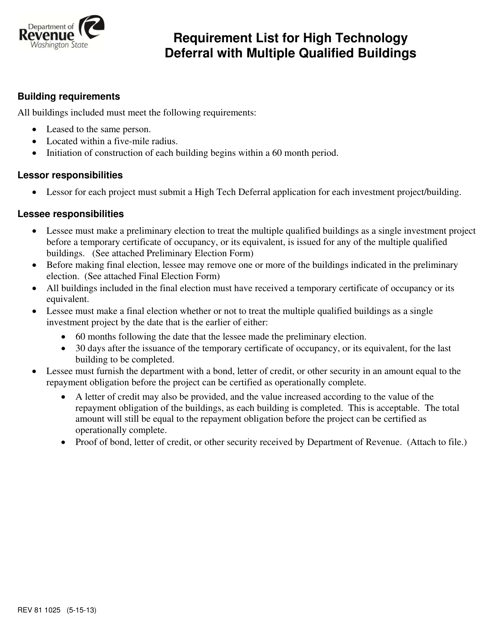

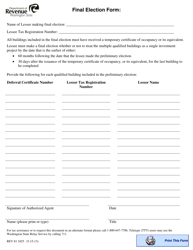

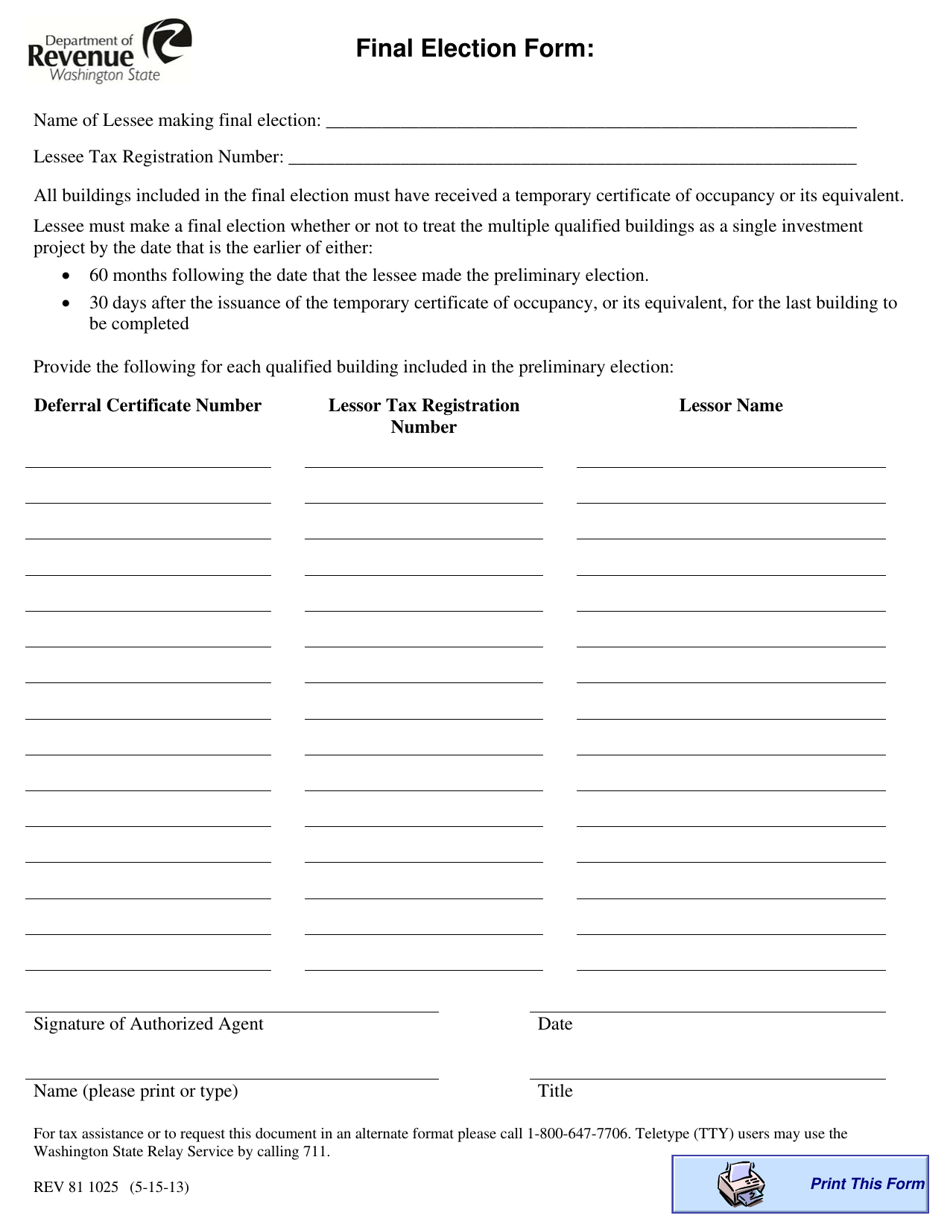

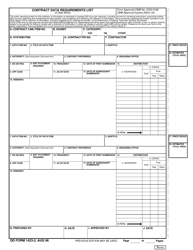

Form REV81 1025H Requirement List for High Technology Deferral With Multiple Qualified Buildings - Washington

What Is Form REV81 1025H?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV81 1025H?

