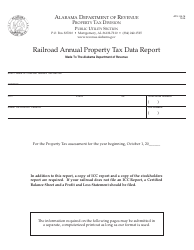

This version of the form is not currently in use and is provided for reference only. Download this version of

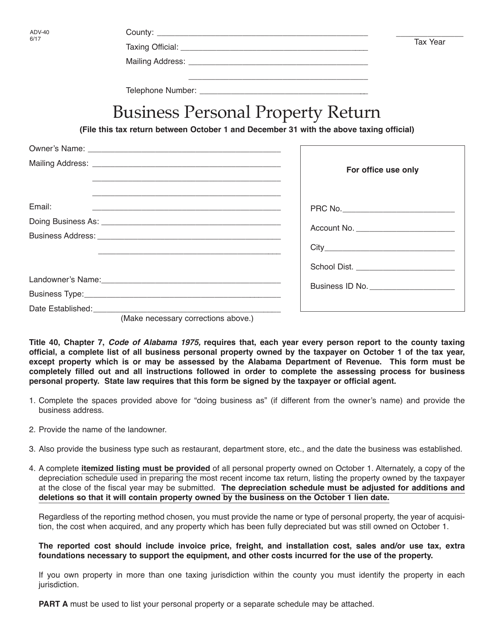

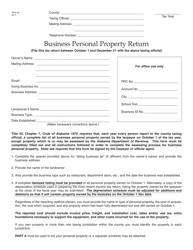

Form ADV-40

for the current year.

