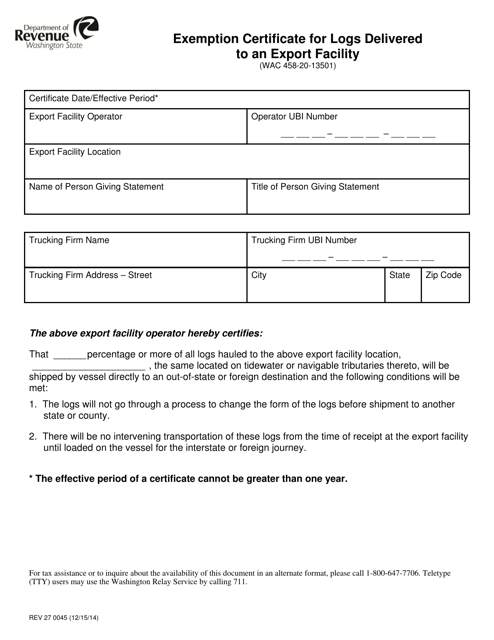

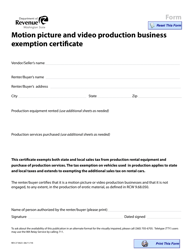

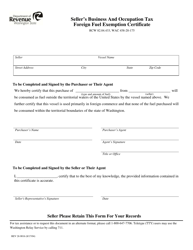

Form REV27 0045 Exemption Certificate for Logs Delivered to an Export Facility - Washington

What Is Form REV27 0045?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV27 0045?

A: Form REV27 0045 is the Exemption Certificate for Logs Delivered to an Export Facility in Washington.

Q: What is the purpose of Form REV27 0045?

A: The purpose of Form REV27 0045 is to claim an exemption from paying certain taxes on logs delivered to an export facility in Washington.

Q: Who needs to use Form REV27 0045?

A: Loggers and sellers of logs who want to claim an exemption from taxes on logs delivered to an export facility in Washington need to use Form REV27 0045.

Q: What taxes are exempted with Form REV27 0045?

A: Form REV27 0045 exempts the Washington Forest Products Fee, the state and local sales tax, and the state and local use tax on logs delivered to an export facility in Washington.

Q: Do I need to provide any supporting documents with Form REV27 0045?

A: Yes, you will need to provide a copy of the scale ticket for each load delivered to the export facility.

Q: Is Form REV27 0045 specific to Washington?

A: Yes, Form REV27 0045 is specific to logs delivered to an export facility in Washington.

Q: Are there any fees associated with filing Form REV27 0045?

A: No, there are no fees associated with filing Form REV27 0045.

Q: How often do I need to file Form REV27 0045?

A: Form REV27 0045 should be filed on a monthly basis.

Form Details:

- Released on December 15, 2014;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV27 0045 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.