This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5

for the current year.

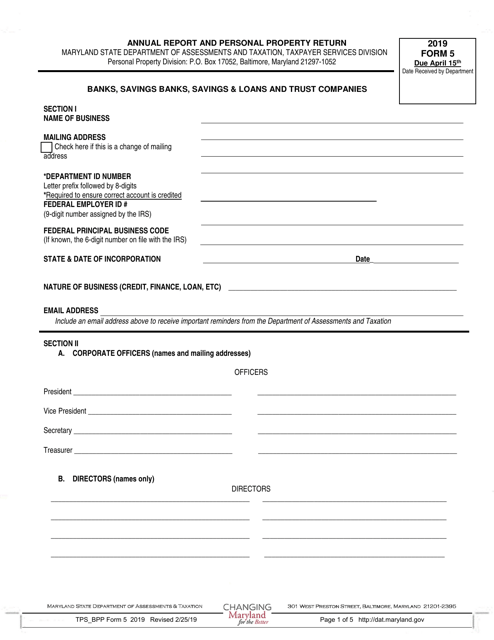

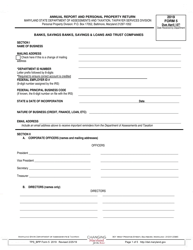

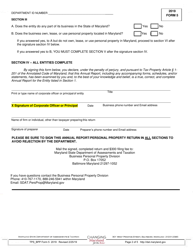

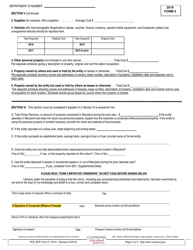

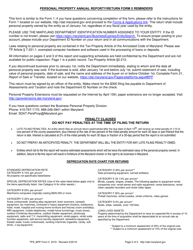

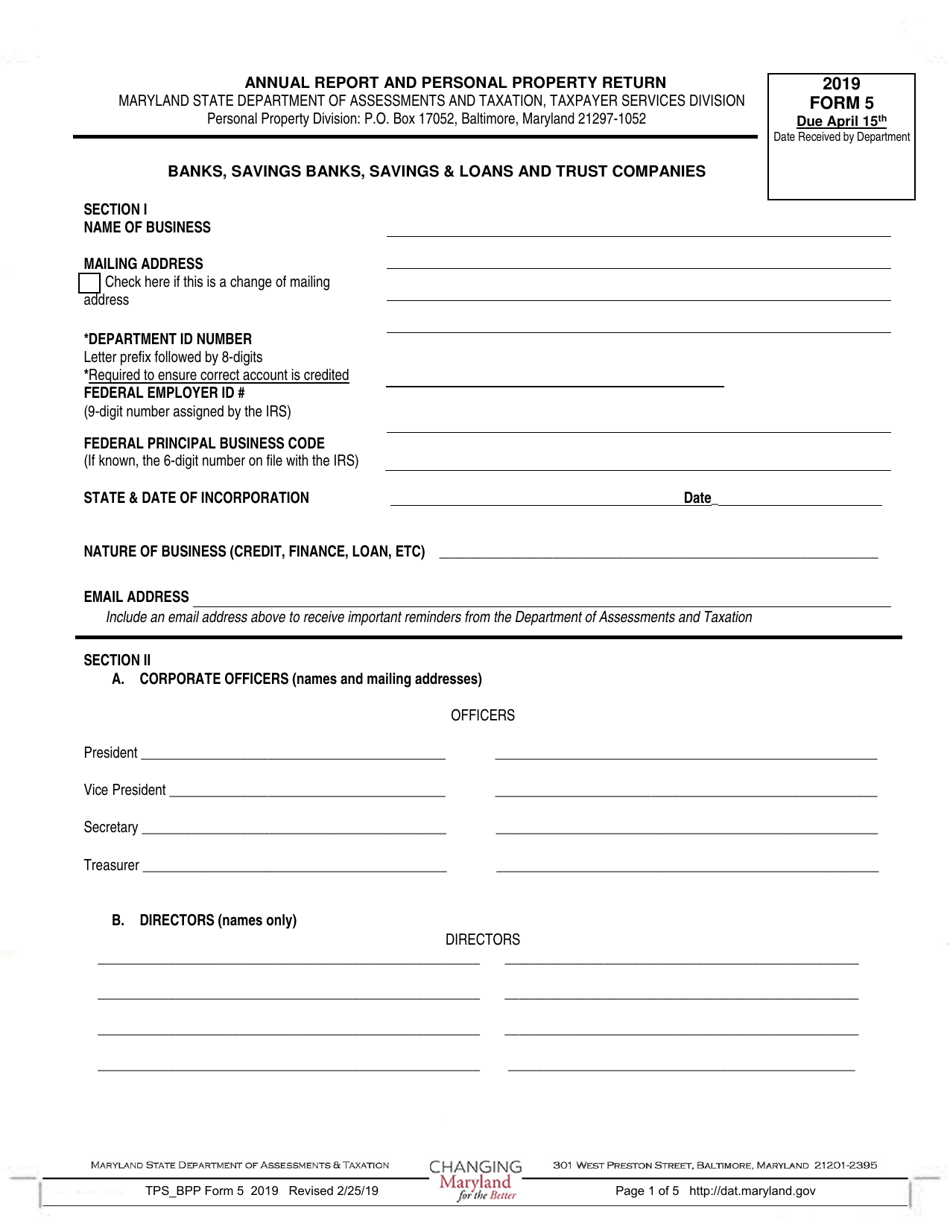

Form 5 Banks, Savings Banks, Savings & Loans and Trust Companies - Annual Report and Personal Property Return - Maryland

What Is Form 5?

