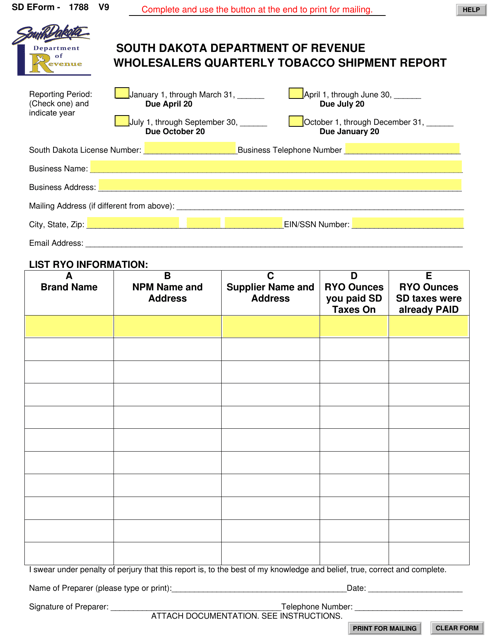

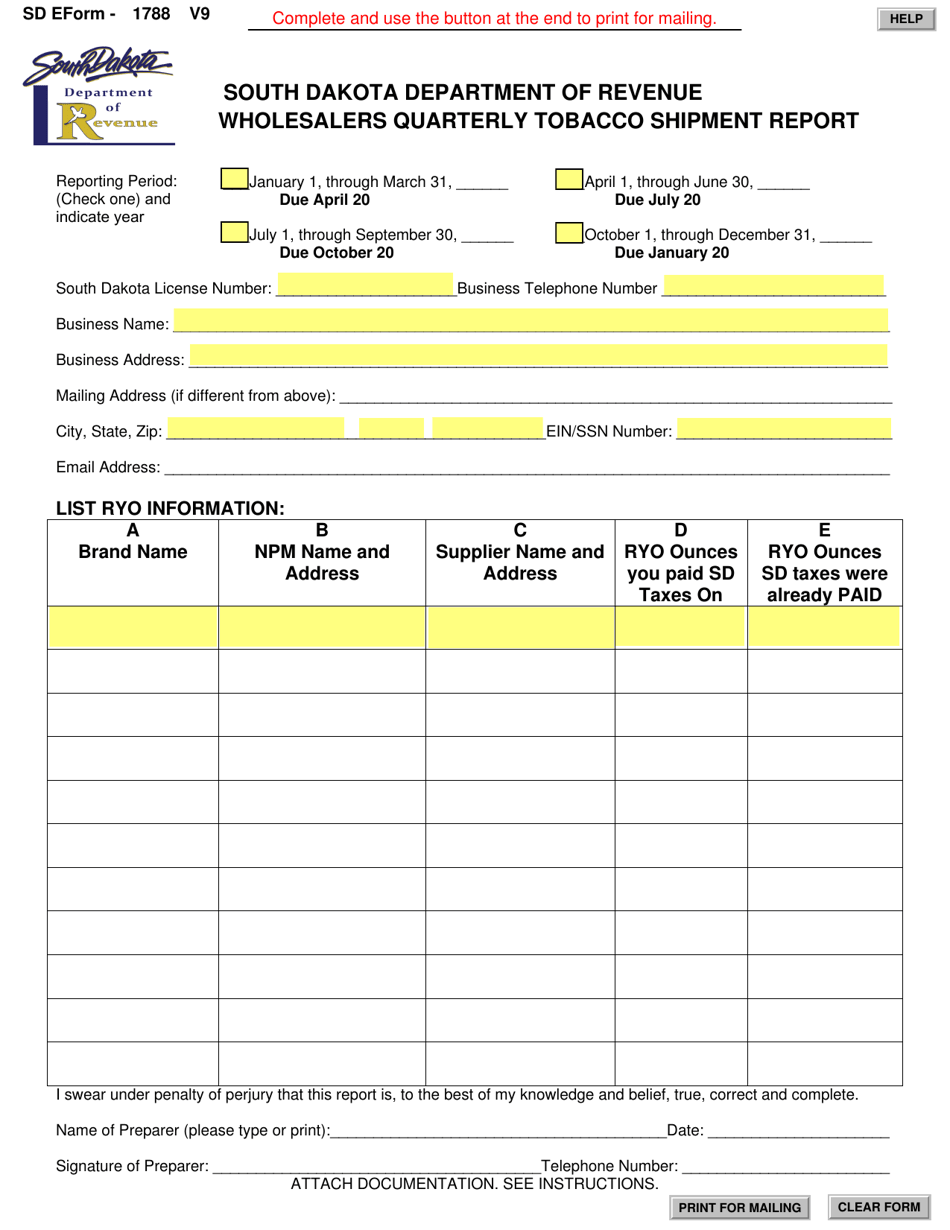

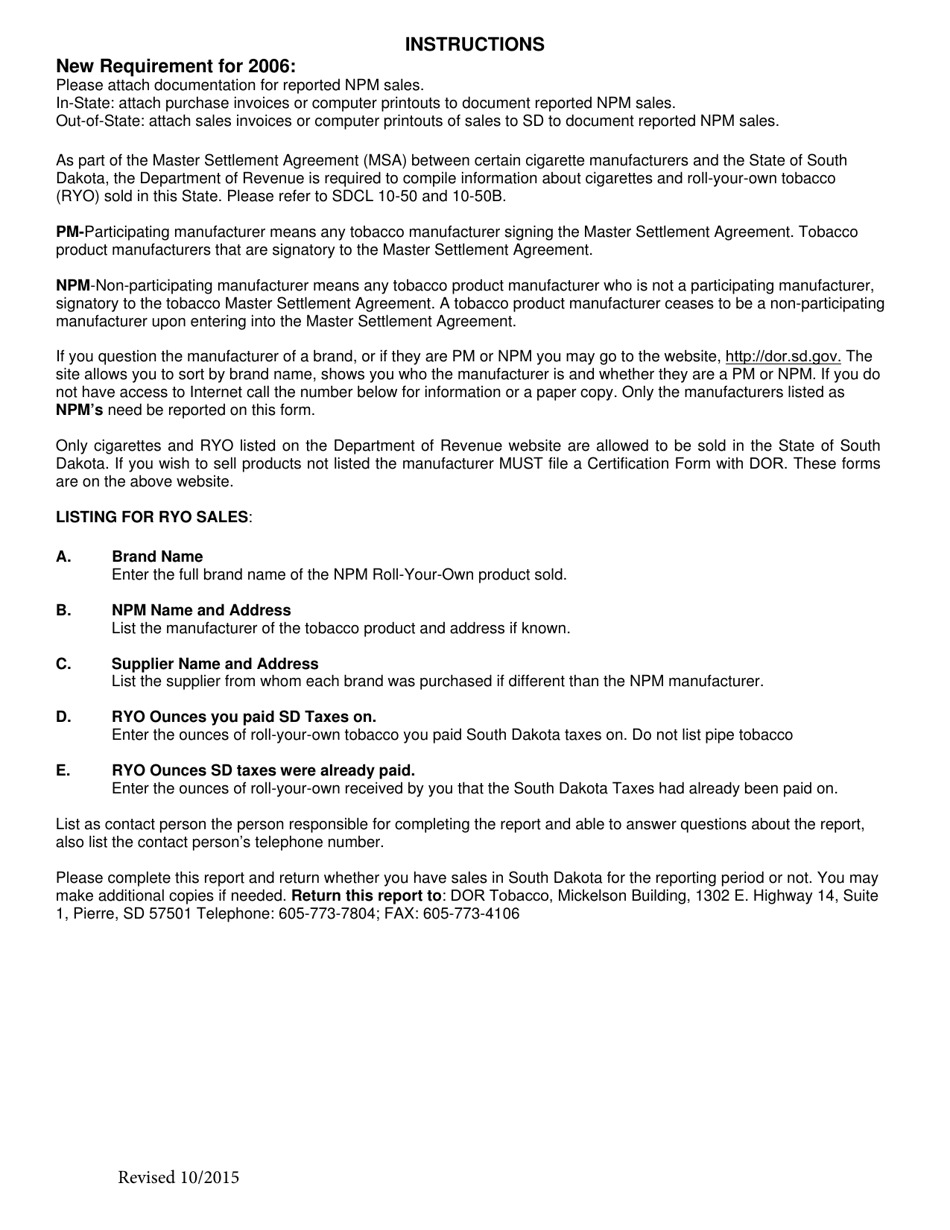

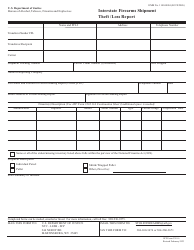

Form 1788 Wholesalers Quarterly Tobacco Shipment Report - South Dakota

What Is Form 1788?

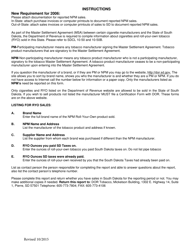

This is a legal form that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form 1788?

A: Form 1788 is used to report quarterly tobacco shipments in South Dakota.

Q: Who is required to file Form 1788?

A: Wholesalers in South Dakota are required to file Form 1788.

Q: What is included in the Form 1788?

A: Form 1788 includes information about the quantity and value of tobacco shipments.

Q: When is Form 1788 due?

A: Form 1788 is due on a quarterly basis. The specific due dates are provided by the South Dakota Department of Revenue.

Q: How should Form 1788 be filed?

A: Form 1788 can be filed electronically or by mail.

Q: Are there any penalties for late or incorrect filing of Form 1788?

A: Yes, there may be penalties for late or incorrect filing of Form 1788. It is important to comply with the filing requirements to avoid penalties.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the South Dakota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1788 by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.