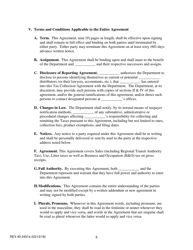

Form REV40 2431A Direct Selling / Multi-Level Organizations Tax Collection Agreement - Washington

What Is Form REV40 2431A?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV40 2431A?

A: Form REV40 2431A is the Direct Selling/Multi-Level Organizations Tax Collection Agreement for Washington.

Q: Who should use Form REV40 2431A?

A: Direct Selling/Multi-Level Organizations operating in Washington should use Form REV40 2431A.

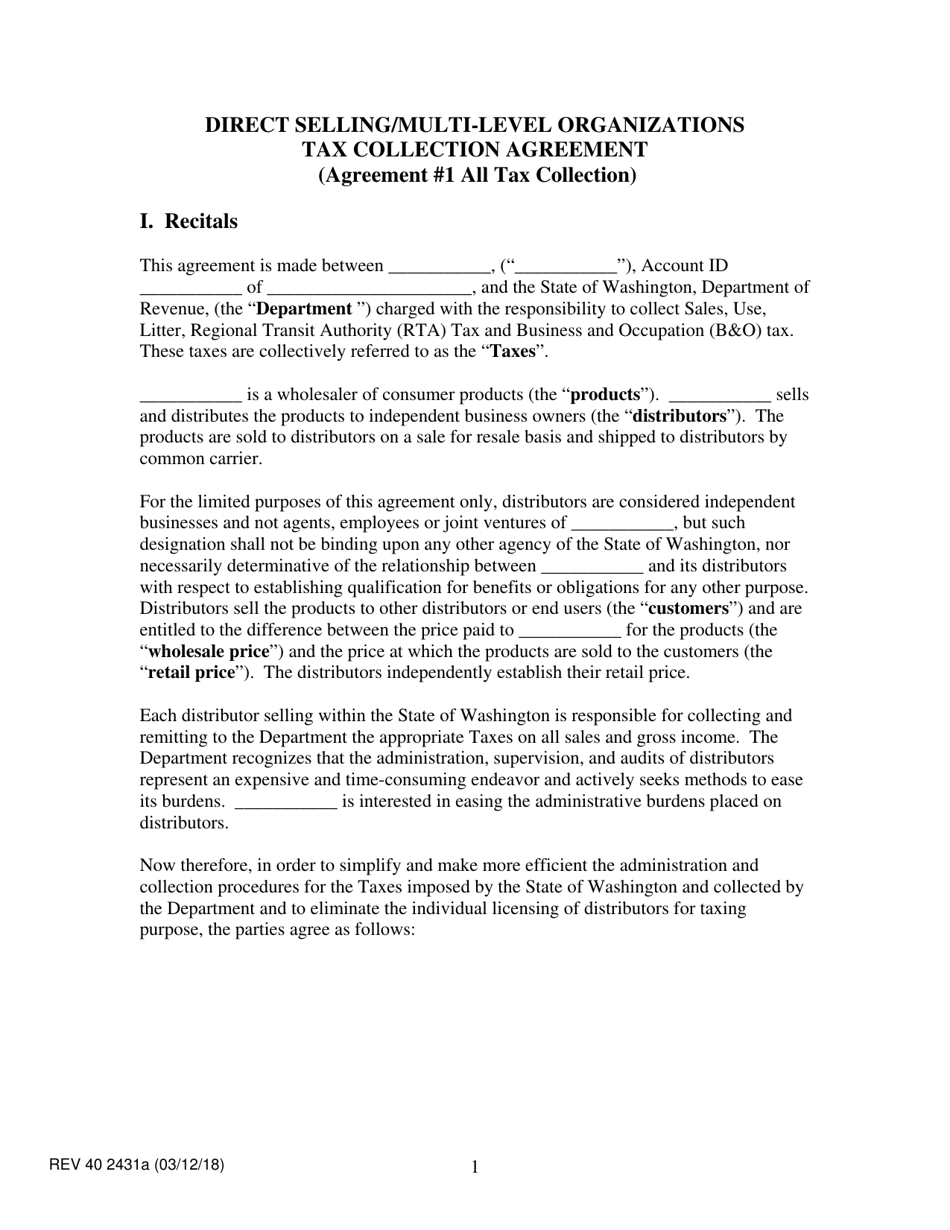

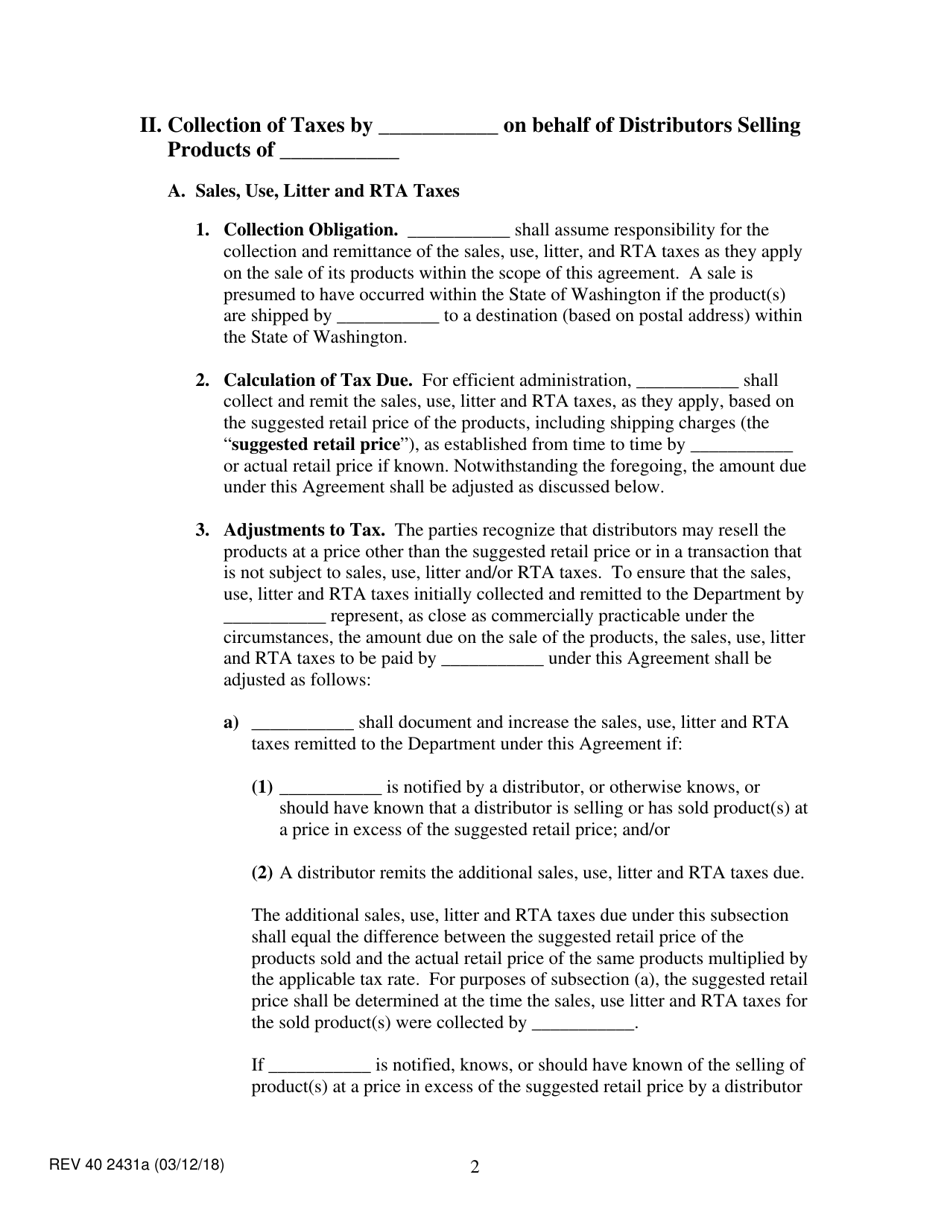

Q: What is the purpose of Form REV40 2431A?

A: Form REV40 2431A is used to establish an agreement between the Direct Selling/Multi-Level Organization and the Washington Department of Revenue for tax collection.

Q: Is Form REV40 2431A mandatory for Direct Selling/Multi-Level Organizations?

A: Yes, Direct Selling/Multi-Level Organizations operating in Washington must complete Form REV40 2431A.

Form Details:

- Released on March 12, 2018;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV40 2431A by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.