This version of the form is not currently in use and is provided for reference only. Download this version of

Form 2

for the current year.

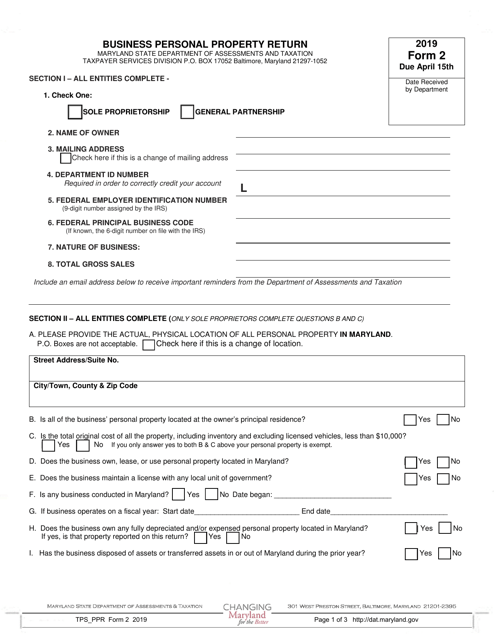

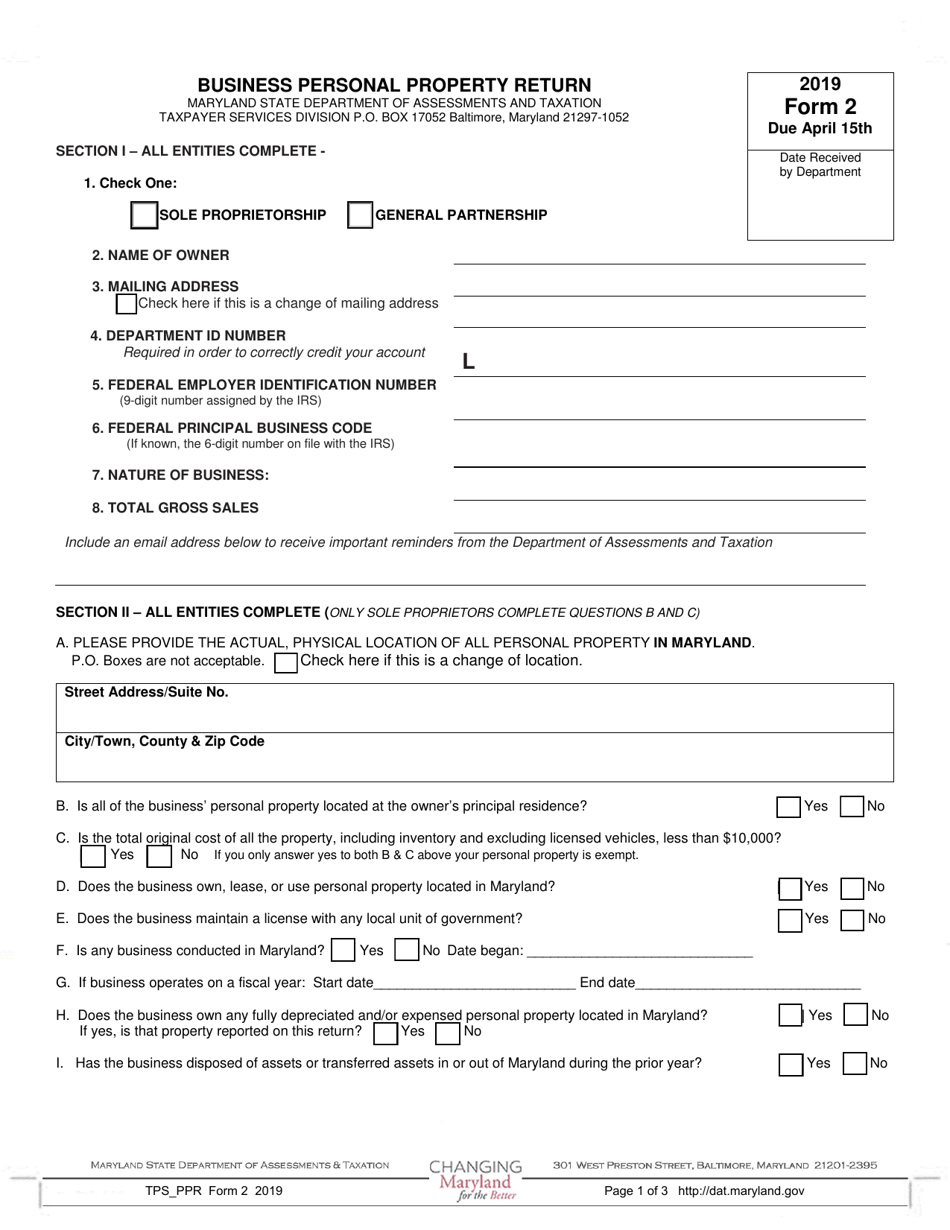

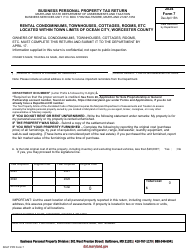

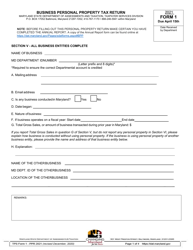

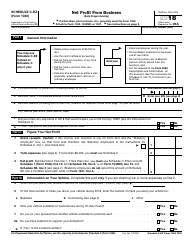

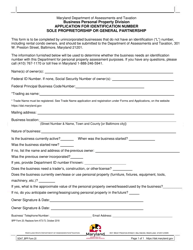

Form 2 Sole Proprietorship and General Partnerships - Business Personal Property Tax Return - Maryland

What Is Form 2?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

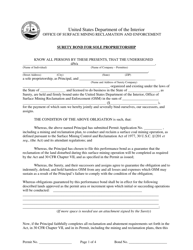

Q: What is a sole proprietorship?

