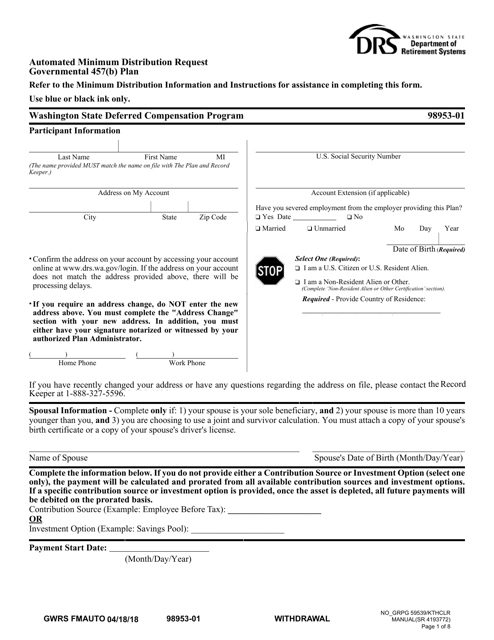

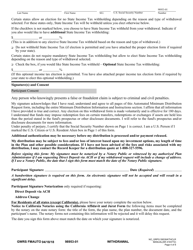

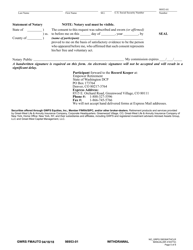

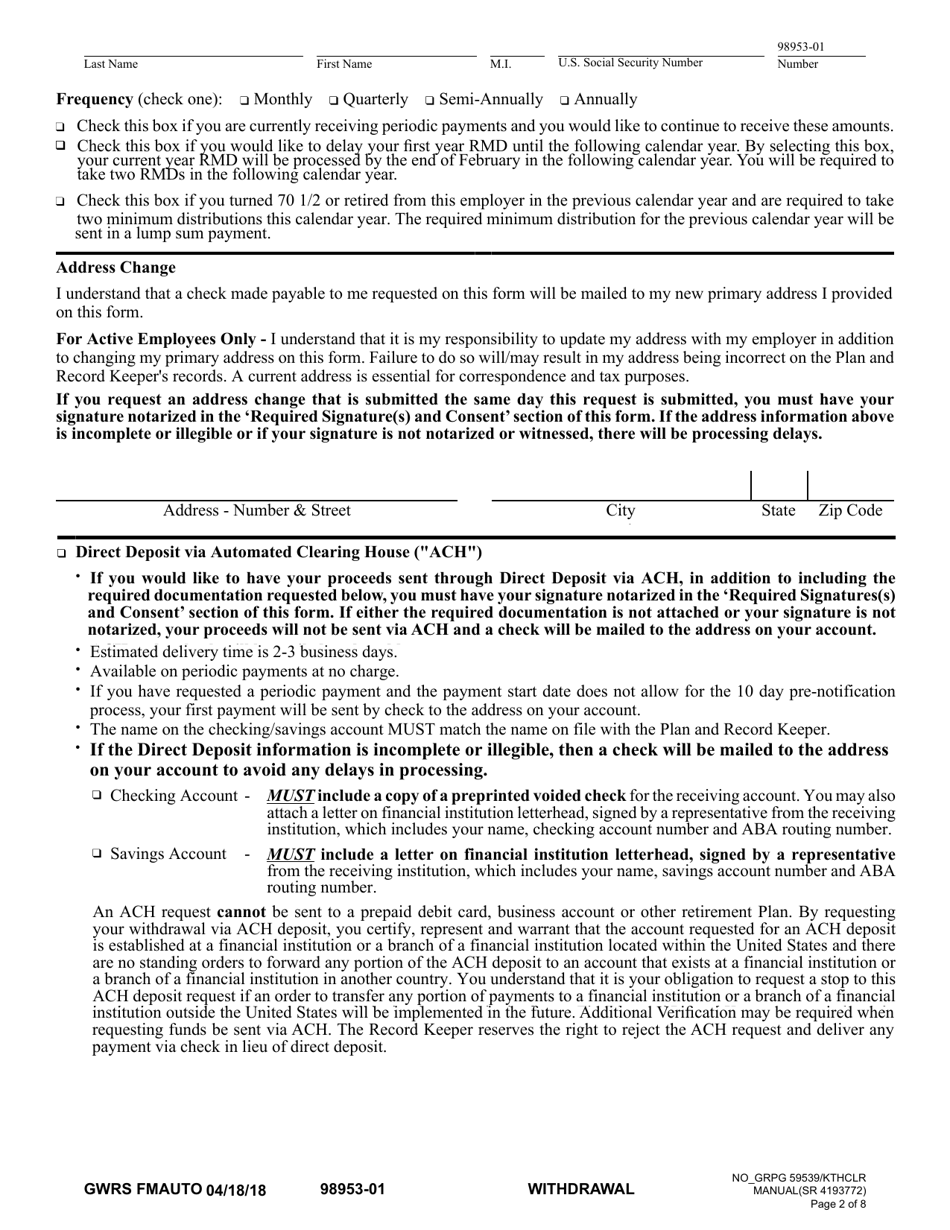

