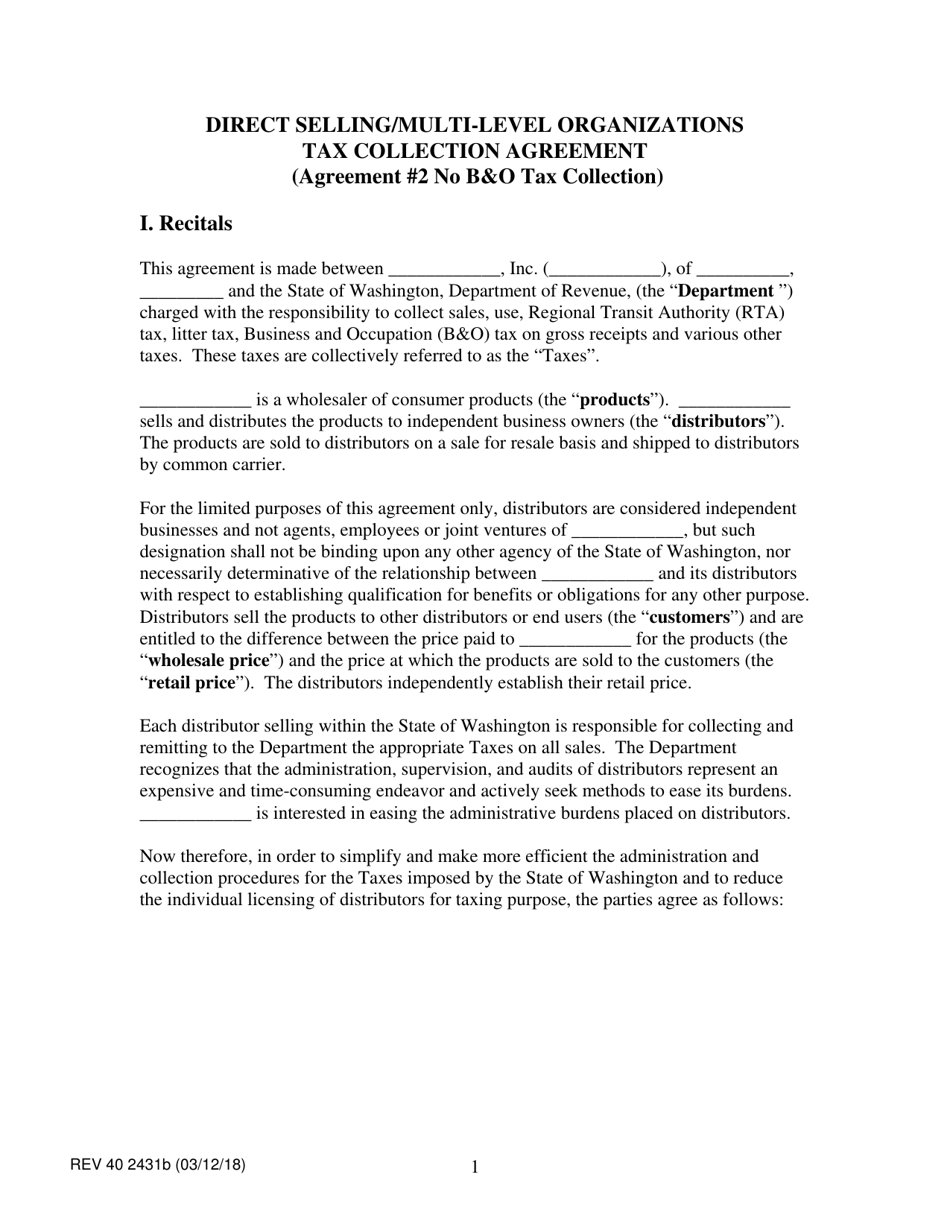

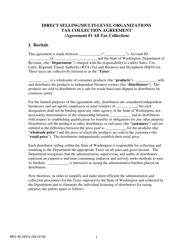

Form REV40 2431B Direct Selling / Multi-Level Organizations Tax Collection Agreement - Washington

What Is Form REV40 2431B?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the REV40 2431B form?