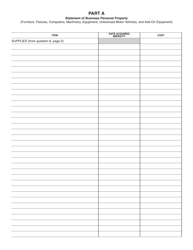

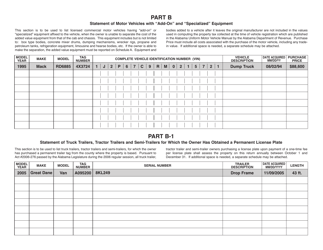

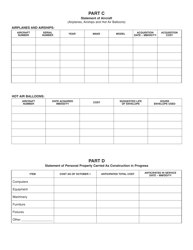

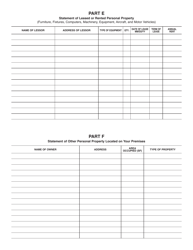

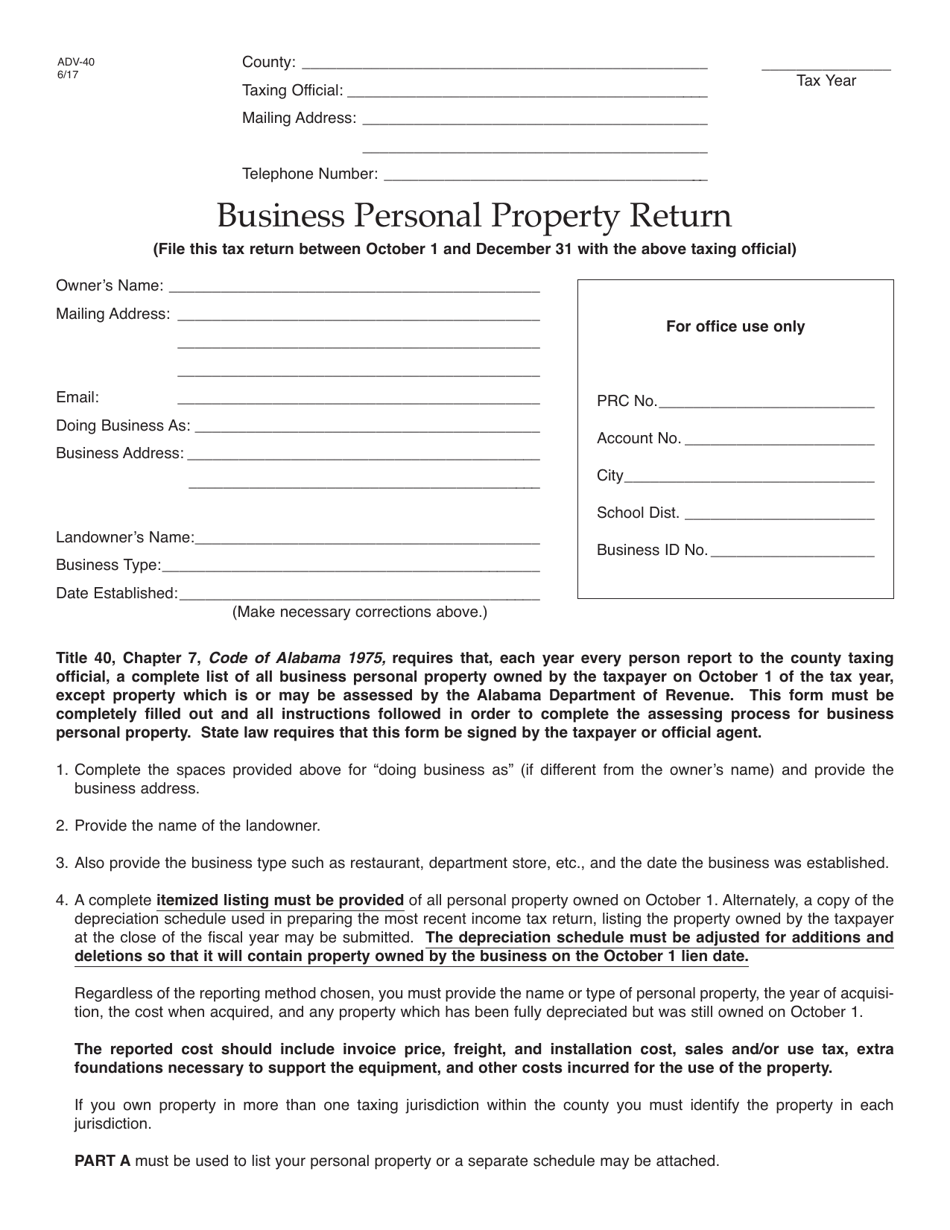

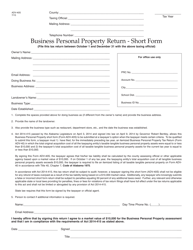

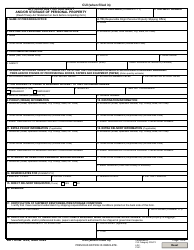

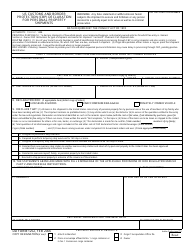

Form ADV-40 Business Personal Property Return - Alabama

What Is Form ADV-40?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADV-40?

A: Form ADV-40 is the Business Personal Property Return in Alabama.

Q: Who needs to file Form ADV-40?