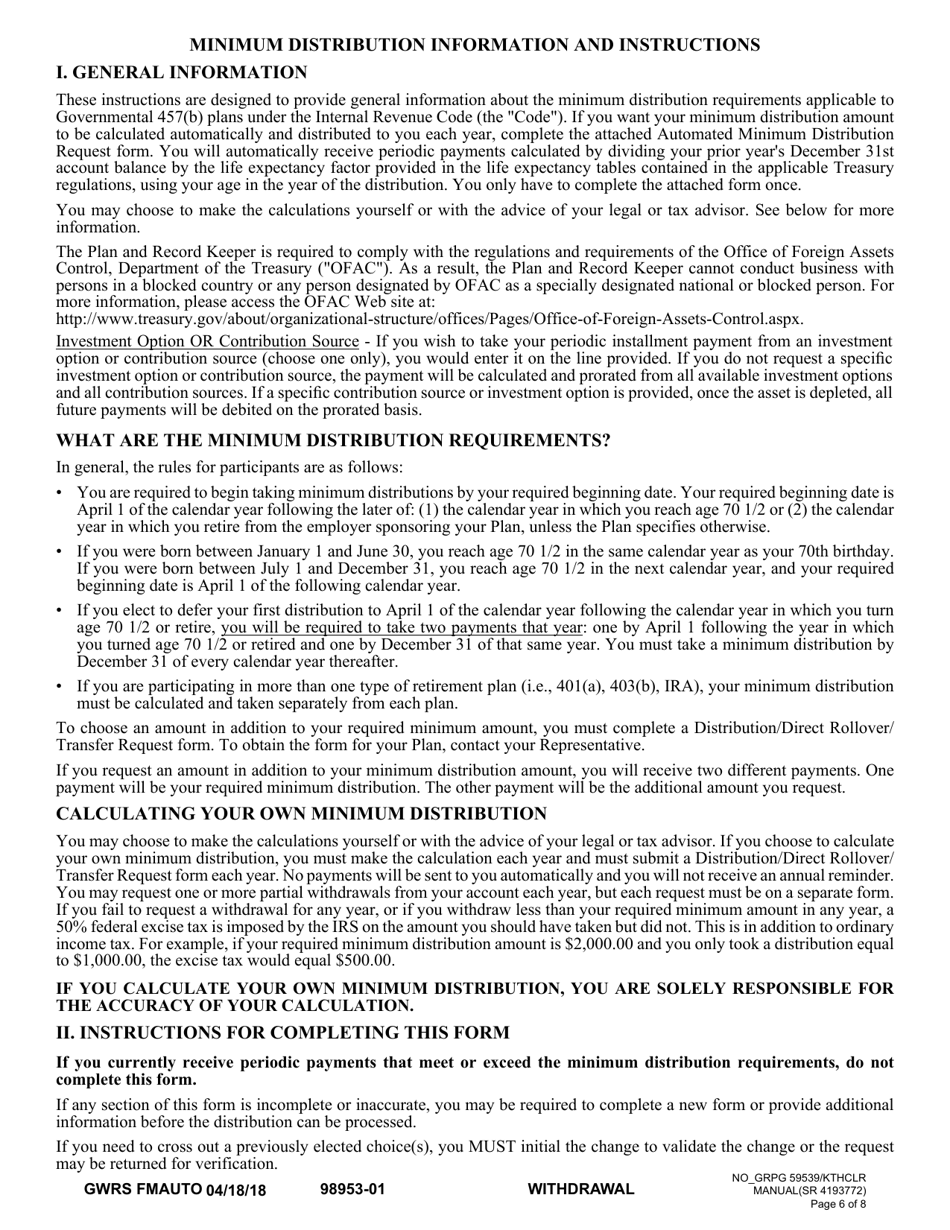

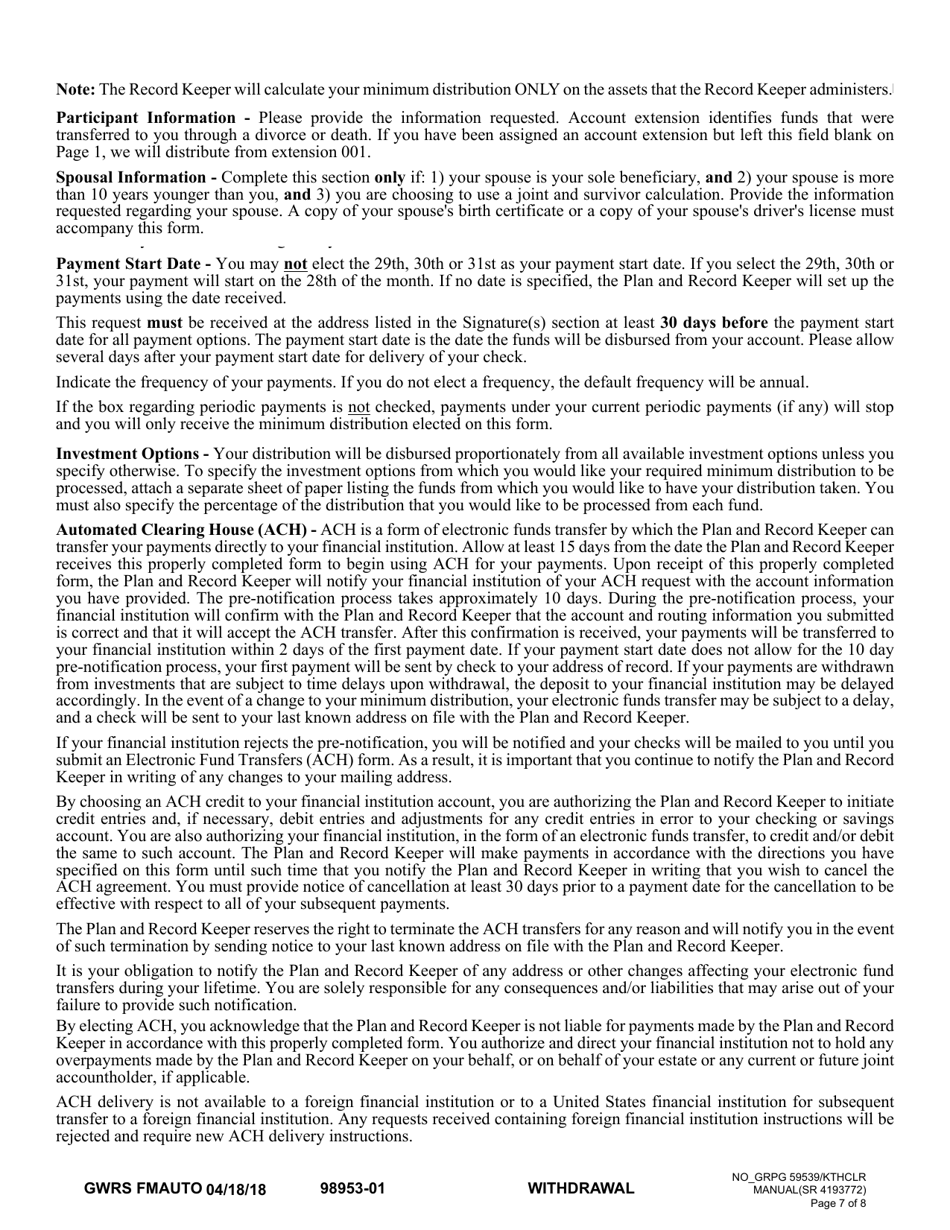

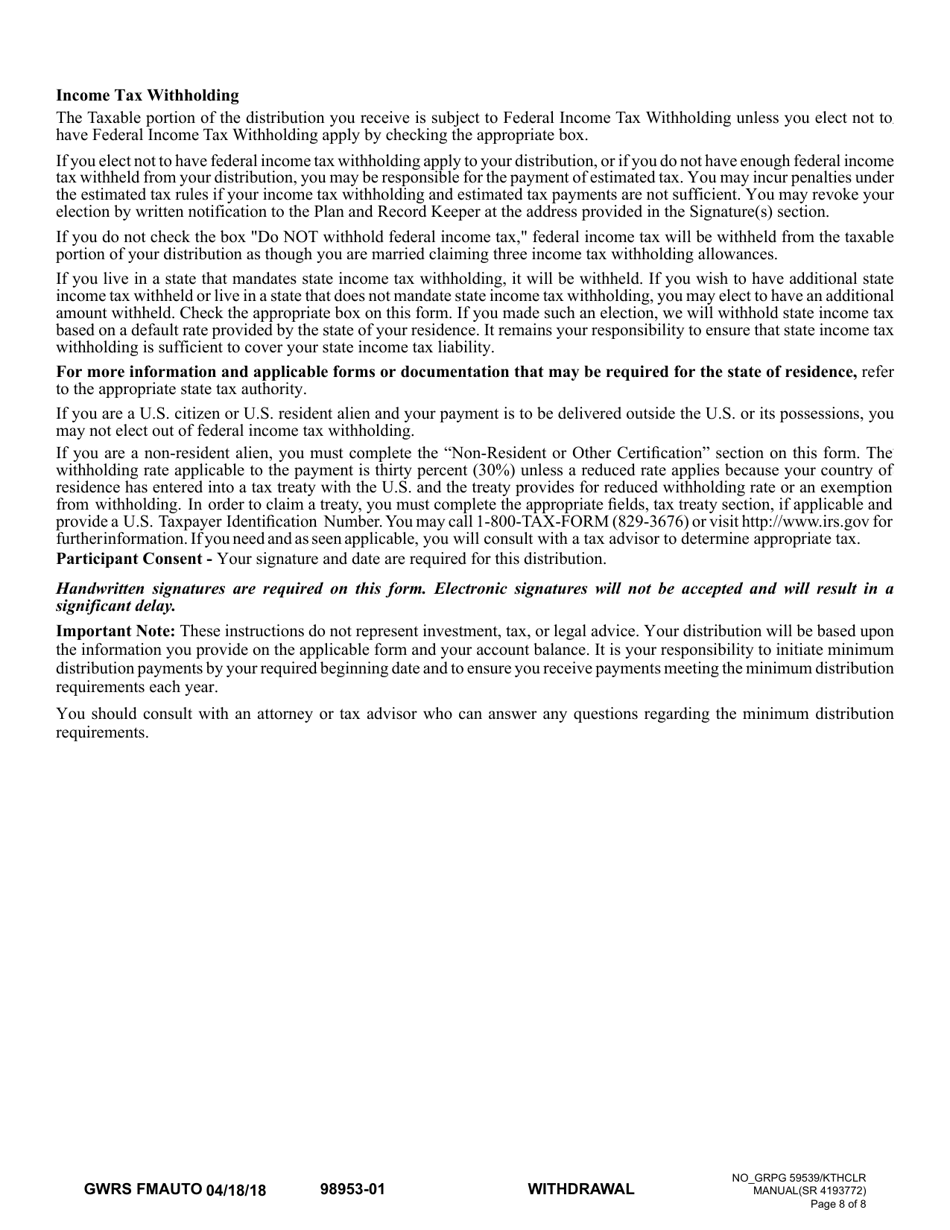

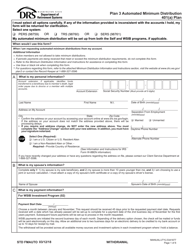

Automated Minimum Distribution Request Governmental 457(B) Plan - Washington

Automated Minimum Distribution Request Governmental 457(B) Plan is a legal document that was released by the Washington State Department of Retirement Systems - a government authority operating within Washington.

