This version of the form is not currently in use and is provided for reference only. Download this version of

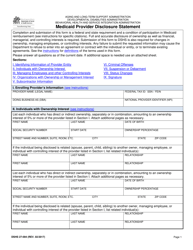

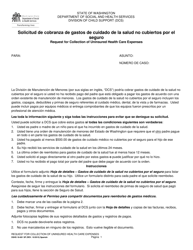

DSHS Form 12-210

for the current year.

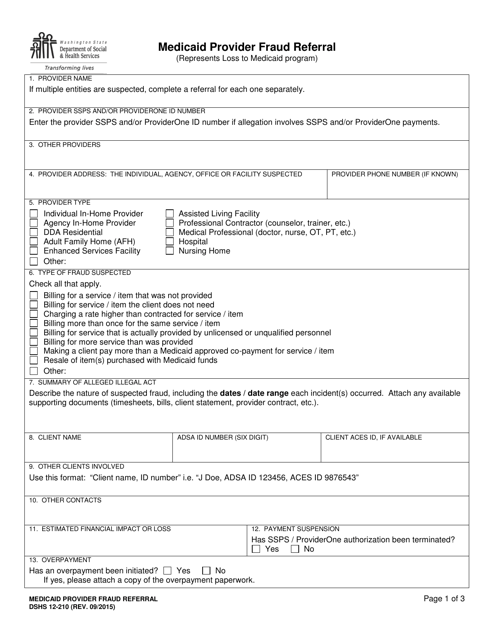

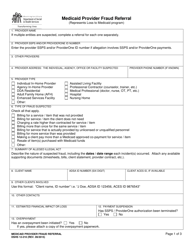

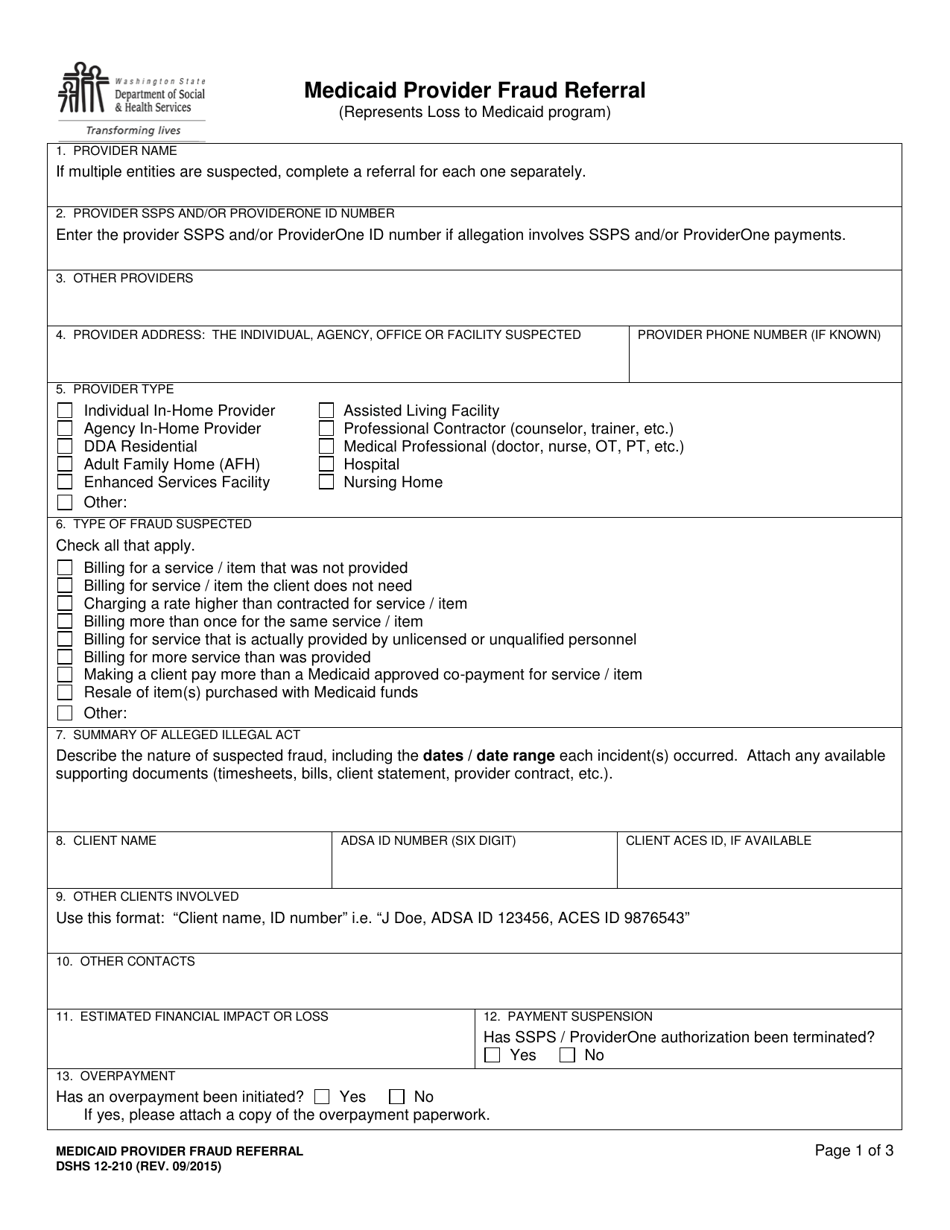

DSHS Form 12-210 Medicaid Provider Fraud Referral - Washington

What Is DSHS Form 12-210?

