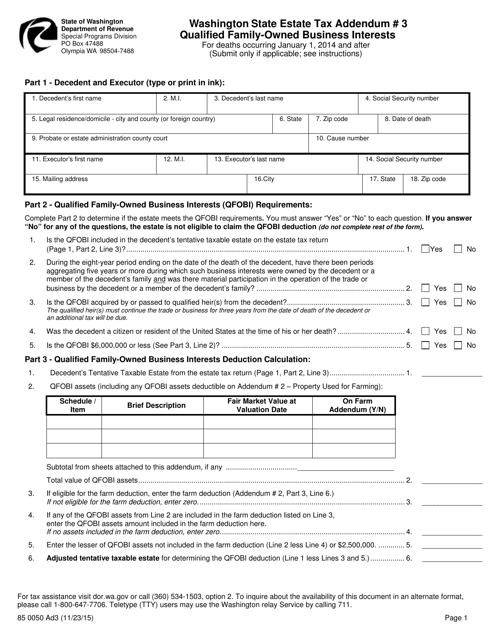

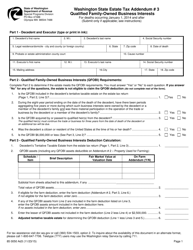

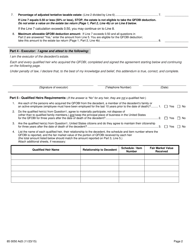

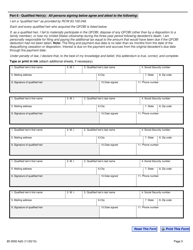

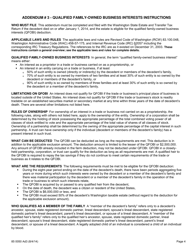

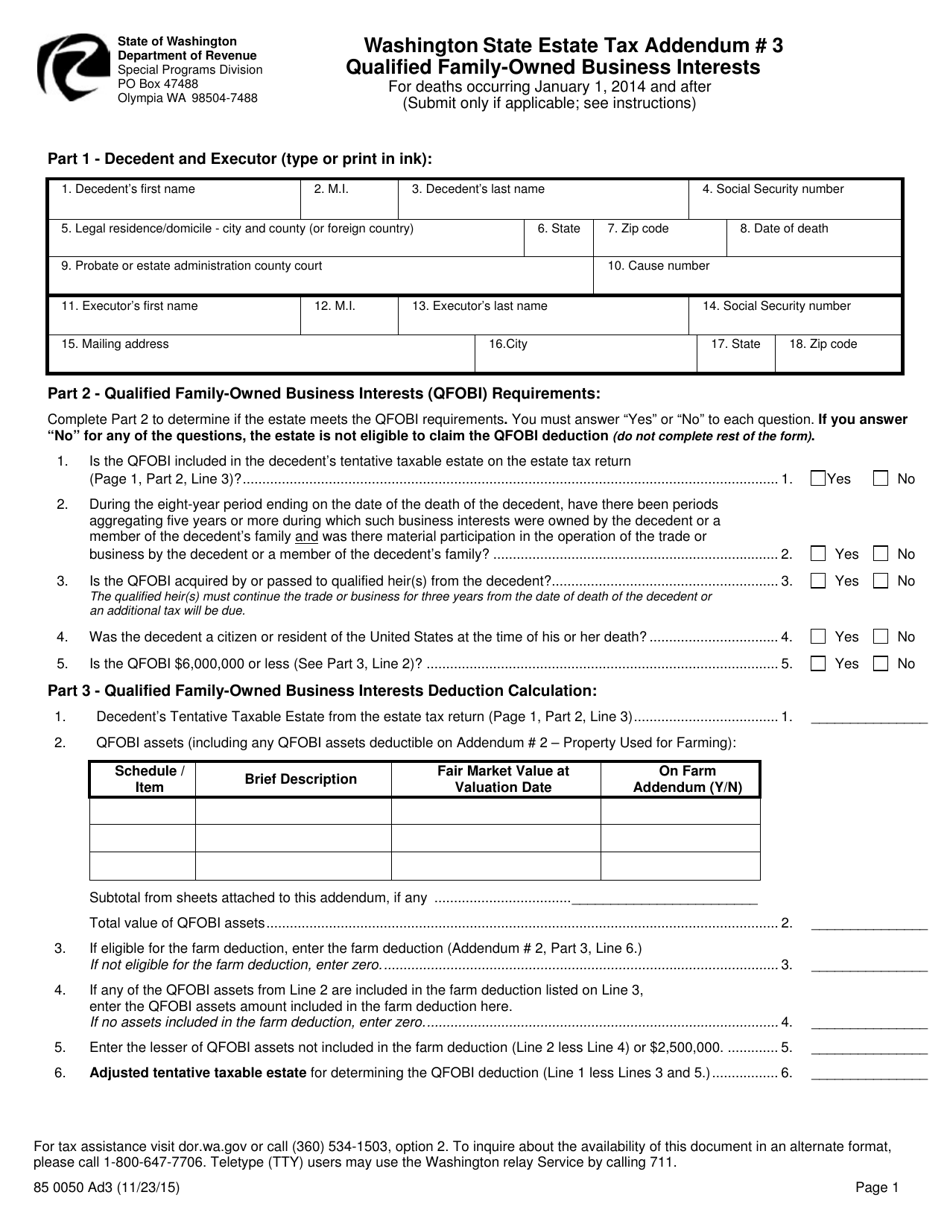

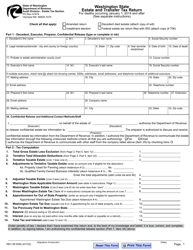

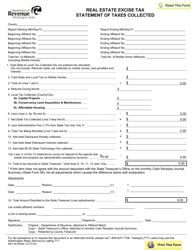

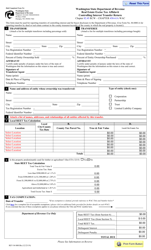

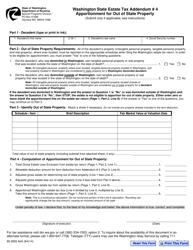

Form 85 0050 Washington State Estate Tax Addendum 3 - Qualified Family-Owned Business Interests - Washington

What Is Form 85 0050?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

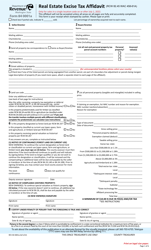

Q: What is Form 85 0050?

A: Form 85 0050 is the Washington State Estate Tax Addendum 3 - Qualified Family-Owned Business Interests.

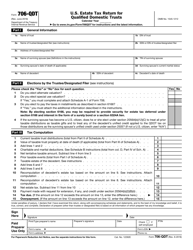

Q: What does the form cover?

A: The form covers qualified family-owned business interests in Washington for estate tax purposes.

Q: Who should use this form?

