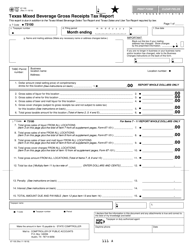

This version of the form is not currently in use and is provided for reference only. Download this version of

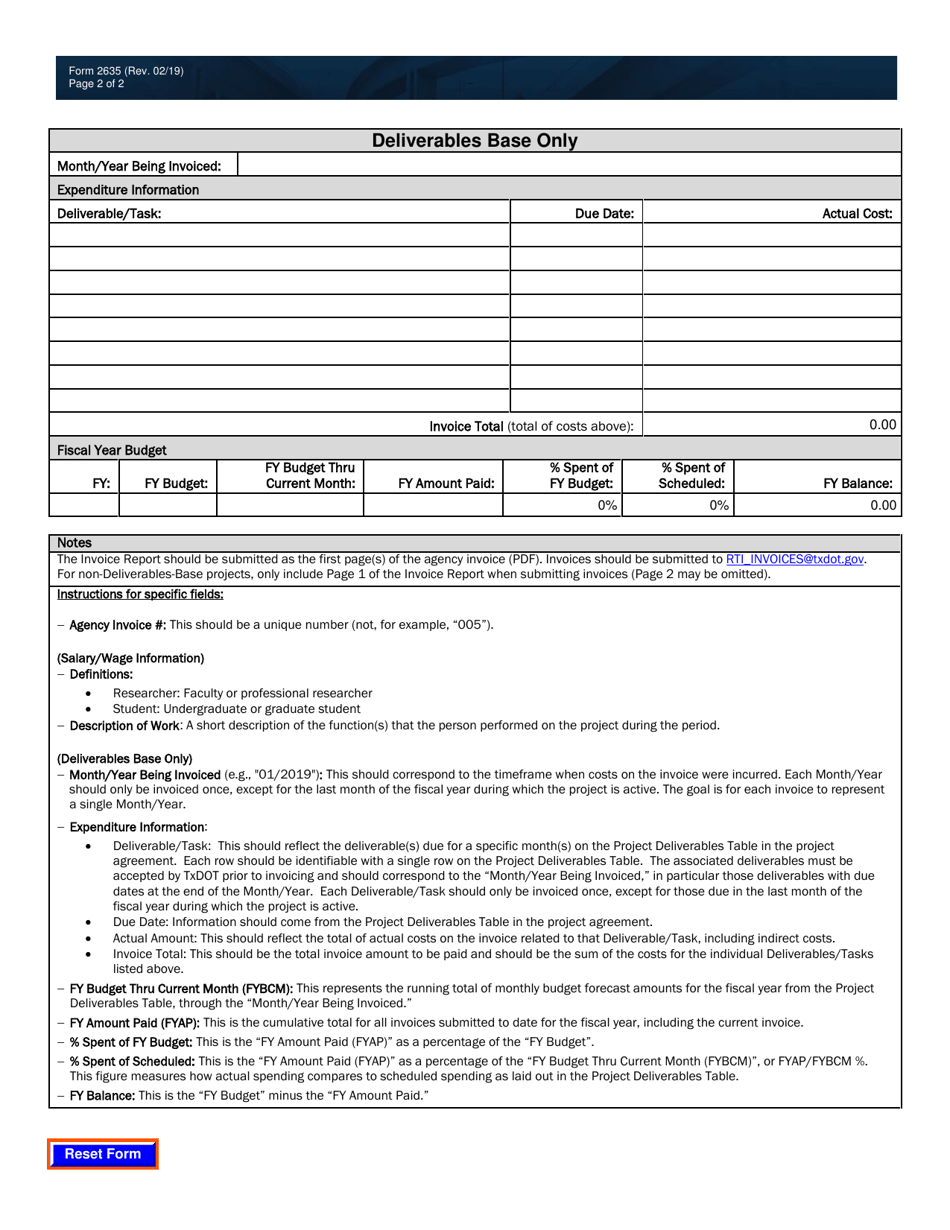

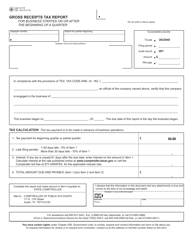

Form 2635

for the current year.