A: The REV40 2431B form is the Direct Selling/Multi-Level Organizations Tax Collection Agreement in the state of Washington.

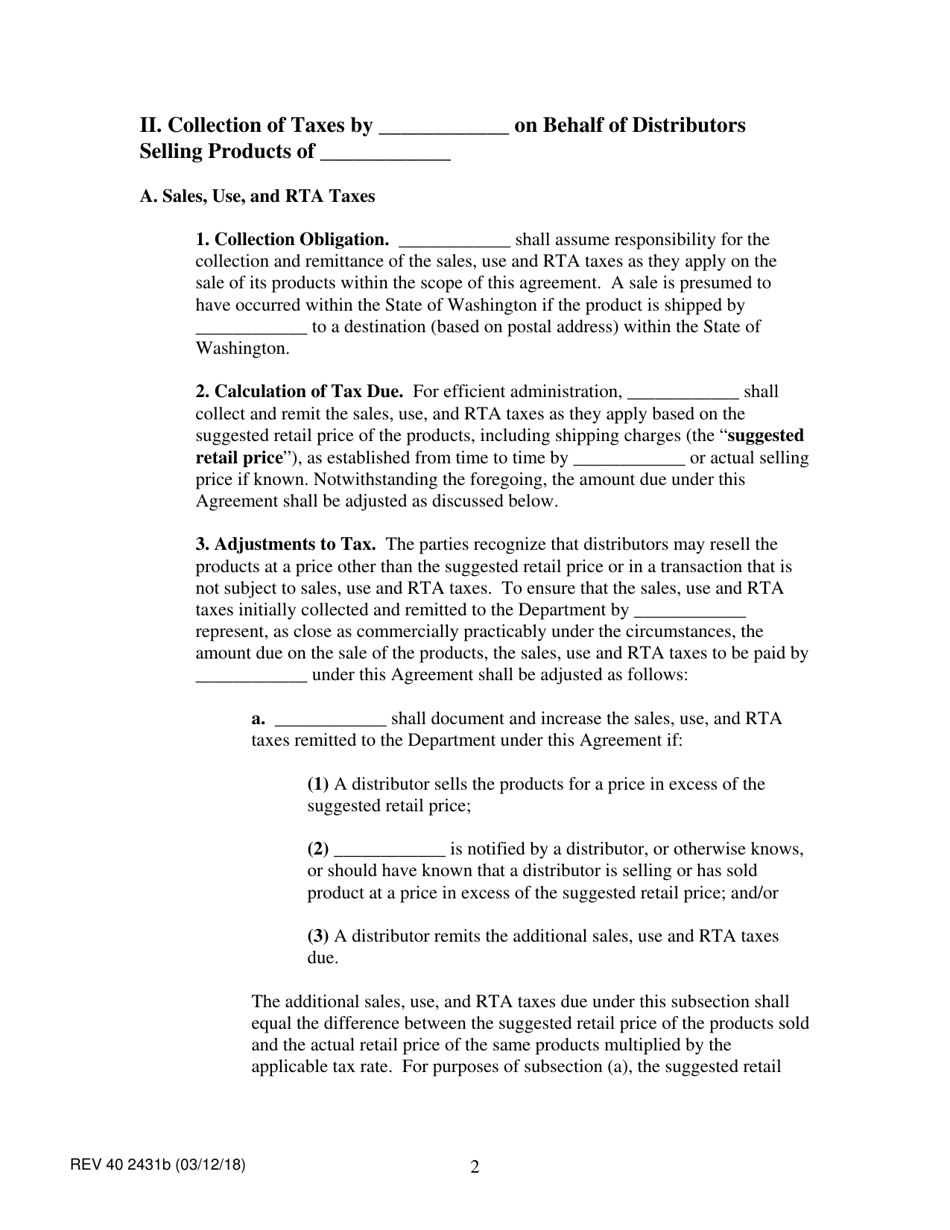

Q: Who needs to fill out this form?

A: Direct Selling/Multi-Level Organizations operating in Washington need to fill out this form.