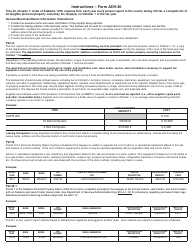

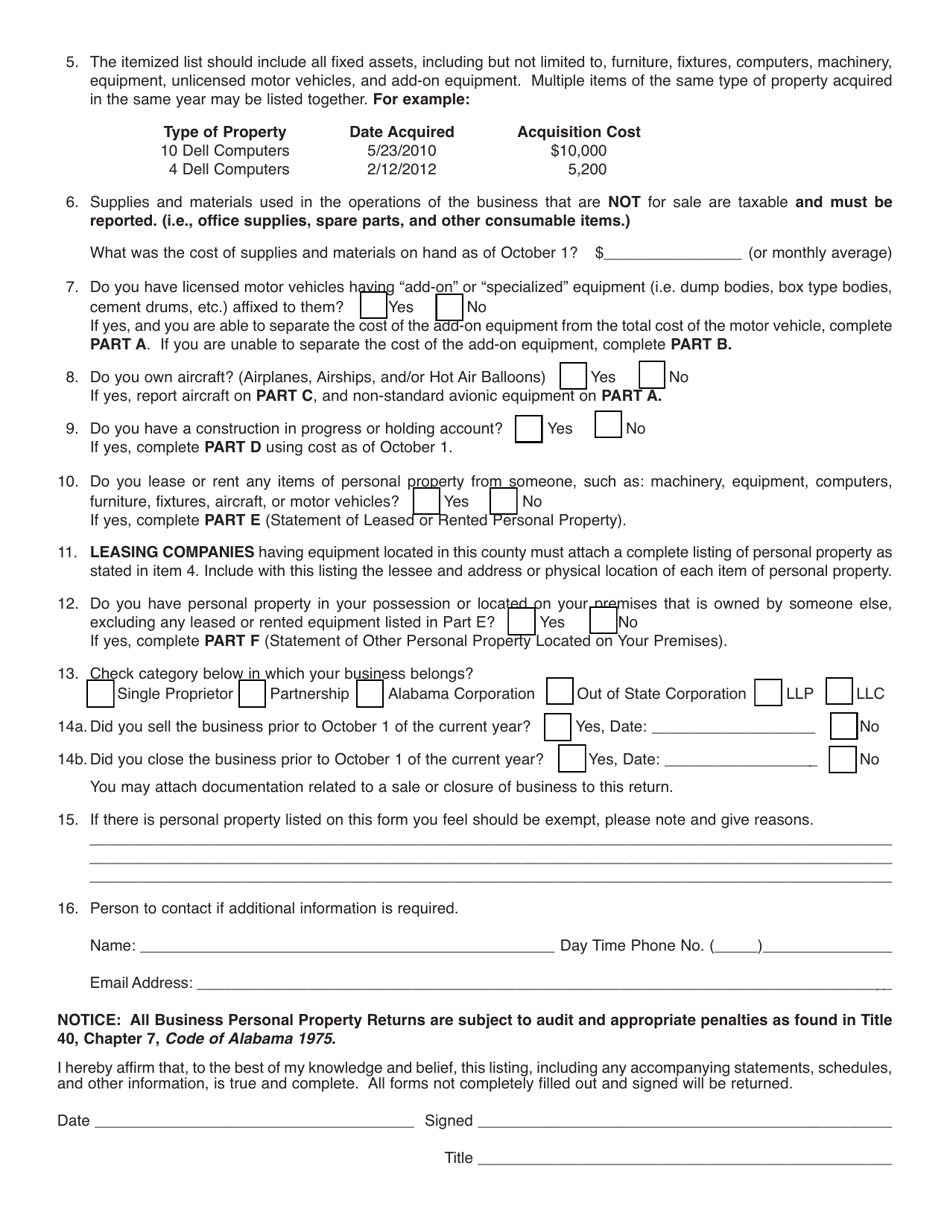

A: All businesses in Alabama that own personal property used for business purposes must file Form ADV-40.

Q: What is personal property?

