This version of the form is not currently in use and is provided for reference only. Download this version of

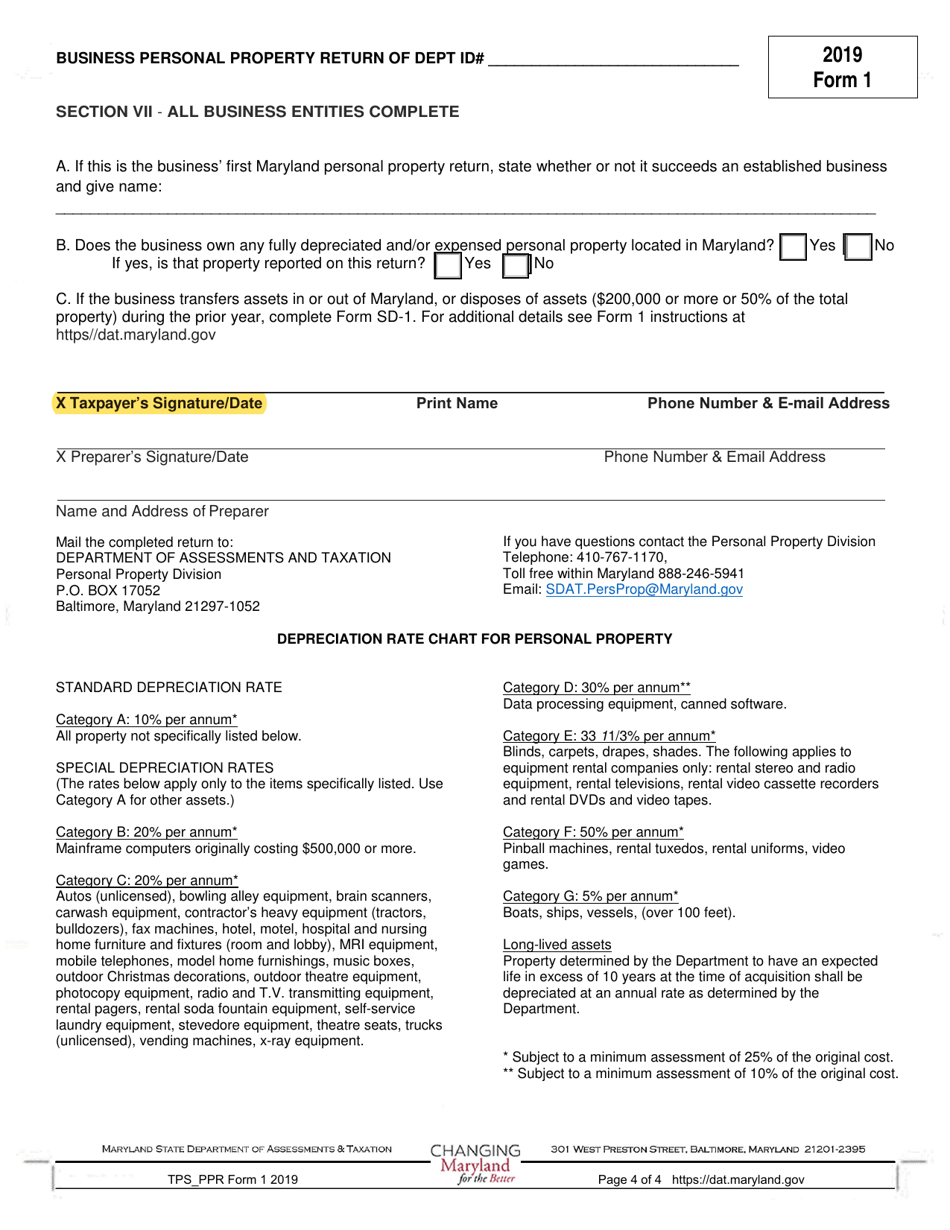

Form 1

for the current year.

