This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

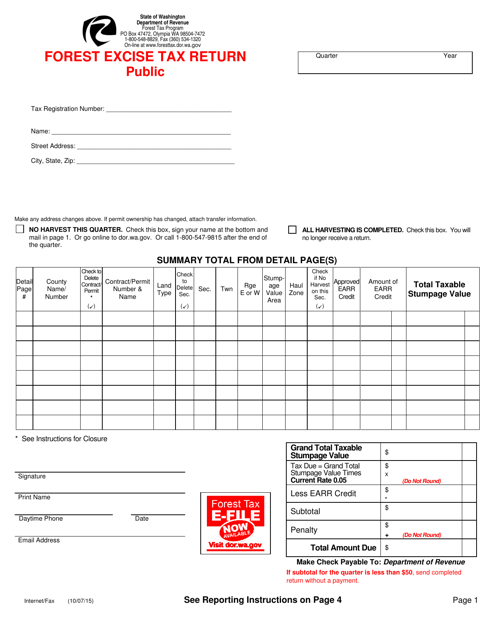

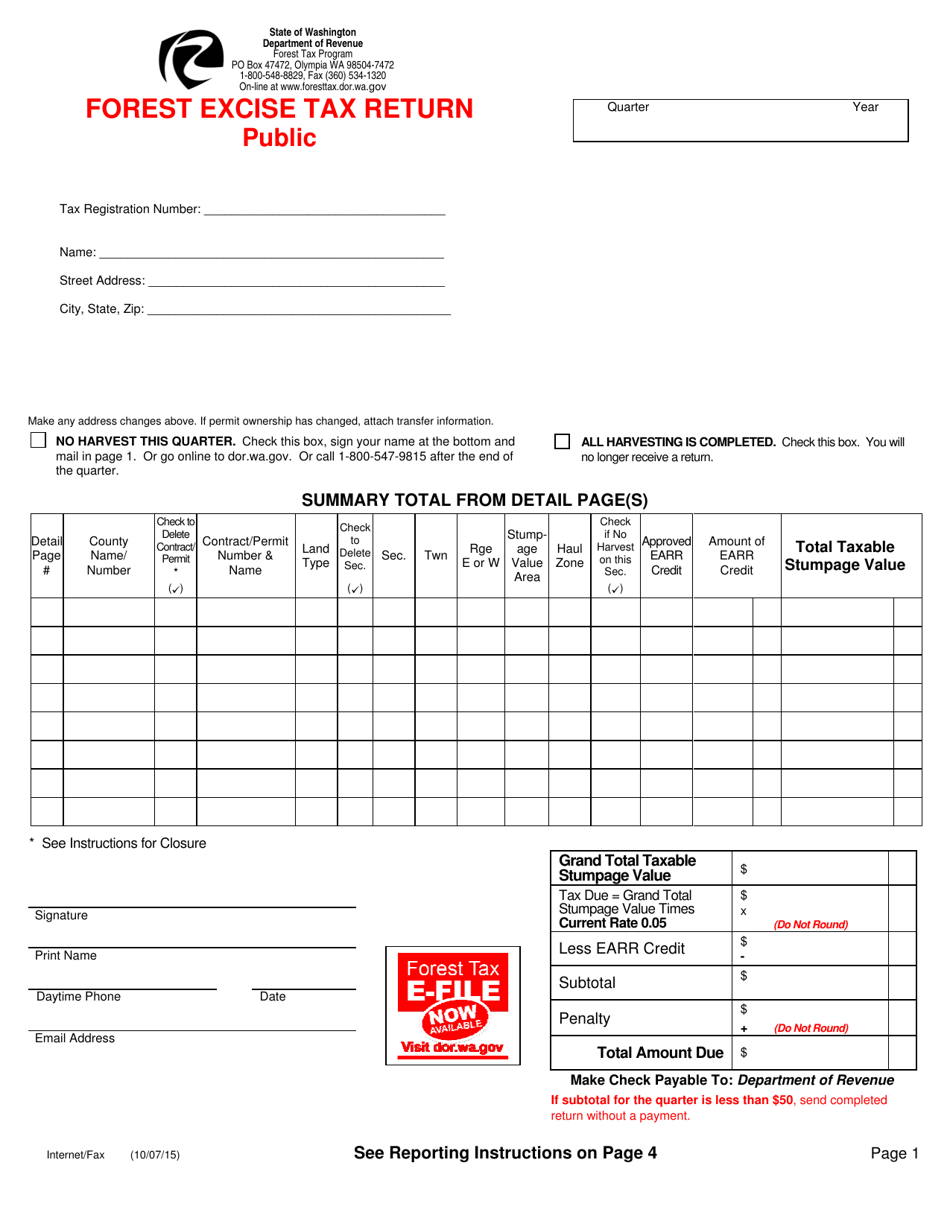

Public Harvester Forest Excise Tax Return - Washington

Public Harvester Forest Excise Tax Return is a legal document that was released by the Washington State Department of Revenue - a government authority operating within Washington.