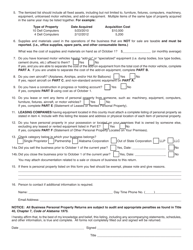

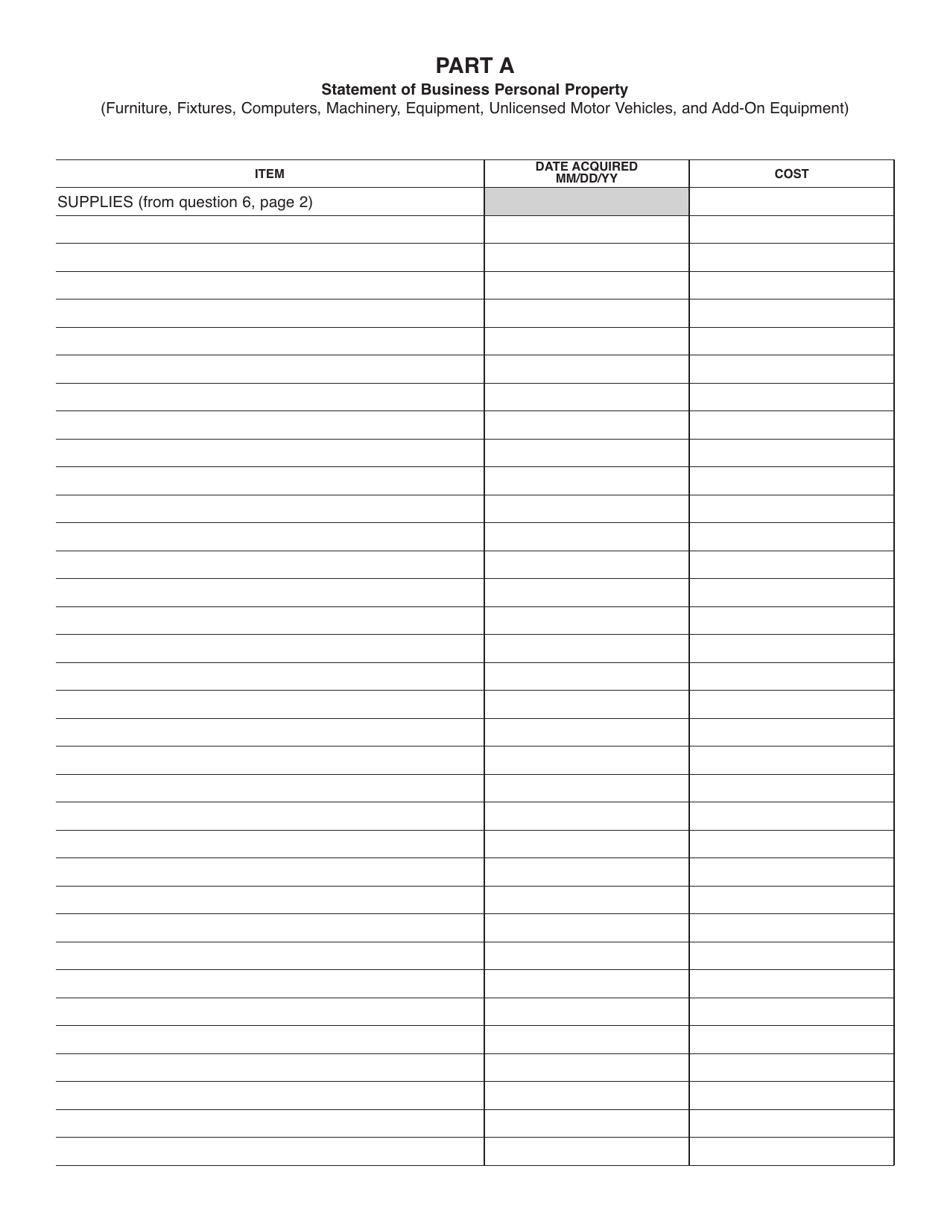

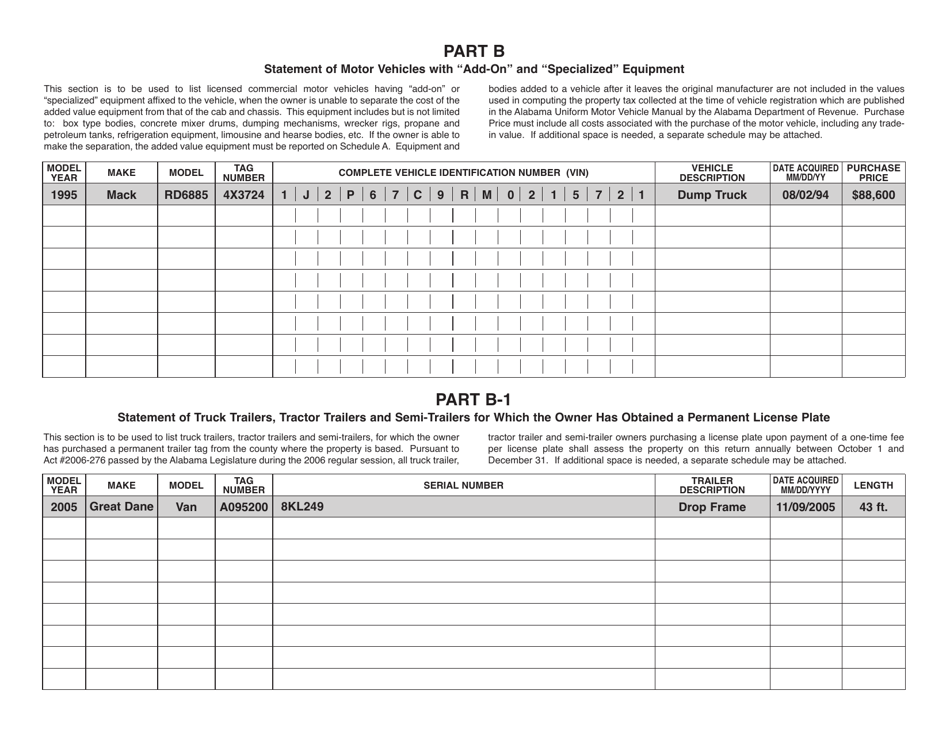

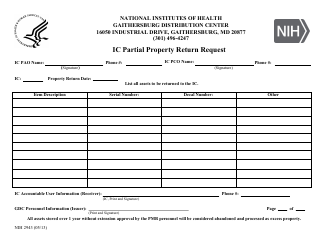

A: Personal property refers to any tangible assets owned by a business, such as furniture, fixtures, equipment, and inventory.

Q: When is the deadline to file Form ADV-40?