FAQ

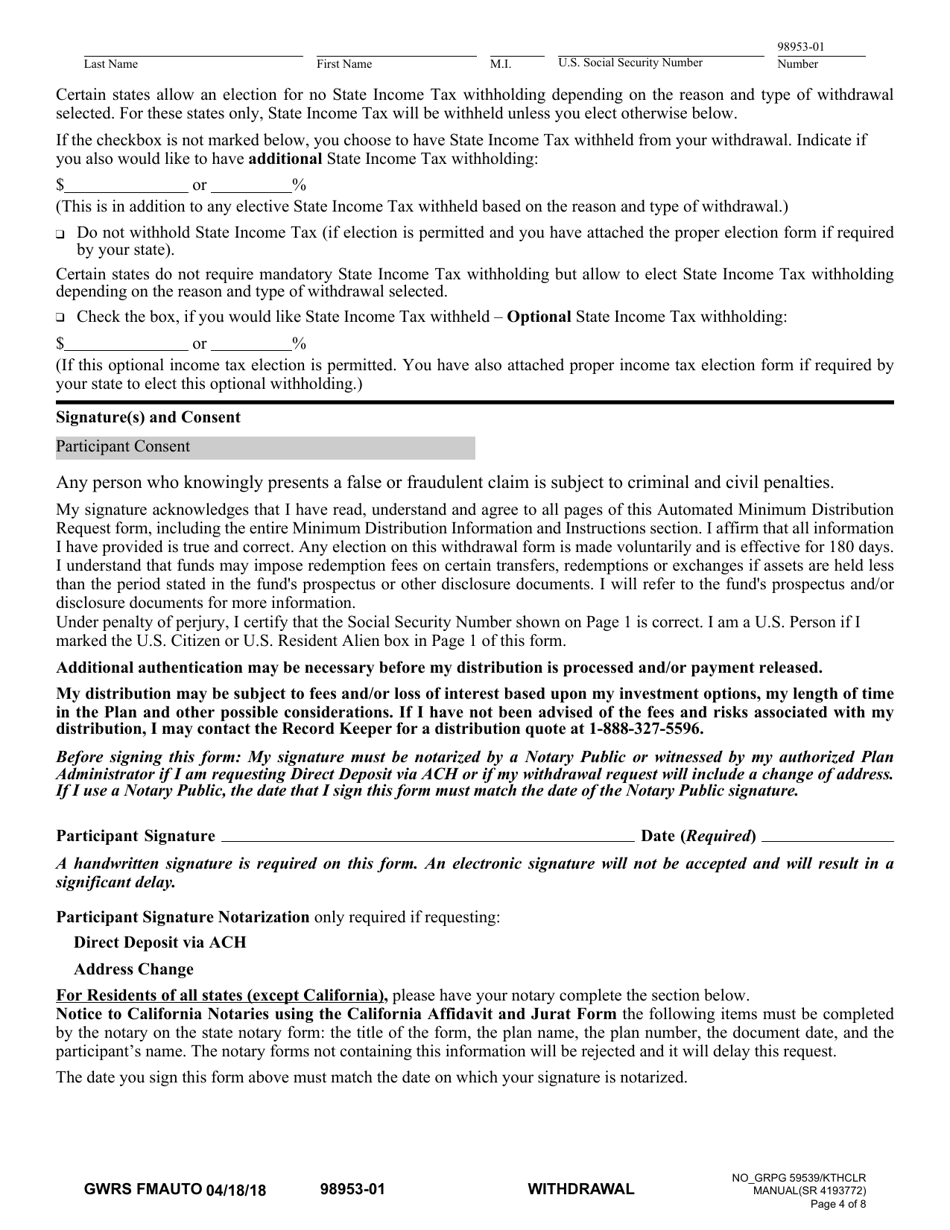

Q: What is an Automated Minimum Distribution Request Governmental 457(B) plan?

A: An Automated Minimum Distribution Request Governmental 457(B) plan is a retirement plan offered by the government for eligible employees.

Q: Who is eligible for the Automated Minimum Distribution Request Governmental 457(B) plan in Washington?

A: Eligible employees of the government in Washington can participate in the plan.