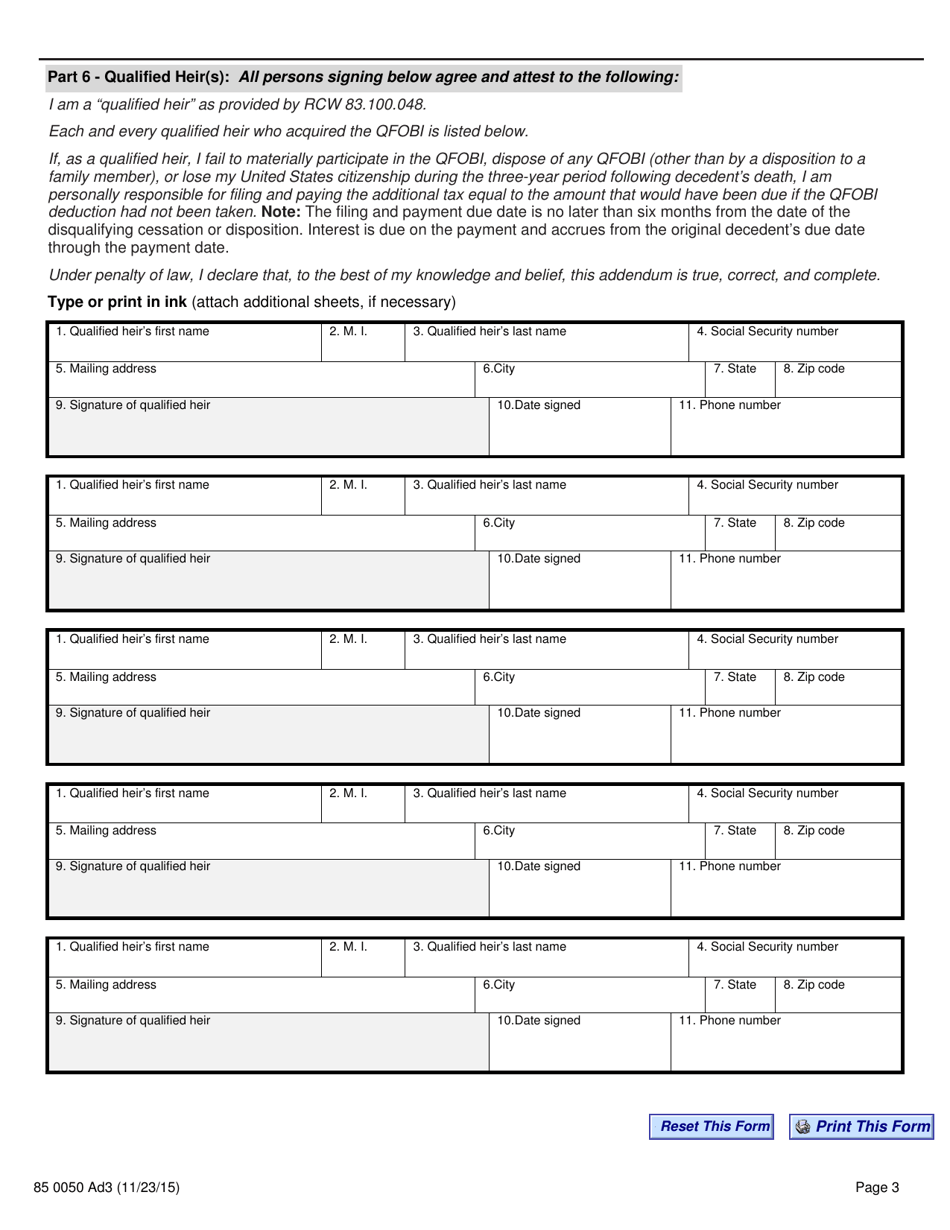

A: This form should be used by individuals who have qualified family-owned business interests and are subject to the Washington State Estate Tax.

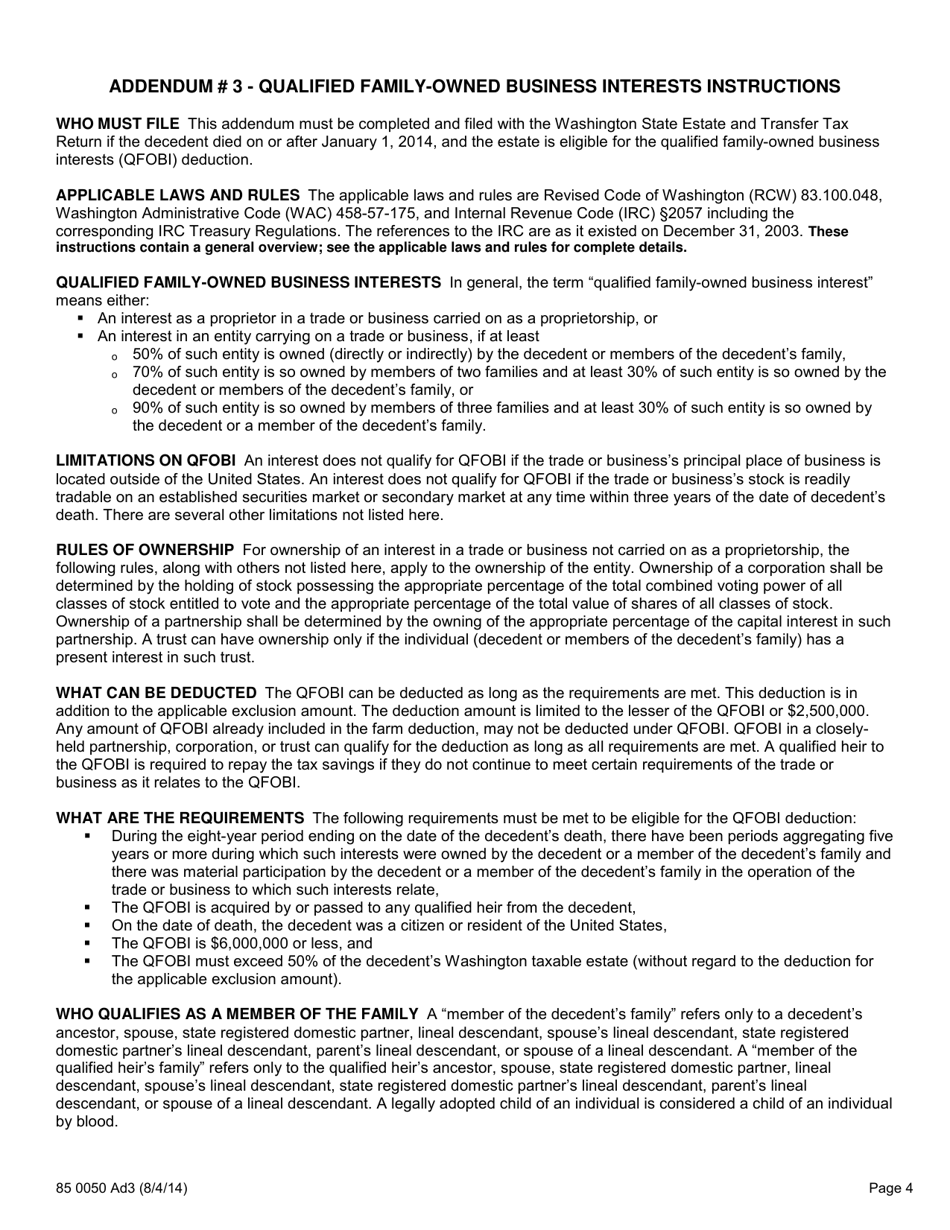

Q: What is a qualified family-owned business interest?

A: A qualified family-owned business interest refers to an interest in a business that meets certain criteria, including being actively engaged in business operations and being owned by the decedent's family members.

Q: Why is the form important?

A: The form is important because it allows individuals to claim certain exemptions and deductions related to qualified family-owned business interests for the Washington State Estate Tax.

Form Details:

- Released on November 23, 2015;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 85 0050 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.