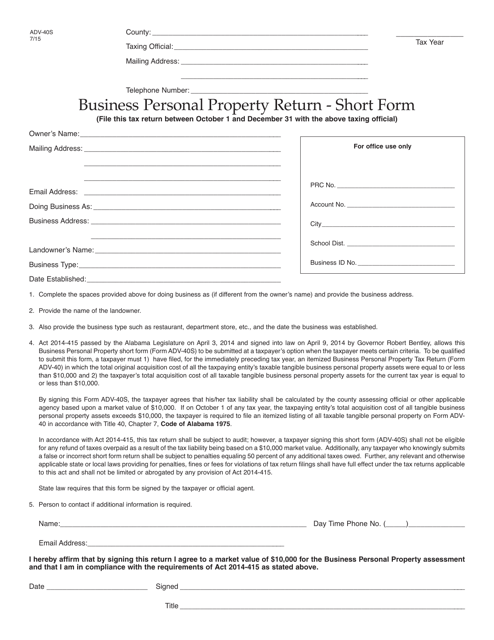

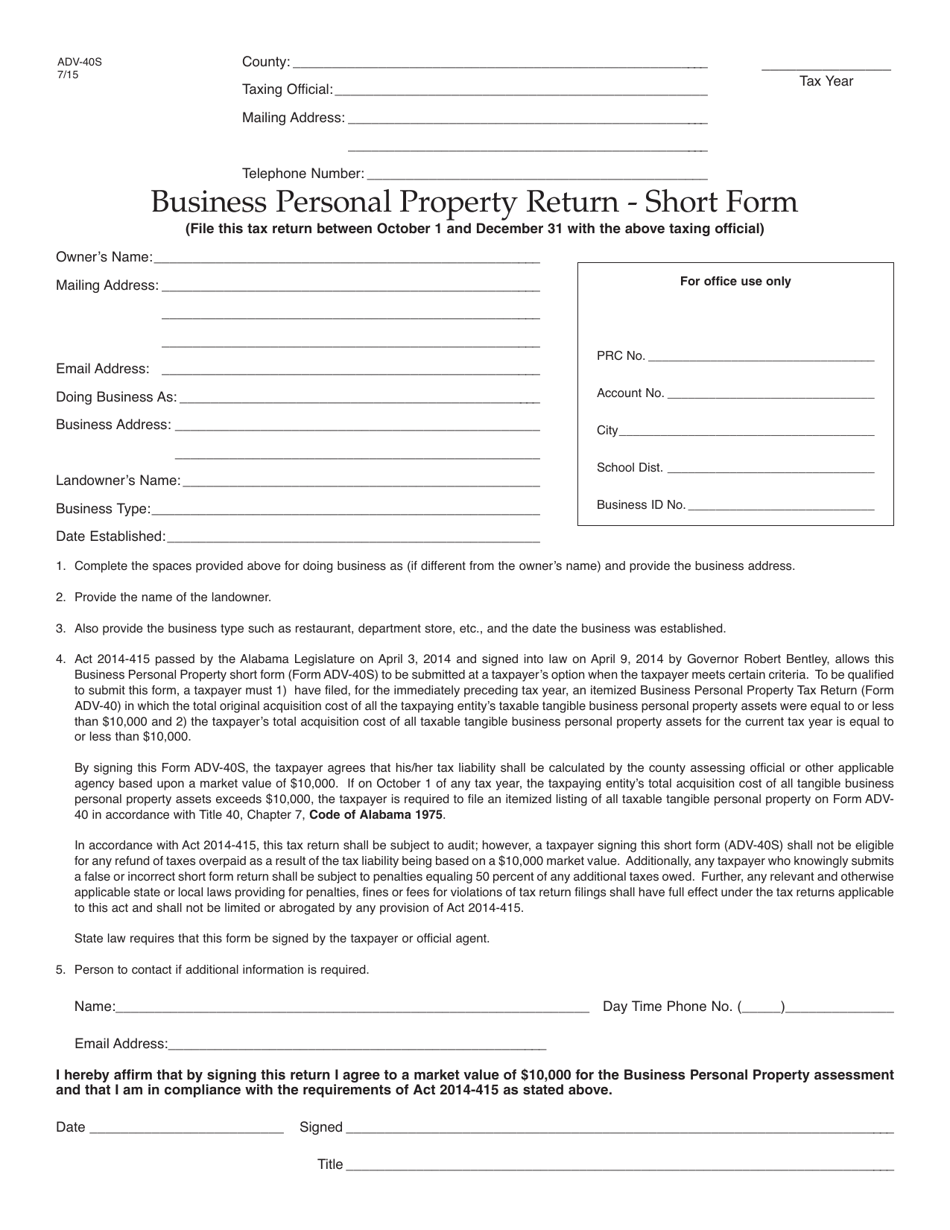

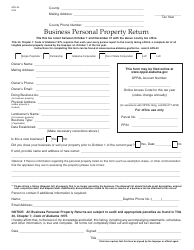

Form ADV-40S Business Personal Property Return - Short Form - Alabama

What Is Form ADV-40S?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADV-40S?

A: Form ADV-40S is the Business Personal Property Return - Short Form used in Alabama.

Q: Who needs to file Form ADV-40S?

A: Any business or individual owning taxable personal property with a total cost of $10,000 or less in Alabama must file Form ADV-40S.

Q: What is considered taxable personal property?

A: Taxable personal property includes furniture, fixtures, machinery, equipment, supplies, and inventory owned by a business or individual.

Q: What is the deadline for filing Form ADV-40S?

A: Form ADV-40S must be filed by December 31st of each year.

Q: Are there any penalties for not filing Form ADV-40S?

A: Yes, failure to file Form ADV-40S may result in penalties and interest.

Q: Is there any exemption for filing Form ADV-40S?

A: There is an exemption for businesses that qualify for the Small Business Exemption, which exempts them from filing Form ADV-40S if their total cost of taxable personal property is $10,000 or less.

Q: Is there a fee for filing Form ADV-40S?

A: No, there is no fee for filing Form ADV-40S.

Q: Do I need to file Form ADV-40S every year?

A: Yes, Form ADV-40S must be filed annually as long as you own taxable personal property in Alabama.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADV-40S by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.