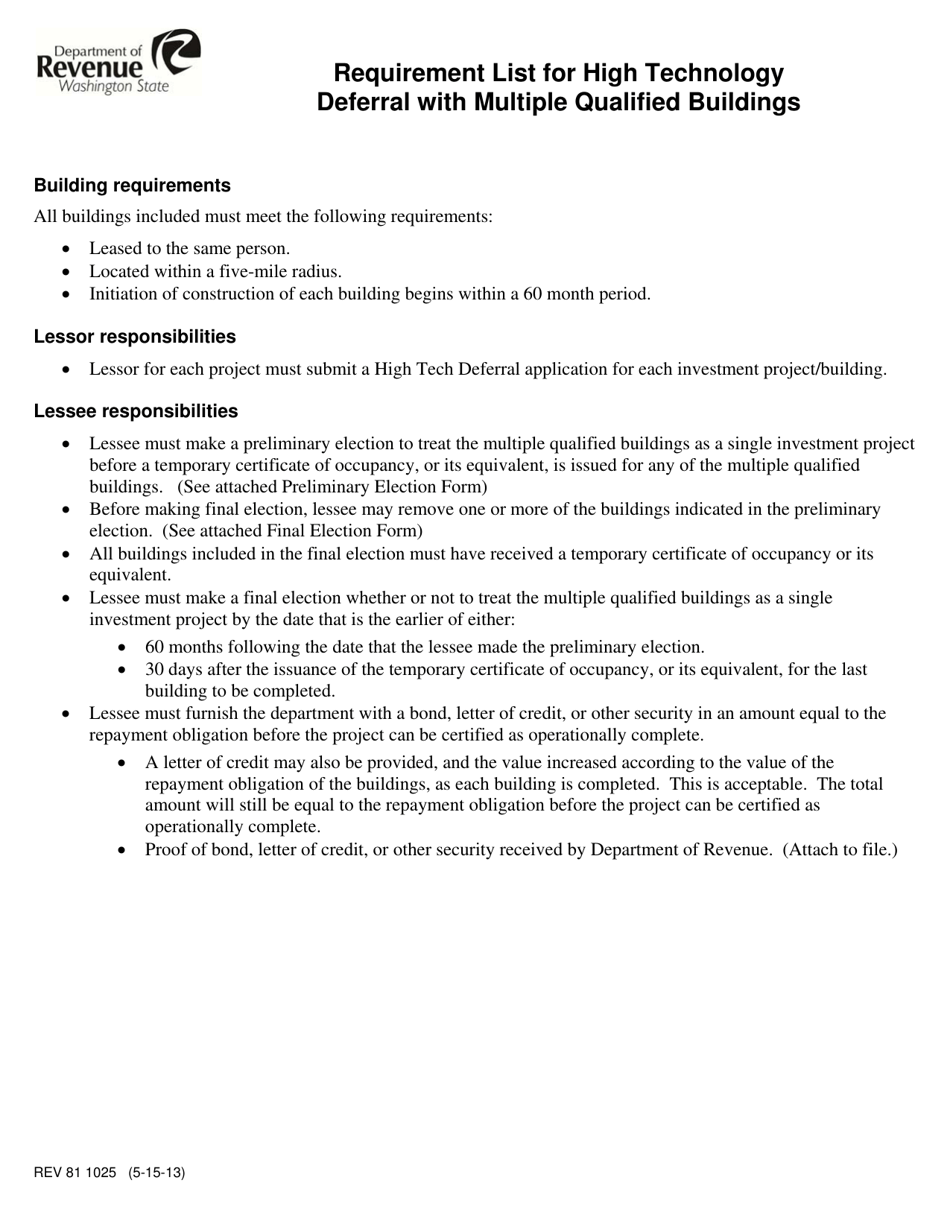

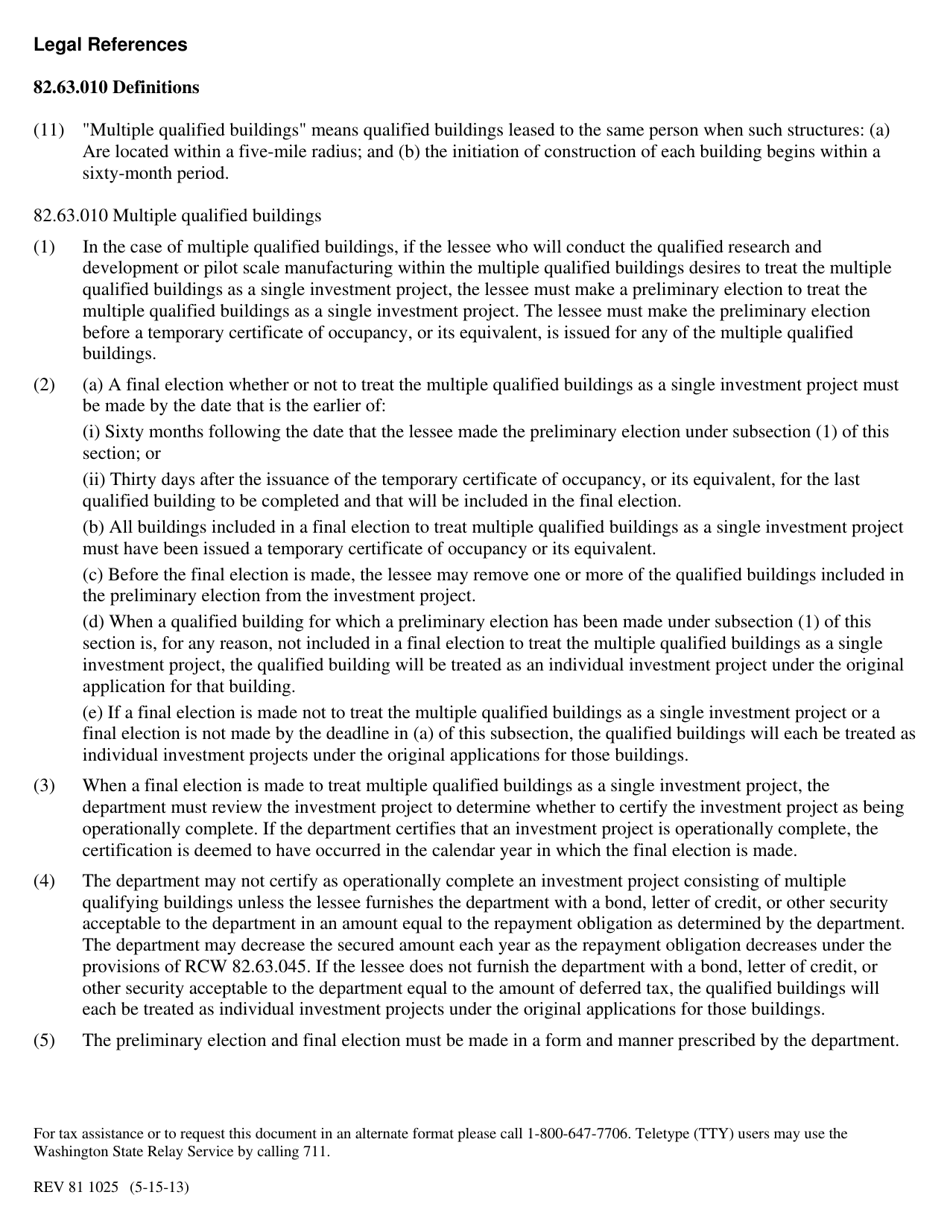

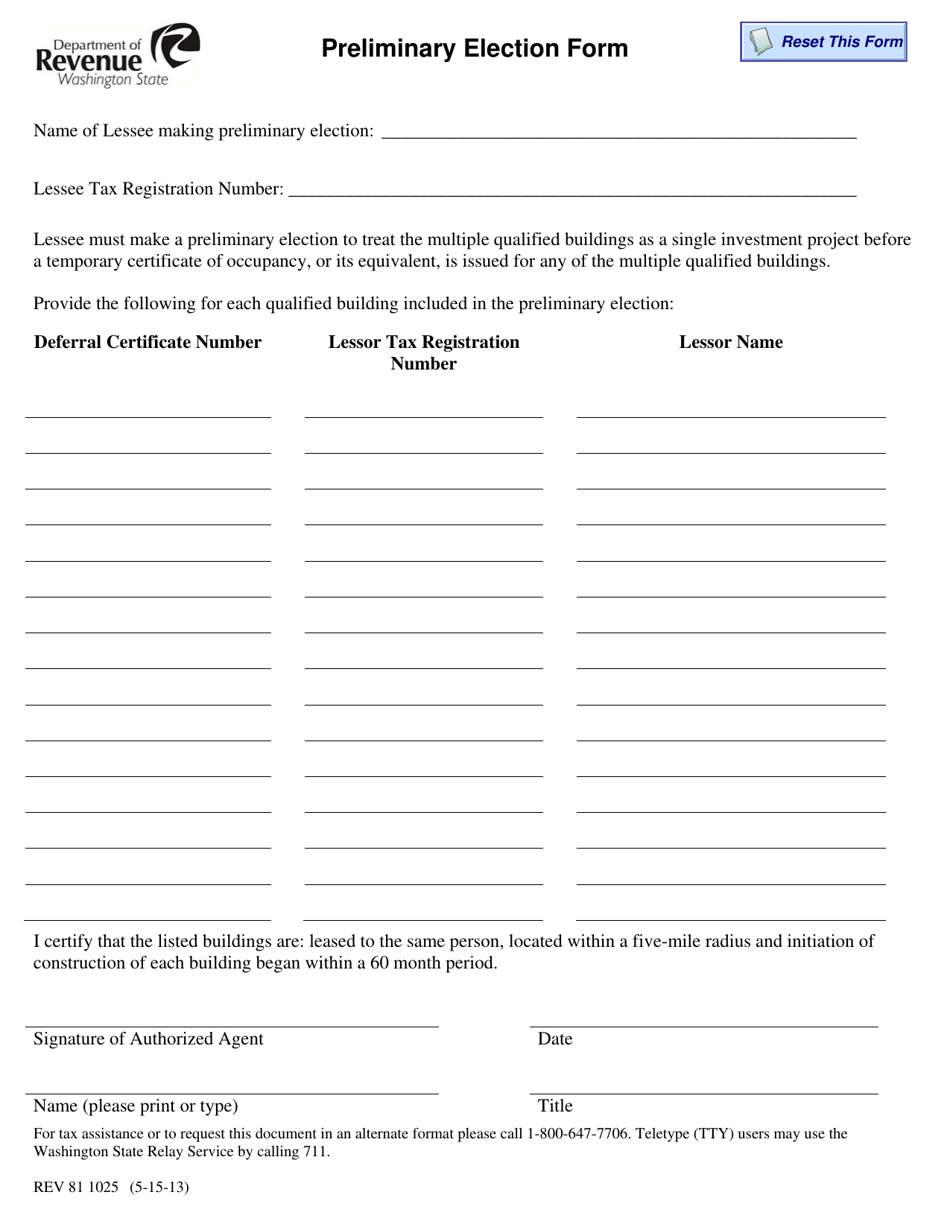

A: Form REV81 1025H is a requirement list for High Technology Deferral with Multiple Qualified Buildings in Washington.

Q: What is High Technology Deferral?

A: High Technology Deferral is a program in Washington that allows businesses to defer paying property taxes on certain high-tech equipment and facilities.

Q: What are Multiple Qualified Buildings?

A: Multiple Qualified Buildings are buildings that meet the criteria for High Technology Deferral and are used for high-tech business activities.

Q: What is the purpose of Form REV81 1025H?

A: The purpose of Form REV81 1025H is to provide a list of requirements and documentation needed to apply for High Technology Deferral with Multiple Qualified Buildings.

Q: Who needs to fill out Form REV81 1025H?

A: Businesses that have multiple qualified buildings and want to apply for High Technology Deferral in Washington need to fill out Form REV81 1025H.

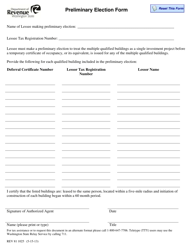

Form Details:

- Released on May 15, 2013;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV81 1025H by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.