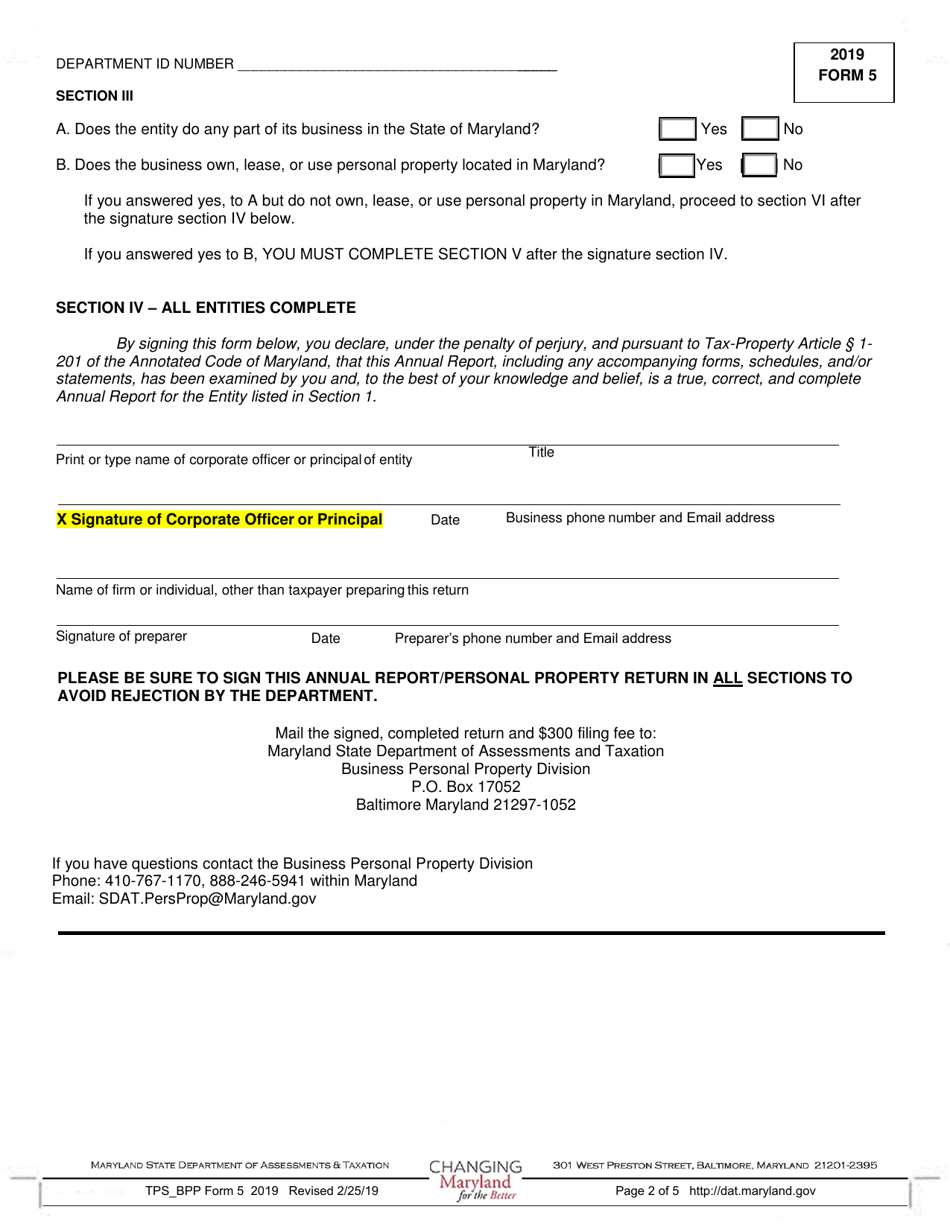

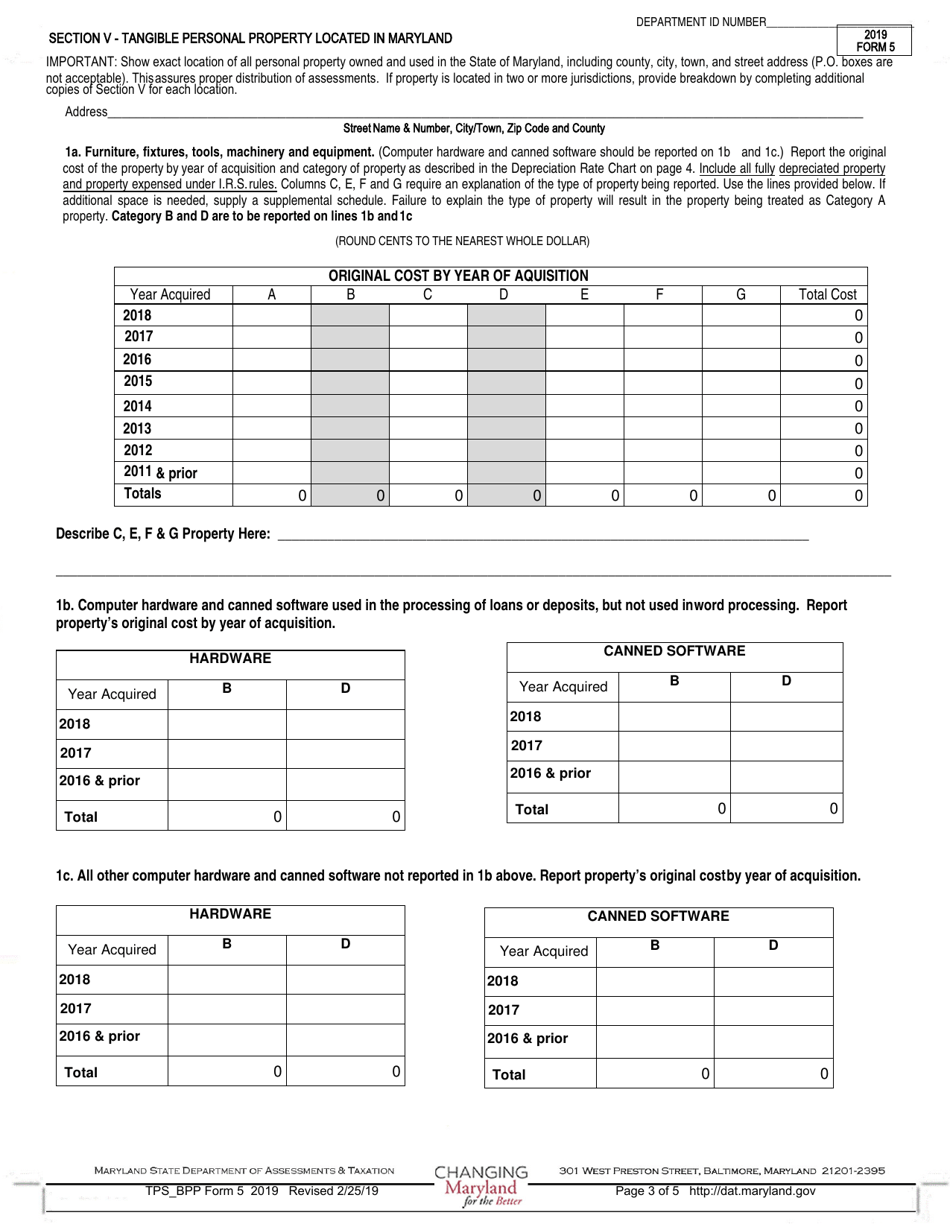

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

