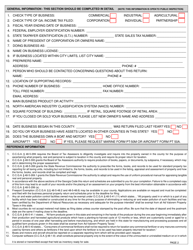

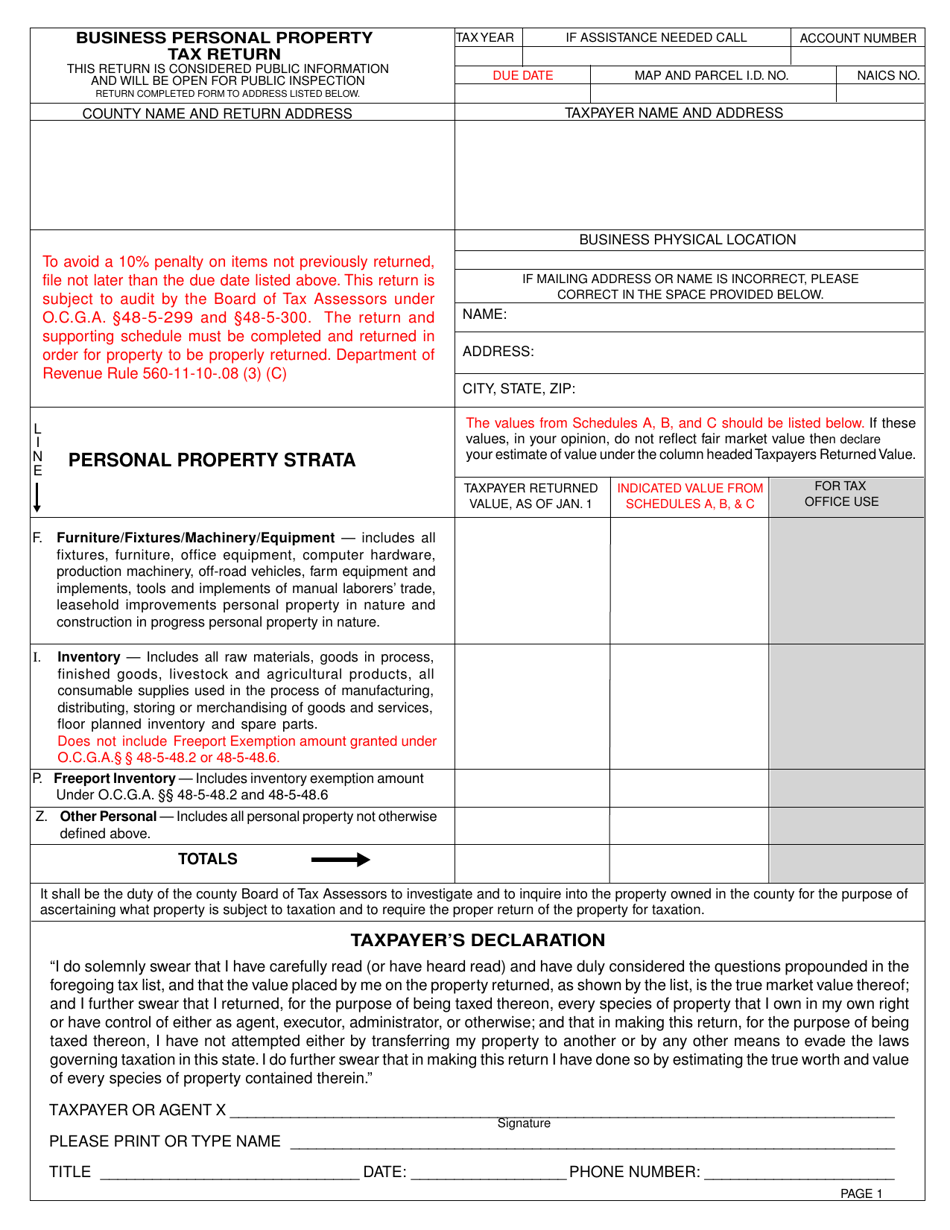

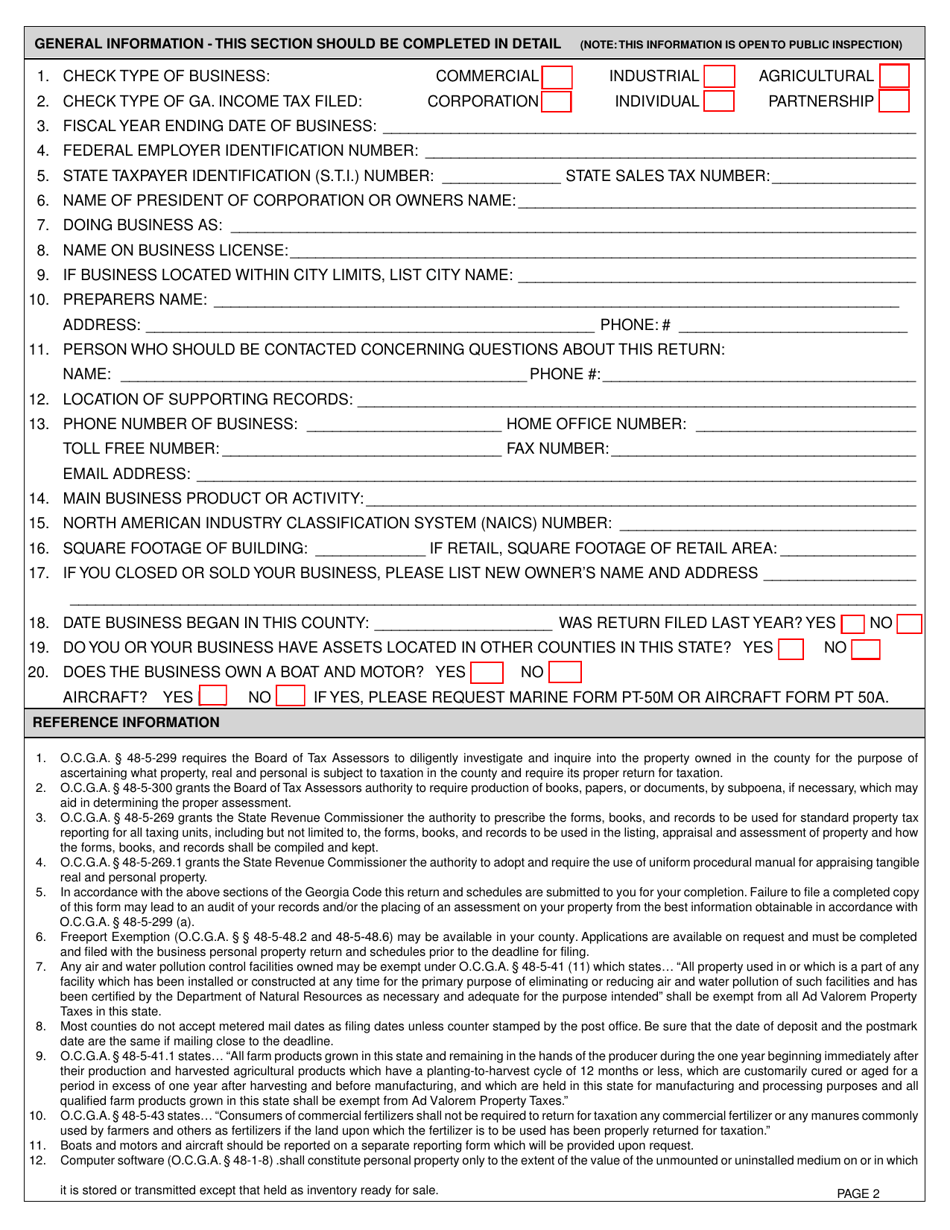

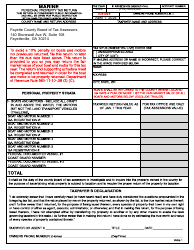

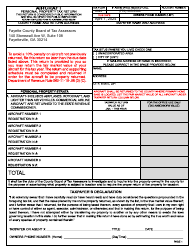

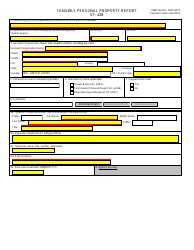

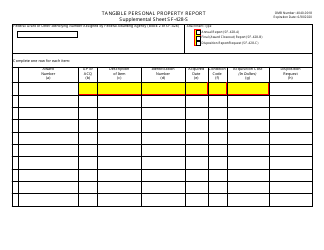

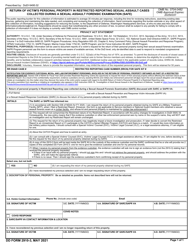

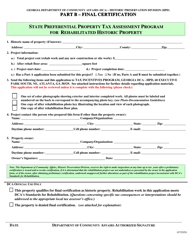

Form PT-50P Tangible Personal Property Tax Return and Schedules - Georgia (United States)

What Is Form PT-50P?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-50P?