FAQ

Q: What is the Public Harvester Forest Excise Tax Return?

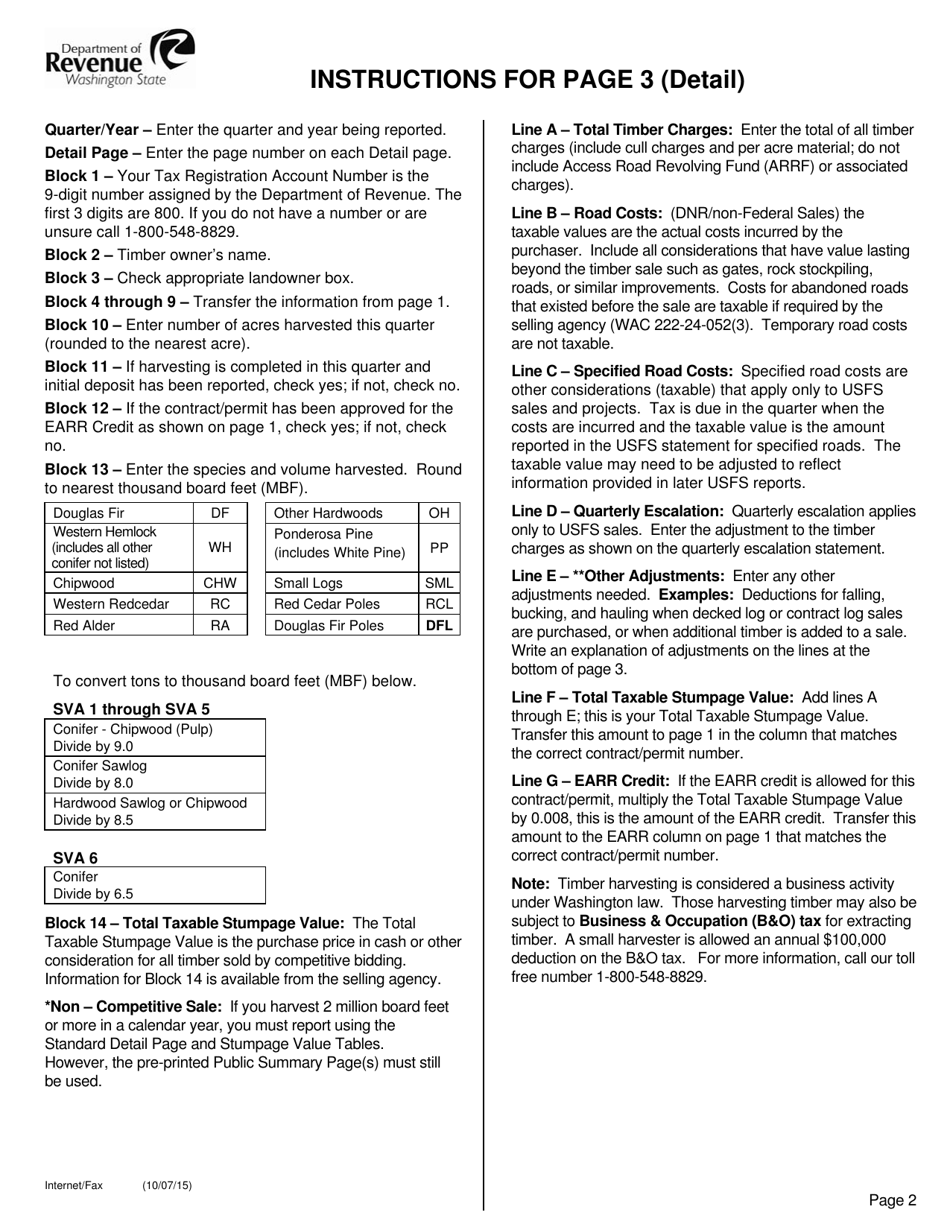

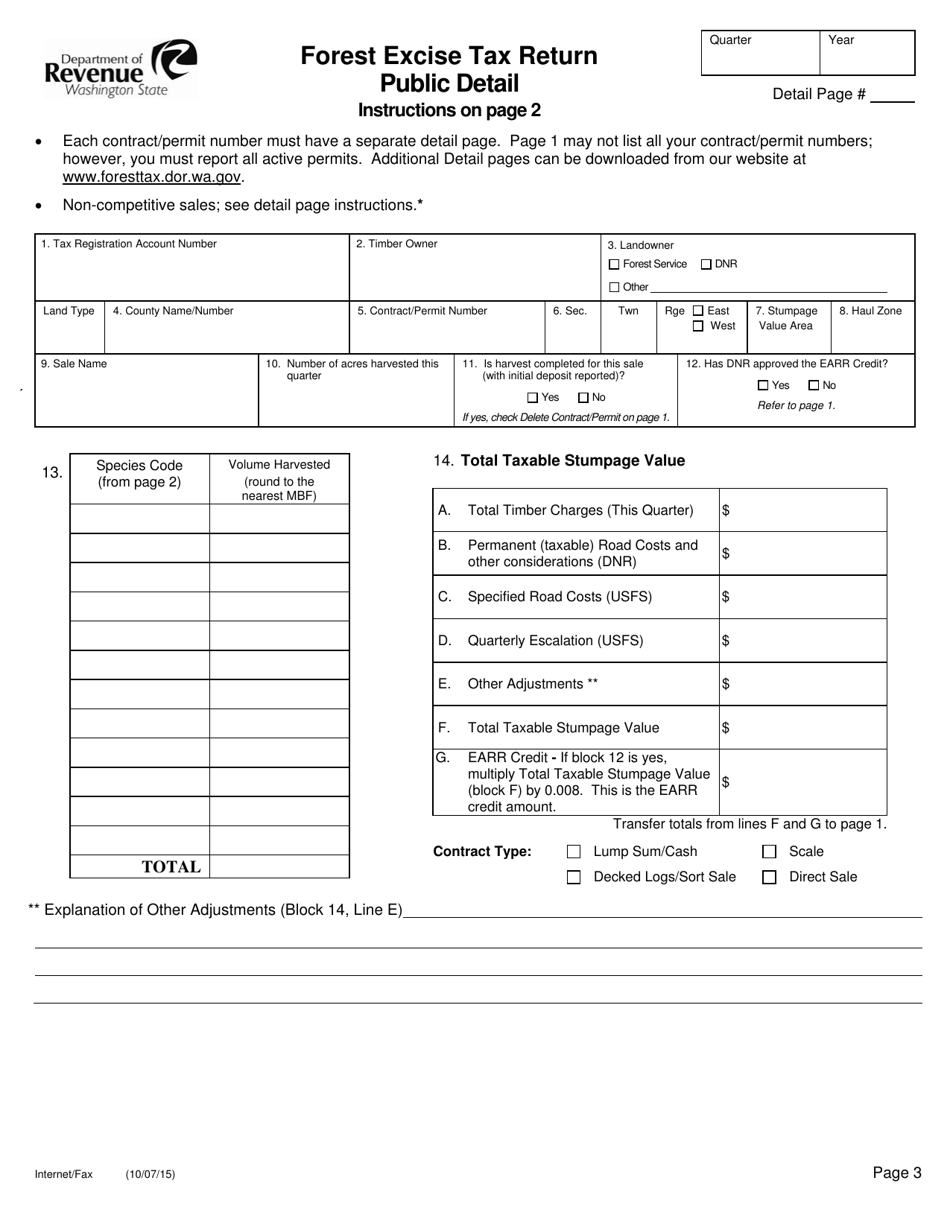

A: The Public Harvester Forest Excise Tax Return is a tax form used in the state of Washington to report and pay the excise tax on timber harvested from public lands.

Q: Who needs to file the Public Harvester Forest Excise Tax Return?

A: Individuals or businesses who harvest timber from public lands in Washington need to file the Public Harvester Forest Excise Tax Return.

Q: How often do I need to file the Public Harvester Forest Excise Tax Return?

A: The Public Harvester Forest Excise Tax Return is filed quarterly.

Q: What is the purpose of the excise tax on timber harvested from public lands?

A: The excise tax on timber harvested from public lands helps generate revenue for the state and supports the management and preservation of public forests.

Q: How do I calculate the amount of excise tax owed?

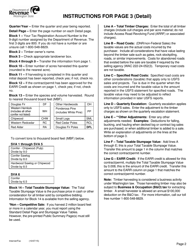

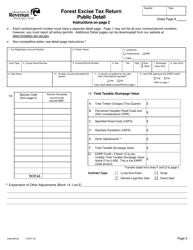

A: The amount of excise tax owed is calculated based on the volume or value of timber harvested from public lands, as specified in the Washington Administrative Code.

Q: Are there any exemptions or credits available for the excise tax on timber harvested from public lands?

A: Yes, there are certain exemptions and credits available for the excise tax on timber harvested from public lands, such as the Small Forest Landowner Exemption or the Forest Products Harvested by Tribes Credit. These exemptions and credits are subject to specific eligibility criteria.

Form Details:

- Released on October 7, 2015;

- The latest edition currently provided by the Washington State Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.