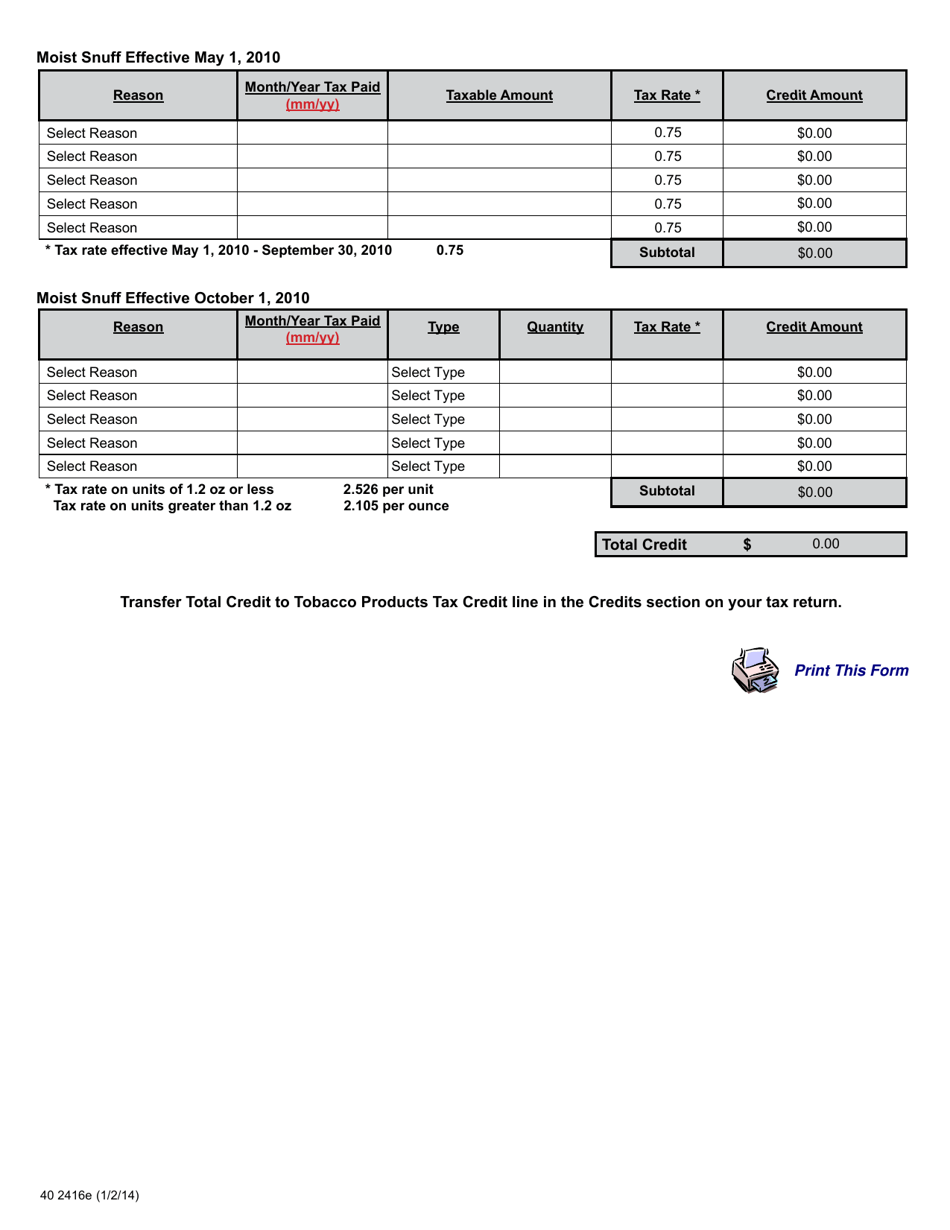

Form 40 2416E Tobacco Products Tax Credit Worksheet - Washington

What Is Form 40 2416E?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

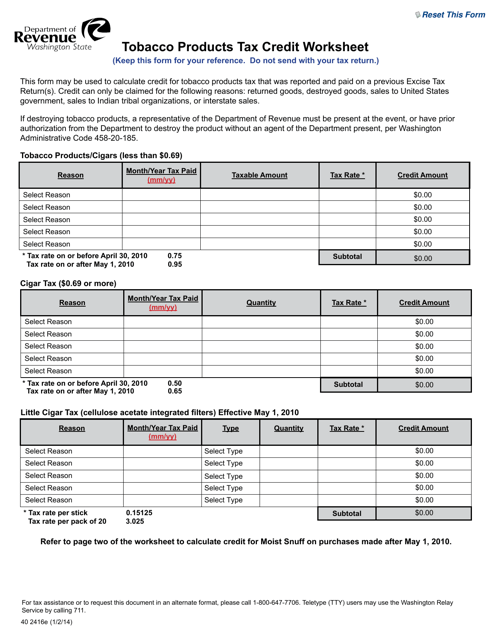

Q: What is form 40 2416E?

A: Form 40 2416E is the Tobacco Products Tax Credit Worksheet for Washington.

