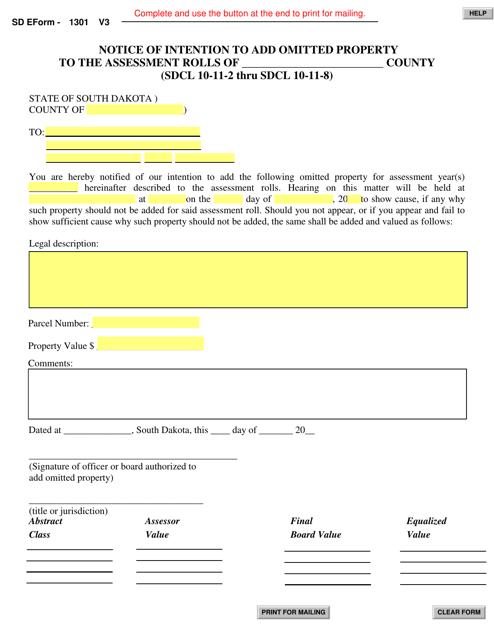

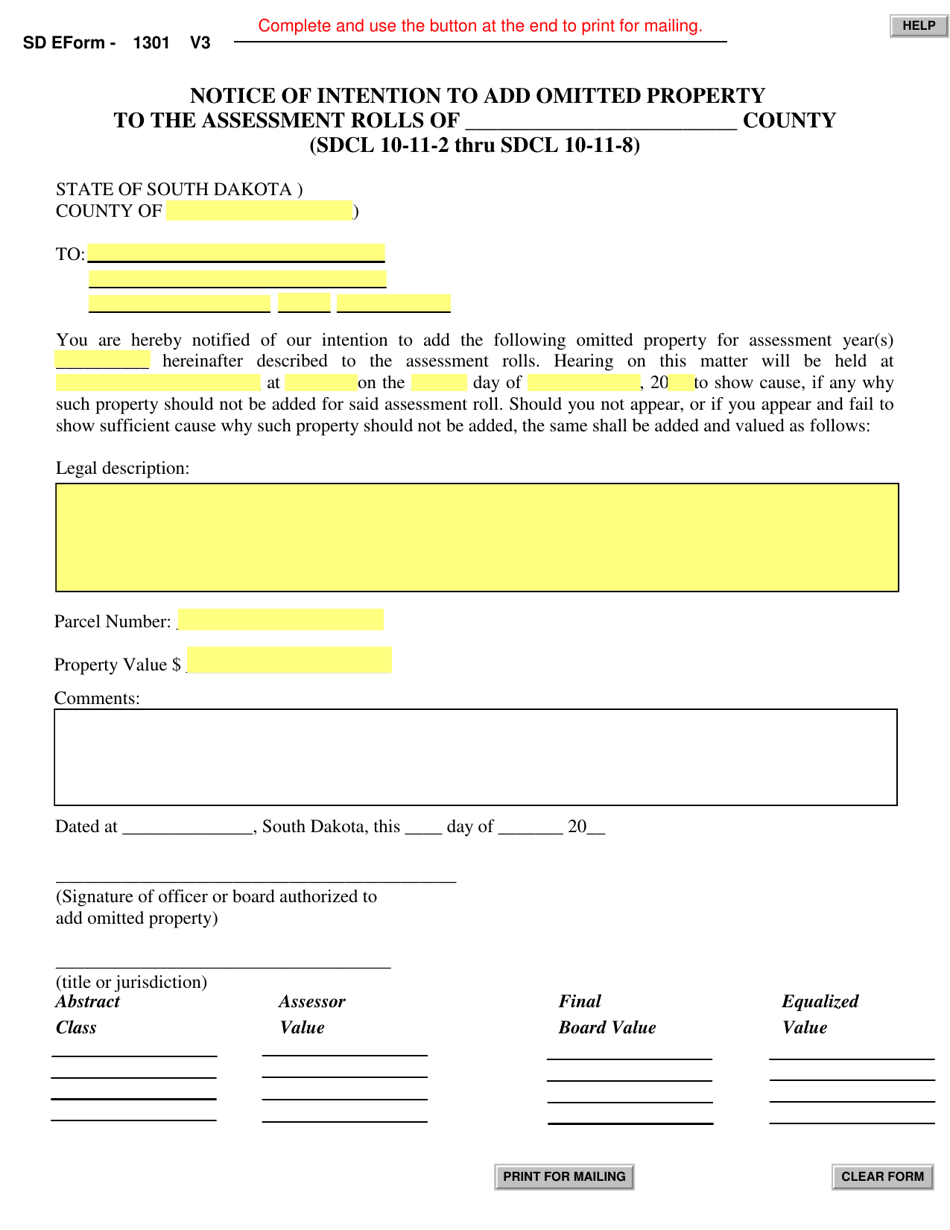

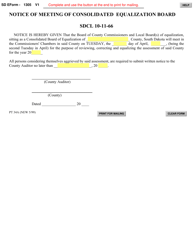

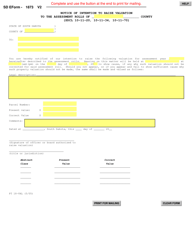

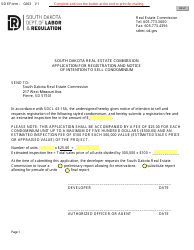

SD Form 1301 (PT18) Notice of Intention to Add Omitted Property or Valuation to the Assessment Rolls - South Dakota

What Is SD Form 1301 (PT18)?

This is a legal form that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SD Form 1301 (PT18)?

A: SD Form 1301 (PT18) is the Notice of Intention to Add Omitted Property or Valuation to the Assessment Rolls in South Dakota.

Q: What is the purpose of SD Form 1301 (PT18)?

A: The purpose of SD Form 1301 (PT18) is to notify the authorities in South Dakota about the intention to add omitted property or valuation to the assessment rolls.

Q: When should SD Form 1301 (PT18) be submitted?

A: SD Form 1301 (PT18) should be submitted when there is a need to report omitted property or valuation to the assessment rolls in South Dakota.

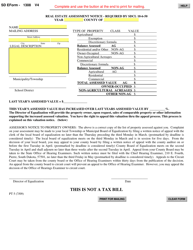

Q: Is there a deadline for submitting SD Form 1301 (PT18)?

A: Yes, there is a deadline for submitting SD Form 1301 (PT18). Please check with the authorities in South Dakota for the specific deadline.

Q: What happens after submitting SD Form 1301 (PT18)?

A: After submitting SD Form 1301 (PT18), the authorities in South Dakota will review the information and take necessary action to add the omitted property or valuation to the assessment rolls.

Q: Are there any penalties for not submitting SD Form 1301 (PT18) if required?

A: Failure to submit SD Form 1301 (PT18) when required may result in penalties or legal consequences. It is important to comply with the reporting requirements in South Dakota.

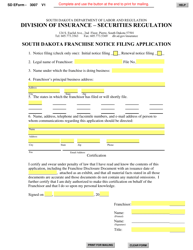

Q: Who should I contact for more information about SD Form 1301 (PT18)?

A: For more information about SD Form 1301 (PT18), you can contact the relevant authorities or tax assessors in South Dakota.

Form Details:

- The latest edition provided by the South Dakota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SD Form 1301 (PT18) by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.