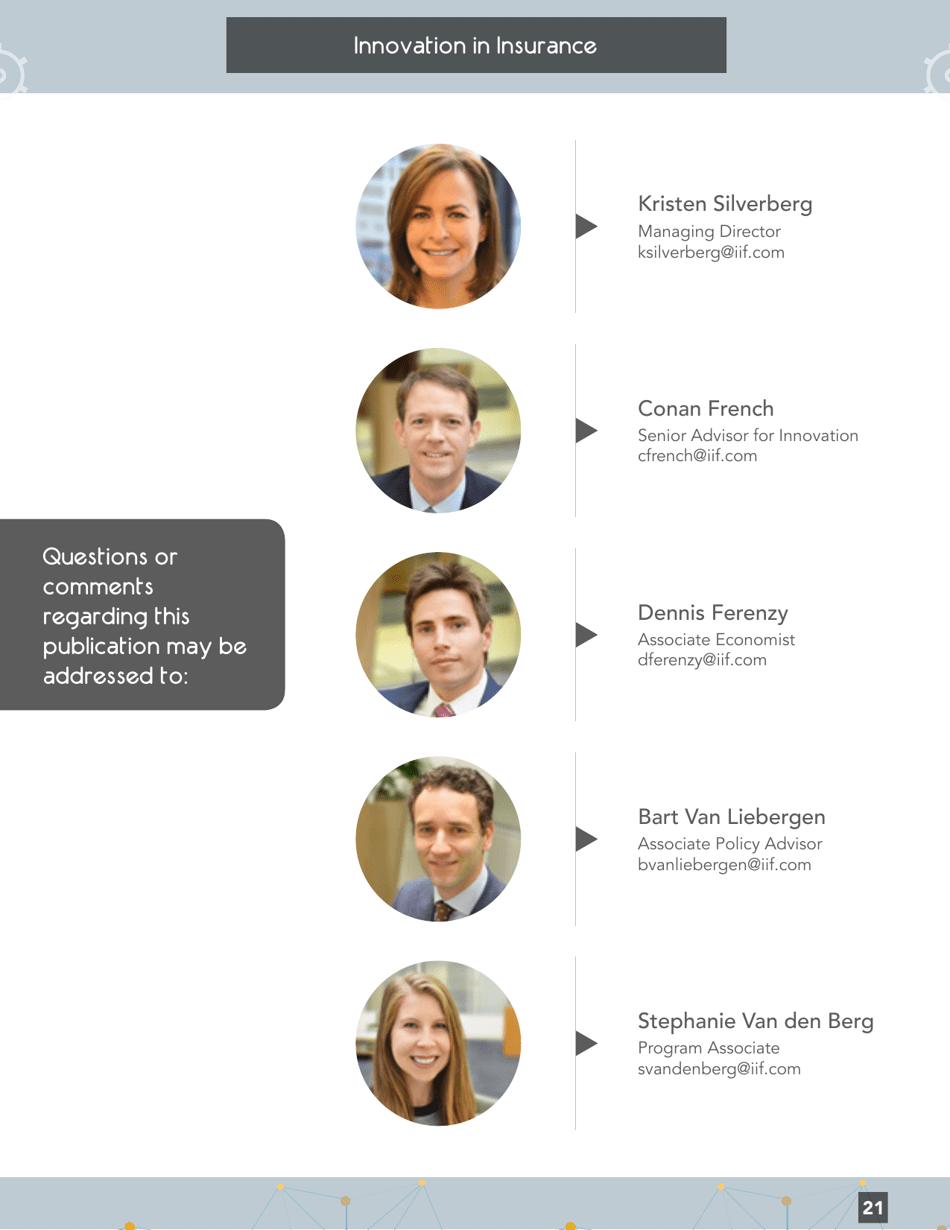

Innovation in Insurance: How Technology Is Changing the Industry - Institute of International Finance

The Institute of International Finance (IIF) provides insights into how technology is changing the insurance industry through their publication titled "Innovation in Insurance: How Technology Is Changing the Industry." This document likely explores the impact of technological advancements on insurance practices and highlights the changes and innovations occurring in the industry.

The Institute of International Finance files the Innovation in Insurance: How Technology Is Changing the Industry.

FAQ

Q: What is the Institute of International Finance?

A: The Institute of International Finance is an association of financial institutions that operates globally.

Q: How is technology impacting the insurance industry?

A: Technology is bringing significant changes to the insurance industry, improving efficiency, customer experience, and risk assessment.

Q: What are some examples of technology in insurance?

A: Examples of technology in insurance include wearable devices, artificial intelligence, and blockchain.

Q: What are the benefits of technology in insurance?

A: Technology in insurance brings benefits such as faster claims processing, personalized policies, and improved fraud detection.

Q: Are there any challenges with technology in insurance?

A: Challenges with technology in insurance include data security concerns, regulatory compliance, and the need for skill training.

Q: What is wearable technology in insurance?

A: Wearable technology in insurance refers to devices like fitness trackers or smartwatches that track and monitor policyholders' health or activities.

Q: What is artificial intelligence in insurance?

A: Artificial intelligence in insurance is the use of advanced algorithms and machine learning to automate processes, analyze data, and make predictions.

Q: What is blockchain in insurance?

A: Blockchain in insurance is a decentralized and transparent digital ledger that enables secure and efficient data sharing and transaction processing.