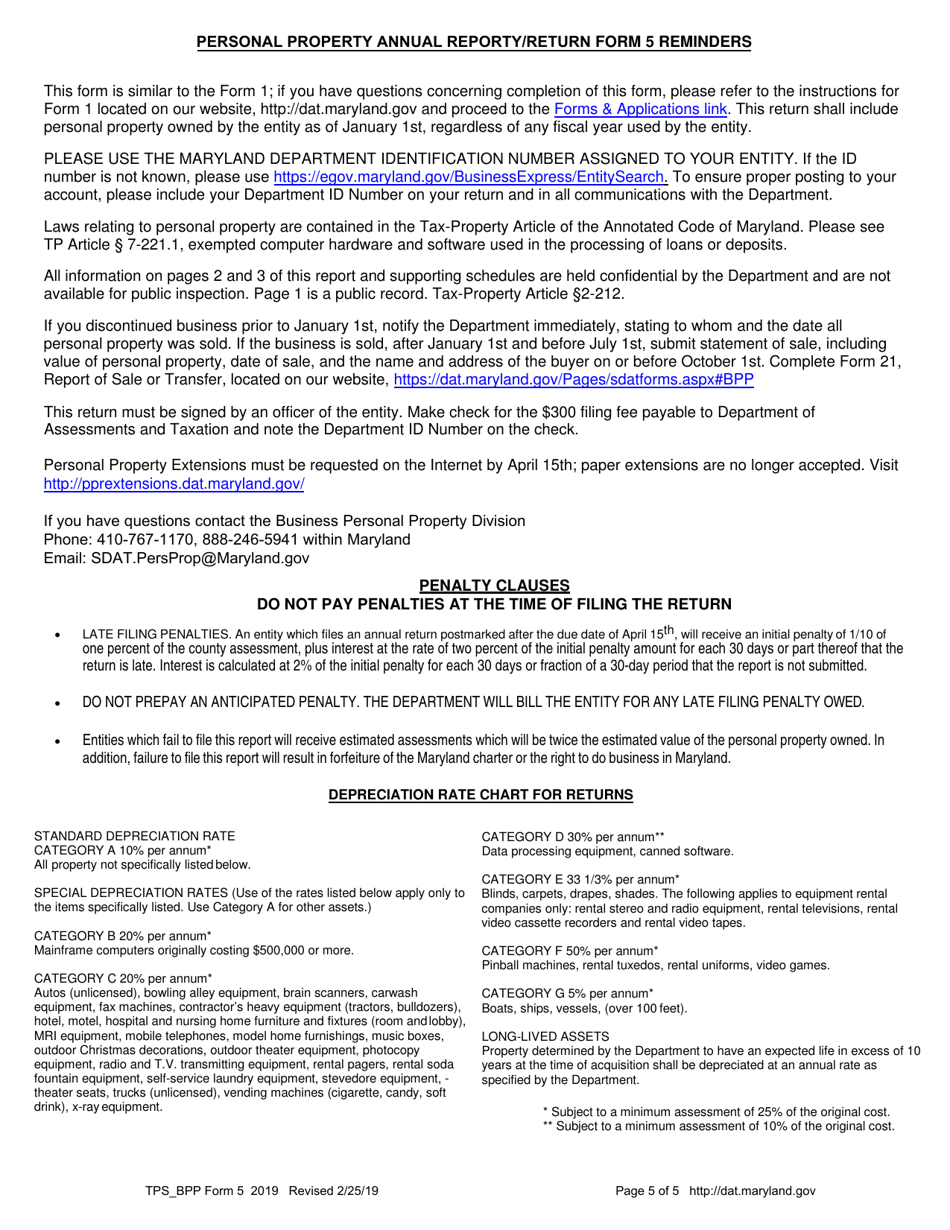

Q: What is the annual report and personal property return?

A: Annual report and personal property return is a document that banks, savings banks, savings & loans, and trust companies in Maryland are required to file each year.

Q: Who needs to file the annual report and personal property return?