A: The deadline to file Form ADV-40 in Alabama is typically on or before December 31st of each year.

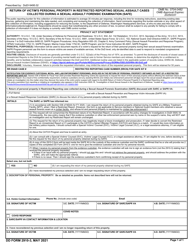

Q: Are there any exemptions from filing Form ADV-40?

A: Yes, certain businesses may be exempt from filing Form ADV-40. You should consult the instructions or reach out to the Alabama Department of Revenue for more information.

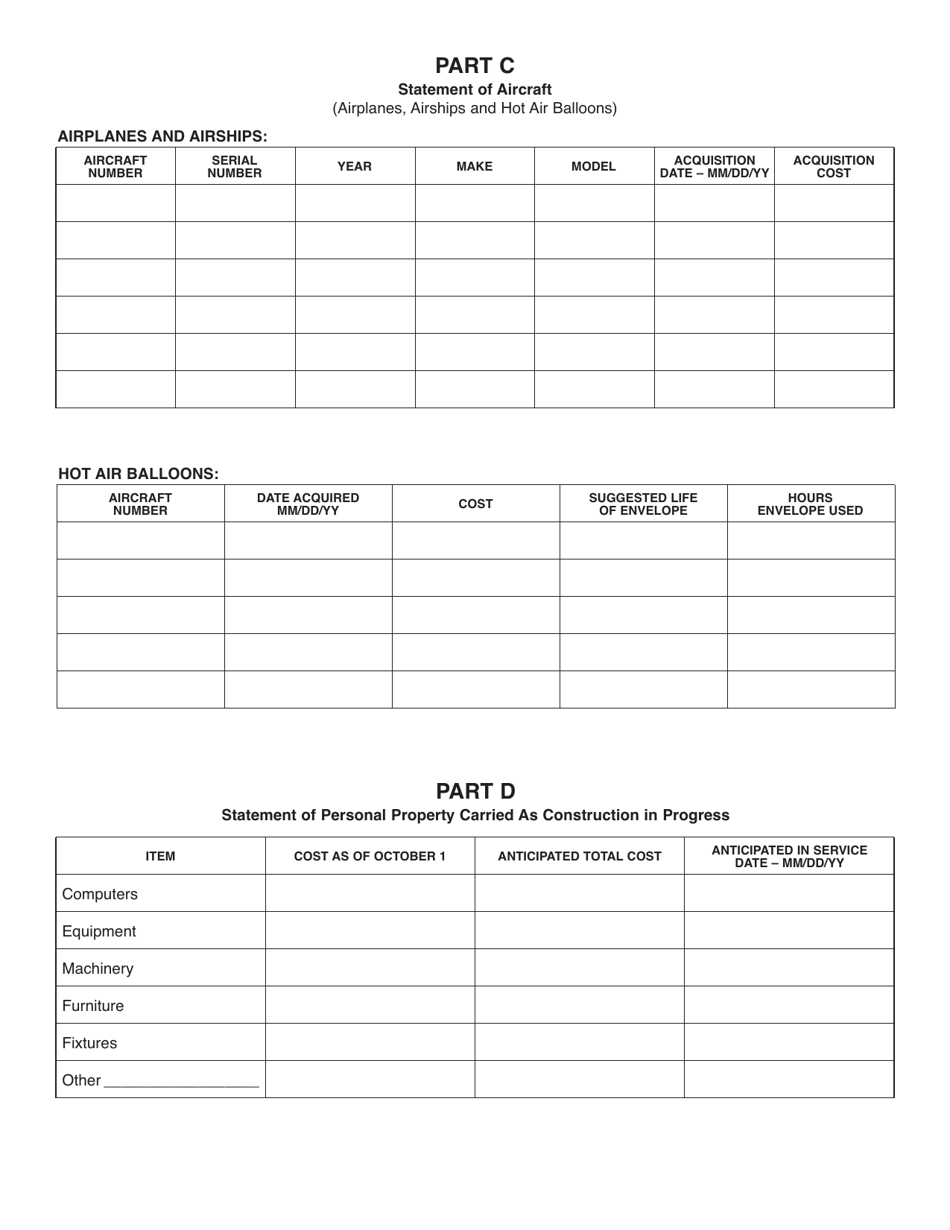

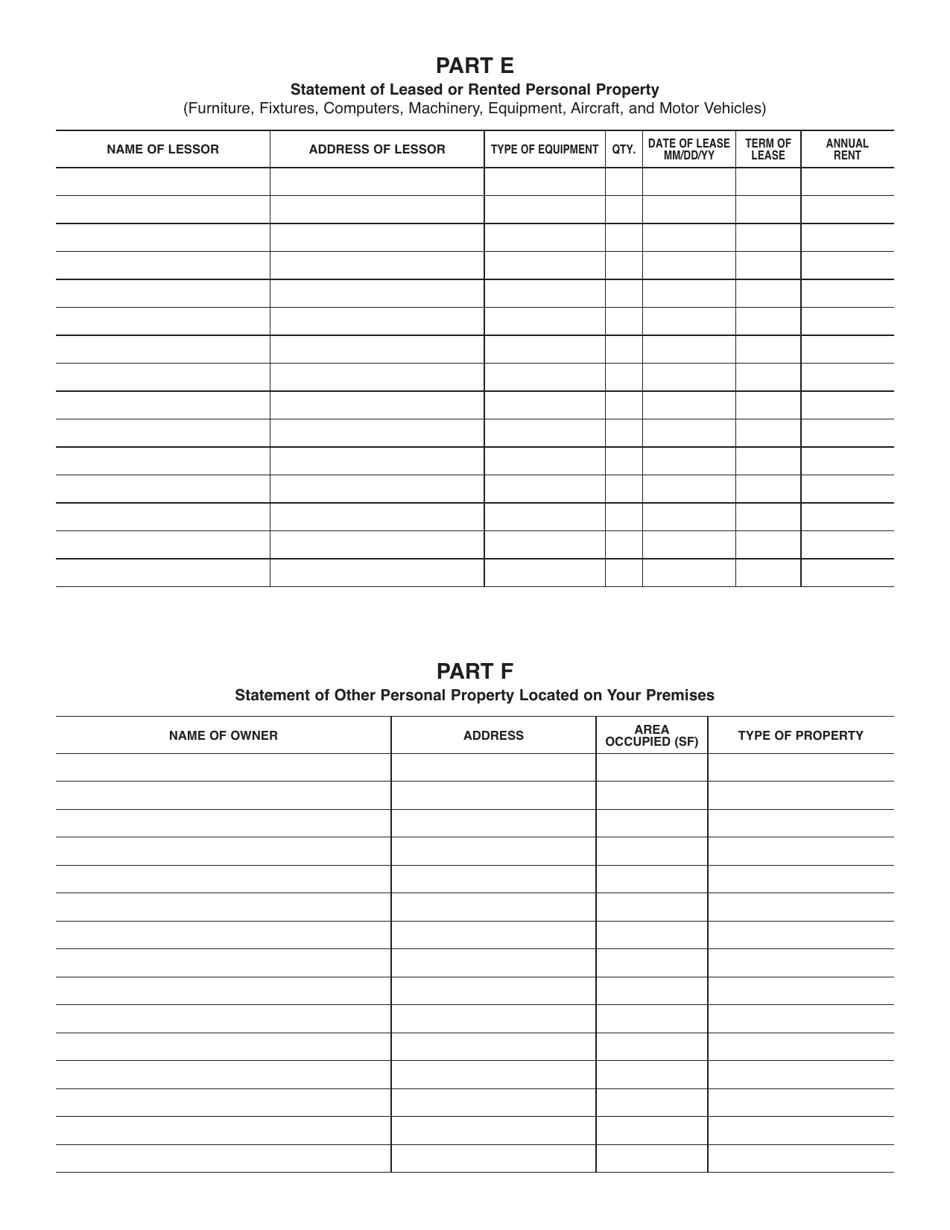

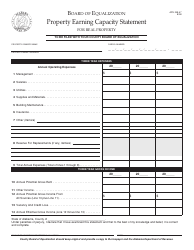

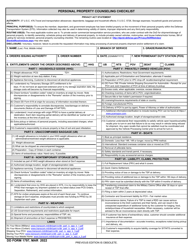

Q: What information is required on Form ADV-40?

A: Form ADV-40 requires information about the business' personal property, including a description of each item, its original cost, and its current value.

Q: What happens if I don't file Form ADV-40?

A: Failure to file Form ADV-40 may result in penalties and interest assessed by the Alabama Department of Revenue.

Q: Can I amend Form ADV-40 after filing?

A: Yes, if you need to make corrections or updates to your original filing, you can file an amended Form ADV-40.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADV-40 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.