This is a legal form that was released by the Washington State Department of Social and Health Services - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DSHS Form 12-210?

A: DSHS Form 12-210 is a Medicaid Provider Fraud Referral form used in Washington.

Q: What is Medicaid Provider Fraud Referral?

A: Medicaid Provider Fraud Referral is a process aimed at reporting incidents of fraud committed by healthcare providers who participate in the Medicaid program.

Q: Who uses DSHS Form 12-210?

A: DSHS Form 12-210 is used by individuals or organizations to report instances of possible Medicaid provider fraud in Washington.

Q: Why is it important to report Medicaid provider fraud?

A: Reporting Medicaid provider fraud is important because it helps prevent fraudulent activities and ensures that Medicaid funds are used for their intended purpose of providing healthcare services to eligible individuals.

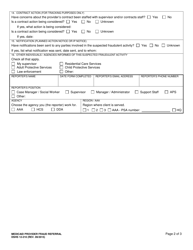

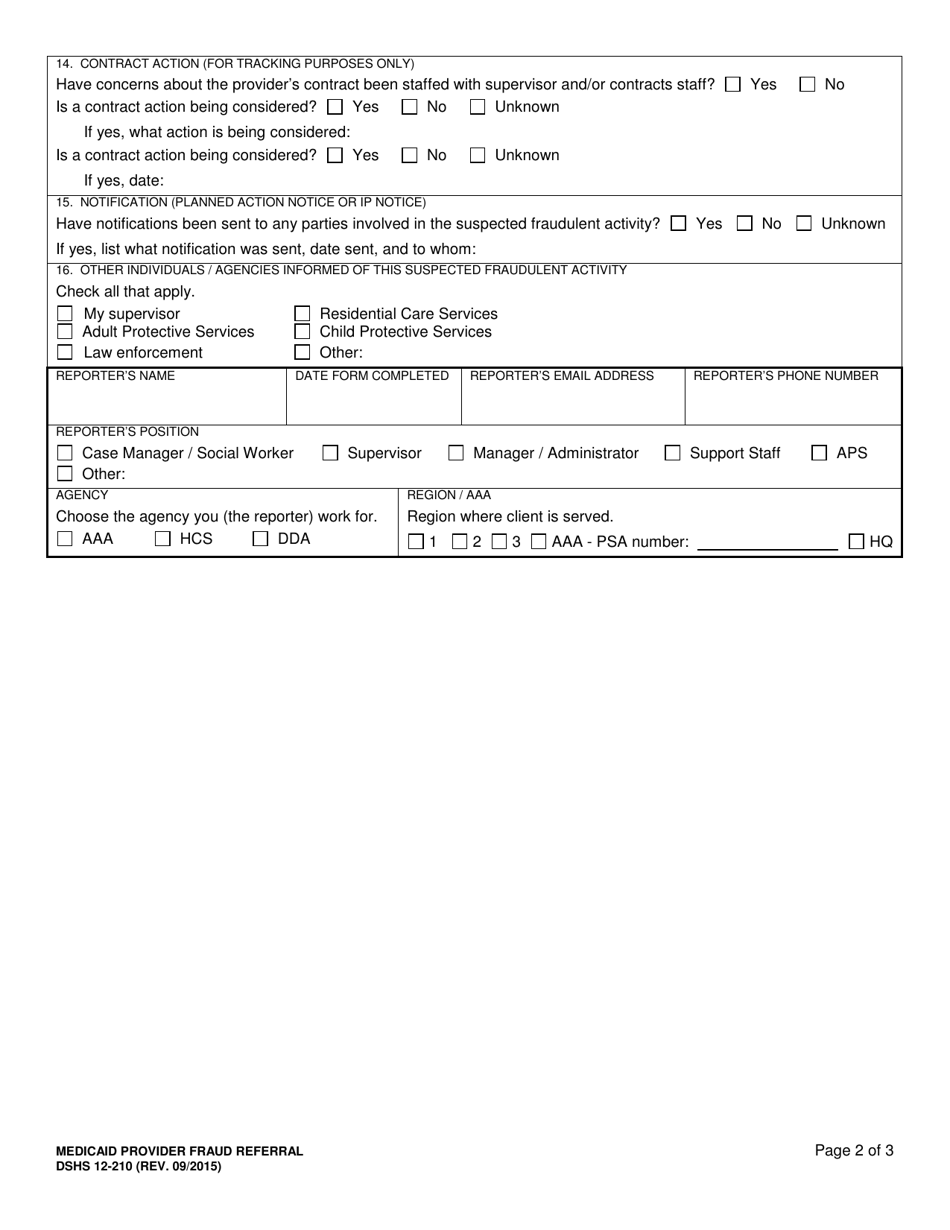

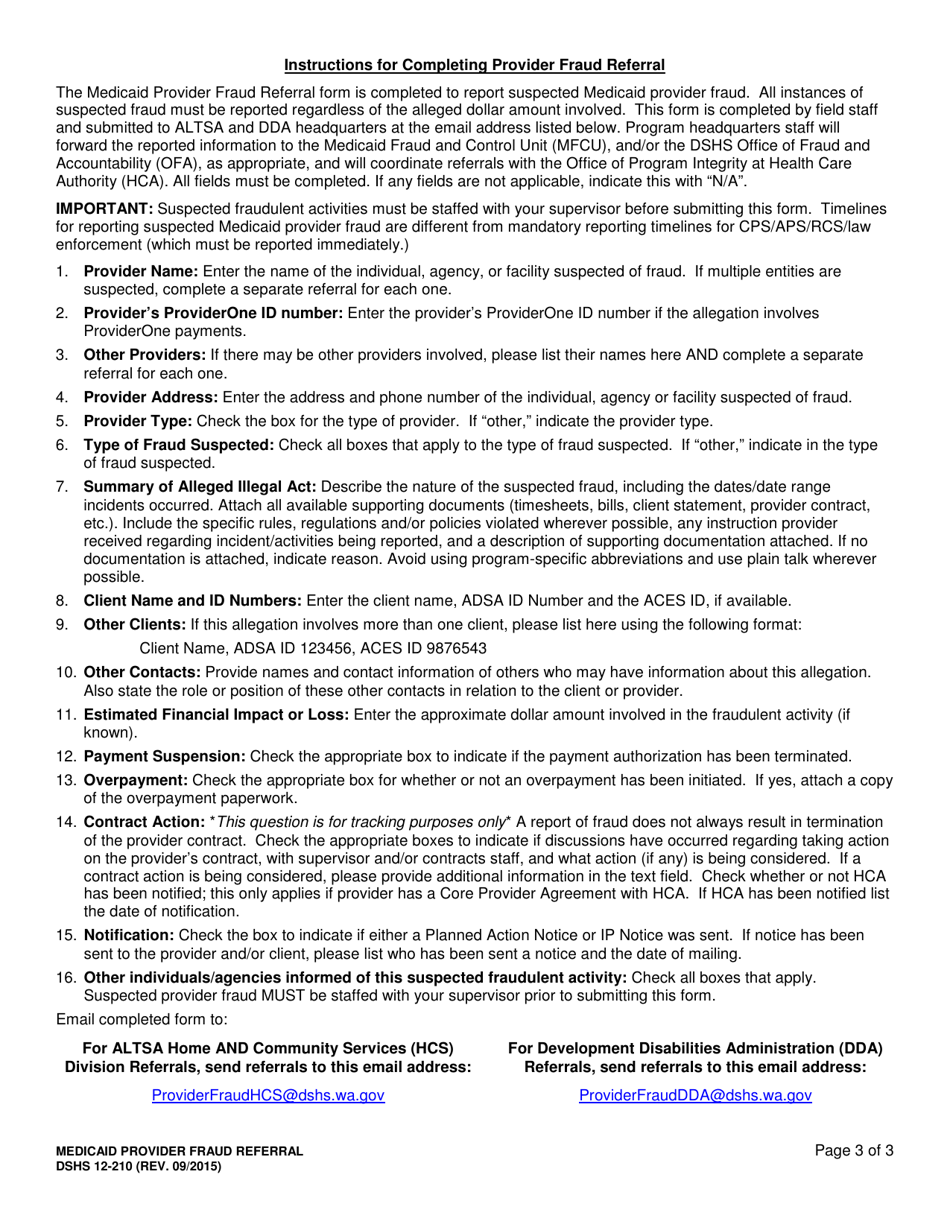

Q: What information should be provided when filling out DSHS Form 12-210?

A: When filling out DSHS Form 12-210, you should provide detailed information about the suspected fraudulent activities, the healthcare provider involved, and any supporting evidence or documentation.

Q: Is the information provided on DSHS Form 12-210 confidential?

A: Yes, the information provided on DSHS Form 12-210 is kept confidential to the extent allowed by law.

Q: What happens after submitting DSHS Form 12-210?

A: After submitting DSHS Form 12-210, the Washington State Department of Social and Health Services (DSHS) will review the information and conduct an investigation if deemed necessary.

Q: Can I remain anonymous when reporting Medicaid provider fraud?

A: Yes, you can choose to remain anonymous when reporting Medicaid provider fraud using DSHS Form 12-210.

Q: Are there any penalties for false reporting of Medicaid provider fraud?

A: Yes, knowingly making false reports of Medicaid provider fraud can result in penalties and legal consequences.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the Washington State Department of Social and Health Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of DSHS Form 12-210 by clicking the link below or browse more documents and templates provided by the Washington State Department of Social and Health Services.