A: Banks, savings banks, savings & loans, and trust companies in Maryland need to file the annual report and personal property return.

Q: What information is included in the annual report and personal property return?

A: The annual report and personal property return includes information about the financial health and operations of the bank, savings bank, savings & loans, or trust company.

Q: When is the annual report and personal property return due?

A: The deadline for filing the annual report and personal property return varies, but it is usually due in the early part of the year.

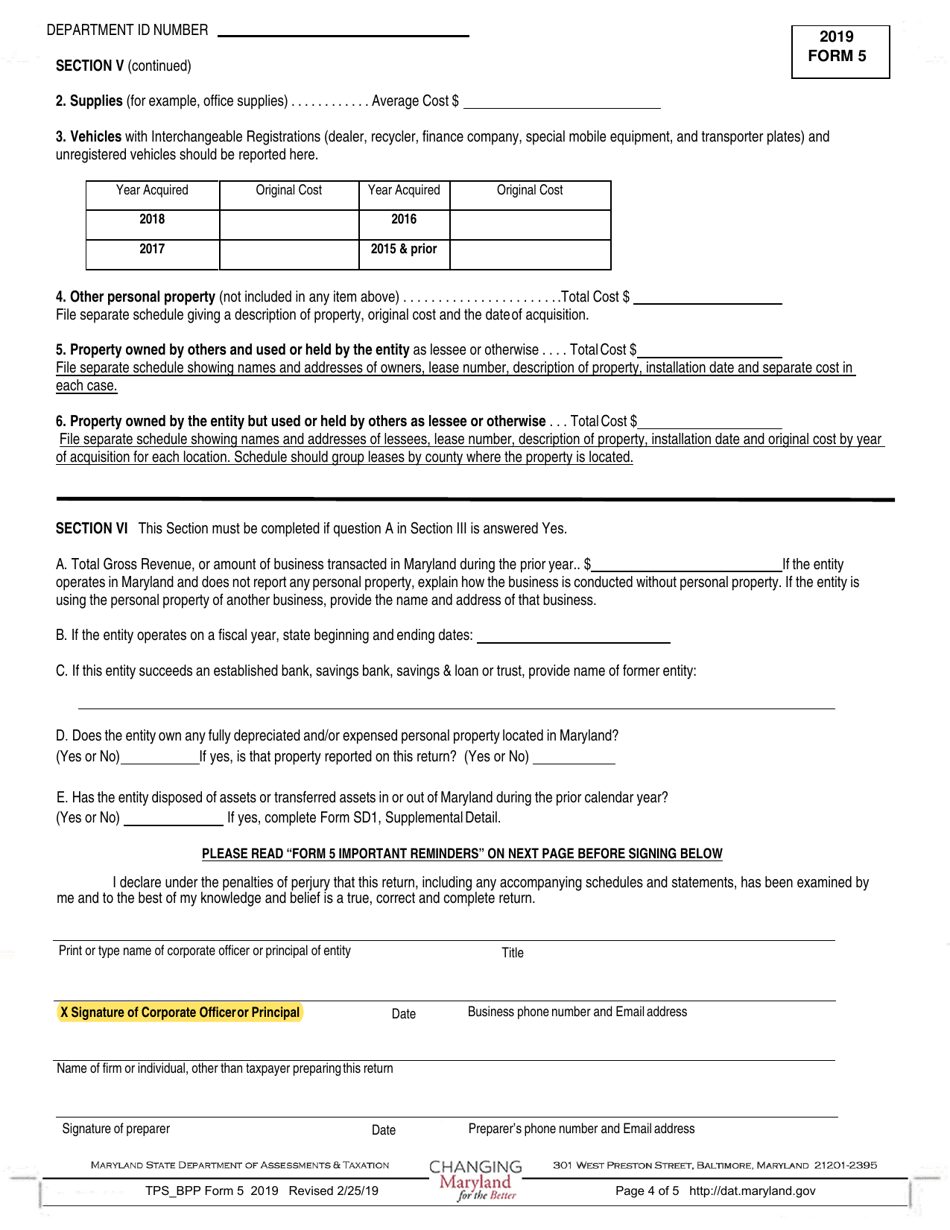

Q: Are there any penalties for not filing the annual report and personal property return?

A: Yes, there are penalties for not filing the annual report and personal property return, including late fees and potential legal consequences.

Form Details:

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.