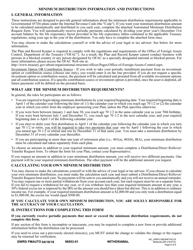

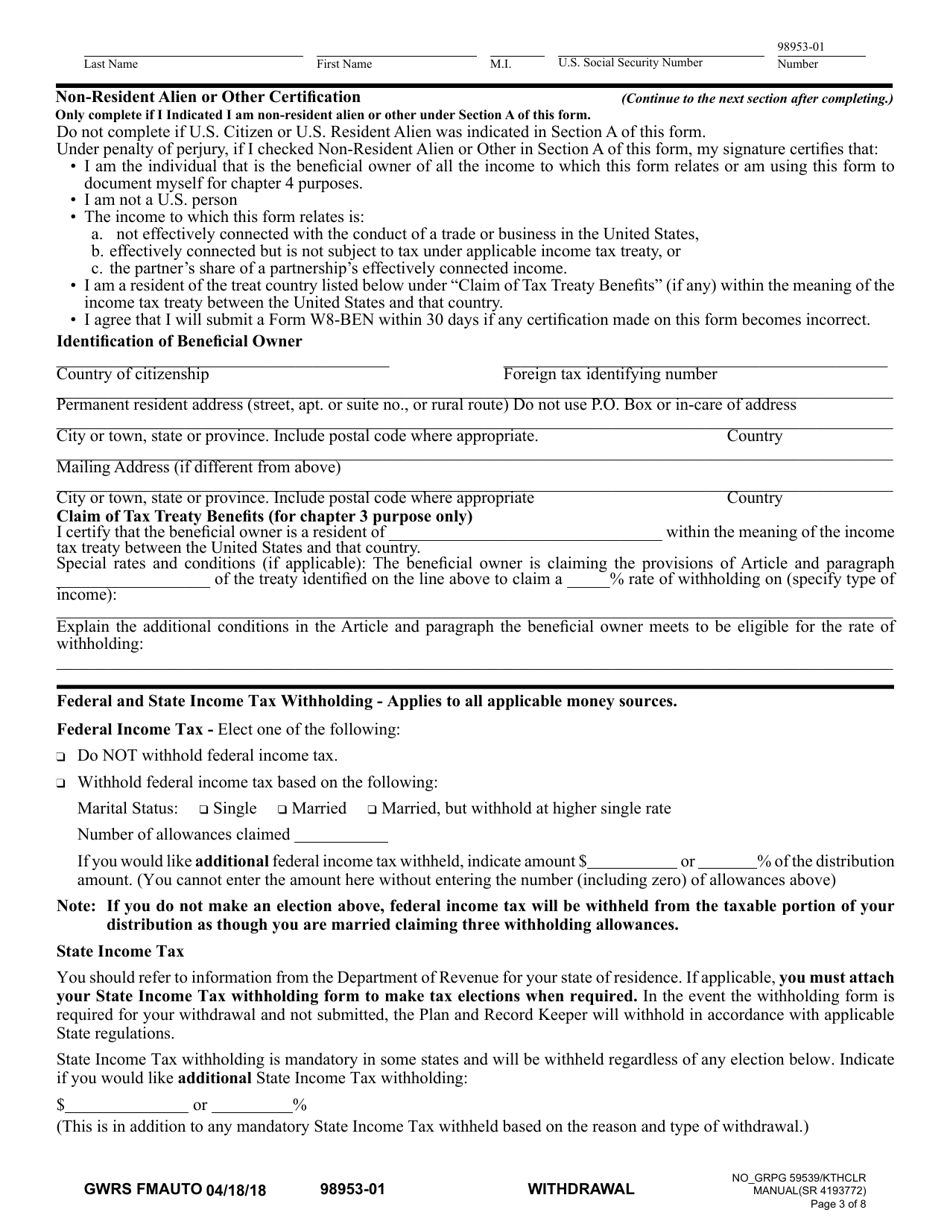

Q: What is a minimum distribution request?

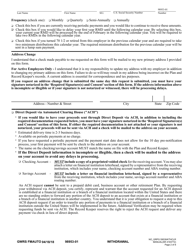

A: A minimum distribution request refers to the amount of money that must be withdrawn from a retirement account by a certain age to avoid penalties.

Q: Is the Automated Minimum Distribution Request Governmental 457(B) plan specific to Washington state?

A: No, the plan is available to eligible government employees in other states as well.

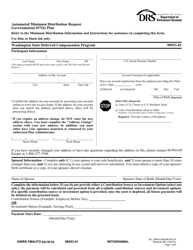

Q: How does the Automated Minimum Distribution Request Governmental 457(B) plan work?

A: Employees contribute a portion of their salary to the plan, which is then invested and grows tax-deferred until retirement. They can then make minimum distribution requests to withdraw money from the account.

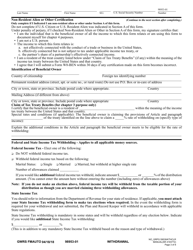

Q: Are there any penalties for not making minimum distribution requests?

A: Yes, failing to make minimum distribution requests can result in penalties and taxes on the withdrawn amount.

Q: Can the Automated Minimum Distribution Request Governmental 457(B) plan be rolled over into another retirement account?

A: Yes, participants can roll over the funds from the plan into another eligible retirement account, such as an IRA or a new employer's retirement plan.

Q: Are there any contribution limits for the Automated Minimum Distribution Request Governmental 457(B) plan?

A: Yes, there are annual contribution limits set by the IRS for this type of plan.

Q: Can the Automated Minimum Distribution Request Governmental 457(B) plan be accessed before retirement?

A: In most cases, withdrawals from the plan can only be made after retirement or separation from service.

Q: Is the Automated Minimum Distribution Request Governmental 457(B) plan taxable?

A: Yes, withdrawals from the plan are generally taxable as ordinary income.

Form Details:

- Released on April 18, 2018;

- The latest edition currently provided by the Washington State Department of Retirement Systems;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Washington State Department of Retirement Systems.