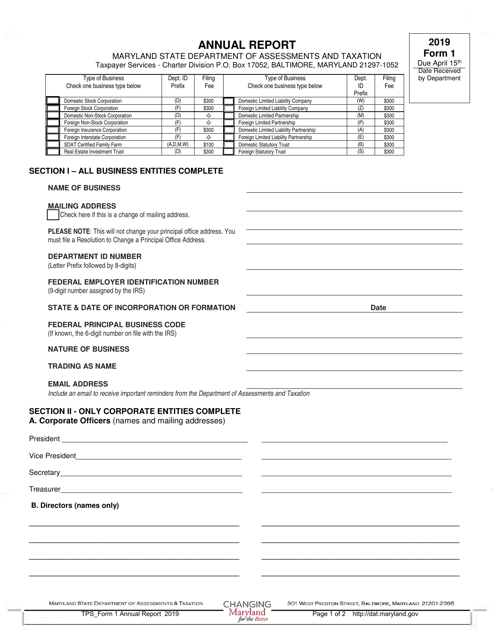

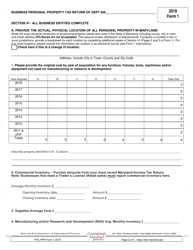

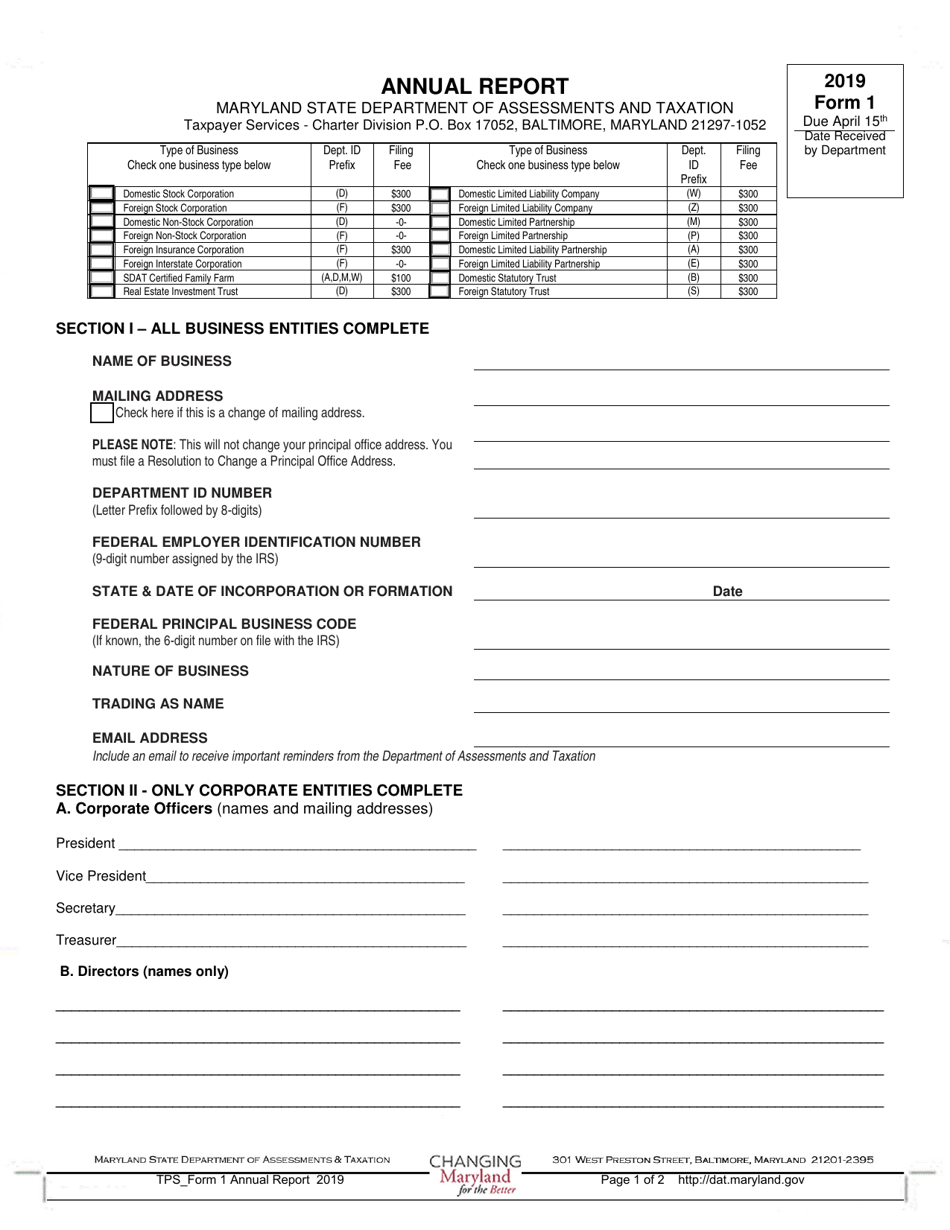

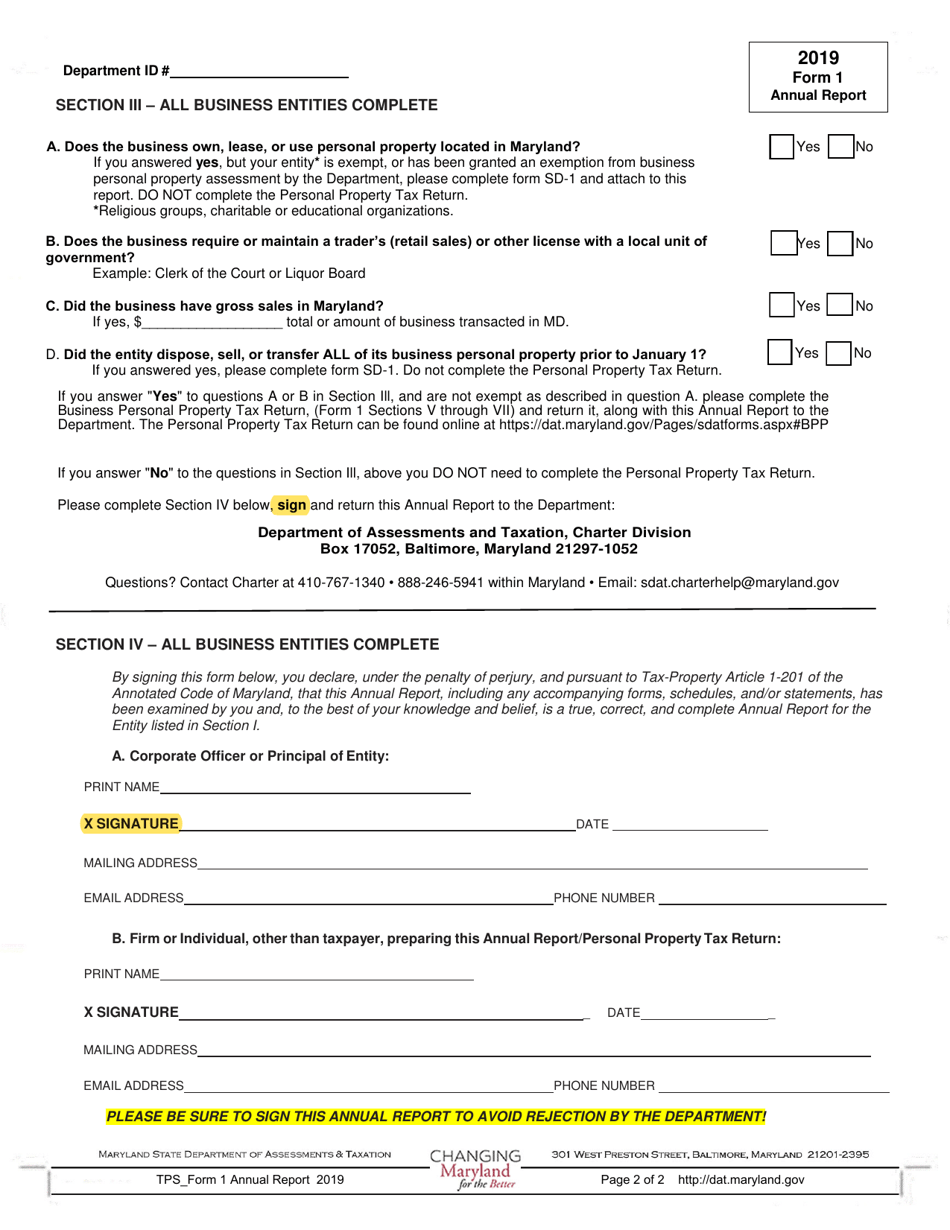

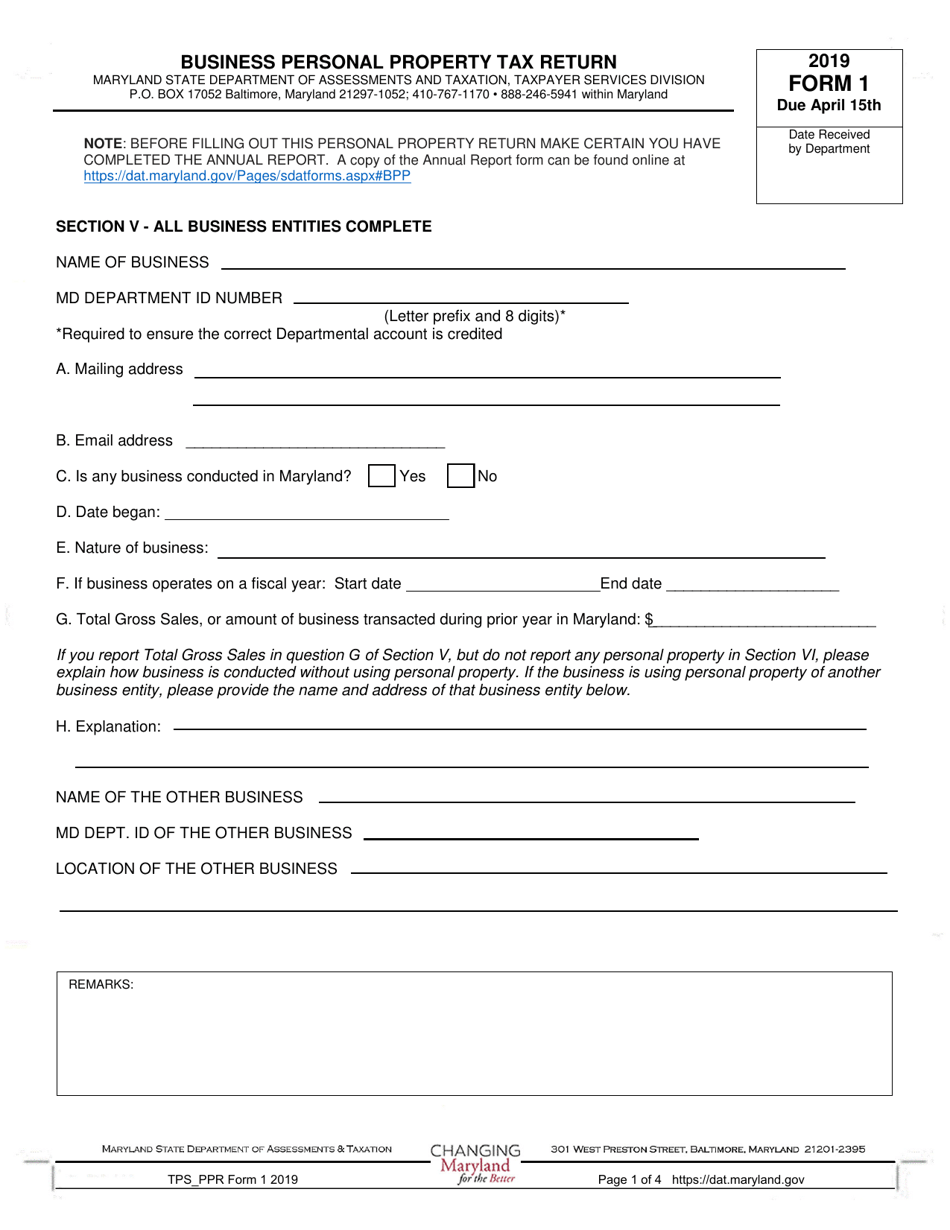

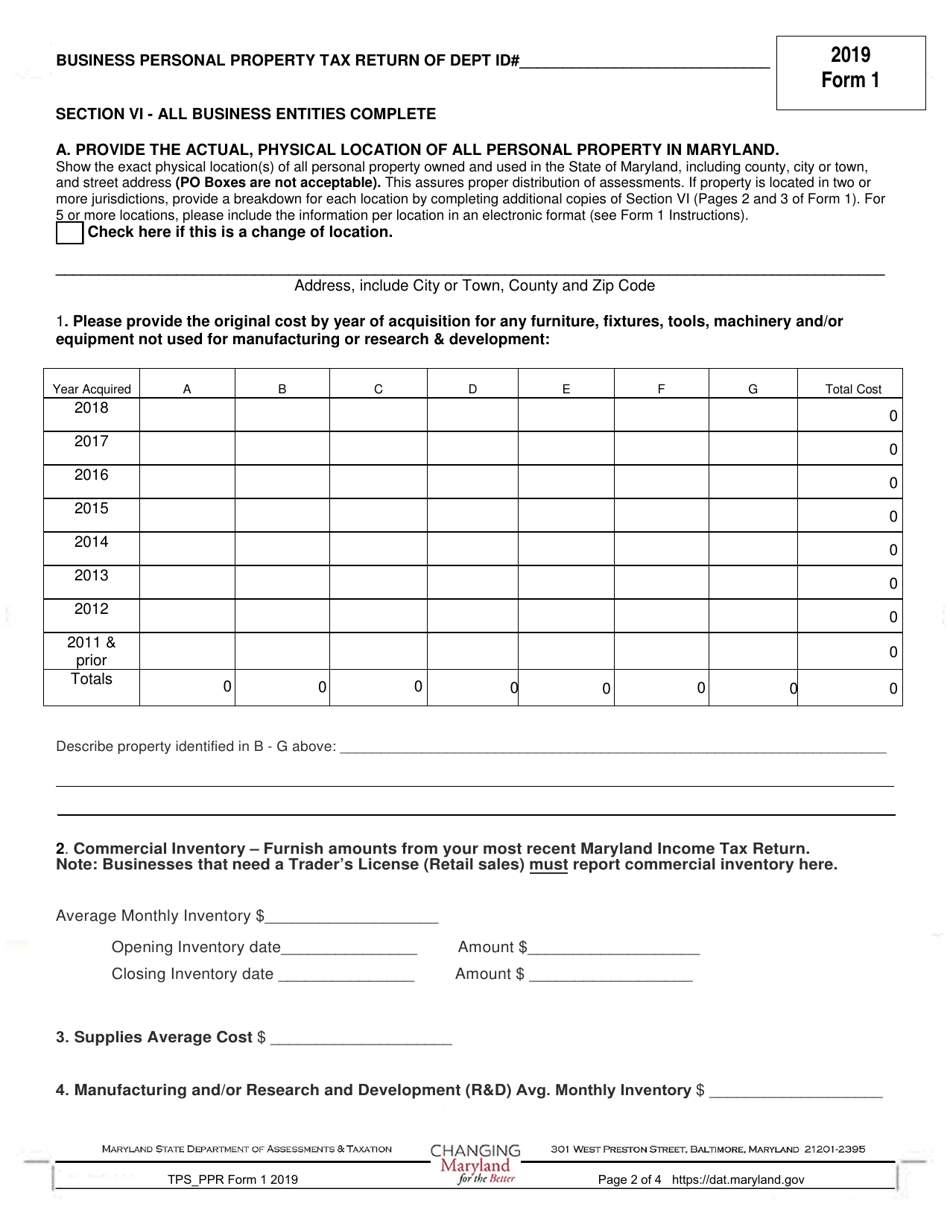

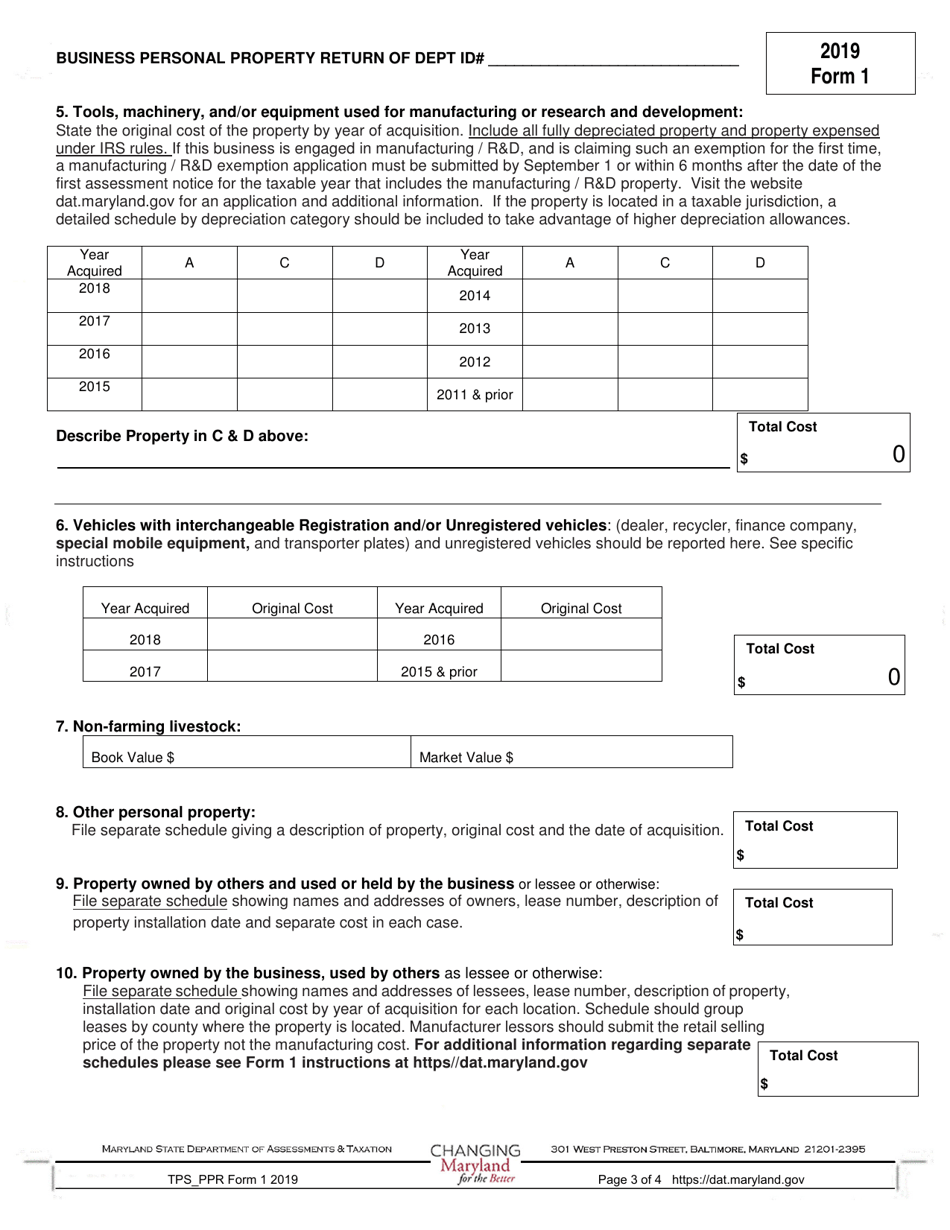

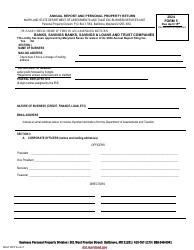

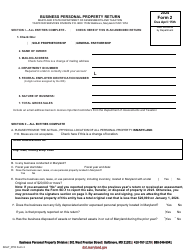

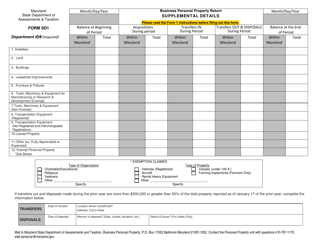