A: A sole proprietorship is a type of business owned and operated by one individual.

Q: What is a general partnership?

A: A general partnership is a type of business owned and operated by two or more individuals.

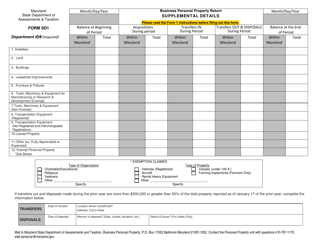

Q: What is a Business Personal Property Tax Return?

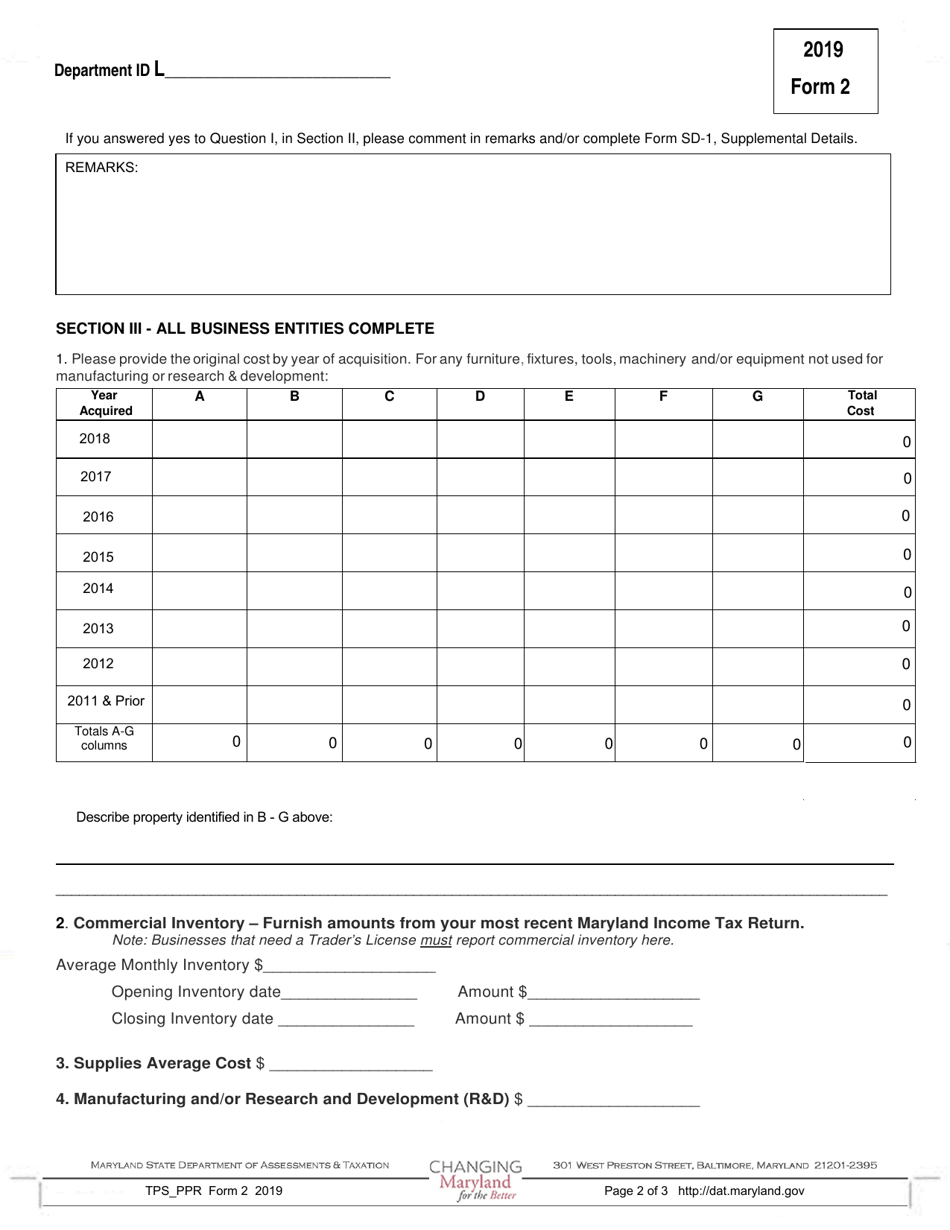

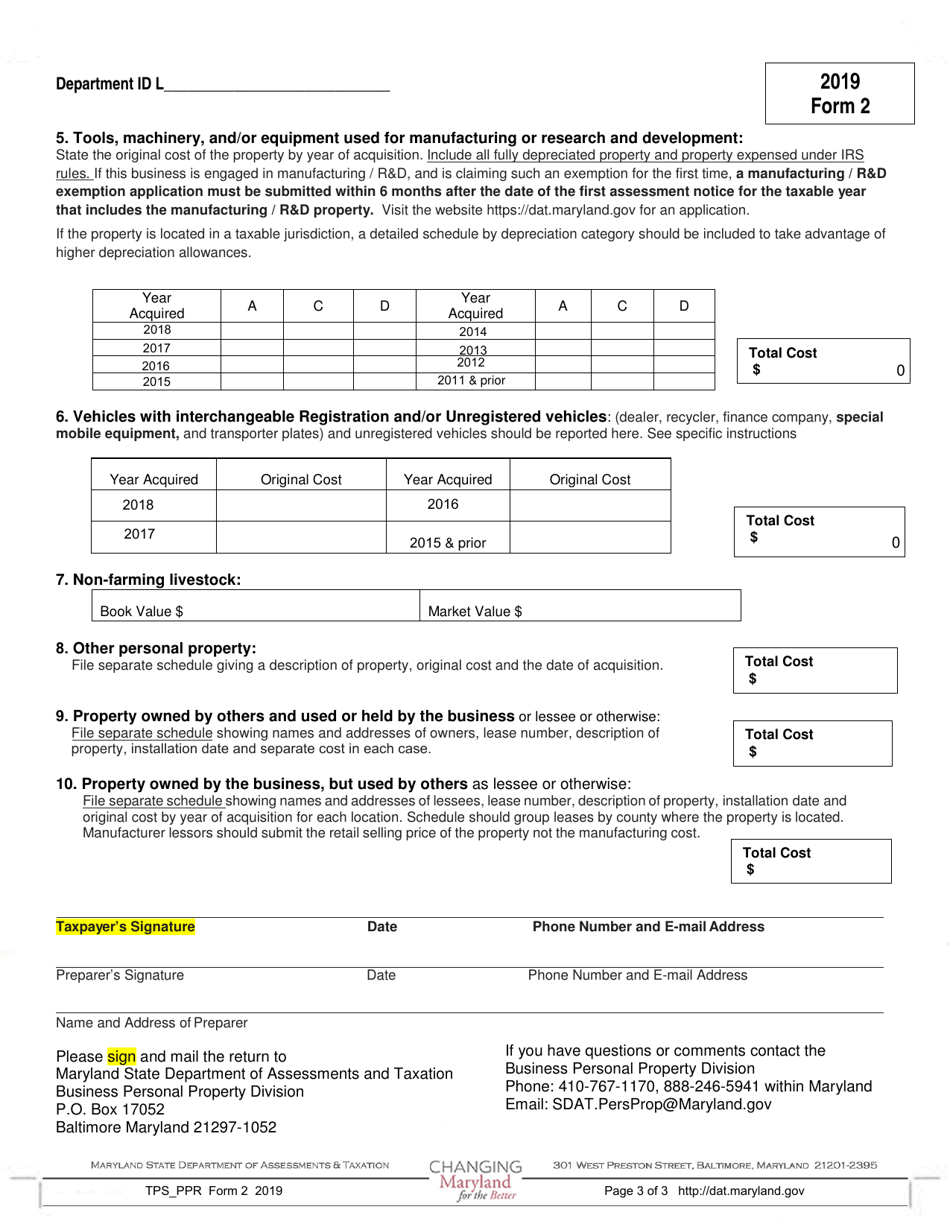

A: A Business Personal Property Tax Return is a form used to report and assess the value of tangible personal property owned by a business.

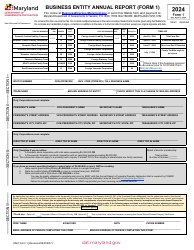

Q: Who needs to file a Business Personal Property Tax Return in Maryland?

A: Any individual or business entity that owns tangible personal property used in a business or rental activity in Maryland needs to file a Business Personal Property Tax Return.

Q: What is considered tangible personal property?

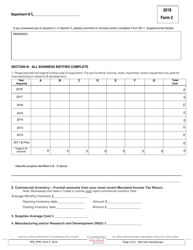

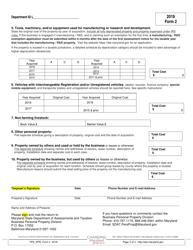

A: Tangible personal property includes physical assets such as furniture, equipment, machinery, and inventory.

Q: How often do I need to file the Business Personal Property Tax Return in Maryland?

A: The Business Personal Property Tax Return in Maryland is due by April 15th each year.

Q: What happens if I don't file the Business Personal Property Tax Return?

A: Failure to file the Business Personal Property Tax Return may result in penalties and interest charges.

Q: Are there any exemptions or deductions available for Business Personal Property Tax in Maryland?

A: Yes, there are various exemptions and deductions available for Business Personal Property Tax in Maryland. You should consult the Maryland Department of Assessments and Taxation or a tax professional for more information.

Form Details:

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.