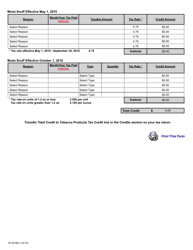

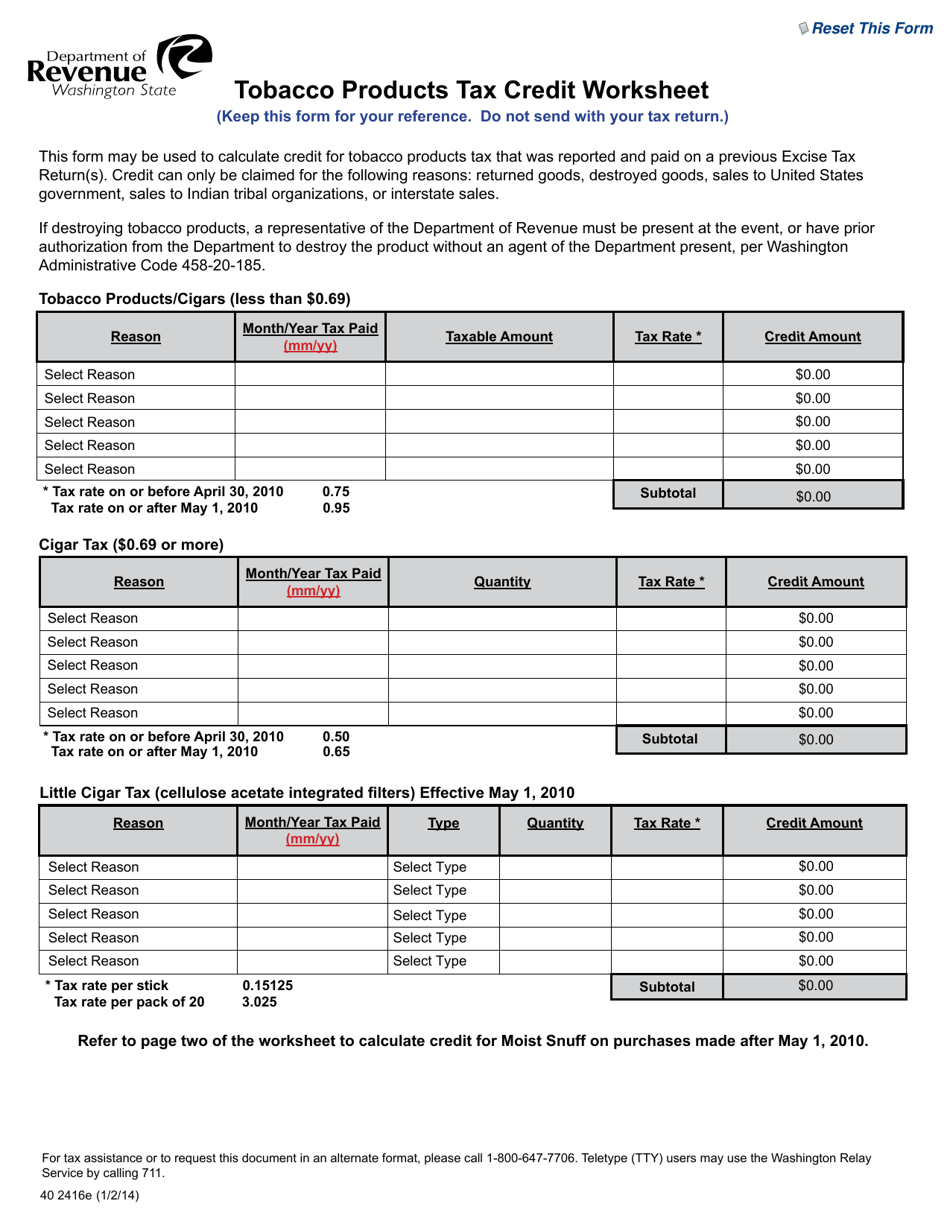

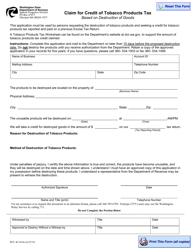

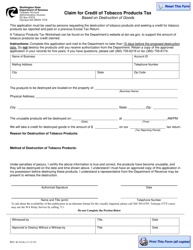

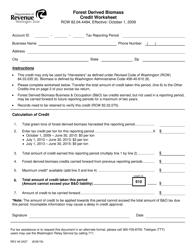

Q: What is the purpose of form 40 2416E?

A: The purpose of form 40 2416E is to calculate the tobacco productstax credit in Washington.

Q: Who needs to fill out form 40 2416E?

A: Individuals or businesses claiming the tobacco products tax credit in Washington need to fill out form 40 2416E.

Q: What information do I need to fill out form 40 2416E?

A: To fill out form 40 2416E, you will need information about your tobacco product purchases and sales in Washington.

Q: When is the deadline to file form 40 2416E?

A: The deadline to file form 40 2416E is the same as the deadline for filing your Washington state tax return.

Q: Can I e-file form 40 2416E?

A: Yes, you can e-file form 40 2416E if you are filing your Washington state tax return electronically.

Q: Are there any restrictions or limitations on the tobacco products tax credit?

A: Yes, there are restrictions and limitations on the tobacco products tax credit, which are explained in the instructions for form 40 2416E.

Q: What happens if I make a mistake on form 40 2416E?

A: If you make a mistake on form 40 2416E, you can file an amended form to correct the error.

Q: Do I need to keep a copy of form 40 2416E for my records?

A: Yes, it is recommended to keep a copy of form 40 2416E for your records in case of future audits or inquiries.

Form Details:

- Released on January 2, 2014;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40 2416E by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.