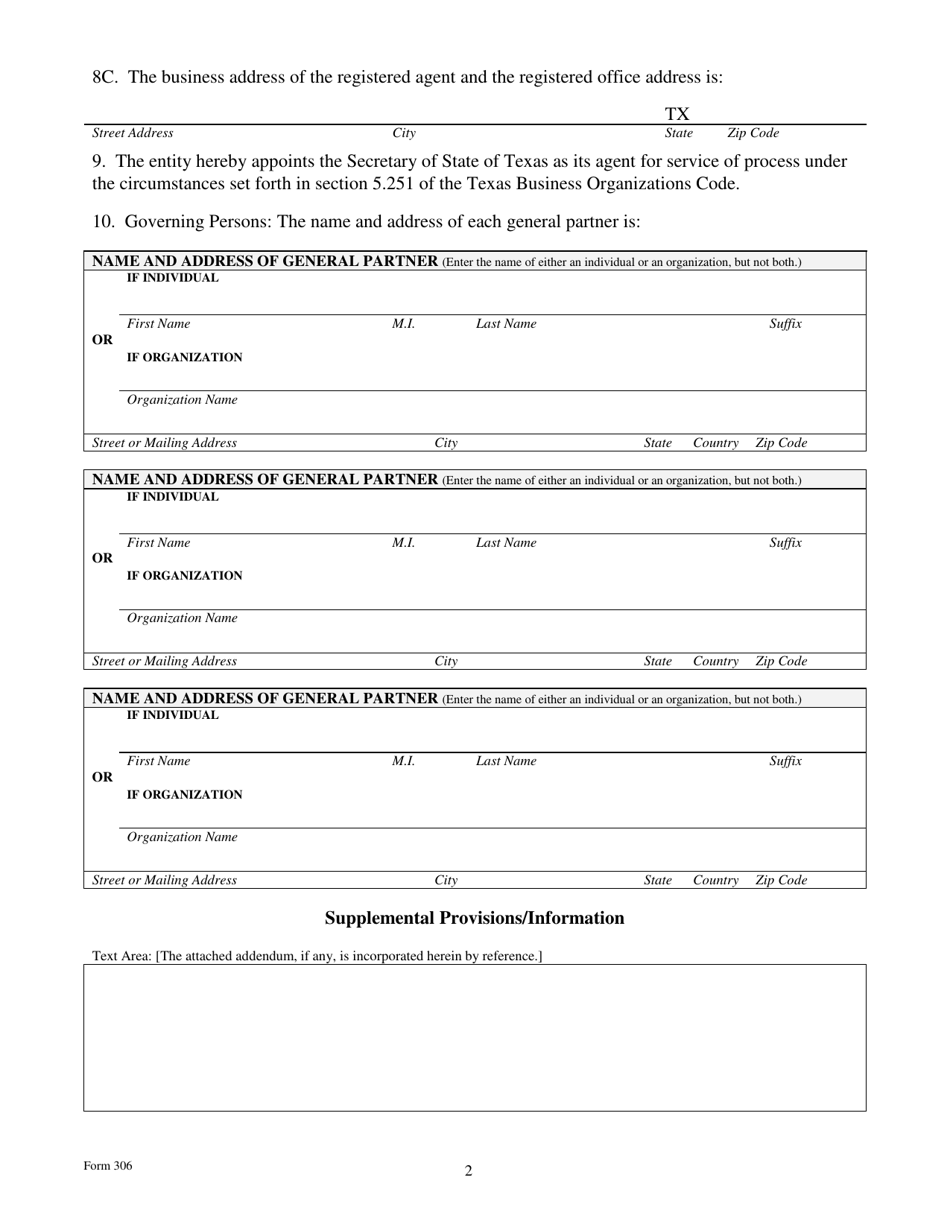

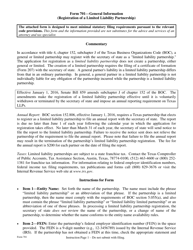

Form 306 Application for Registration of a Foreign Limited Partnership - Texas

What Is Form 306?

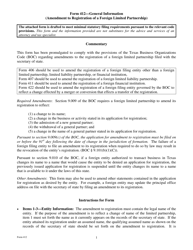

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 306?

A: Form 306 is the Application for Registration of a Foreign Limited Partnership in Texas.

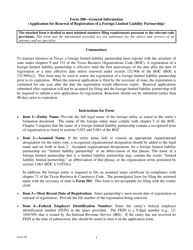

Q: Who should file Form 306?

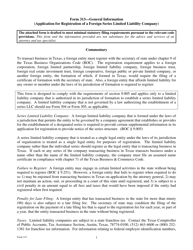

A: This form should be filed by a foreign limited partnership that wishes to do business in Texas.

Q: What is a foreign limited partnership?

A: A foreign limited partnership is a partnership formed in another state or country.

Q: What information is required in Form 306?

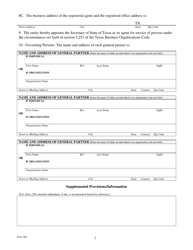

A: Form 306 requires information about the foreign limited partnership, its partners, and its registered agent in Texas.

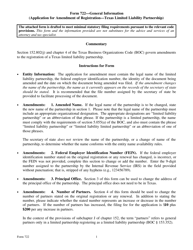

Q: Are there any fees for filing Form 306?

A: Yes, there is a filing fee for Form 306. The fee varies depending on the type of partnership and the number of partners.

Q: Is it necessary to have a registered agent in Texas?

A: Yes, a foreign limited partnership must have a registered agent in Texas to accept legal documents on its behalf.

Q: What happens after Form 306 is approved?

A: After Form 306 is approved, the foreign limited partnership is registered to do business in Texas.

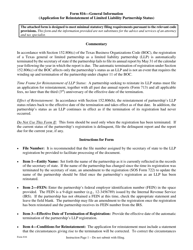

Q: What if there are changes to the information provided in Form 306?

A: If there are changes to the information provided in Form 306, an amended form must be filed with the Texas Secretary of State.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 306 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.