Form 2635 Invoice Report - Texas

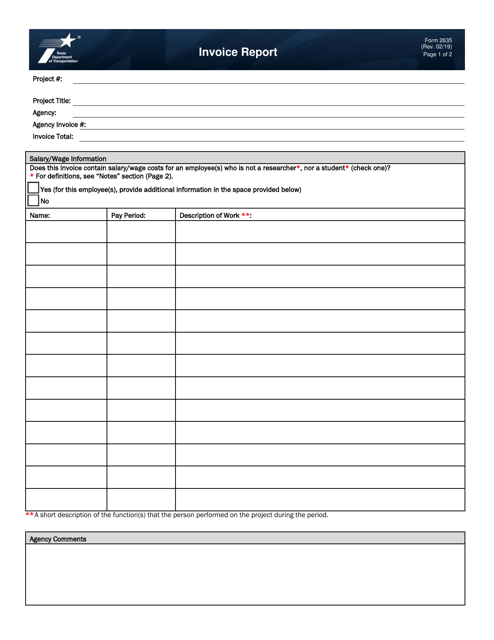

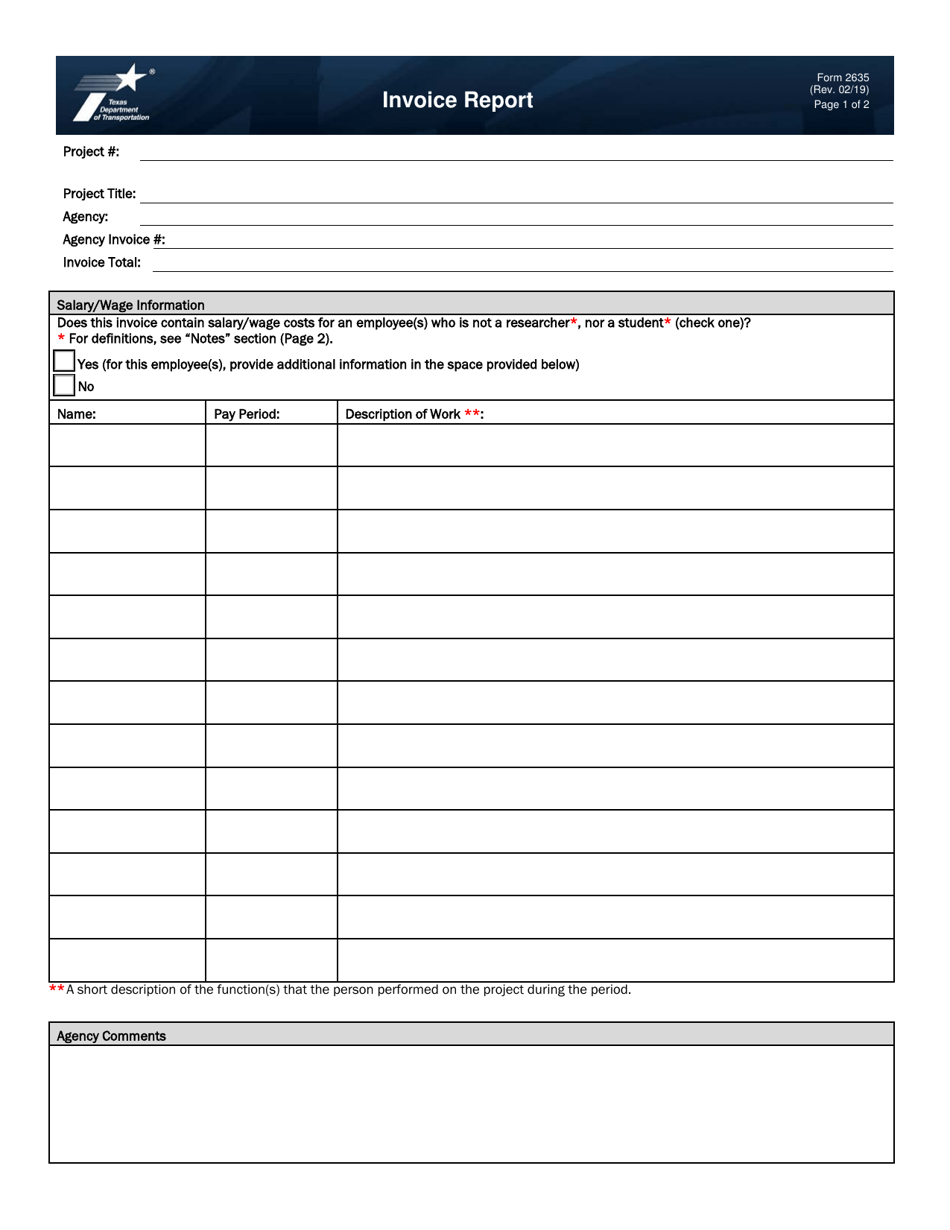

What Is Form 2635?

This is a legal form that was released by the Texas Department of Transportation - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

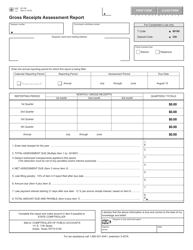

Q: What is Form 2635 Invoice Report?

A: Form 2635 Invoice Report is a document used for reporting invoices in the state of Texas.

Q: Who needs to file Form 2635 Invoice Report?

A: Entities that have provided goods or services to the state of Texas and have been issued an invoice need to file Form 2635 Invoice Report.

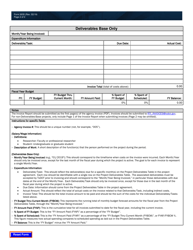

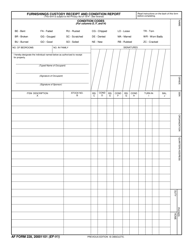

Q: What information is required on Form 2635 Invoice Report?

A: The form requires details such as the vendor information, invoice number, invoice date, invoice amount, and payment details.

Q: How often does Form 2635 Invoice Report need to be filed?

A: Form 2635 Invoice Report needs to be filed on a monthly basis.

Q: Is there a deadline for filing Form 2635 Invoice Report?

A: Yes, Form 2635 Invoice Report must be filed by the 10th day of the month following the month in which the invoice was issued.

Q: What are the consequences of not filing Form 2635 Invoice Report?

A: Failure to file Form 2635 Invoice Report may result in penalties and interest charges.

Q: Are there any exemptions to filing Form 2635 Invoice Report?

A: Yes, certain entities may be exempt from filing Form 2635 Invoice Report. Please refer to the instructions provided with the form for more information.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Texas Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2635 by clicking the link below or browse more documents and templates provided by the Texas Department of Transportation.