A: Form PT-50P is the Tangible Personal Property Tax Return and Schedules used in Georgia, United States.

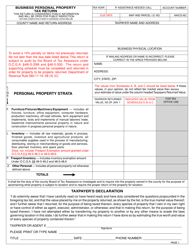

Q: Who needs to file Form PT-50P?

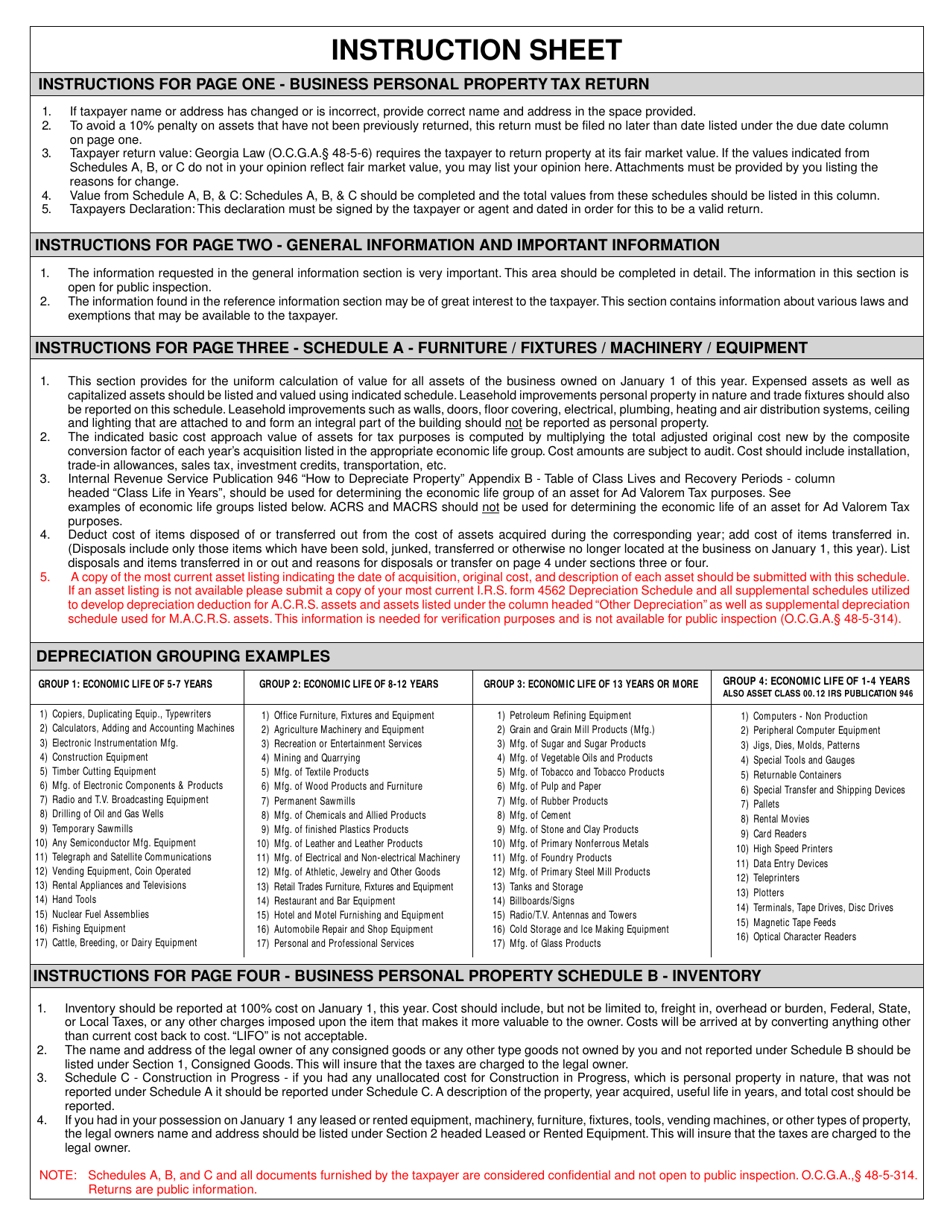

A: Anyone who owns tangible personal property in Georgia and meets the filing requirements must file Form PT-50P.

