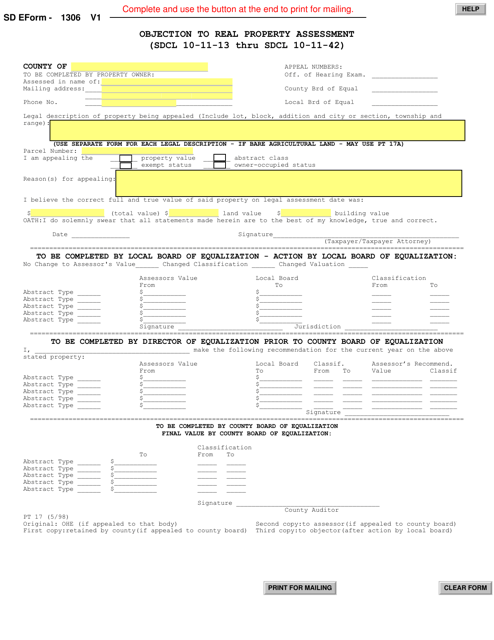

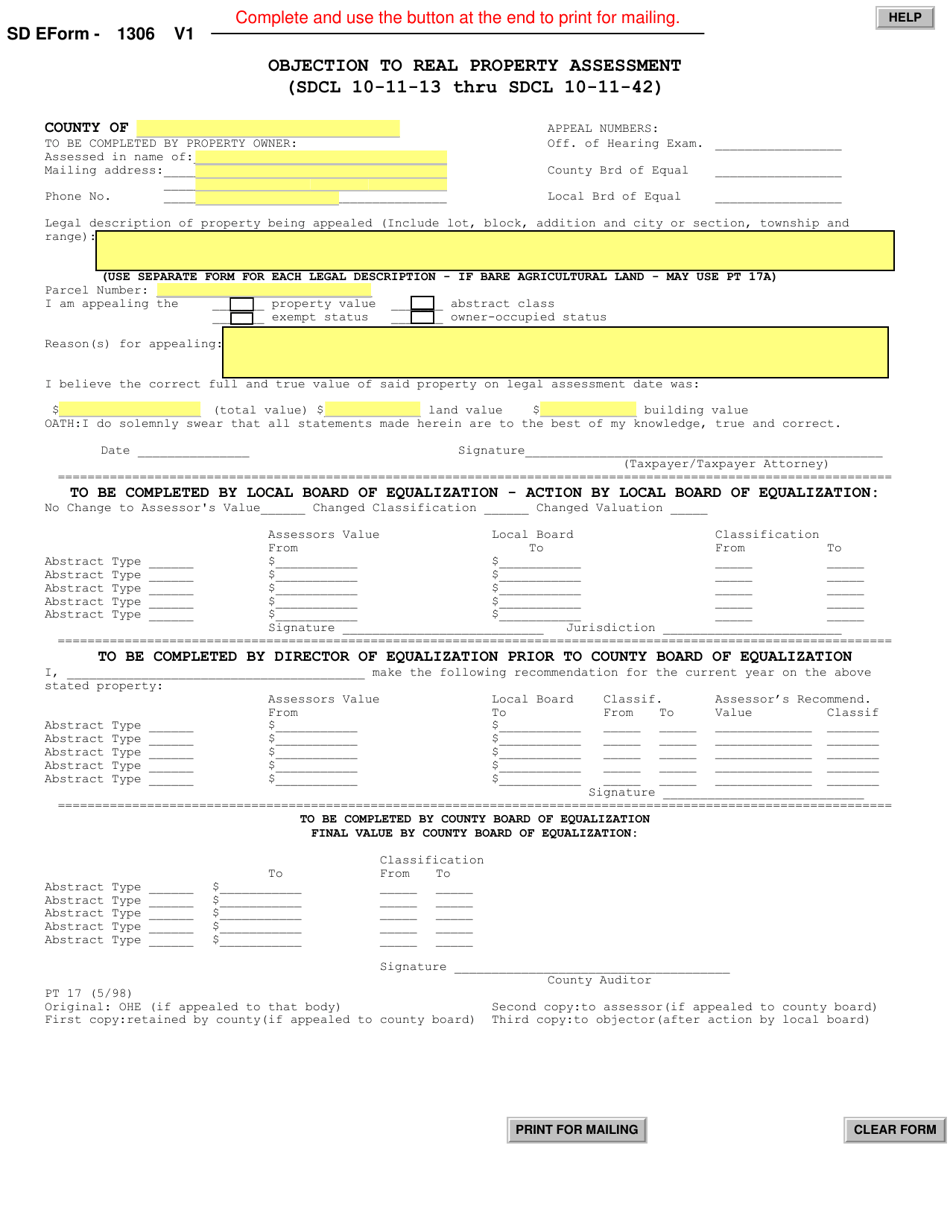

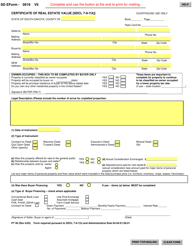

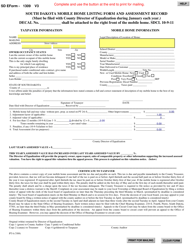

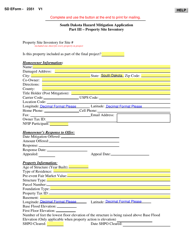

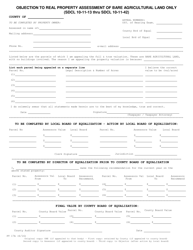

SD Form 1306 (PT17) Objection to Real Property Assessment - South Dakota

What Is SD Form 1306 (PT17)?

This is a legal form that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

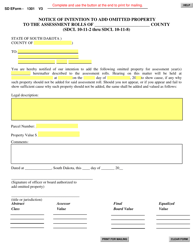

Q: What is SD Form 1306 (PT17)?

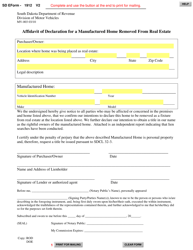

A: SD Form 1306 (PT17) is a form used to file an objection to a real property assessment in South Dakota.

Q: When should I use SD Form 1306 (PT17)?

A: You should use SD Form 1306 (PT17) when you want to file an objection to the assessment of your real property in South Dakota.

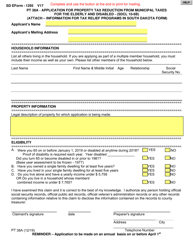

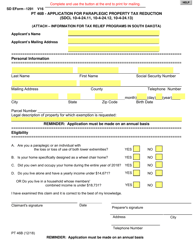

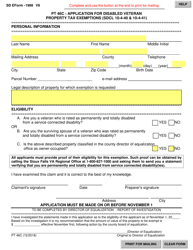

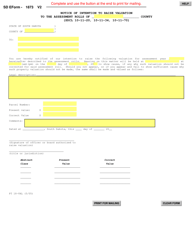

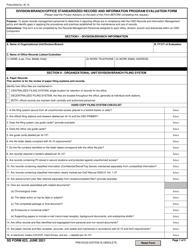

Q: What information do I need to provide on SD Form 1306 (PT17)?

A: You need to provide your contact information, the property details, the reason for the objection, and any supporting evidence.

Q: Is there a deadline for filing SD Form 1306 (PT17)?

A: Yes, the form must be filed on or before March 10th of the assessment year.

Q: What happens after I submit SD Form 1306 (PT17)?

A: After you submit SD Form 1306 (PT17), the local county board of equalization will review your objection and make a decision.

Q: Can I appeal the decision of the local county board of equalization?

A: Yes, if you disagree with the decision of the local county board of equalization, you can appeal to the South Dakota Office of Hearing Examiners.

Q: Are there any fees for filing SD Form 1306 (PT17)?

A: No, there are no fees for filing SD Form 1306 (PT17).

Q: Can I get assistance in completing SD Form 1306 (PT17)?

A: Yes, you can seek assistance from the local county director of equalization or a tax professional to complete SD Form 1306 (PT17).

Form Details:

- Released on May 1, 1998;

- The latest edition provided by the South Dakota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SD Form 1306 (PT17) by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.