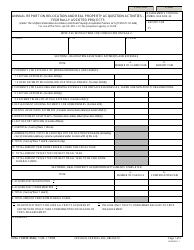

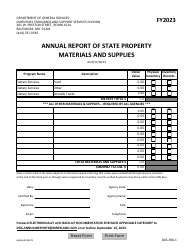

Form 1 Annual Report & Business Personal Property Return - Maryland

What Is Form 1?

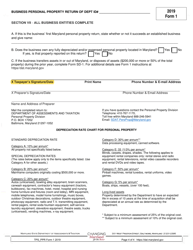

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1 Annual Report & Business Personal Property Return?

A: Form 1 Annual Report & Business Personal Property Return is a form used in Maryland for businesses to report their annual financial information and personal property.

Q: Who needs to file Form 1 Annual Report & Business Personal Property Return?

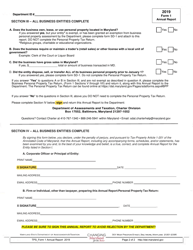

A: All businesses and entities registered or authorized to do business in Maryland are required to file Form 1 Annual Report & Business Personal Property Return.

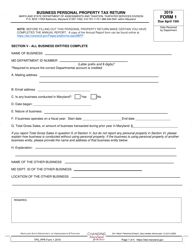

Q: What information is required to be reported on Form 1 Annual Report & Business Personal Property Return?

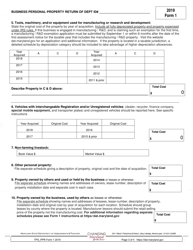

A: Form 1 Annual Report & Business Personal Property Return requires information such as business details, financial data, and a listing of personal property owned by the business.

Q: When is the deadline to file Form 1 Annual Report & Business Personal Property Return?

A: The deadline to file Form 1 Annual Report & Business Personal Property Return in Maryland is April 15th.

Q: What happens if I fail to file Form 1 Annual Report & Business Personal Property Return?

A: Failure to file Form 1 Annual Report & Business Personal Property Return may result in penalties, fines, and the loss of business entity status.

Form Details:

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.