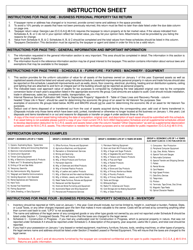

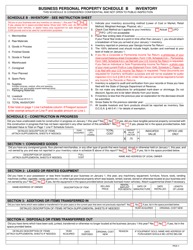

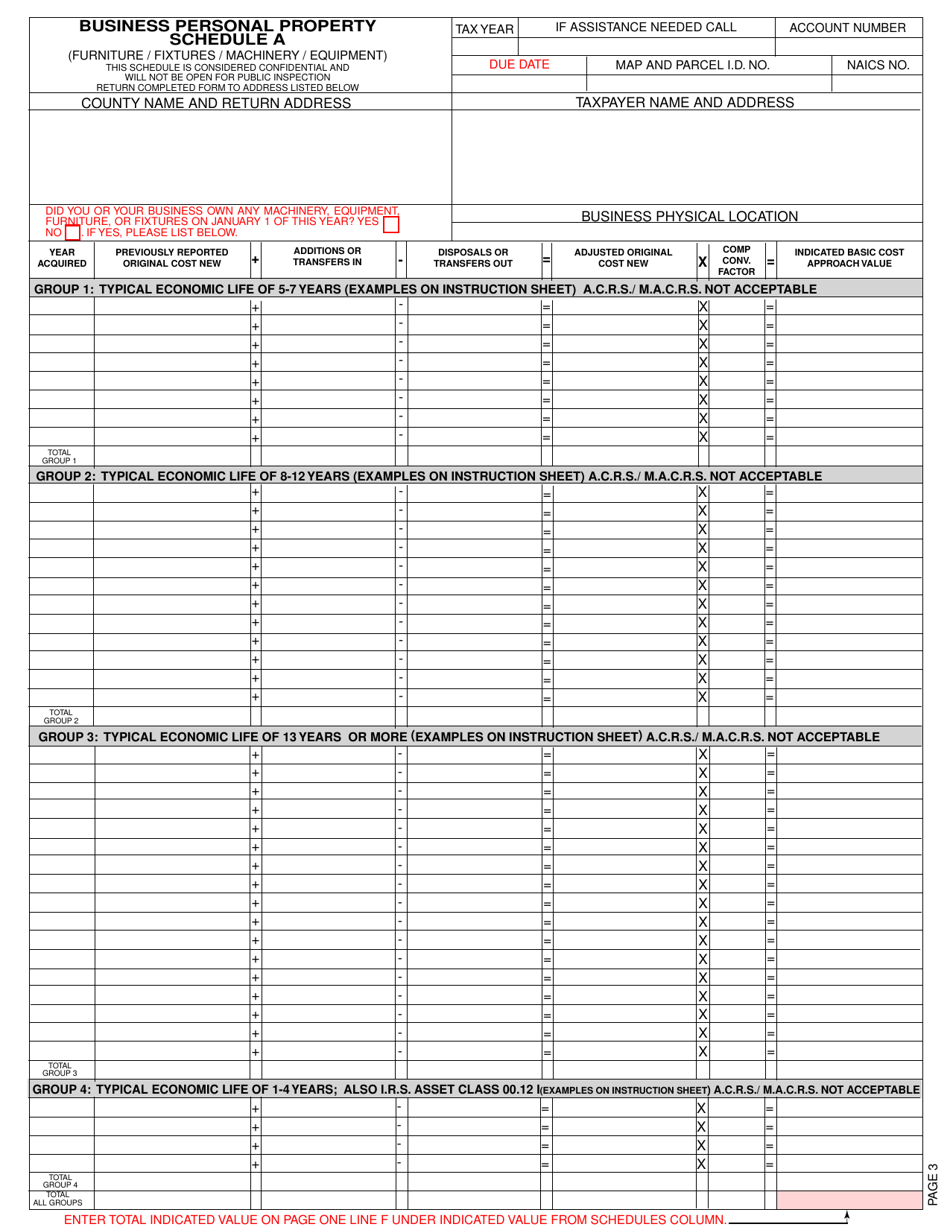

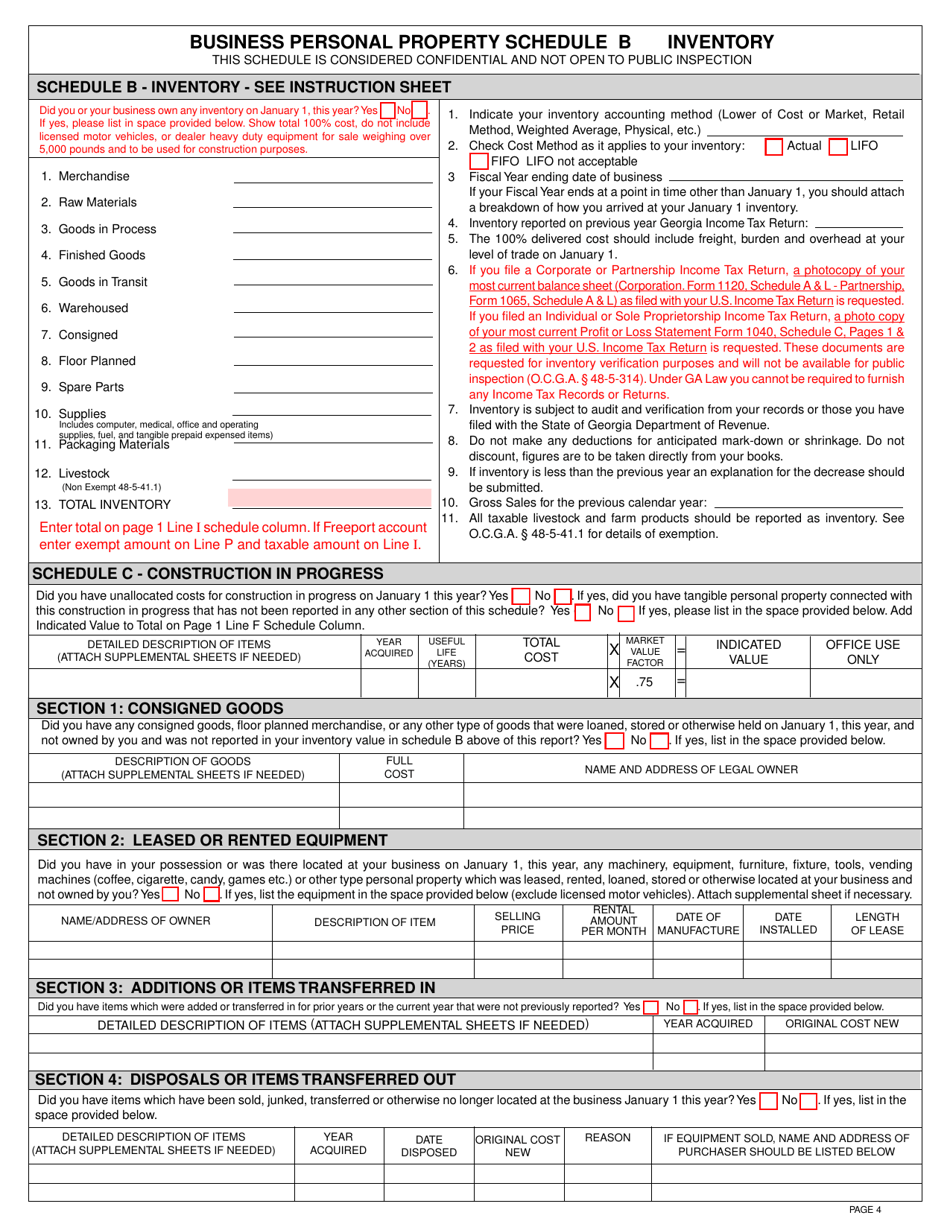

Q: What is tangible personal property?

A: Tangible personal property includes items such as furniture, equipment, and machinery that are used for business purposes.

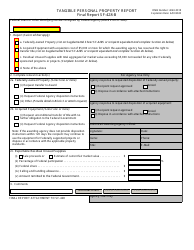

Q: What are the filing requirements for Form PT-50P?

A: You must file Form PT-50P if the total value of your tangible personal property exceeds $7,500.

Q: When is the deadline for filing Form PT-50P?

A: Form PT-50P must be filed by April 1st of each year.

Q: Are there any penalties for not filing Form PT-50P?

A: Yes, if you fail to file Form PT-50P by the deadline, you may be subject to penalties and interest.

Form Details:

- Released on January 18, 2017;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT-50P by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.