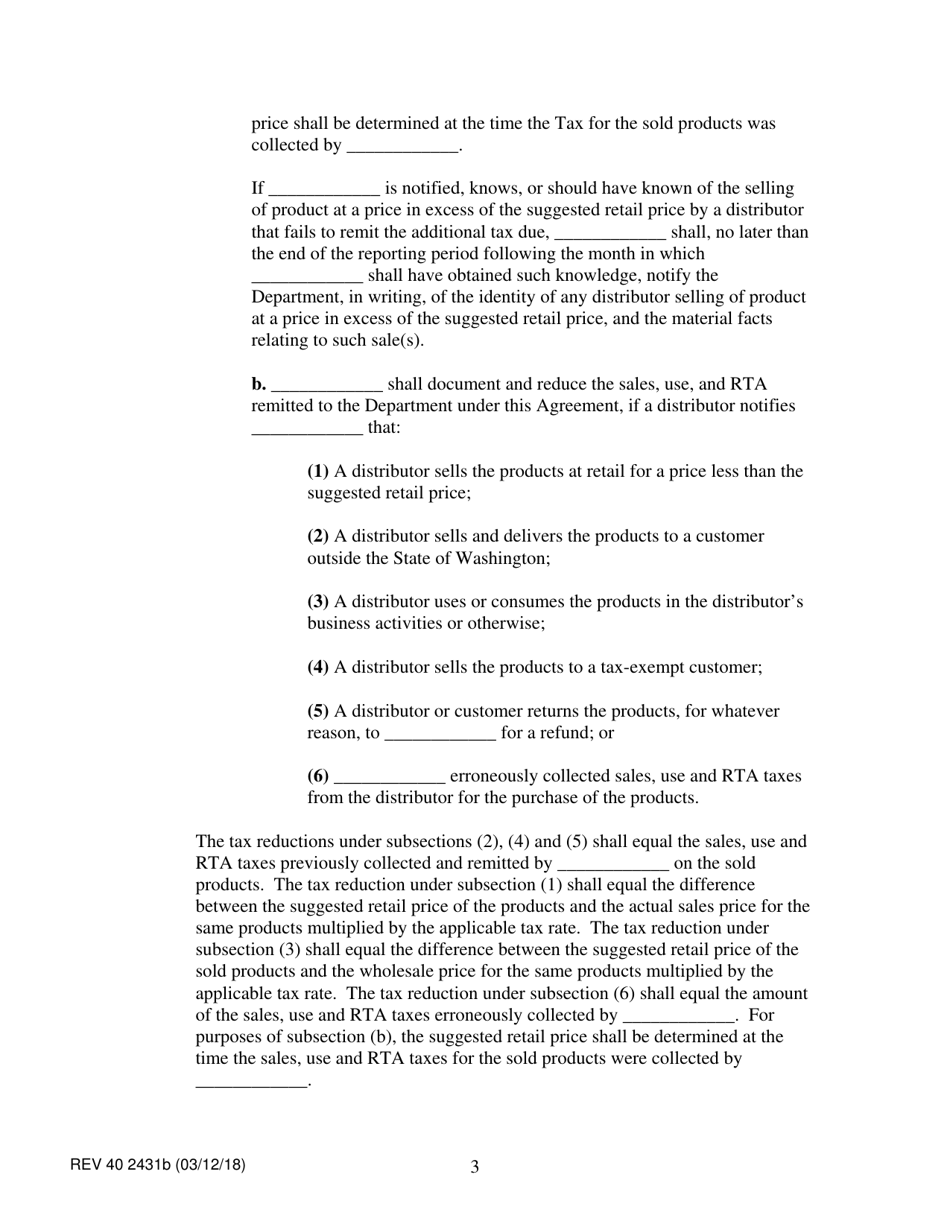

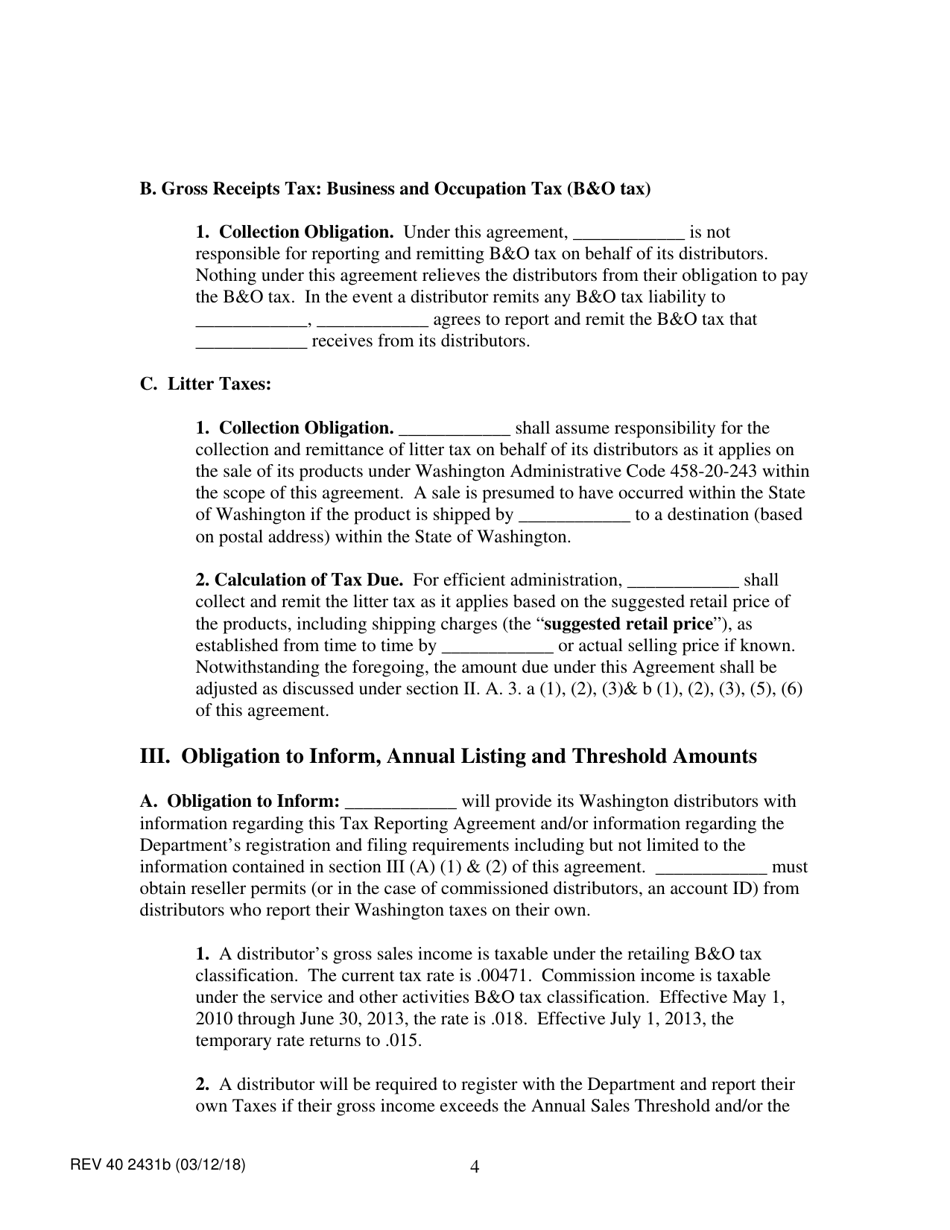

Q: What is the purpose of this form?

A: The purpose of this form is to establish an agreement between the Direct Selling/Multi-Level Organization and the Washington Department of Revenue for the collection and remittance of sales tax.

Q: Is this form mandatory?

A: Yes, Direct Selling/Multi-Level Organizations operating in Washington are required to fill out this form.

Q: Are there any fees associated with this form?

A: There are no fees associated with filling out this form.

Q: What should I do once I have filled out this form?

A: Once you have filled out this form, you should submit it to the Washington Department of Revenue.

Q: Is there any additional documentation required?

A: There may be additional documentation required depending on the specific circumstances of your Direct Selling/Multi-Level Organization.

Form Details:

- Released on March 12, 2018;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV40 2431B by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.